The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Elliott Wave Explained: Why the Market’s Sharp Correction Isn’t the End of the Bull Run

Read MoreIn this article, we contend that the current sharp correction in market indices like S&P 500 (SPX) does not signal the end of the bull run. To support this view, we’ve produced a video that outlines our argument with detailed technical analysis. You can view the video at the end of this article for an […]

-

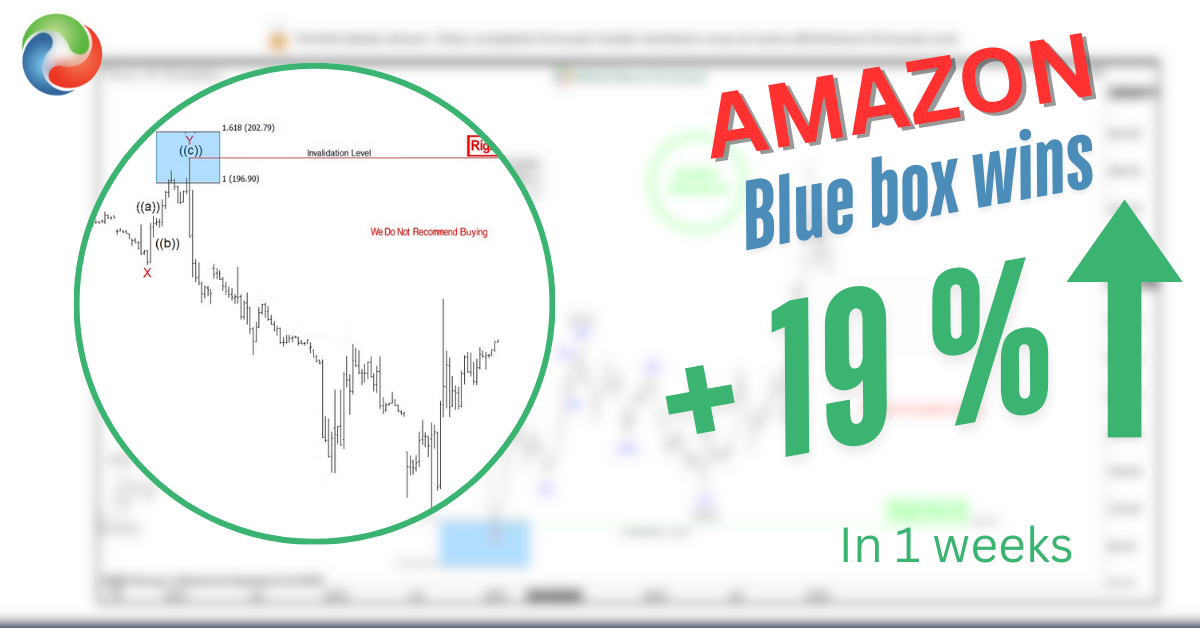

Amazon (AMZN) Falls 19% From Projected Blue Box Zone

Read MoreHello traders and welcome to a a new blog post. This post will discuss how we utilize the Elliott wave theory to spot trading opportunities from our proprietary blue box zone. In this one, the spotlight will be on AMZN stock price. Amazon.com, Inc. is a global tech giant known for its e-commerce platform, cloud […]

-

Zomato Ltd. (ZOMATO) Elliott Wave Analysis: Bullish Structure Intact

Read MoreZomato Ltd. is poised to resume its uptrend after completing wave IV, with Elliott Wave analysis pointing toward a strong rally in wave V. Zomato maintains a strong bullish Elliott Wave outlook. The daily chart suggests that wave IV has likely ended, paving the way for the final advance in wave V. This rally is […]

-

CEG 50% Crash Sets Stage for Its Next Weekly Move

Read MoreConstellation Energy (NASDAQ: CEG) has faced a dramatic 50% crash since the start of the year. In this article we will review the recent downturn, evaluate the Elliott Wave technical framework, and highlights potential paths for growth ahead. In a previous 2023 article, we analyzed the impulsive bullish rally that began in January 2022. This cycle […]

-

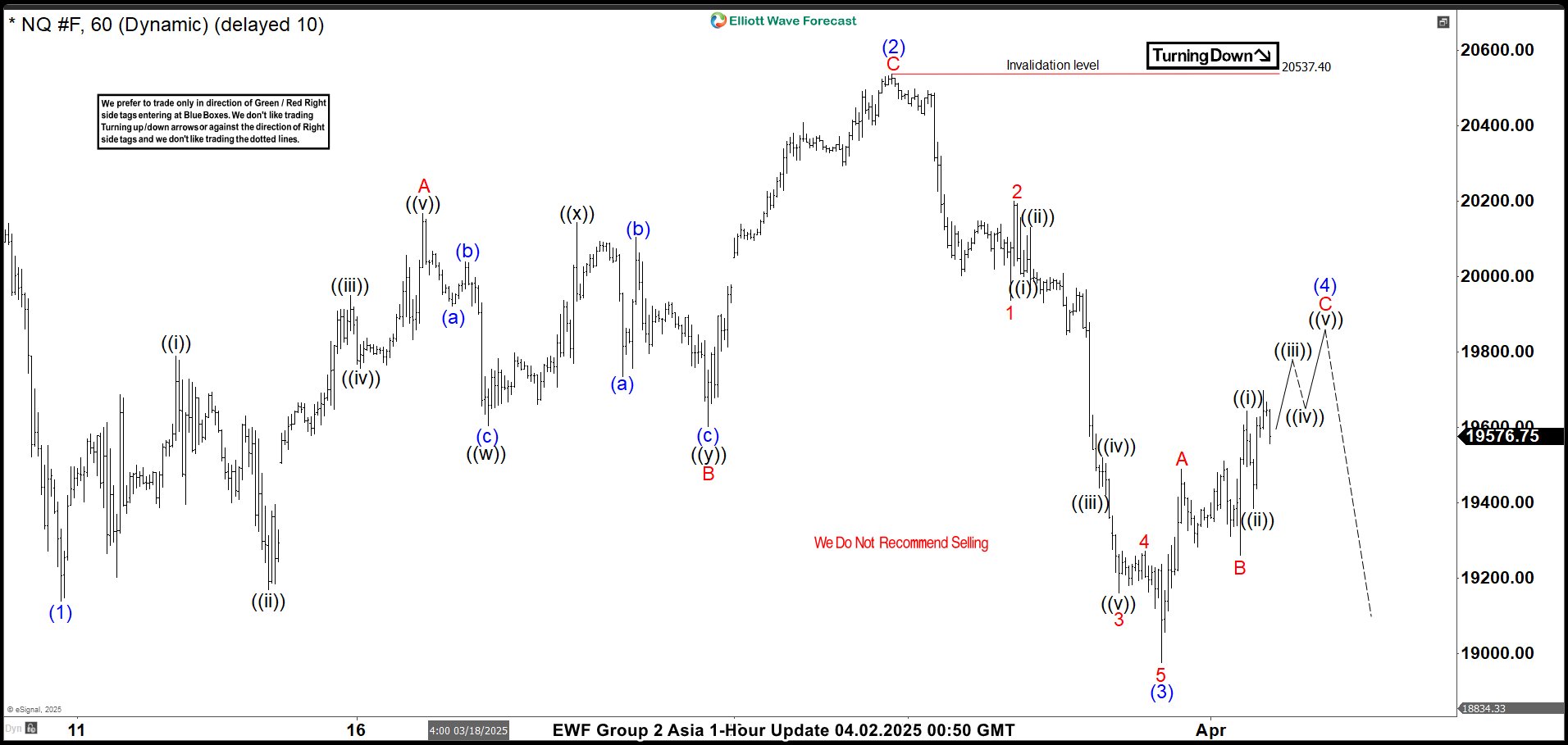

NASDAQ ( NQ_F) Elliott Wave : Incomplete Sequences Calling the Decline

Read MoreHello fellow traders. In this technical article we’re going to look at the Elliott Wave charts of NASDAQ ( NQ_F ) published in members area of the website. As our members know, NQ_F has shown incomplete bearish sequences in the cycle from the 22410.9 peak (December 2024 ). The price structure indicated further weakness. In the […]

-

NextEra Energy (NEE) Continues Potential Downside Towards 56.17

Read MoreNextEra Energy, Inc. (NEE) operates in the Utility sector, generating and distributing electricity to retail and wholesale customers in North America. Its energy portfolio includes wind, solar, nuclear, and natural gas, emphasizing clean energy solutions. The company is listed on NYSE with the ticker “NEE.” NEE – Elliott Wave Latest Weekly View: Based on Elliott […]