The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

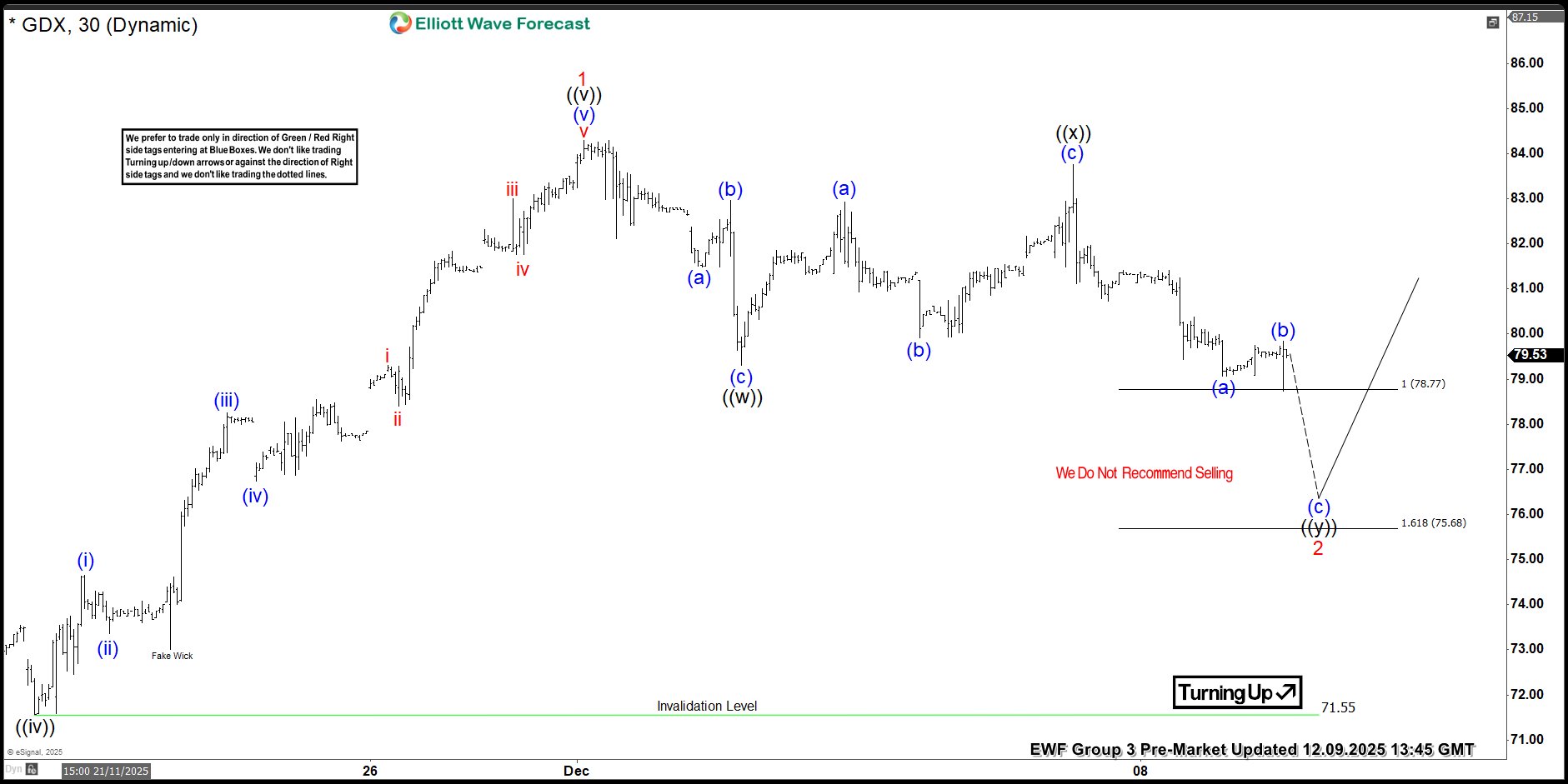

VanEck Gold Miners ETF $GDX Extreme Area Offers A Buying Opportunity

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of VanEck Gold Miners ETF ($GDX) through the lens of Elliott Wave Theory. We’ll review how the rally from the Nov 2025 low unfolded as a 5-wave impulse followed by a 7-swing correction (WXY) and discuss our forecast for the next move. Let’s dive into the structure and expectations for this ETF. […]

-

Tesla (TSLA) Extends Rally to Historic High, Pullback Should Find Strong Bid

Read MoreTesla (TSLA) recently advanced to a new all‑time high, underscoring the strength of bullish momentum in the market. The short‑term Elliott Wave analysis indicates that the cycle from the November 14, 2025 low has concluded as a clear impulse structure. From that low, wave 1 terminated at $423.69, followed by a corrective decline in wave […]

-

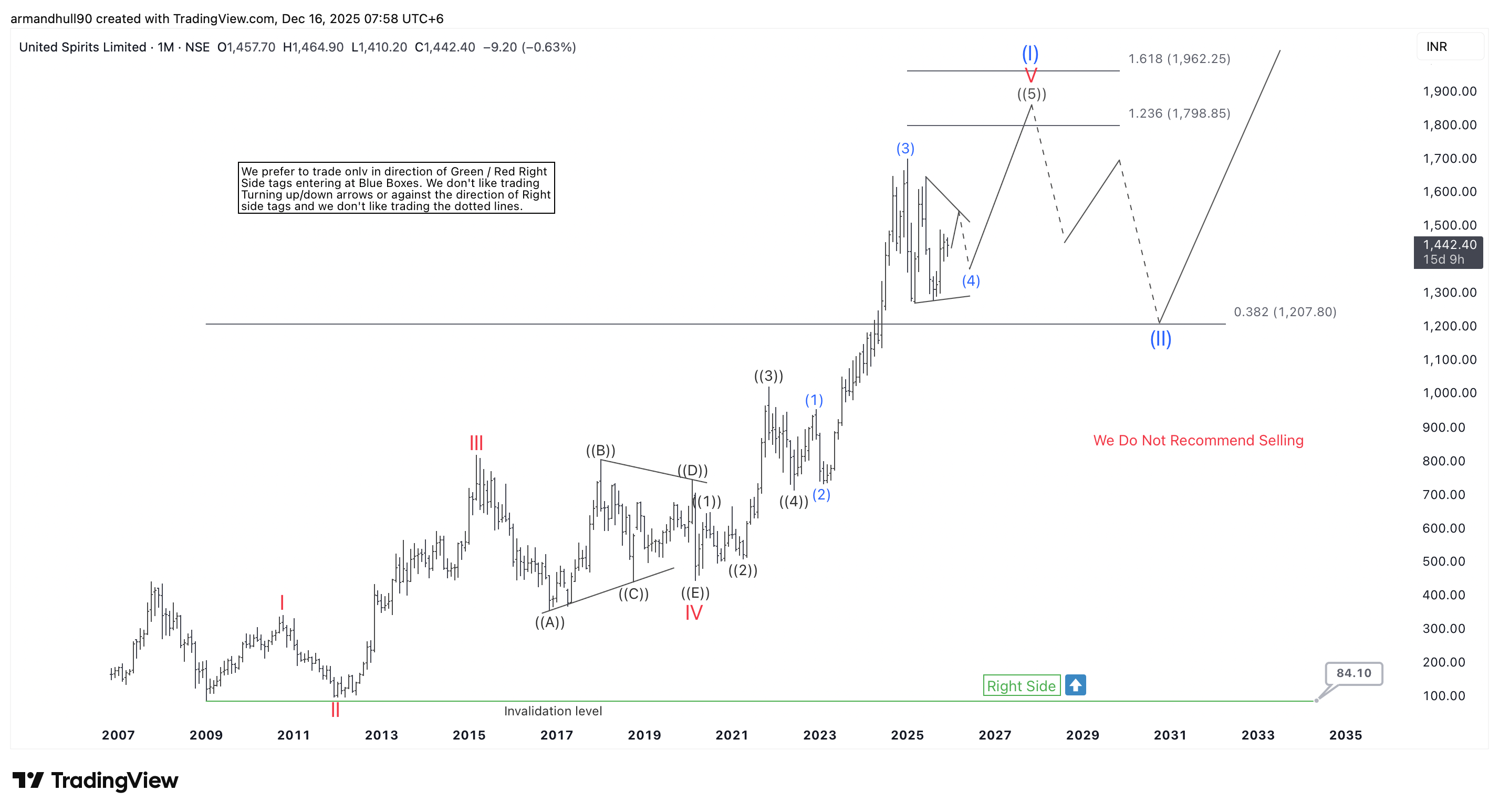

UNITDSPR Elliott Wave Outlook: Bullish Structure Points to ₹1,798–₹1,962 Targets

Read MoreMonthly Elliott Wave analysis shows Wave I nearing completion, key Fibonacci targets ahead, and a corrective pullback before the next major rally. United Spirits Limited (NSE: UNITDSPR) continues to trade in a strong long-term bullish Elliott Wave structure on the monthly chart. The broader trend remains positive despite short-term price swings. Since the 2020–2021 period, […]

-

TSM Road to $340 Target and Strategic Correction

Read MoreOur prior analysis established Taiwan Semiconductor (NYSE: TSM) bullish weekly trajectory. Now, we examine the daily Elliott Wave structure. This detailed view identifies the next key target and signals a potential near-term correction. Elliott Wave Analysis TSM daily rally began at the April 2025 low of $134. Subsequently, Wave ((1)) peaked at $248. Then, Wave […]

-

Vistra Corp (VST): Trading The ((2)) Pullback For Next Big Rally

Read MoreVistra Corp., (VST) operates as an integrated retail electricity & power generation company in the United States. It operates through five segments like Retail, Texas, East, West & Asset Closure. It comes under Utilities sector & trades as “VST” ticker at NYSE. In daily, VST ended April rally in ((1)) at $219.82 high & favors […]

-

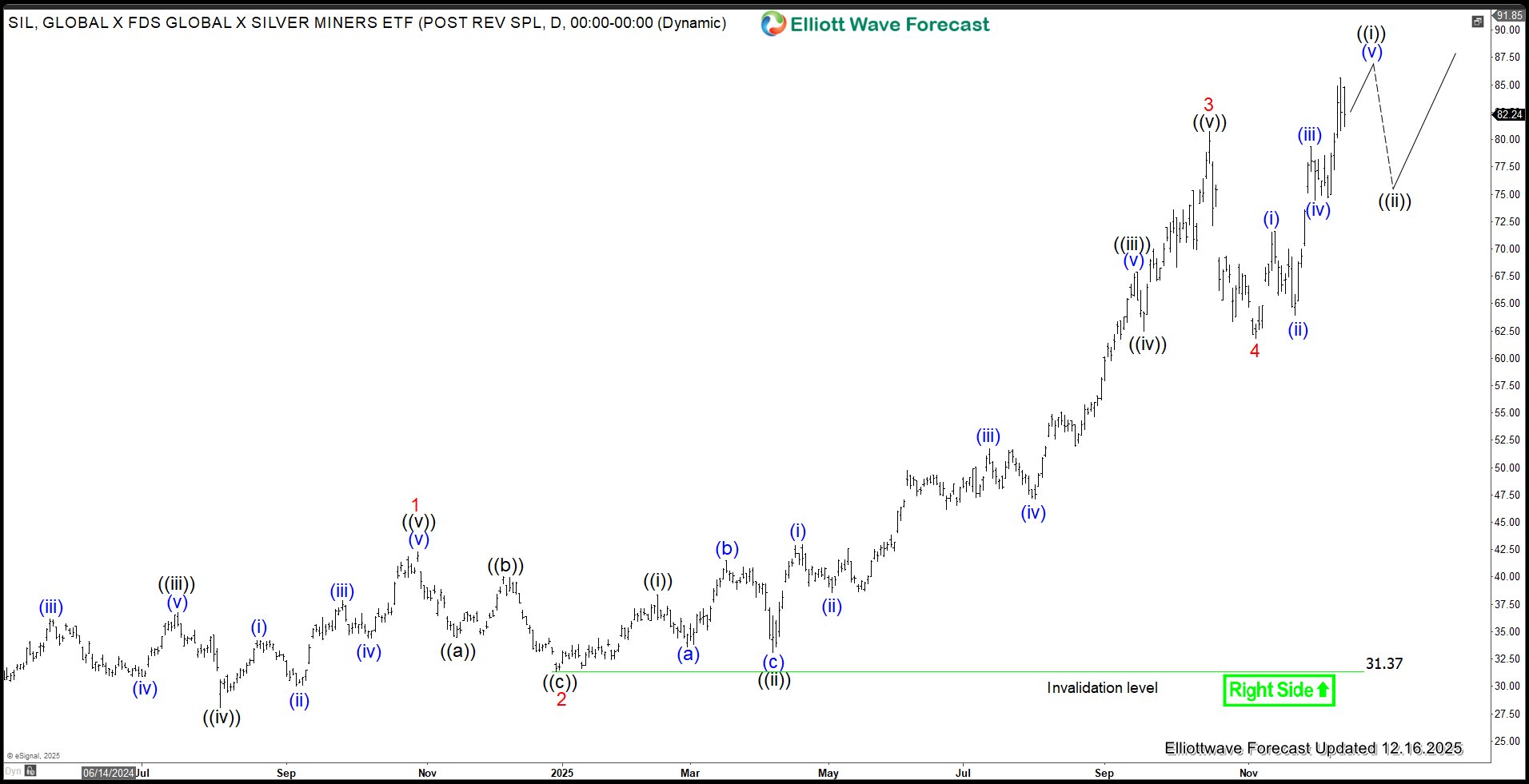

Silver Miners ETF (SIL)Surges to All-Time High on Impulsive Breakout

Read MoreSilver Miners ETF (SIL) continues to extend to new all-time high in impulsive structure. This article looks at the Elliott Wave path.