In this technical blog, we will look at the past performance of the 4hr Elliott Wave Charts of XOM. In which, the rally from the 23 March 2020 low is unfolding as an impulse and showed a higher high sequence. Therefore, we knew that the structure in XOM is incomplete to the upside for 1 more high & should see more upside. So, we advised members not to sell the stock & buy the dips in 3, 7, or 11 swings at the blue box areas. We will explain the structure & forecast below:

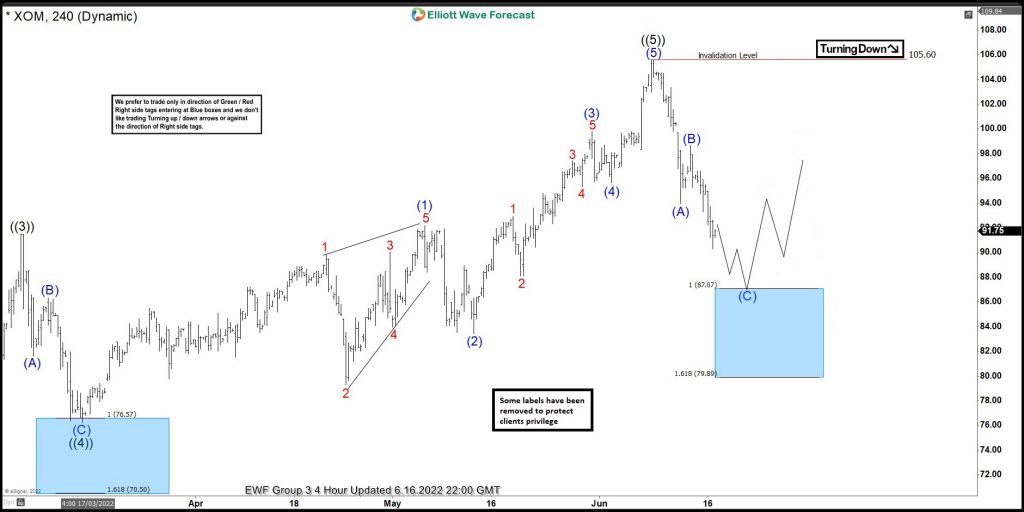

XOM 4 Hour Elliott Wave Chart

Here’s the Elliott wave Chart from the 6/12/2022 update. In which, the rally to $105.60 high ended the cycle from the 19 August 2021 low in wave III & made a pullback in wave IV. The internals of that pullback unfolded as Elliott wave zigzag structure where wave (A) ended at $93.92 low. Then a bounce to $98.67 high ended wave (B) & started the next leg lower in wave (C) towards $87.07- $79.89 blue box area. From there, buyers were expected to appear looking for new highs ideally or for a 3 wave bounce minimum.

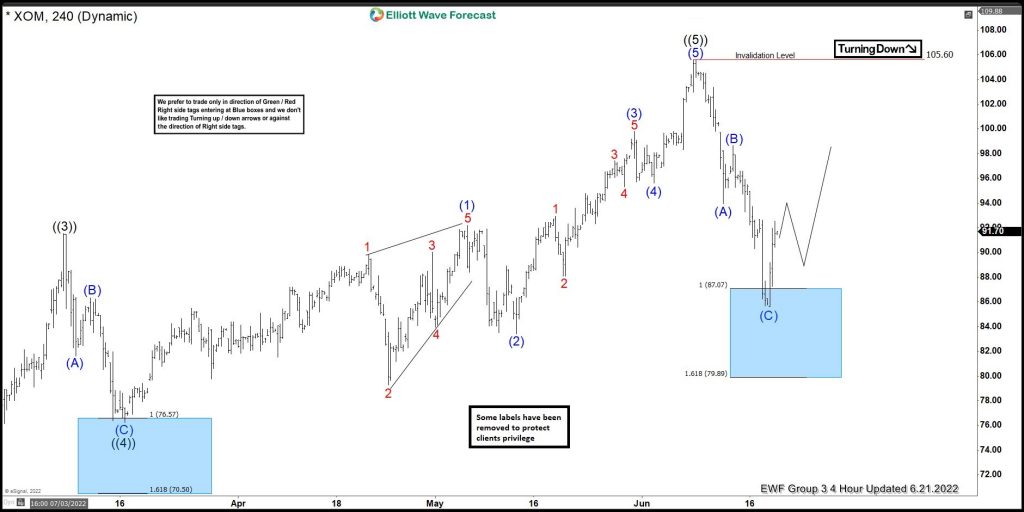

XOM Latest 4hr Elliott Wave Chart

Above is the latest Elliott wave Chart from the 6/21/2022 update. In which the stock is showing a reaction higher taking place from the blue box area at $87.07- $79.89. Right after ending the zigzag correction within the blue box area. Allowed members to create a risk-free position with the minimum reaction higher towards 50%- 61.8% Fibonacci retracement from the wave (B) peak at $92.11- $93.66 area. However, a break above $105.60 high is still needed to confirm the next extension higher & avoid double correction lower.

If you are looking for real-time analysis in XOM along with the other stocks & ETFs then join us with a 14-Day Trial for the latest updates & price action.

Success in trading requires proper risk and money management as well as an understanding of Elliott Wave theory, cycle analysis, and correlation. We have developed a very good trading strategy that defines the entry.

Stop loss and take profit levels with high accuracy and allow you to take a risk-free position, shortly after taking it by protecting your wallet. If you want to learn all about it and become a professional trader. Then join our service by taking a Trial.

Back