Hello everyone. In today’s article, we will look at the past performance of the 1H Hour Elliott Wave chart of VanEck Gold Miners ETF ($GDX). The rally from 10.04.2023 low unfolded as a 5 wave impulse. So, we expected the pullback to unfold in 3 swings and find buyers again. We will explain the structure & forecast below:

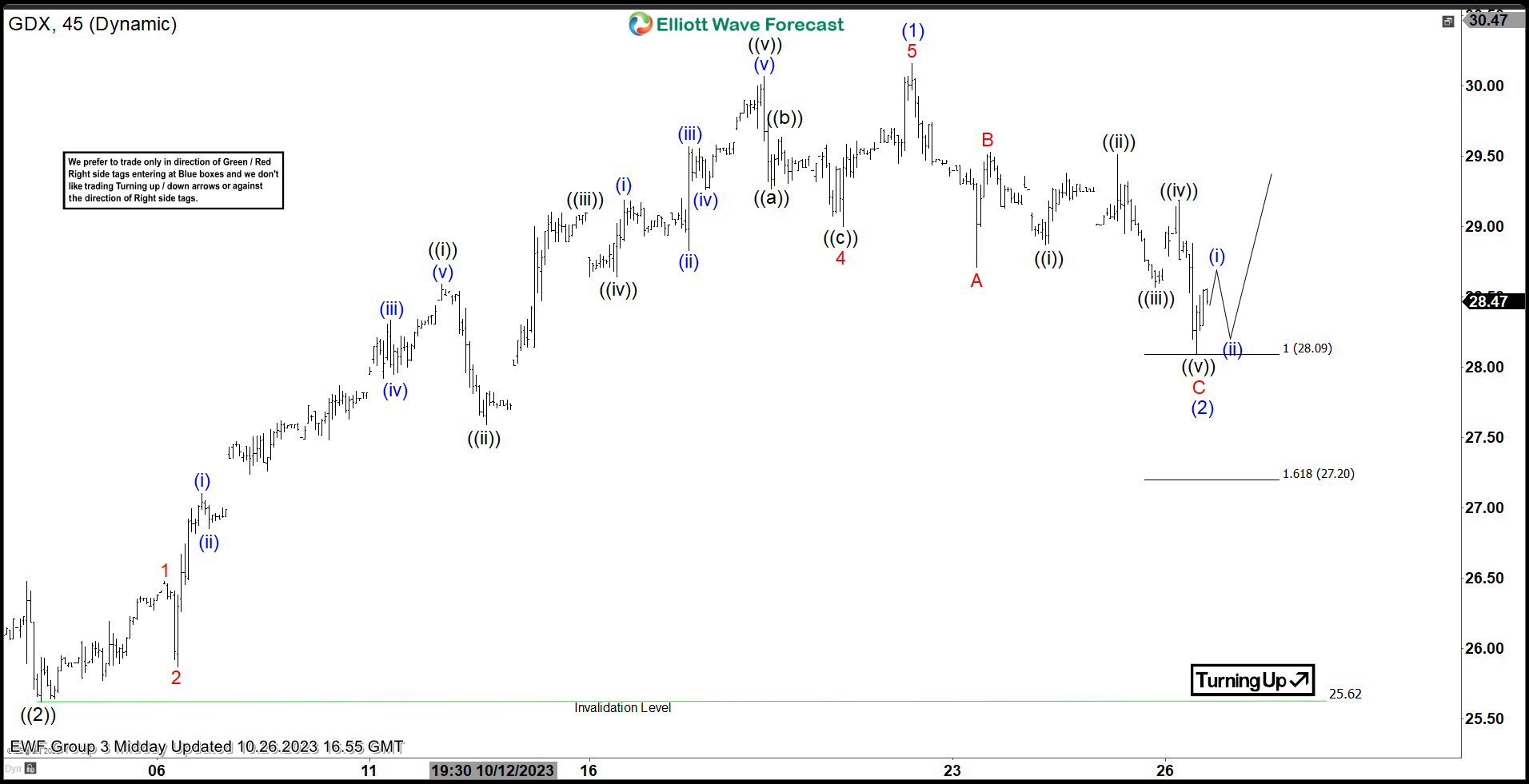

$GDX 1H Elliott Wave Chart 10.26.2023:

Here is the 1H Elliott Wave count from 10.26.2023. The rally from 10.04.2023 peaked at blue (1) $30.16 and started a pullback to correct it. We expected the pullback to find buyers at (2) in 3 swings (ABC) at $28.09 – 27.20.

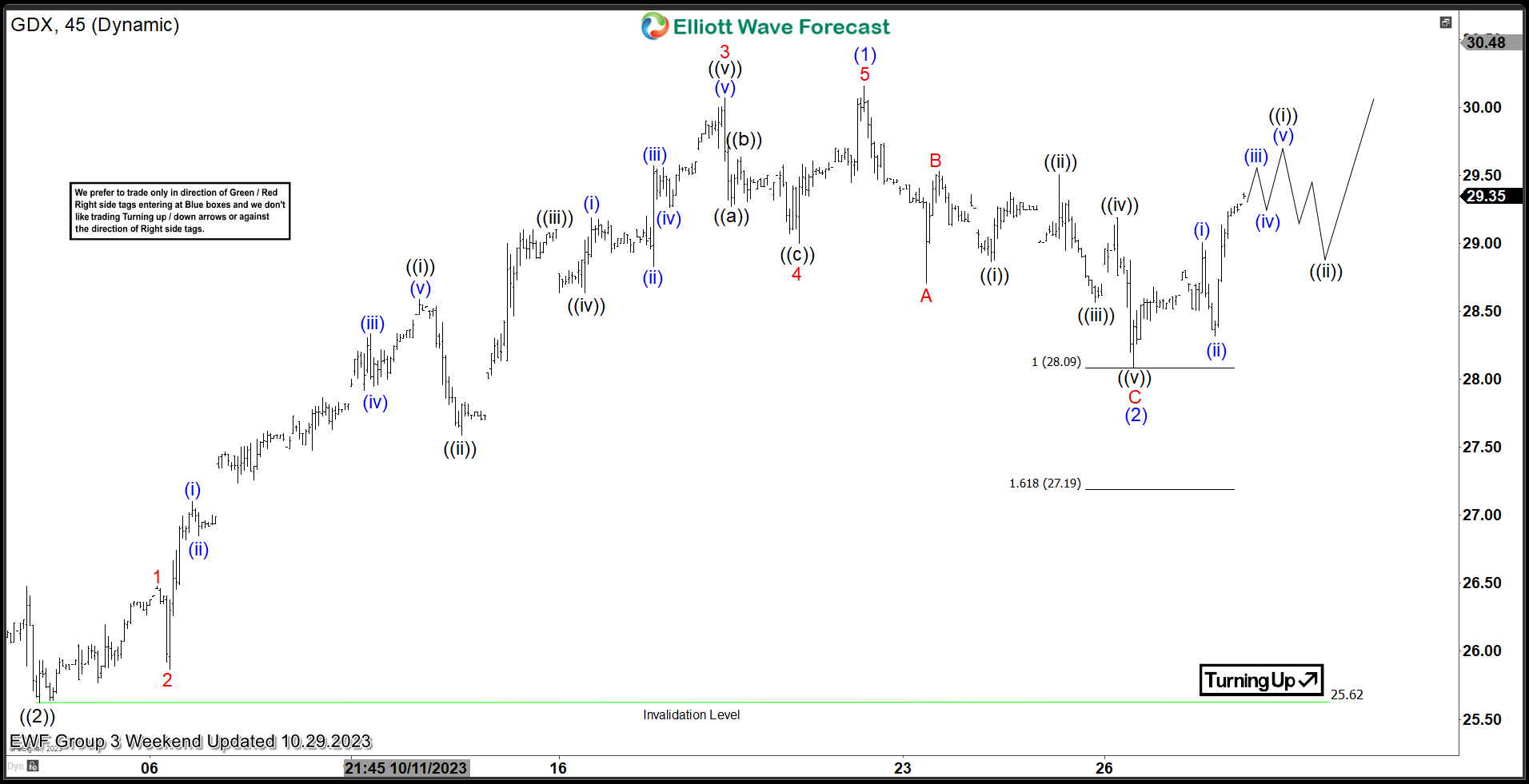

$GDX 1H Elliott Wave Chart 10.29.2023:

Here is the 1H update from 10.29.2023 showing the bounce taking place as expected. The ETF reacted higher after reaching the equal legs area allowing longs to get a risk free position. We expect the ETF to continue higher in wave (3) towards 32.65 – 35.47 before a pullback can happen. Alternatively, if the ETF is unable to break above $30.16 at blue (1) then a double correction lower can happen (WXY) before higher.

Here is the 1H update from 10.29.2023 showing the bounce taking place as expected. The ETF reacted higher after reaching the equal legs area allowing longs to get a risk free position. We expect the ETF to continue higher in wave (3) towards 32.65 – 35.47 before a pullback can happen. Alternatively, if the ETF is unable to break above $30.16 at blue (1) then a double correction lower can happen (WXY) before higher.

Elliott Wave Forecast

We cover 78 instruments, but not every chart is a trading recommendation. We present Official Trading Recommendations in the Live Trading Room. If not a member yet, Sign Up for Free 14 days Trial now and get access to new trading opportunities.

Welcome to Elliott Wave Forecast!

Back