The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

PM Price Analysis: Risk-Free Target Met, $215 Ahead?

Read MorePhilip Morris International Inc. (PM) may have ended the over 4 months bearish cycle from June 2025. The current rebound happened at the blue box where the October 29 blog post alerted traders to go long. After reaching the first target, why do I think it could reach $215 in the coming days or weeks. […]

-

Robinhood (HOOD): Can It Dip Below $100 Before New Highs?

Read MoreOur earlier review highlighted Robinhood‘s (NASDAQ: HOOD) bullish five-swing structure. Currently, we are analyzing the weekly Elliott Wave pattern. This study clarifies the ongoing correction and prepares us for the next strategic phase ahead of a new bullish cycle. Elliott Wave Analysis HOOD completed a five-wave advance from its 2022 low of $6.81. This rally […]

-

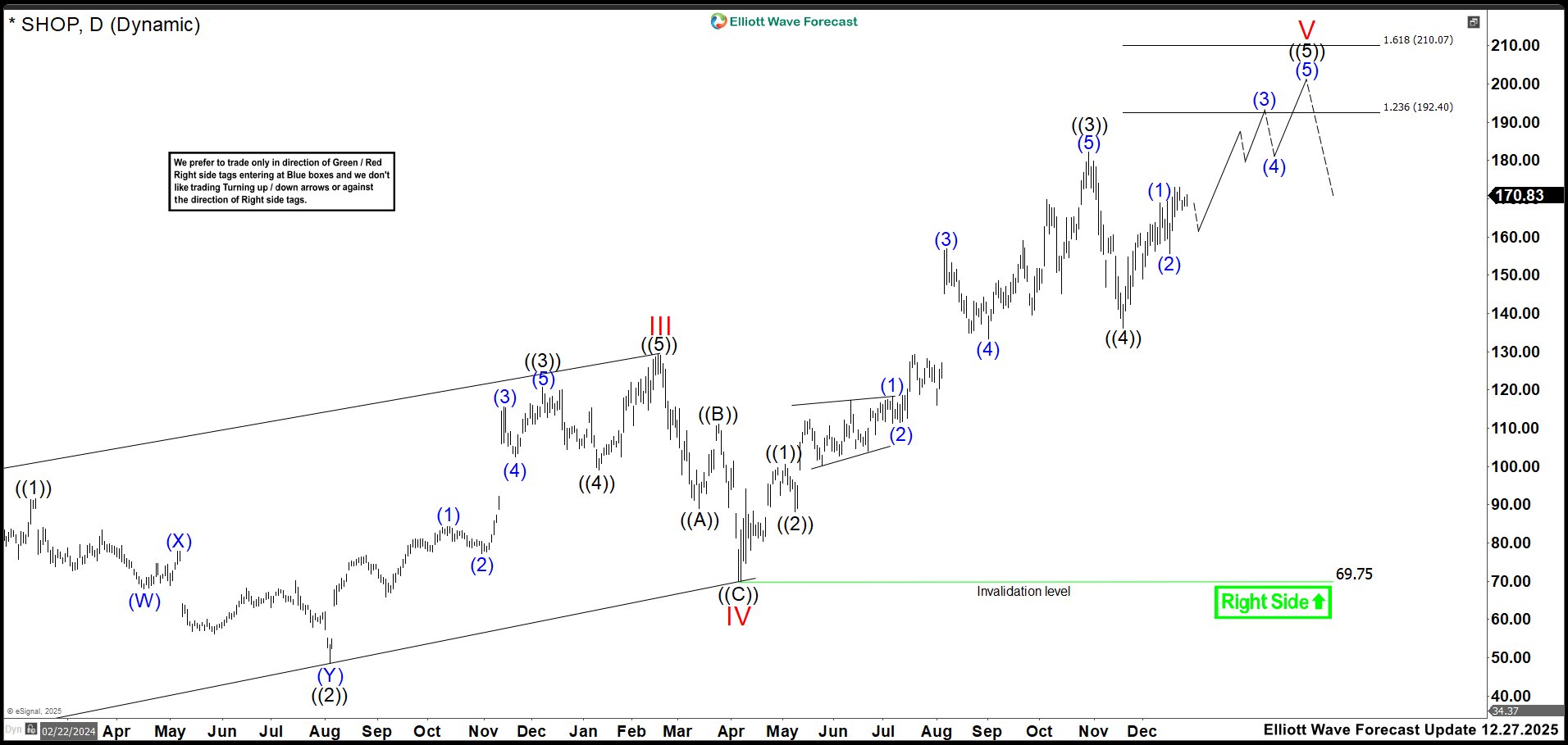

A 25% Drop Shook Traders… but SHOP Still Points Higher

Read MoreShopify (SHOP) enters the next quarters with solid momentum, and more importantly, its latest results suggest that this strength is not temporary. The company delivered 31% year‑over‑year revenue growth. Also, it saw GMV accelerate across North America, Europe, and Asia, with Europe alone growing 42% on a constant‑currency basis. As a result, management now expects […]

-

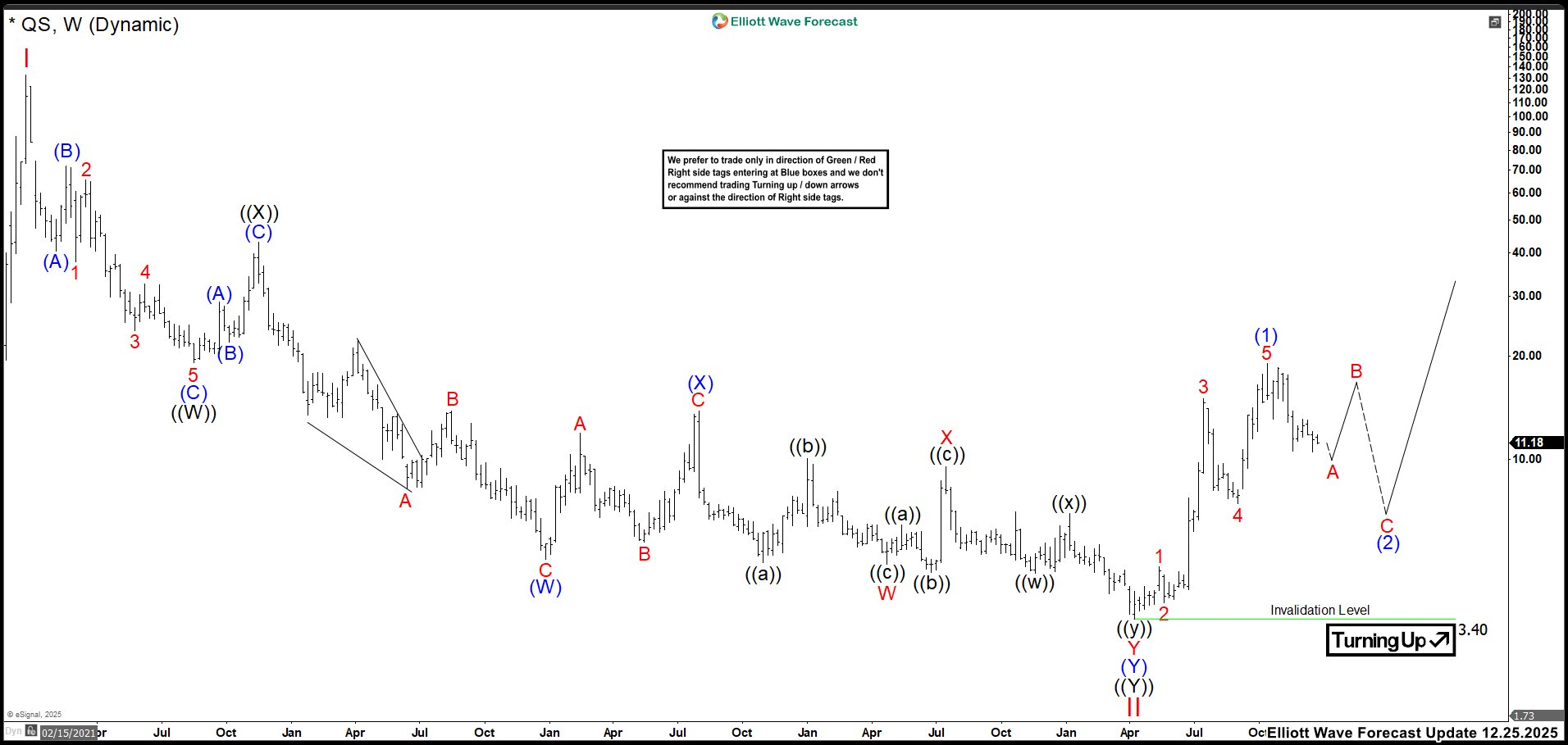

Why Traders Are Watching QS More Closely Than Ever?

Read MoreQuantumScape (QS) enters the next quarter at a pivotal moment. The company moves from lab‑scale development to real‑world validation after shipping its B1 sample cells, a key milestone noted in recent reports. This step strengthens its long‑term case for solid‑state battery leadership as it improves energy density, charging speed, and safety. Even so, QuantumScape remains […]

-

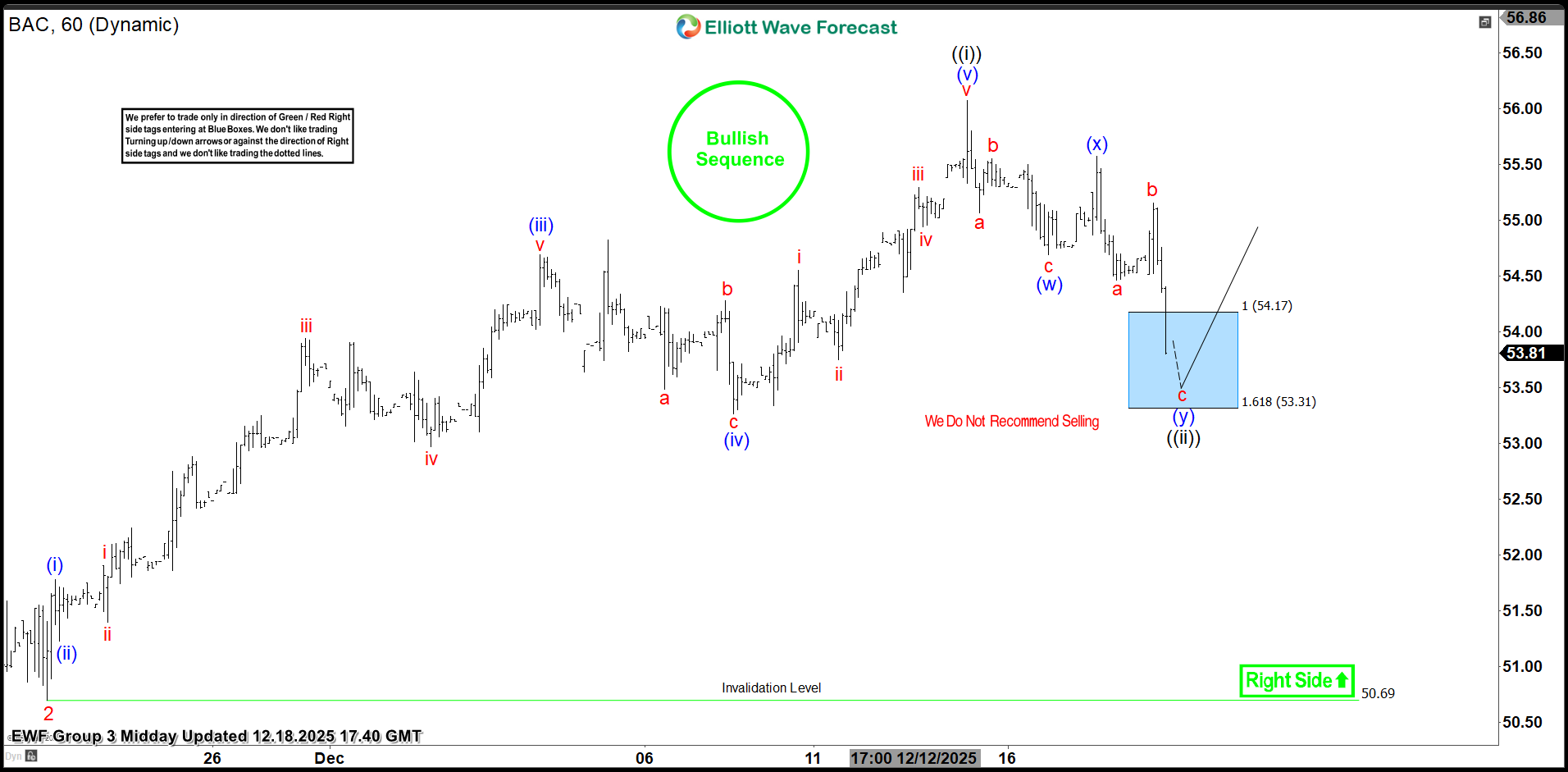

BAC Ignites Higher: Textbook Blue Box Area Reaction

Read MoreIn this blog, we take a look at the past performance of BAC charts. In which, the textbook blue box area reaction higher took place.

-

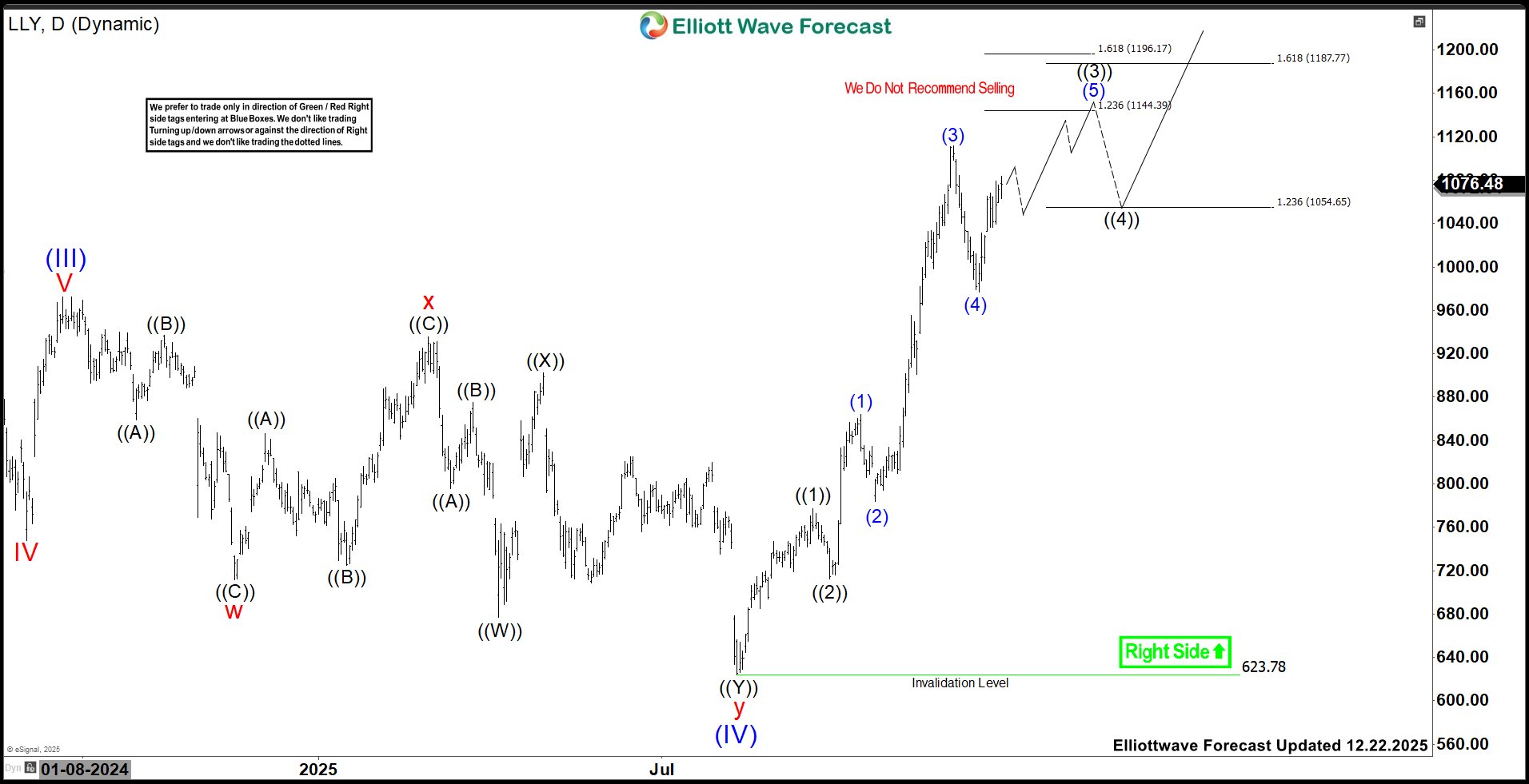

Eli Lilly & Company (LLY): Buyers Looking For Rally Between $1144.4 – $1196.17

Read MoreEli Lilly & Company (LLY) discovers, develops & markets human pharmaceuticals worldwide. It comes under Healthcare sector & trades as “LLY” ticket at NYSE. As discussed in last article, LLY favors rally in ((3)) of impulse I within August-2025 rally. It favors upside between $1144.39 – $1196.17 area, while above 12.10.2025 low to finish ((3)). […]