The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

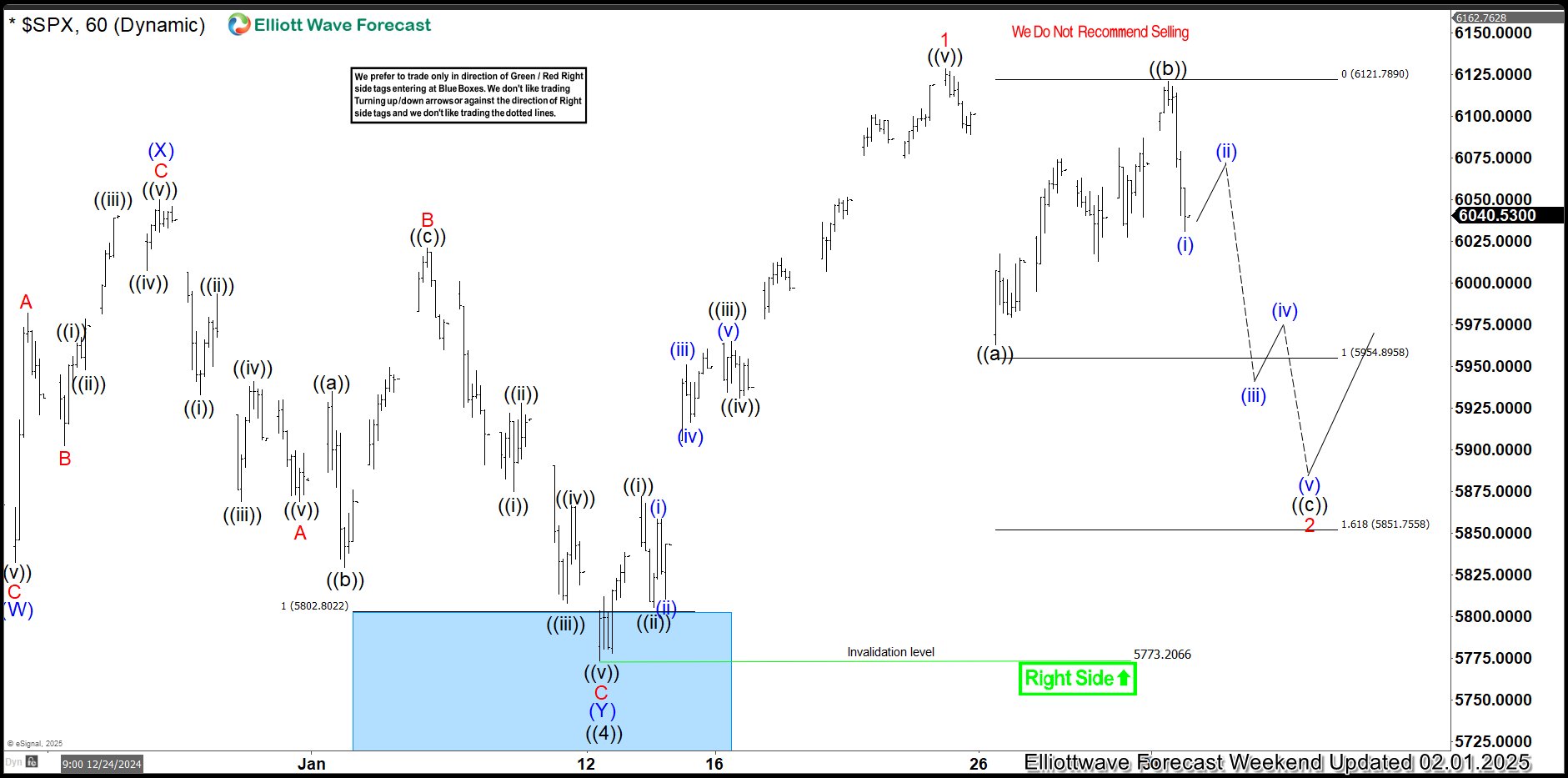

SPX Reacting Higher From Extreme Equal Legs Area

Read MoreIn this blog, we take a look at the past performance of SPX Charts. The index is reacting perfectly higher from extreme equal legs area.

-

J.P. Morgan (JPM) Bullish Cycle Remains Intact

Read MoreJ.P. Morgan (JPM) continues to rally to new all-time high and the bullish cycle remains intact. This article and video look at the Elliott Wave path.

-

Broadcom Inc (AVGO) Favors Rally Towards $275

Read MoreBroadcom Inc., (AVGO) designs, develops & supplies various semiconductor devices with focus on complex digital & mixed signal metal oxide semiconductor. The company operates in Semiconductor Solutions & Infrastructure Software. It comes under Technology Sector & trades as “AVGO” ticker at Nasdaq. AVGO reacted higher from the extreme areas after correction ended at $196.23 low. […]

-

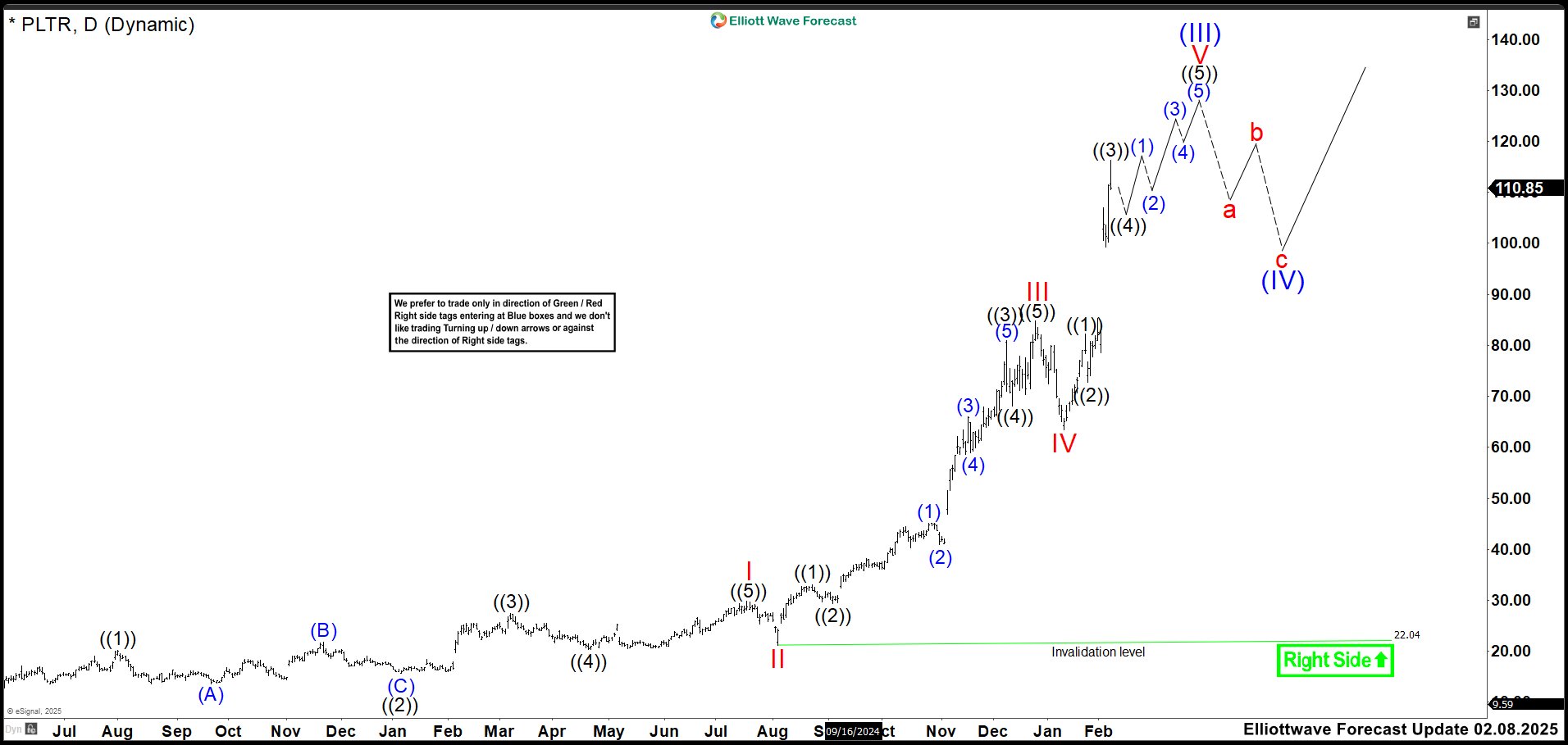

Palantir (PLTR) Stocks: Poised for Continued Growth Amidst Strong Earnings and AI Momentum

Read MorePalantir Technologies (PLTR), Inc. is a holding company, which engages in the development of data integration and software solutions. It operates through the Commercial and Government segments. The firm offers automotive, financial compliance, legal intelligence, mergers and acquisitions solutions. Palantir (PLTR) Weekly Technical Analysis – September 2024 Palantir (PLTR) Weekly Chart – Elliott Wave Forecast […]

-

Long Term Elliott Wave View on SMIC

Read MoreSemiconductor Manufacturing International Corporation (SMIC) is looking to extend higher as an impulse. This article looks at the Elliottwave path.

-

BlackRock (NYSE: BLK) Incomplete Bullish Sequence Support The Upside

Read MoreIn our previous article, we explained weekly breakout for BlackRock (NYSE: BLK) and presented the technical structure within its current cycle from 2022 low. Today, we’ll continue analysing the weekly path based on the Elliott Wave Theory. BlackRock BLK rally into new all time highs in recent month created an incomplete bullish sequence from all time low […]