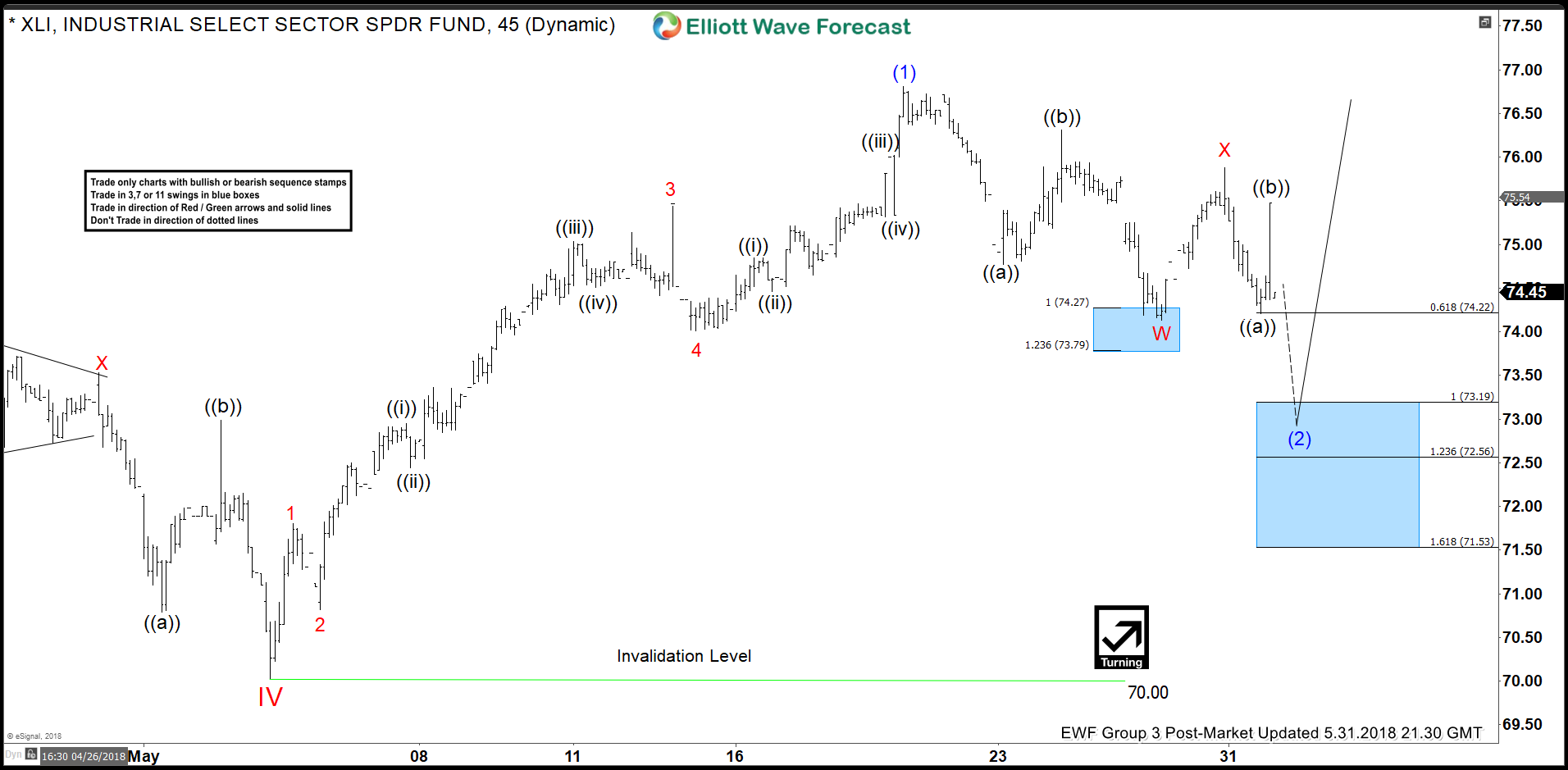

XLI: Industrial sector ETF short-term Elliott wave view suggests that the decline to 70$ on May 03 low ended cycle degree wave IV pullback. Above from there, the instrument rallied higher as an impulse and has scope to resume the cycle degree wave V higher. In an impulse structure, the subdivision of wave 1, 3, and 5 is also an impulse structure of a lesser degree. On the other hand, wave 2 & 4 are corrective in nature i.e double, triple three, Flat etc.

Down from 70$ low, the rally to 71.80$ high ended Minor wave 1 in 5 waves and pullback to 70.83$ low ended Minor wave 2 pullback. Above from there the rally to 75.12$ high ended Minor wave 3 in 5 waves structure and the pullback to 74.01$ ended Minor wave 4. A rally from there to 7.80$ high ended Minor wave 5 and also completed the intermediate wave (1) of an impulse. Below from there, the ETF is correcting the cycle from 5/03 low (70$) in 3, 7 or 11 swings.

Near-term focus remains towards 73.19$-72.56$ 100%-123.6% Fibonacci extension area of Minor W-X to end the intermediate wave (2) pullback as Elliott Wave double three. Afterwards, the ETF is expected to resume the upside ideally provided the pivot at 5/03 low (70$) stays intact or should do a 3 wave bounce at least. We don’t like selling it into a proposed pullback.

XLI 1 Hour Elliott Wave Chart

Keep in mind that the market is dynamic and the view could change in the meantime. Success in trading requires proper risk and money management as well as an understanding of Elliott Wave theory, cycle analysis, and correlation. We have developed a very good trading strategy that defines the entry. Stop loss and take profit levels with high accuracy and allows you to take a risk-free position, shortly after taking it by protecting your wallet. If you want to learn all about it and become a professional trader, then join our service with a limited time special 50% off promotion.

Back