The Santa rally is a capital market phenomenon named in 1972 by Yale Hirsc. He noticed an unusual upward movement in the markets from December 28 to January 2 of the following year. This event has been recurrent for years that it has earned its own name “The Santa Rally”. According to the Stock Trader Almanac, since 1896 the Dow Jones gained an average of 1.7% during this period obtaining a positive return 77% of the time.

The Santa rally is not a guaranteed occurrence and it doesn’t happen every year. It is more of a historical pattern or trend that traders and investors have noticed over time. The reasons behind the Santa Rally are not entirely clear, and various factors may contribute to it. Some theories suggest that the holiday season tends to bring about positive sentiment and optimism among investors, leading to increased buying activity.

What About December?

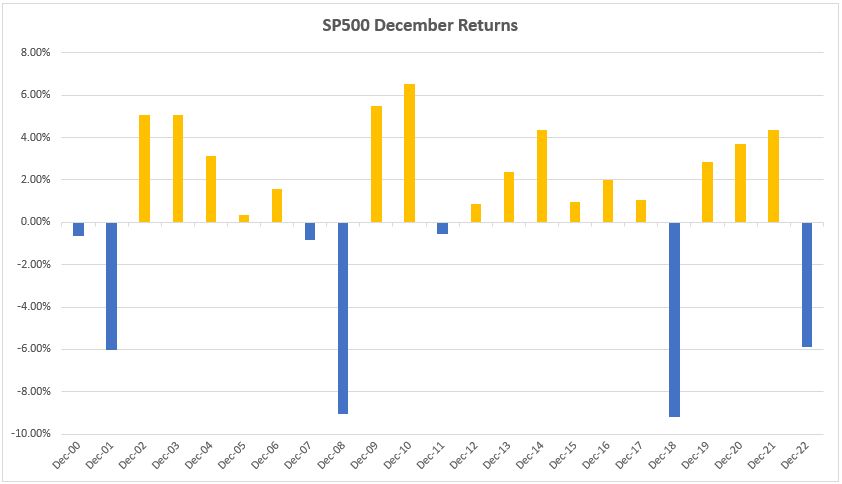

As we could read, the Santa rally arrives in the last week of December. Let’s better analyze what has happened in the last month of the year that has just begun. In the chart below we can see the December returns of the SP500 since 2000.

If we had invested a certain capital in the SP500 on December 1, 2000, and we had finished that investment at the close of New York on December 31, and we reinvested the result of that investment again and again every single December until the 31st December 2022, then the investment would have brought a return of 16.61%. Which indicates that investing in the last month of the year could bring us a favorable result. We say could, because 4 of the last 23 Decembers were terrible.

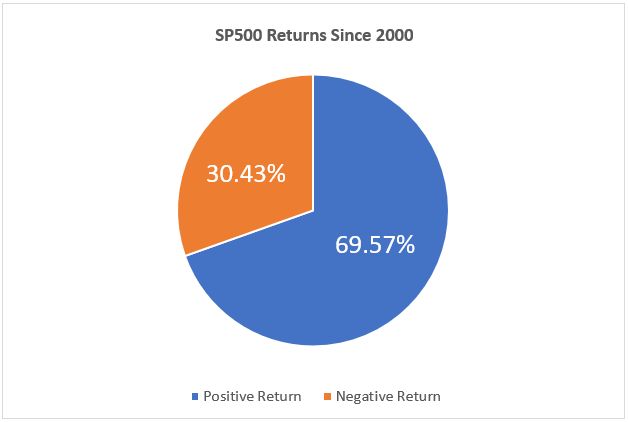

In the pie above, we can see the results of the last 23 Decembers. 16 months were positive, that is, 69.57% and the negative results (7) were 30.43%. Although the positive numbers are better, we cannot assume that in December 2023 the results will be good. Furthermore, when December traded downwards it had very bad results.

DAX 4 Hour Chart December 2

How do we get out of this dilemma if December is going to be a good month or not in 2023? Here we have the daily chart of the DAX updated on December 2 that is correlated with SP500. As we can see, we are calling to build an impulse structure from the October lows and we are still in wave 3. Therefore, if we see that in the week of December 3 the beginning of a retracement, we think that it will only be wave 4. After finishing this correction, the DAX, as well as the SPX, should continue the rally until the end of the month and have a positive Santa rally for this year.

It’s important to note that while the Santa rally is well-known, it’s not a foolproof strategy for making investment decisions. Market behavior is influenced by a multitude of factors, and past performance is not indicative of future results. Investors should conduct thorough research and analysis before making any investment decisions, considering a wide range of factors that may impact the markets.

Elliott Wave Forecast

www.elliottwave-forecast.com updates one-hour charts 4 times a day and 4-hour charts once a day for all our 78 instruments. We do a daily live session where we guide our clients on the right side of the market. In addition, we have a chat room where our moderators will help you with any questions you have about what is happening in the market.

14 day Trial costs $9.99 only. Cancel anytime at support@elliottwave-forecast.com

Back