The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

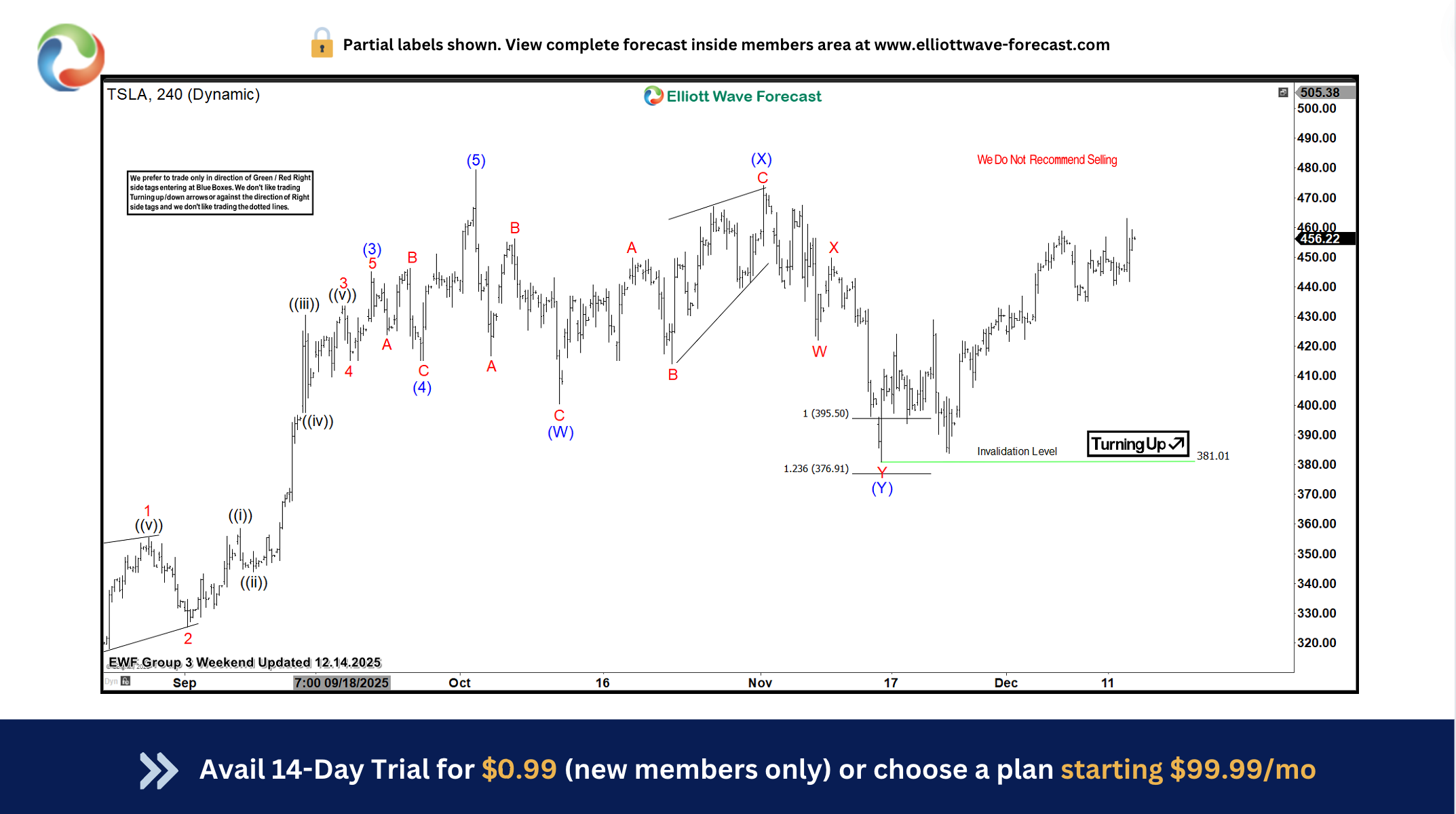

TSLA Rally Nears $500 After Successful Dip-Buying Opportunity

Read MoreHello traders. Welcome to a new blog post where we discuss trade setups. In this post, the spotlight will be on TSLA which renewed the bullish trend since the April low. The blog will explain how members went long from this extreme zone and the potential targets area. Tesla, Inc. (TSLA) is a global leader […]

-

Surfing the Market Waves: How the Blue Box Shapes Hecla Mining (HL)

Read MoreHecla Mining (HL) has shown strong revenue growth in 2025, climbing to $1.33 billion, up 43% year-over-year, while earnings per share surged to $0.38 from $0.06. This performance highlights the company’s ability to capitalize on favorable silver and gold prices, as well as operational improvements across its mining assets. However, despite these gains, analysts remain […]

-

AIZ Trade Setup: Buyers Launched from Blue Box Aiming $250

Read MoreOn AIZ stocks, buyers activated new Longs from the blue box while aiming $250-$260 as the bullish cycle from year 2020 continues. In this blog post, we’ll discuss potential targets for this setup as well as where and where traders can wait for next opportunity. Assurant Inc. (NYSE: AIZ) is a leading global provider of […]

-

NASDAQ (NQ_F) Elliott Wave: Buying the Dips in a Blue Box

Read MoreHello traders. As our members know we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in E-mini Nasdaq-100 Futures. Recently NQ_F made a clear three-wave correction. The pull back completed as Elliott Wave Double Three pattern and made a […]

-

American Airlines (AAL) Bullish Trend Signals Opportunity on Retracement

Read MoreAmerican Airlines (AAL) shows a bullish sequence from October 1 low favoring more upside. This article and video look at the Elliott Wave path.

-

Russell 2000 ETF $IWM Soars 11% from Blue Box Area, With $258 Target Still Ahead

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of Russell 2000 ETF ($IWM) through the lens of Elliott Wave Theory. We’ll review how the powerful rally from the November 2025 low unfolded as a textbook 5-wave impulse and discuss our evolving forecast for the next move. Let’s dive into the structure and expectations for this tech […]