The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

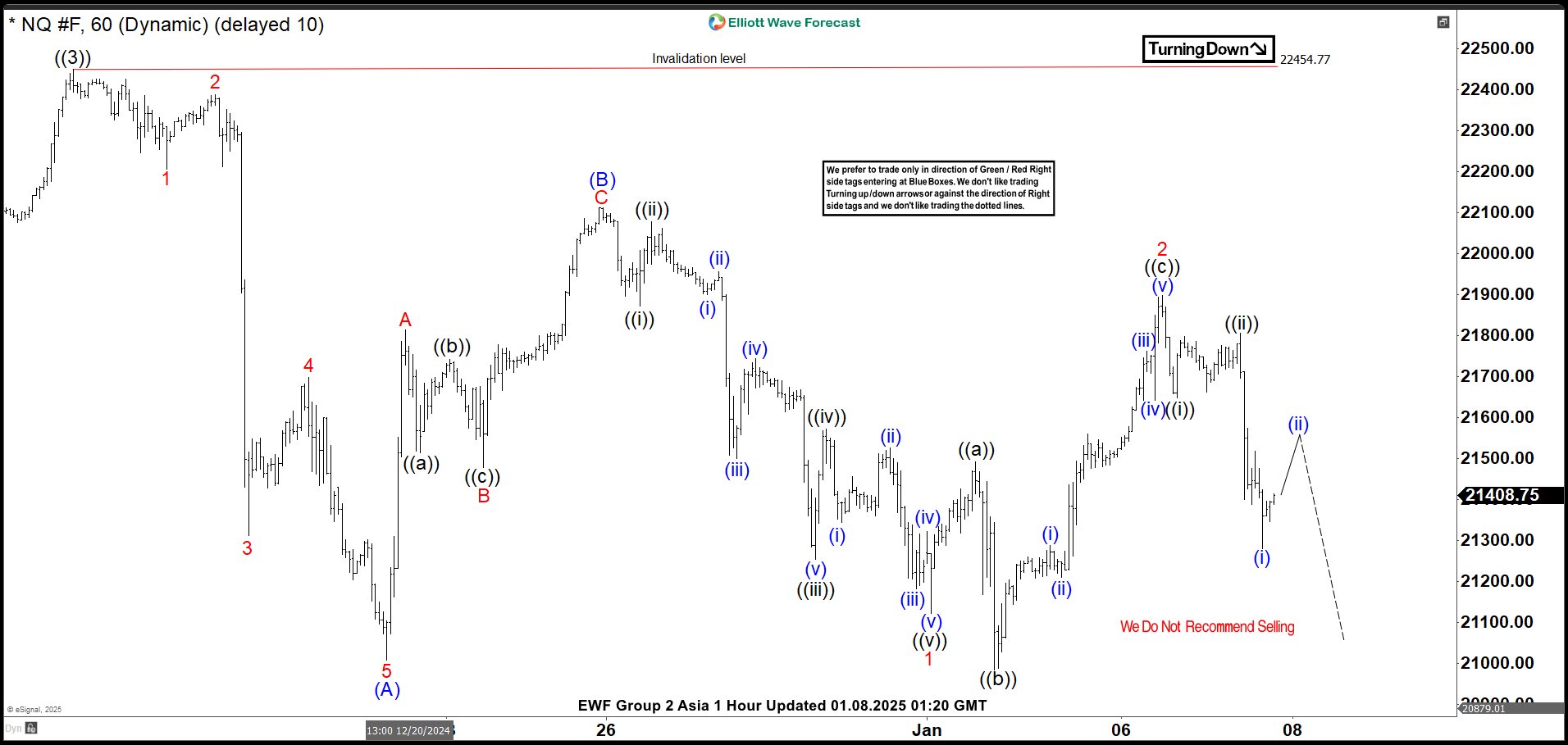

Elliott Wave View: Nasdaq (NQ) Looking for Further Correction Lower

Read MoreNasdaq (NQ) is looking to correct in a zigzag structure. This article and video look at the Elliott Wave path and target for the Index.

-

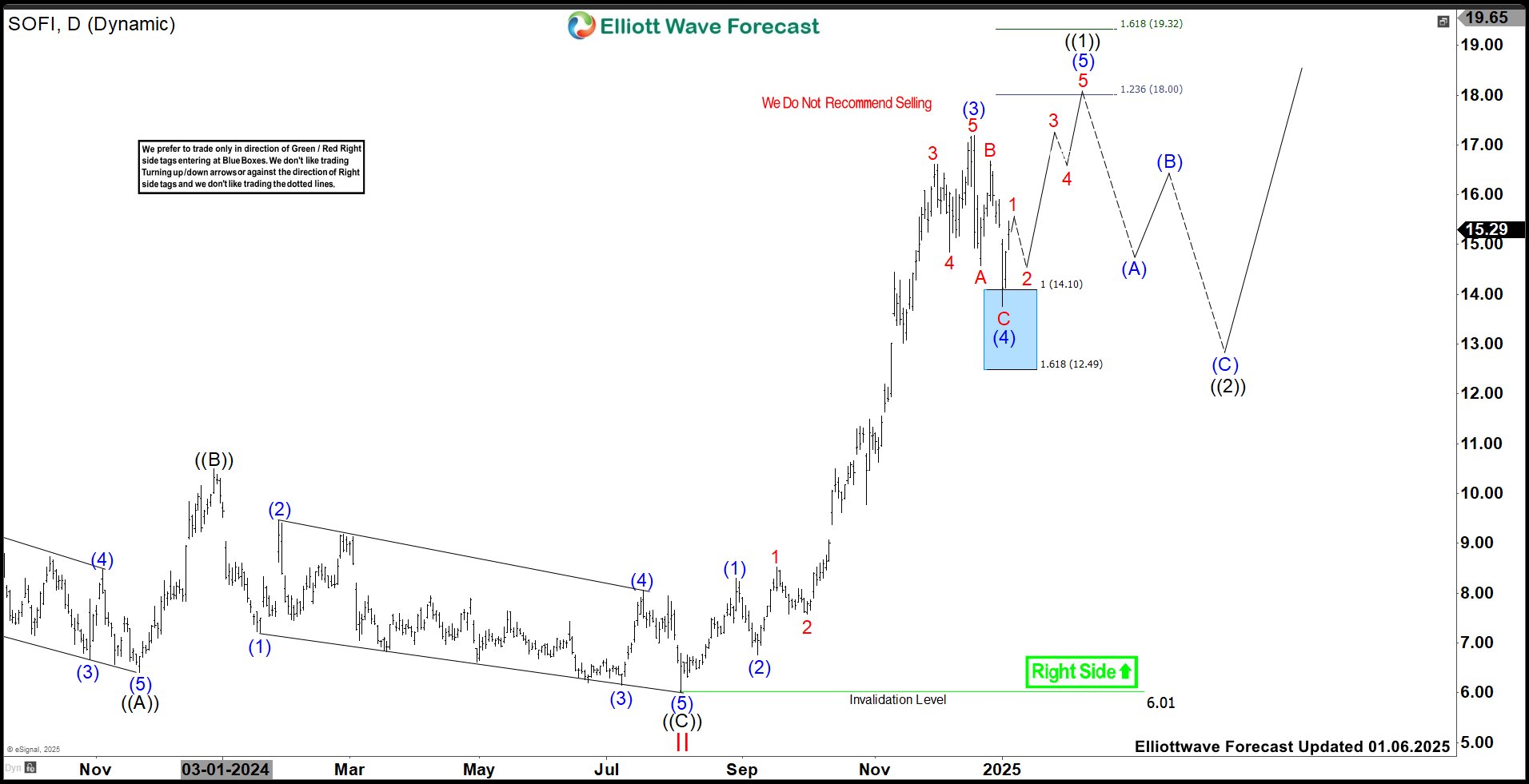

SoFi Technologies (SOFI) Found Buyers To Extend Above $18

Read MoreSoFi Technologies, Inc., (SOFI) provides various financial services in the US, Latin America & Canada. It operates through three segments; Lending, Technology Platform & Financial services. It is based in San Francisco, CA, comes under Financial Services sector & trades as “SOFI” ticker at Nasdaq. In last article, SOFI favored downside in C towards blue […]

-

Uranium Miners ETF (URA) Has Turned Higher

Read MoreThe Global X Uranium ETF (URA) is designed to provide investors with exposure to the uranium mining industry. It includes companies involved in uranium mining, exploration, development, and production, as well as those producing nuclear components. With significant holdings in major uranium producers like Cameco, URA offers a way to invest in the nuclear energy […]

-

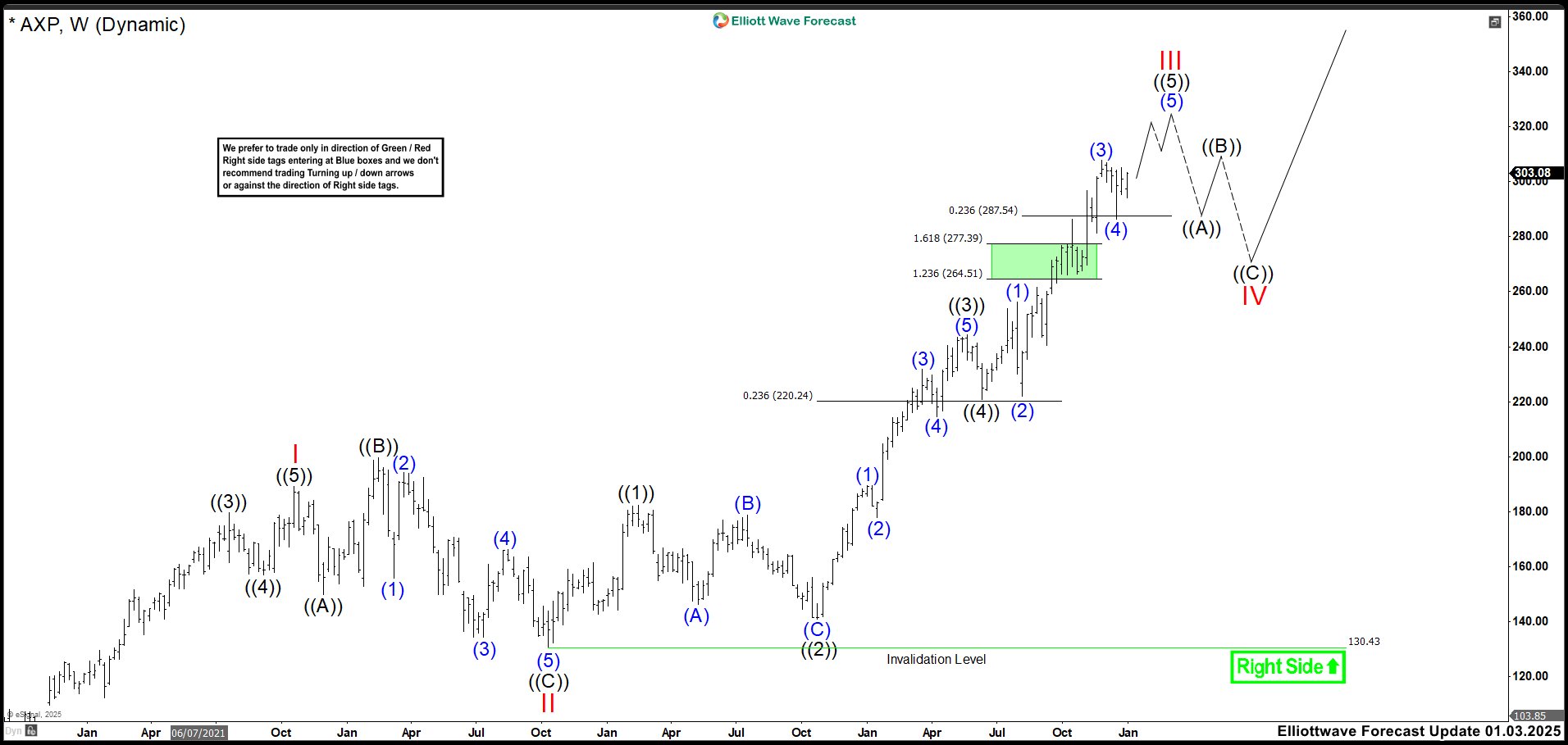

American Express (AXP) Hit Target Extending in wave ((5))

Read MoreAmerican Express Company (Amex), symbol AXP, is an American multinational financial services corporation that specializes in payment cards. Headquartered in New York City, it is one of the most valuable companies in the world and one of the 30 components of the Dow Jones Industrial Average. AXP Weekly Chart April 2024 The stock has been […]

-

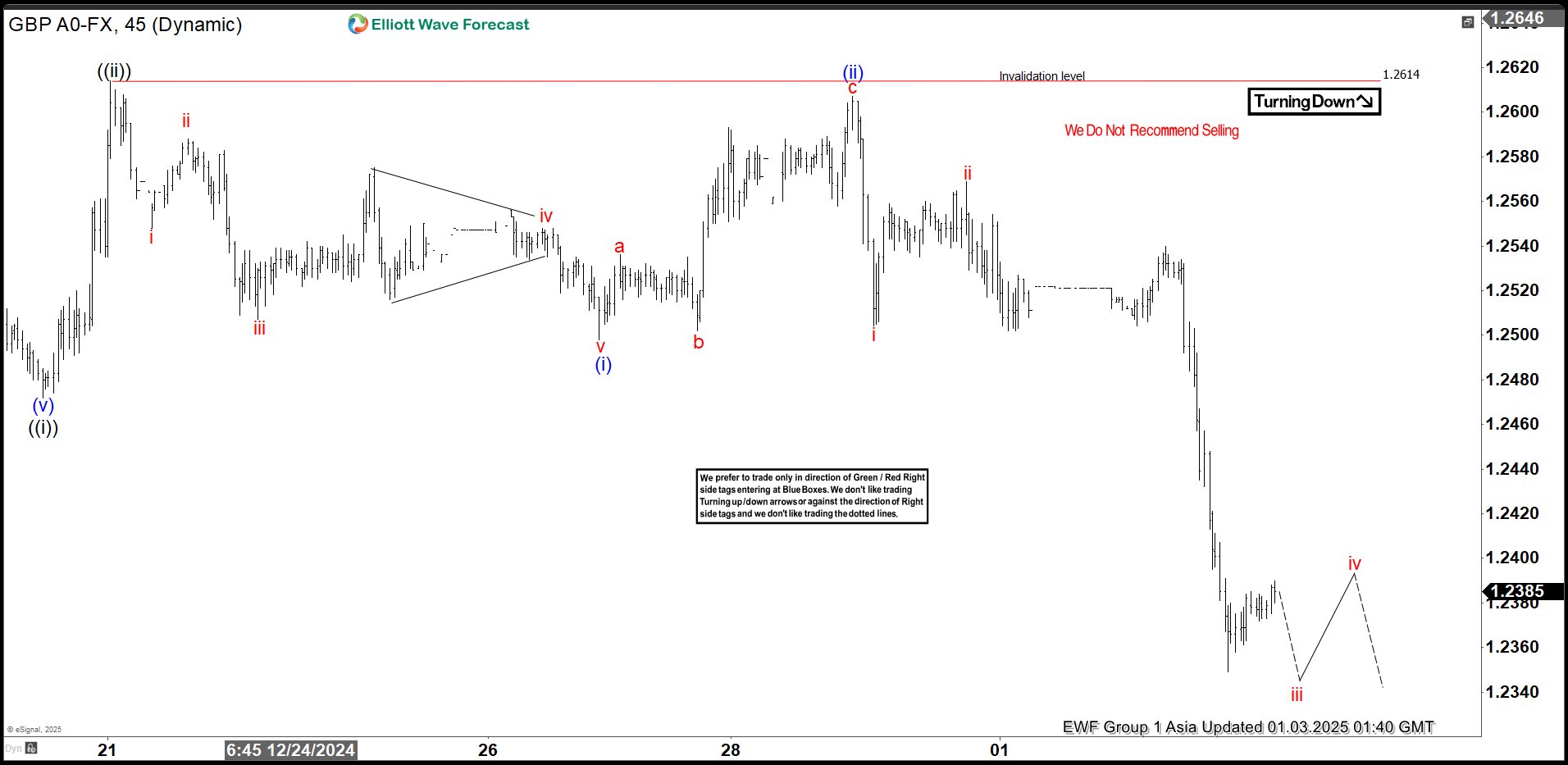

Elliott Wave View: GBPUSD Short Term Remains Bearish

Read MoreGBPUSD short term remains bearish and should see more downside to complete impulsive structure. This article and video look at the Elliott Wave path.

-

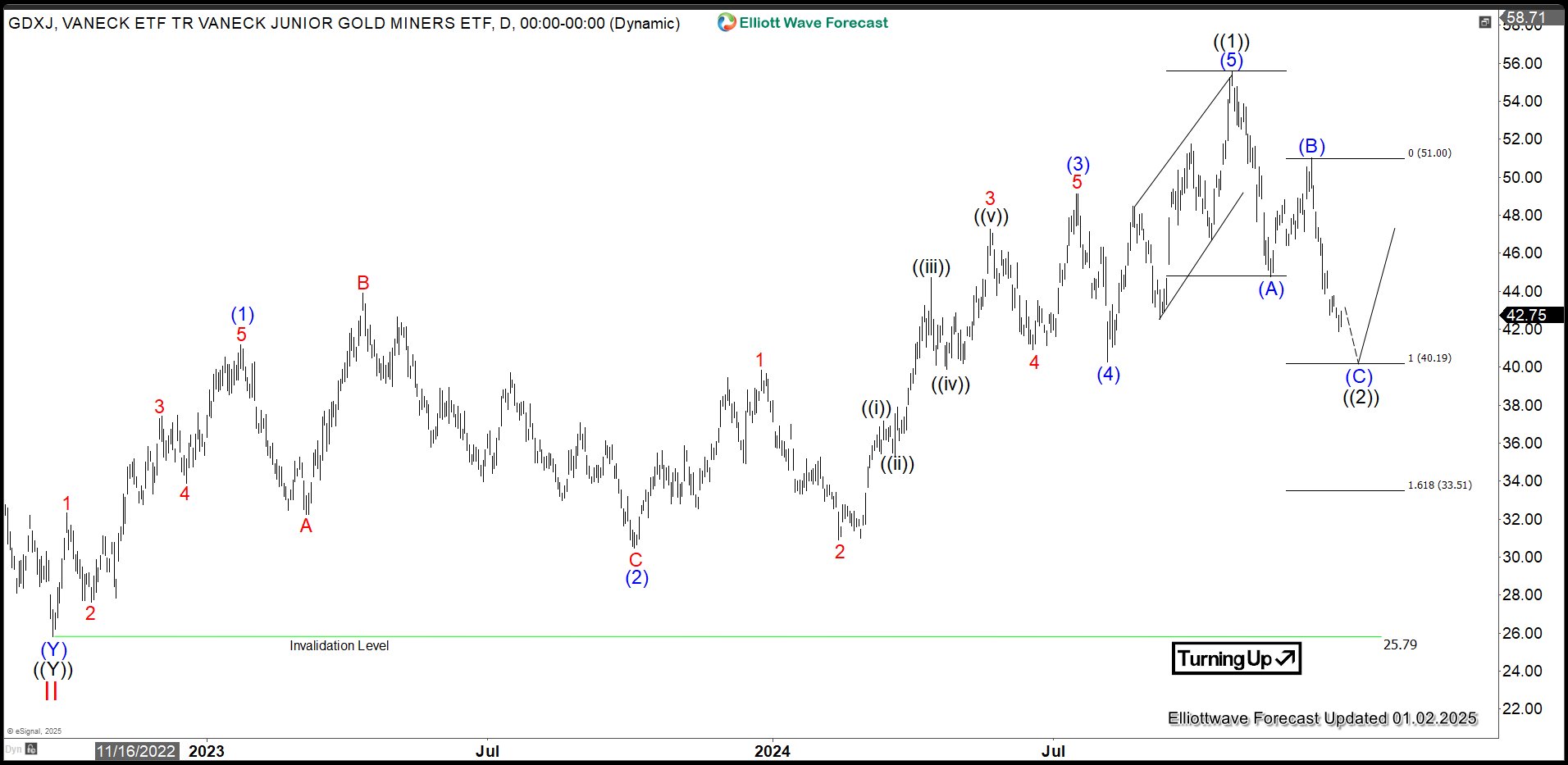

Gold Miners Junior (GDXJ) Zigzag Correction in Progress

Read MoreGold Miners Junior (GDXJ) is an exchange-traded fund (ETF) managed by VanEck. This ETF primarily invests in small-cap companies in the gold and silver mining sector. The ETF has higher potential for growth or risk compared to larger, established mining companies. These junior miners can offer significant leverage to gold price movements. It makes GDXJ […]