The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Gold Miners Junior (GDXJ) Impulsive Rally in Progress

Read MoreThe VanEck Junior Gold Miners ETF (GDXJ) is an exchange-traded fund that aims to replicate the performance of the MVIS Global Junior Gold Miners Index. This index tracks the overall performance of small-capitalization companies primarily involved in mining for gold and silver. GDXJ Monthly Elliott Wave View Gold Miners Junior ETF (GDXJ) ended wave ((II)) […]

-

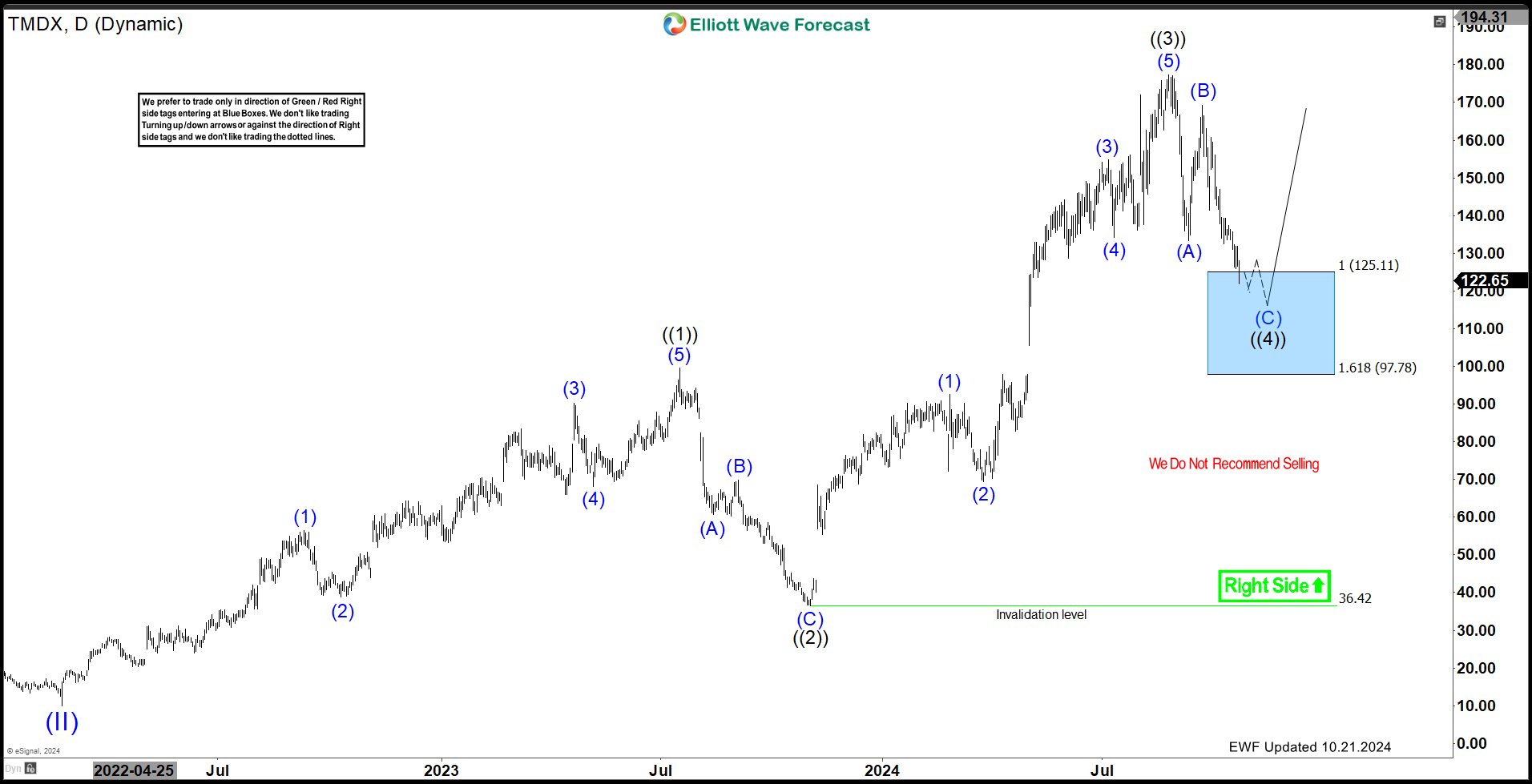

TransMedics Group (TMDX): Prepare for a Potential Rally as Elliott Wave Signals a Bullish Move

Read MoreHello Traders! Today, we will look at the Daily Elliott Wave structure of TransMedics Group Inc. (TMDX) and explain why the stock should soon reach a Blue Box area and react higher. TransMedics Group, Inc., a commercial-stage medical technology company, engages in transforming organ transplant therapy for end-stage organ failure patients in the United States […]

-

Best Stocks for Beginners & New Traders

Read MoreNew investors should focus on buying high-quality stocks of recognizable companies with sound financial fundamentals and easy-to-understand business models. They should start small but aspire for bigger profits while carefully investing. Even though losses are imminent for all traders, new traders tend to get emotional or impulsive in fear of losses. Therefore, it’s always better […]

-

Elliott Wave Intraday View: S&P 500 Futures (ES) Wave 5 In Progress

Read MoreS&P 500 Futures (ES) short term can extend higher within wave 5. This article and video look at the Elliott Wave path of the Index.

-

Micron Technology Inc (MU) Ended the Cycle from December 2022 Low

Read MoreMicron Technology, Inc. (MU) designs, develops, manufactures, and sells memory and storage products worldwide. The company operates through four segments: Compute and Networking Business Unit, Mobile Business Unit, Embedded Business Unit, and Storage Business Unit. Micron Technology, Inc. was founded in 1978 and is headquartered in Boise, Idaho. MU Weekly Chart March 2023 As we see […]

-

SPDR Consumer Staples ETF ( $XLP ) Found Buyers At The Blue Box Area.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 4H Hour Elliott Wave chart of SPDR Consumer Staples ETF ($XLP). The rally from 5.31.2024 low unfolded as 5 waves impulse. So, we expected the pullback to unfold in 3 swings and find buyers again. We will explain the structure & […]