Palantir Technologies (PLTR), Inc. is a holding company, which engages in the development of data integration and software solutions. It operates through the Commercial and Government segments. The firm offers automotive, financial compliance, legal intelligence, mergers and acquisitions solutions.

Palantir (PLTR) Weekly Technical Analysis – September 2024

Palantir (PLTR) Weekly Chart – Elliott Wave Forecast September 2024

You can check above the weekly count of PLTR from September 2024. The market conditions suggested PLTR was in wave I; therefore, we changed the wave I for wave ((1)). Wave ((1)) ended at $29.83 in $29.23 – $32.00 area where we were expecting to hit a target. Then, the price pulled back to 21.23 where we called wave ((2)) completed, resuming with a strong rally breaking above wave ((1)), and supporting that wave ((3)) was underway. We were looking to continue to the upside until completing wave ((3)). We should look for buying dips as price remains above wave ((2)) low. (If you want to learn more about Elliott Wave Theory, follow these links: Elliott Wave Education and Elliott Wave Theory).

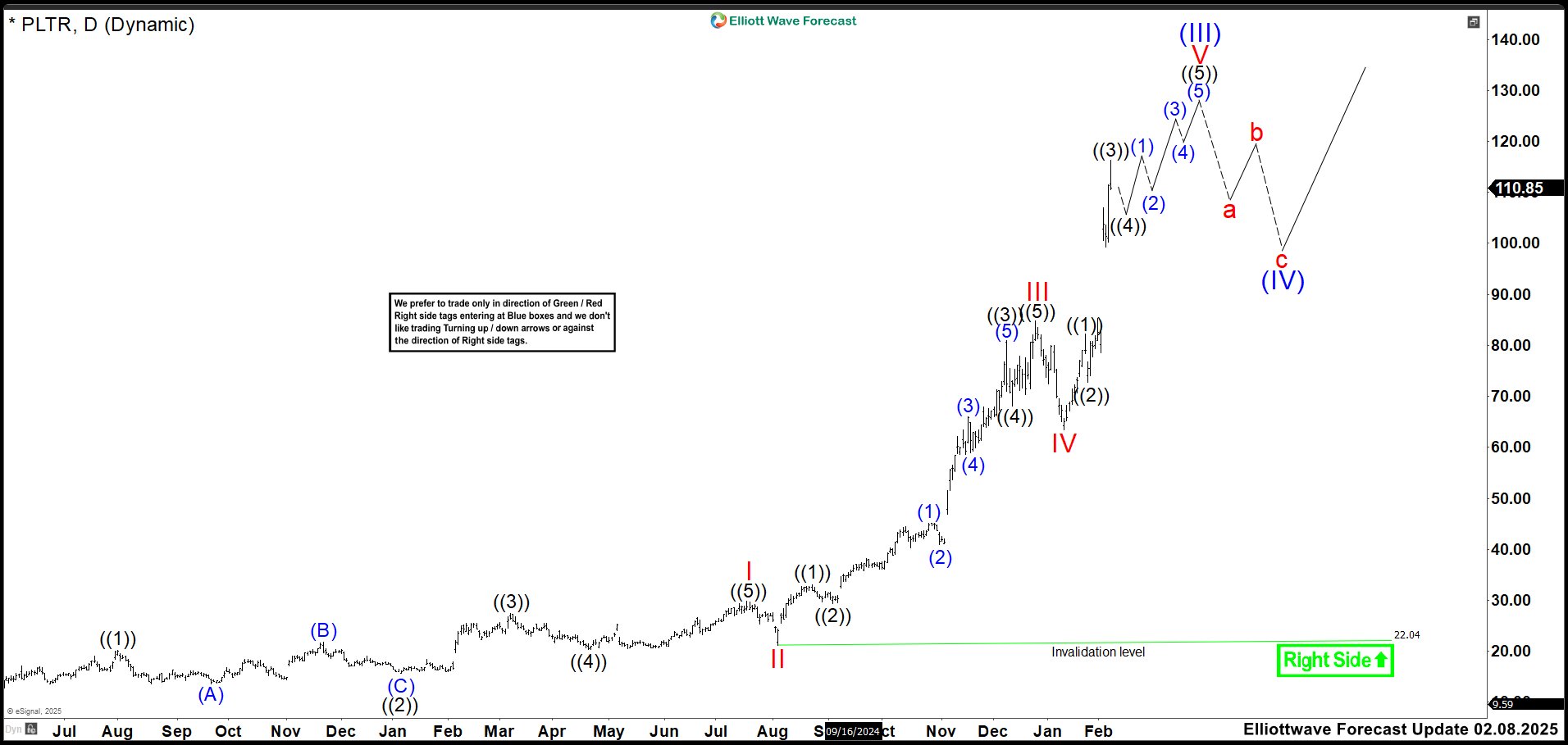

Palantir (PLTR) Daily Chart Update – February 2025

Palantir (PLTR) Daily Chart – Elliott Wave Forecast February 2025

After 5 months, PLTR stock price rised by more than 200%. For this reason, we have retook to the original idea that wave I of (III) had already ended instead of calling it wave ((1)). So, wave I ended at 29.83 high and wave II at 21.23 low. The rally continued as we expected, and we think wave III finished at 84.80 high. Wave IV completed at 63.40 low and the market resumed the bullish trend to build wave V with the last earnings announcement. Currently, the move is showing 3 waves up and we are waiting for wave ((4)) of V before it continues higher. As long as we don’t see that wave ((4)), the price can continue to rise without any problem, but if you see the correction it is an opportunity to buy to continue the trend in wave ((5)) of V and wave (III). At the moment, we are managing a target price of $127 to end the cycle. However, we cannot rule out maintaining the bullish movement, before entering wave (IV). Let see what the market give us. Trade Smart!

Expert Elliott Wave Market Forecasts

www.elliottwave-forecast.com updates one-hour charts 4 times a day and 4-hour charts once a day for all our 78 instruments. We do a daily live session where we guide our clients on the right side of the market. In addition, we have a chat room where our moderators will help you with any questions you have about what is happening in the market. Trial Us!

14 days trial cost $9.99 only. Cancel anytime at support@elliottwave-forecast.com