Sony Group Corporation, commonly known as Sony and stylized as SONY, is a Japanese multinational conglomerate corporation headquartered in Kōnan, Minato, Tokyo, Japan. As a major technology company, it operates as one of the world’s largest manufacturers of consumer and professional electronic products, the largest video game console company and the largest video game publisher.

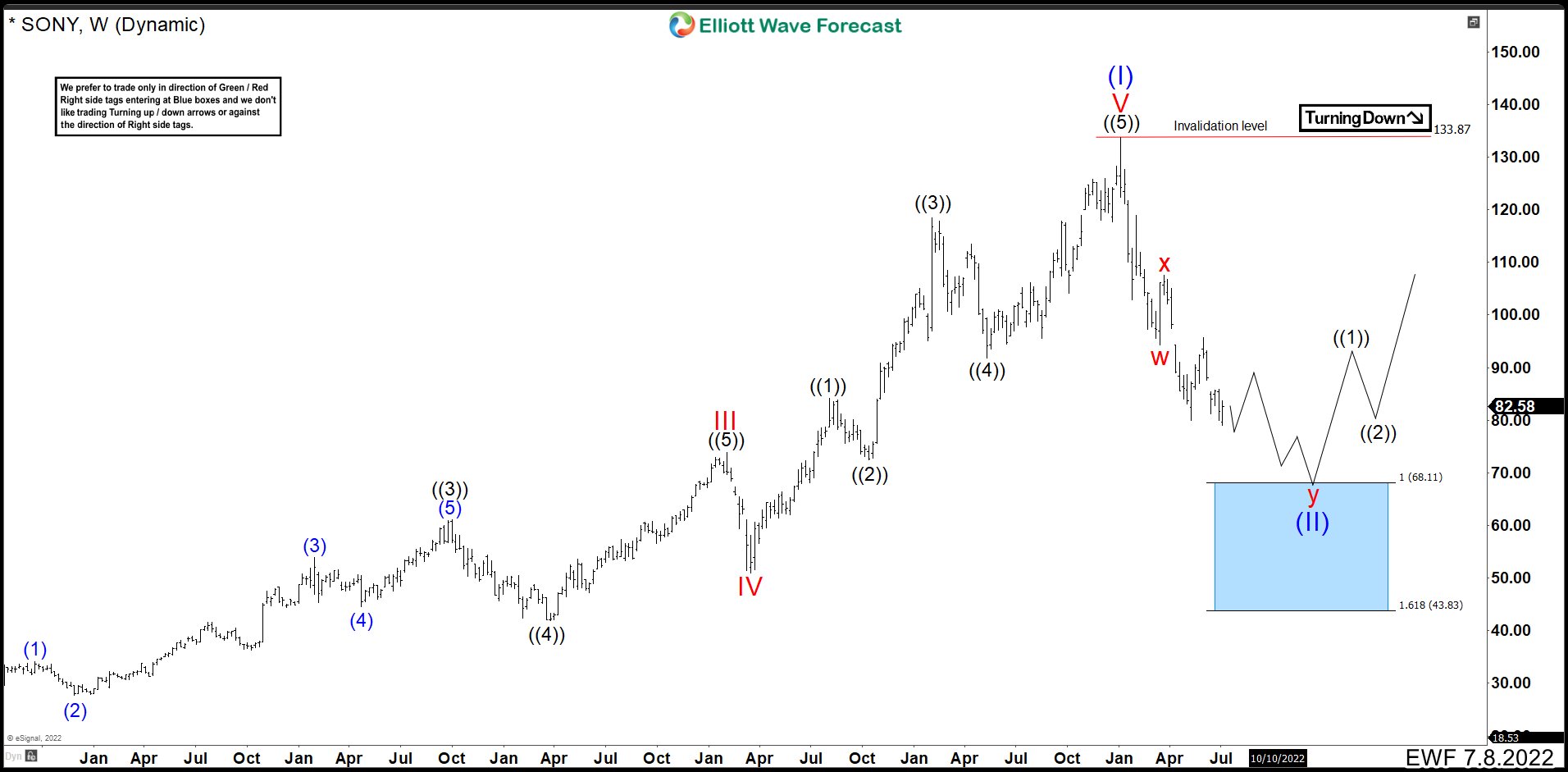

SONY Weekly Chart July 8th 2022

SONY ended an impulse that began at the end of 2012. The share price reached 133.75 in January 2021, that is, 9 years of upward movement. We called this impulse wave (I). From here the price started to fall forming a double correction structure. This would take us to the blue box 68.11 – 43.83 area to complete wave (II) correction and resume the rally. (If you want to learn more about double correction or Elliott Wave Theory, follow these links: Elliott Wave Education and Elliott Wave Theory).

SONY ended an impulse that began at the end of 2012. The share price reached 133.75 in January 2021, that is, 9 years of upward movement. We called this impulse wave (I). From here the price started to fall forming a double correction structure. This would take us to the blue box 68.11 – 43.83 area to complete wave (II) correction and resume the rally. (If you want to learn more about double correction or Elliott Wave Theory, follow these links: Elliott Wave Education and Elliott Wave Theory).

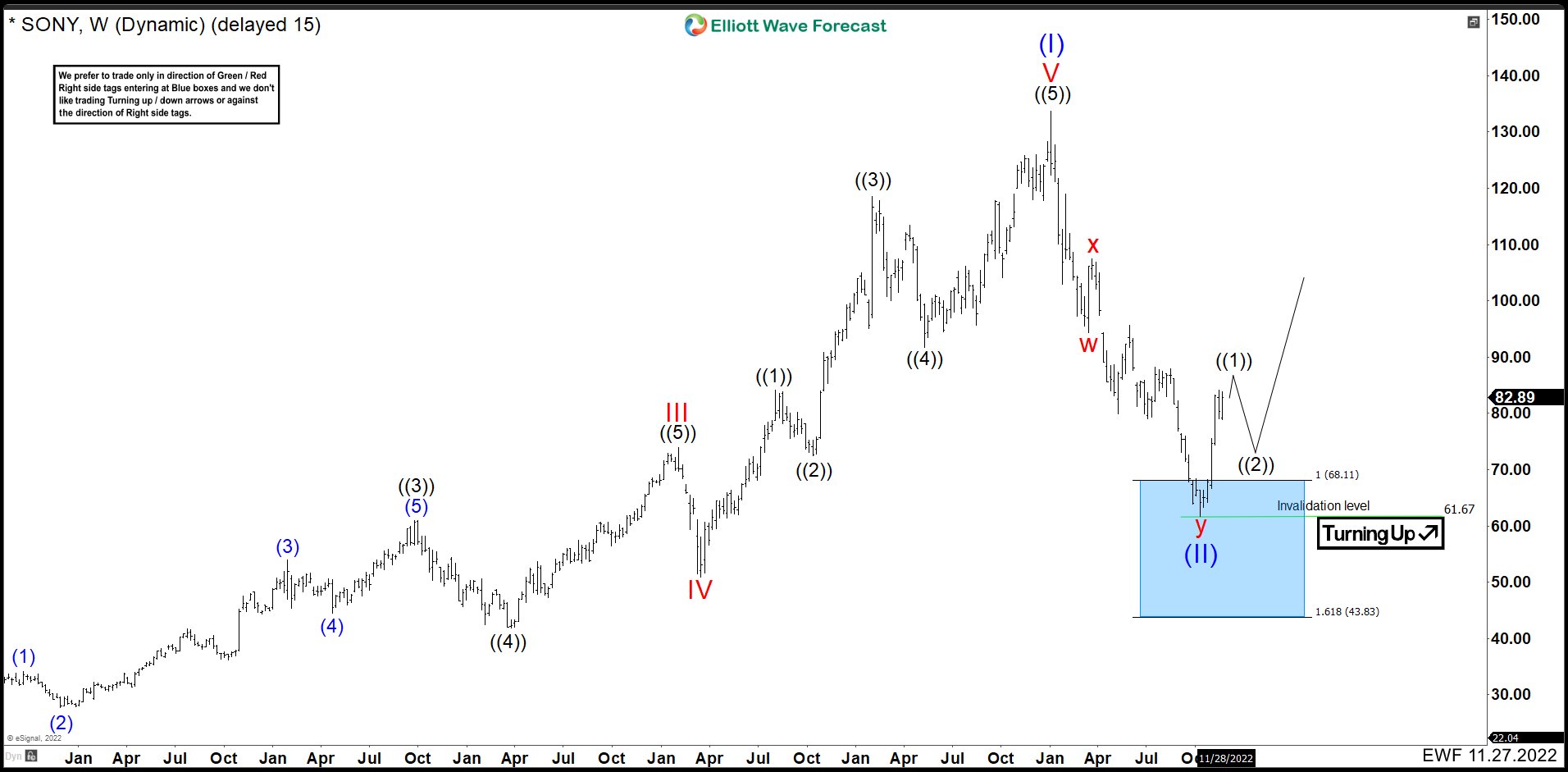

SONY Weekly Chart November 27th 2022

After almost 5 months, double correction as wave (II) finished. The first 3 swings ended wave w at 94.40. Connector wave x finish at 107.79. Down from wave x market made 3 swings lower to complete y. Wave (a) ended at 80.05 and bounced as wave (b) ended at 95.96. Last drop as wave (c) made an impulse to the blue box area ending wave y and wave (II) at 61.67. The rally has already begun and in the near term we need more upside to complete an impulse. The best area to complete wave ((1)) comes at 85.23 – 87.16. After this, it should fall in 3, 7 or 11 swings lower to complete wave ((2)). As we stay above 61.67, the view is valid.

After almost 5 months, double correction as wave (II) finished. The first 3 swings ended wave w at 94.40. Connector wave x finish at 107.79. Down from wave x market made 3 swings lower to complete y. Wave (a) ended at 80.05 and bounced as wave (b) ended at 95.96. Last drop as wave (c) made an impulse to the blue box area ending wave y and wave (II) at 61.67. The rally has already begun and in the near term we need more upside to complete an impulse. The best area to complete wave ((1)) comes at 85.23 – 87.16. After this, it should fall in 3, 7 or 11 swings lower to complete wave ((2)). As we stay above 61.67, the view is valid.

Take 14 Days Trial

Elliottwave Forecast updates one-hour charts 4 times a day and 4-hour charts once a day for all our 78 instruments. We do a daily live session where we guide our clients on the right side of the market. In addition, we have a chat room where our moderators will help you with any questions you have about what is happening in the market.

Let’s trial 14 days for only $9.99 here: I want 14 days trial. Cancel Any time.

Back