The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Why Johnson & Johnson’s (JNJ) Rally Might Be Short-Lived

Read MoreJohnson & Johnson (JNJ) is an American multinational corporation founded in 1886 that develops medical devices, pharmaceuticals, and consumer packaged goods. Its common stock is a component of the Dow Jones Industrial Average, and the company is ranked No. 36 on the 2021 Fortune 500 list of the largest United States corporations by total revenue. […]

-

Chevron Corporation (CVX) Poised for Further Gains in Wave (V)

Read MoreElliott Wave analysis suggests Chevron (CVX) is extending higher in Wave (V), with bullish momentum intact and further upside potential ahead. Chevron Corporation (CVX) continues to show strong bullish momentum, with the Elliott Wave structure pointing to further upside as Wave (V) unfolds. In the past, the stock completed a major impulsive Wave III, followed […]

-

EUROSTOXX (SX5E) Made New Highs From Blue Box Area

Read MoreIn this blog, we take a look at the past performance of Eurostoxx (SXSE) charts. The index made new highs from blue box area.

-

Is Nu Holdings (NU) Ready For Next Rally ?

Read MoreNU Holdings Ltd., (NU) provides digital banking platform in Brazil, Mexico, Colombia, Germany, Argentina, United States & Uruguay. It offers spending solutions comprising credit & prepaid cards, mobile payment solutions & integrated mall that enables customers to purchase goods & services from various ecommerce retailers. It is based in Brazil, comes under Financial services sector […]

-

Consumer Discretionary ETF $XLY Blue Box Area Offers A Buying Opportunity

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of Consumer Discretionary ETF ($XLY) through the lens of Elliott Wave Theory. We’ll review how the rally from the August 065 2024, low unfolded as a 5-wave impulse and discuss our forecast for the next move. Let’s dive into the structure and expectations for this stock. 5 Wave Impulse Structure […]

-

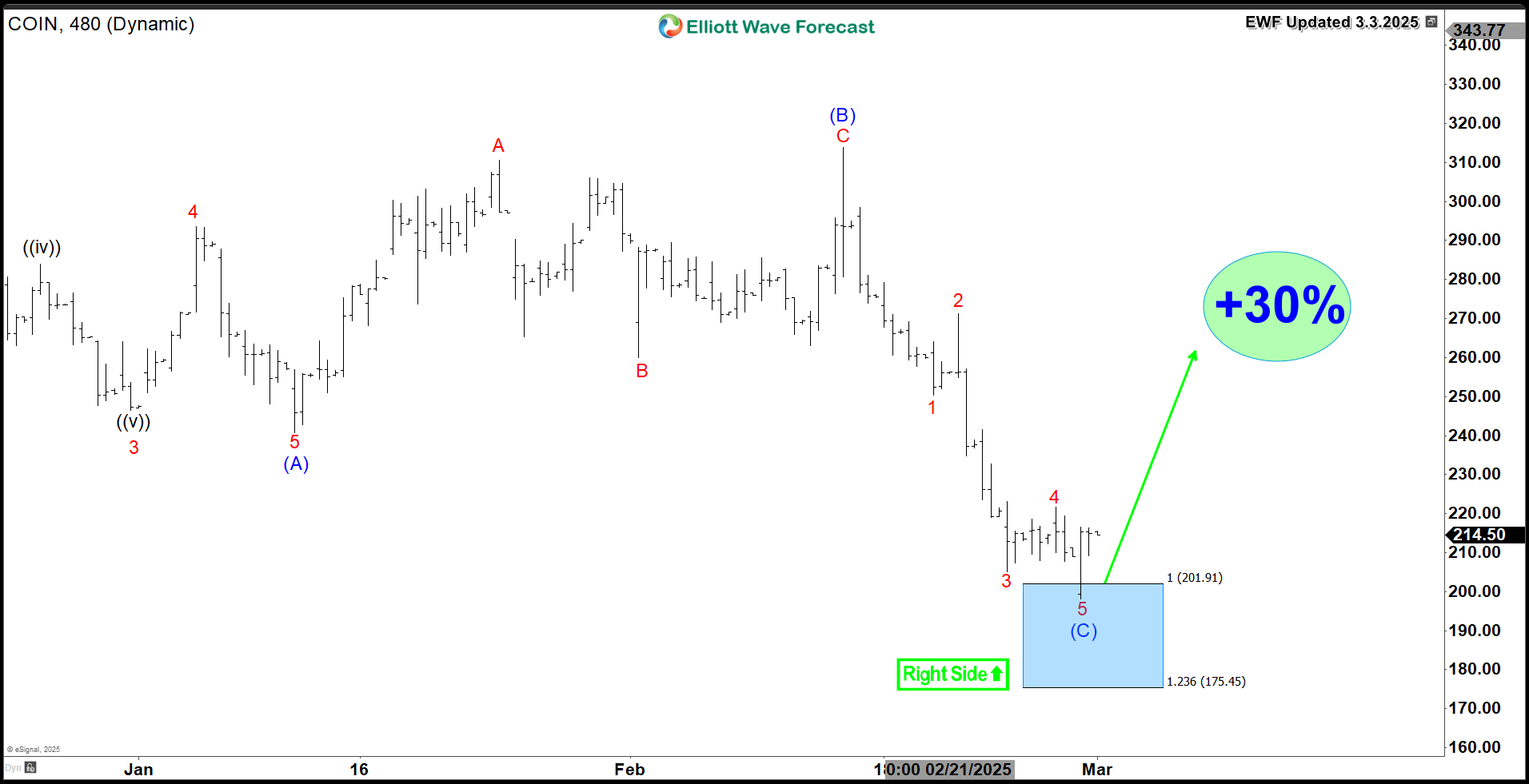

Coinbase COIN Bullish Setup Suggest At Least +30% Bounce

Read MoreCoinbase Global (NASDAQ: COIN) lost 43% of it’s value in the recent three months. In today’s article, we’ll demonstrate the Elliott Wave structure taking place within the daily cycle and we will explain the potential reaction higher that we expect to take place. COIN is currently showing a classical case of an impulsive 5 waves advance, then it’s […]