The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

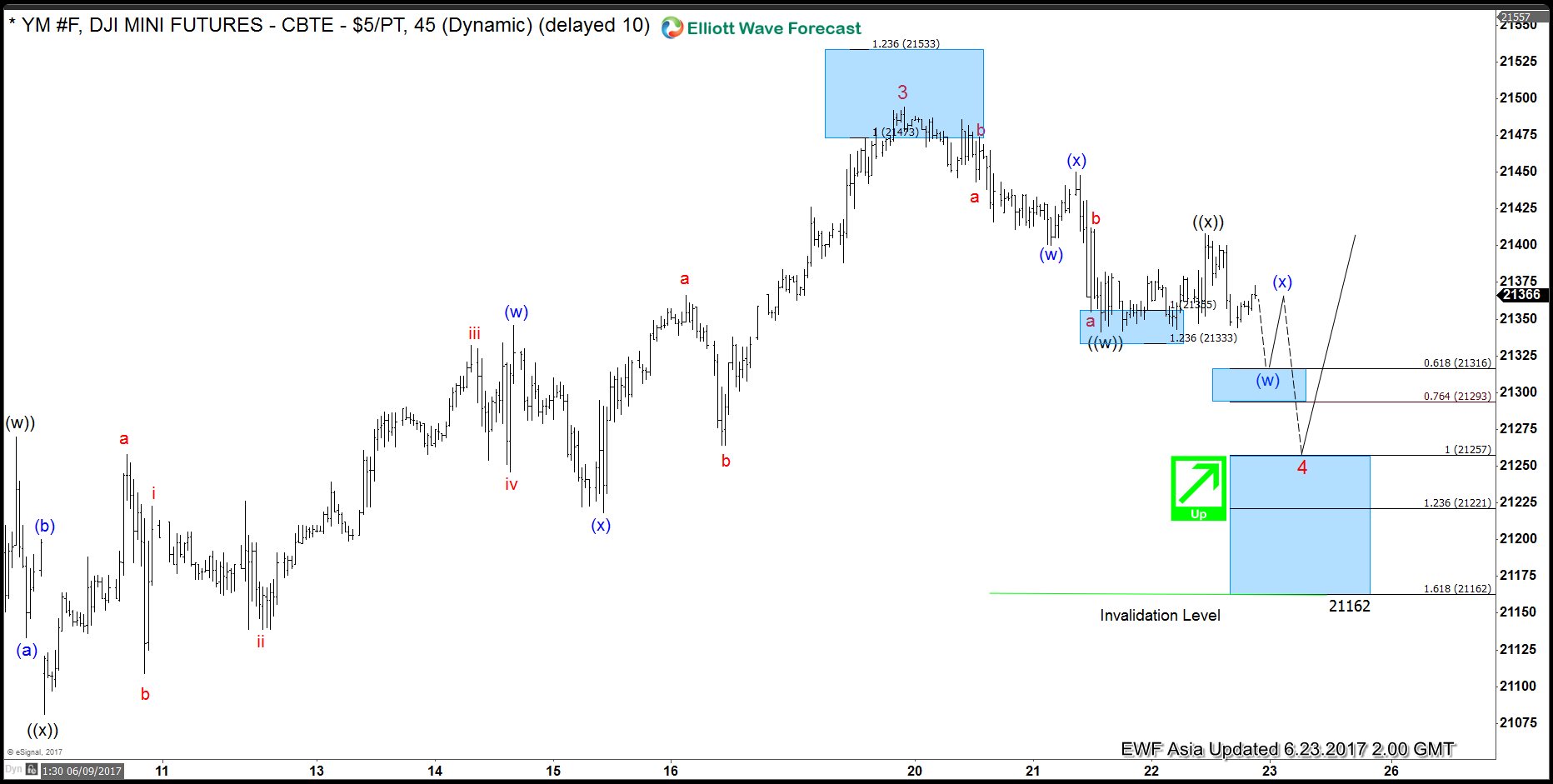

DJI Futures Elliott Wave Analysis: Pull back in progress

Read MoreShort term YM (DJI Futures) Elliott Wave view suggests the rally from 4/19 low is unfolding as a diagonal Elliott Wave structure where Minor wave 1 ended at 21010 (4/26), Minor wave 2 ended at 20474 (5/18), Minor wave 3 ended at 21494 (6/19). Minor wave 4 is in progress and subdivided into a double three Elliott Wave structure. Down from […]

-

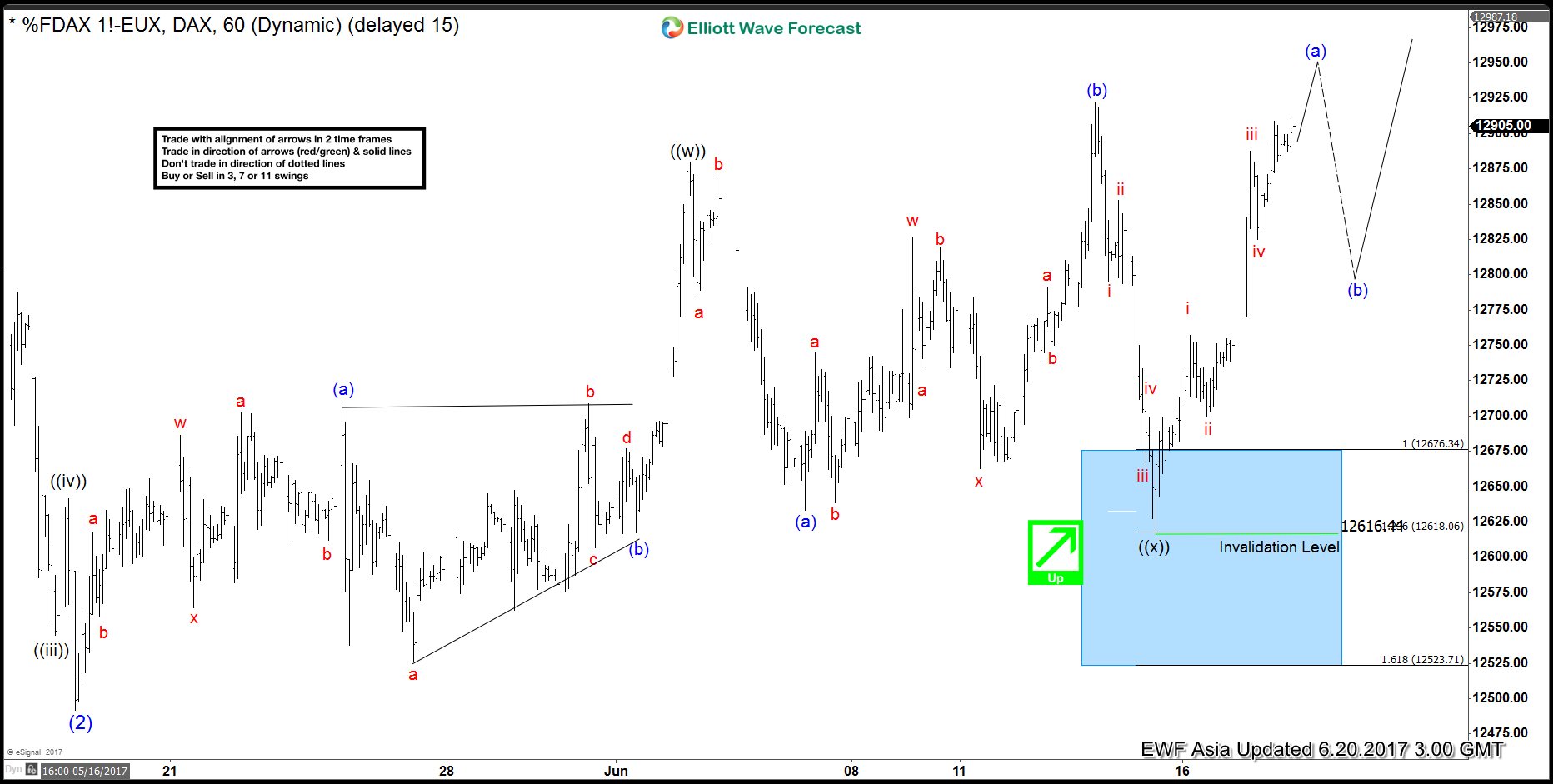

DAX Elliott Wave Analysis: Bullish Against 12617

Read MoreShort term DAX Elliott Wave view suggests the rally from 5/18 is unfolding as a double three Elliott Wave structure. Minute wave ((w)) ended at 12879.5 and Minute wave ((x)) pullback ended at 12617. Internal of Minute wave ((x)) subdivided as an expanded flat Elliott Wave structure where Minutte wave (a) ended at 12633.5, Minutte wave (b) ended […]

-

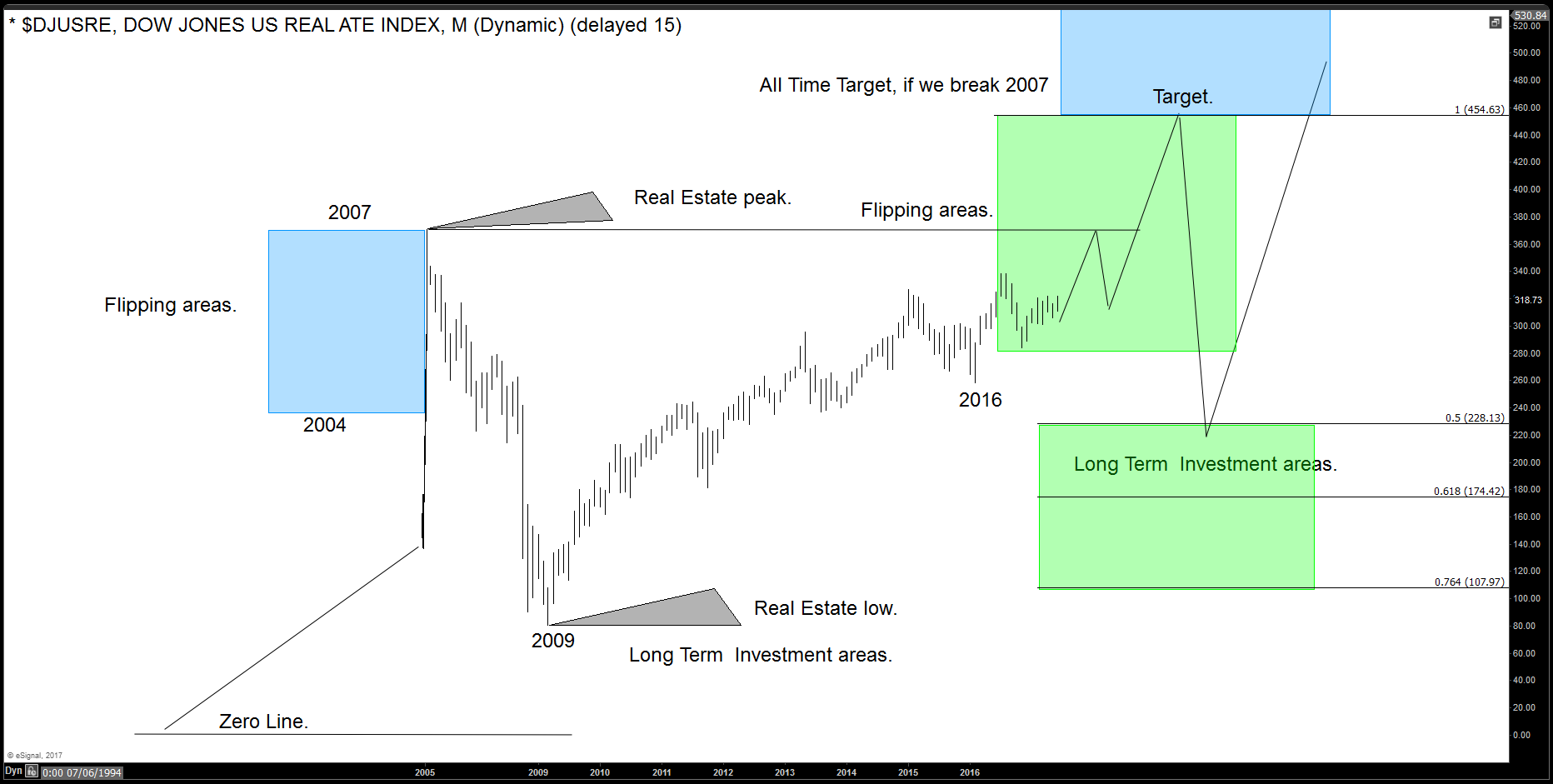

Real Estate (DJUSRE): Buy now or Wait?

Read MoreWe at Elliottwave–forecast.com track a lot of Indices around the World. One of the Indices we track is DJUSRE (Dow Jones US Real Estate Index) which provides a guideline for housing properties in the U.S. Buying real estate is always a good way to invest and make money. For years, investors use the real estate […]

-

DAX Elliott Wave Analysis: More Upside

Read MoreShort term DAX Elliott Wave view suggests the decline to 12491.5 on 5/18 ended Intermediate wave (2). Up from there, the rally is unfolding as a double three Elliott Wave structure. Minute wave ((w)) ended at 12879.5 and Minute wave ((x)) pullback ended at 12616.44. Internal of Minute wave ((x)) is subdivided as an expanded flat Elliott Wave […]

-

YM (Dow Futures) Elliott Wave Analysis 6.16.2017

Read MoreShort term YM (Dow Futures) Elliott Wave view suggests the rally from 4/19 low is unfolding as a diagonal Elliott Wave structure where Minor wave 1 ended at 21010 (4/26), Minor wave 2 ended at 20474 (5/18), Minor wave 3 ended at 21270 (6/8), and Minor wave 4 ended at 21081 (6/8). Minor wave 5 is in progress and […]

-

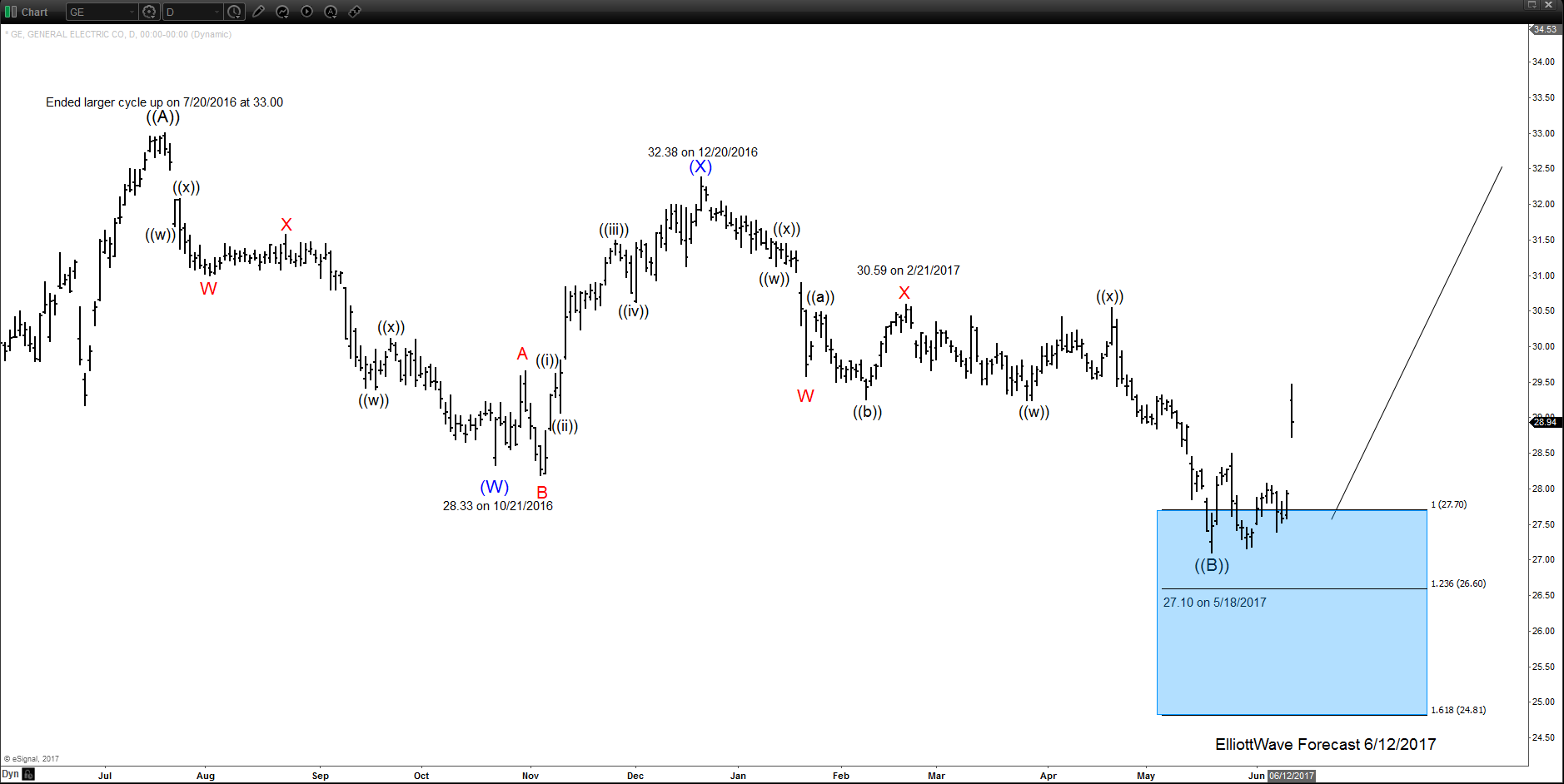

General Electric $GE Bounce is from Technicals or Jeff Immelt’s Resignation?

Read More$GE Bounce is from Technicals or Jeff Immelt’s Resignation? Firstly, I suspect the bounce is technical or at a minimum immaculate timing of the news to go with the technical view. This large multinational organization & conglomerate’s CEO of the past few years Jeff Immelt just announced he would resign from General Electric and there is […]