The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Dow Jones Transportation Index Called The Correction In Indices

Read MoreIn this blog-post, I want to discuss and recap my Blog I did on the Dow Jones Transportation Index in December 2017. First of all, you need to understand that today’s market can advance in 2 types of sequences. The first type is 5-9-13 or motive sequence and the second type is the 3-7-11 or corrective […]

-

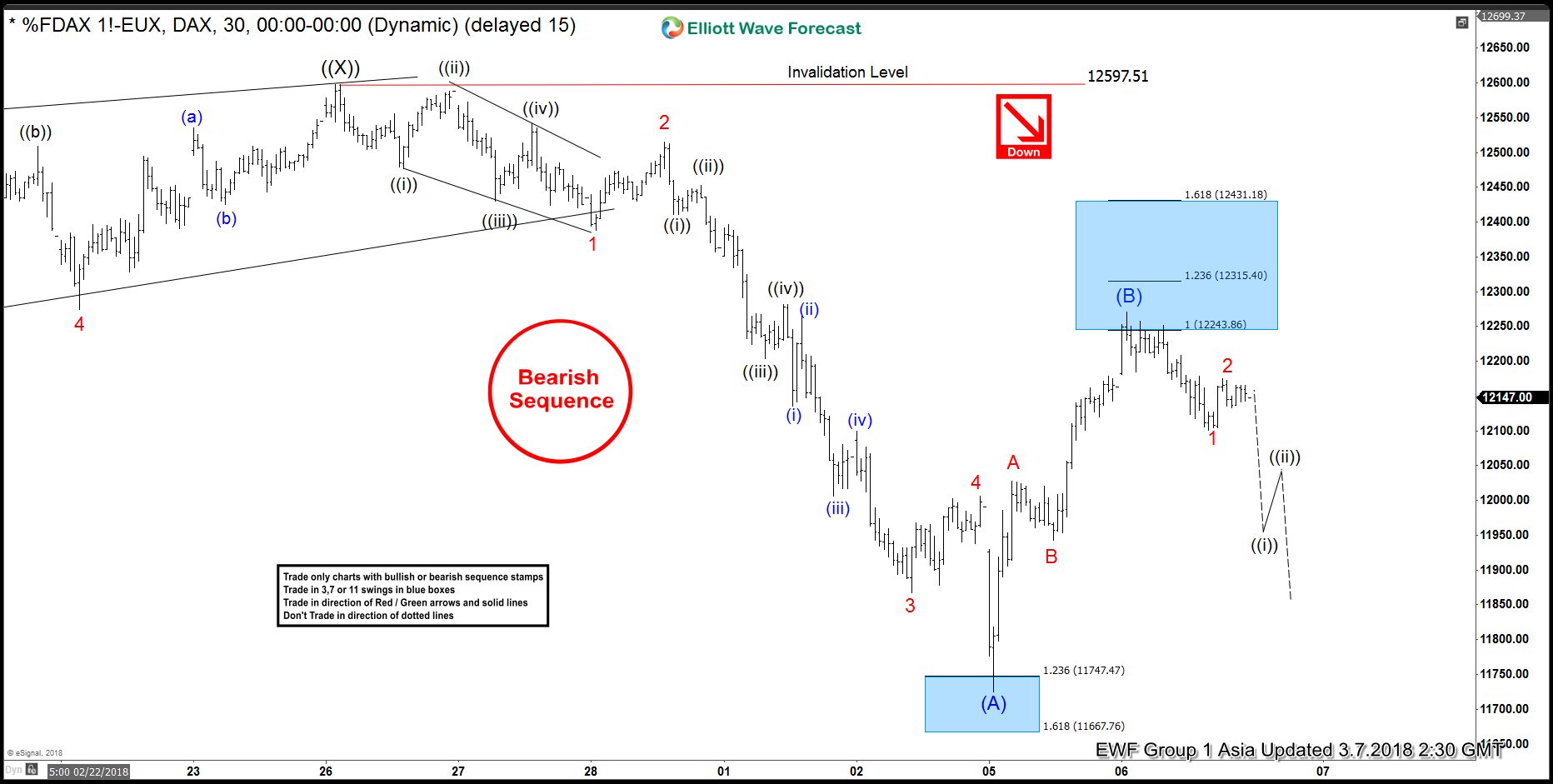

DAX Elliott Wave View: Correction Ended

Read MoreDAX is correcting higher degree cycle from February 2016. Short-term Elliott Wave view suggests that Primary wave ((X)) ended with the rally to 12597.51. Decline from there is unfolding as a Zigzag Elliott Wave structure where Intermediate wave (A) ended at 11725 and Intermediate wave (B) is proposed complete at 12270.50 high in New York earlier today. However, Index […]

-

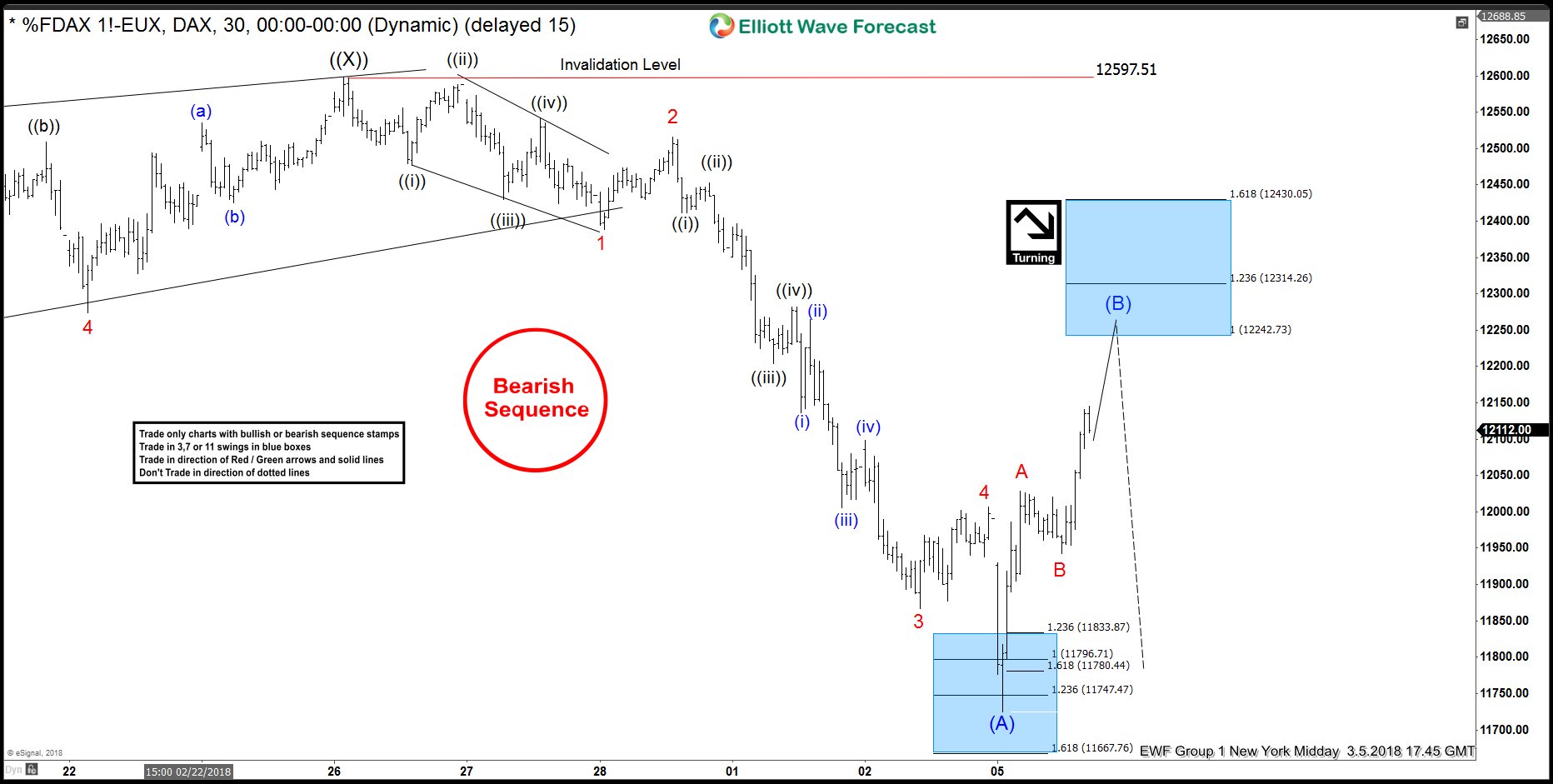

DAX Elliott wave view: Calling for another extension lower

Read MoreDAX, the index from Germany, is correcting higher degree cycle from February 2016. Short-term Elliott Wave view suggests that the rally to 12597.51 at February 26.2018 ended Primary wave ((X)). Down from there, the decline unfolded as a 5 waves Elliott Wave Impulse Sequence which ended at 11730.50 and this 5 waves ended Intermediate wave (A) of a Zigzag structure in the […]

-

United States Steel Corporation $X Daily Elliott Wave View

Read MoreUnited States Steel Corporation (NYSE: X) is the second largest steel domestic producer behind Nucor Corporation (NYSE: NUE) and also the world’s 24th largest steel producer. Last year, Steel price surged higher reaching new all time high of 4772 in December gaining +60% before a correction took place. The price is expected keep rising in the coming years […]

-

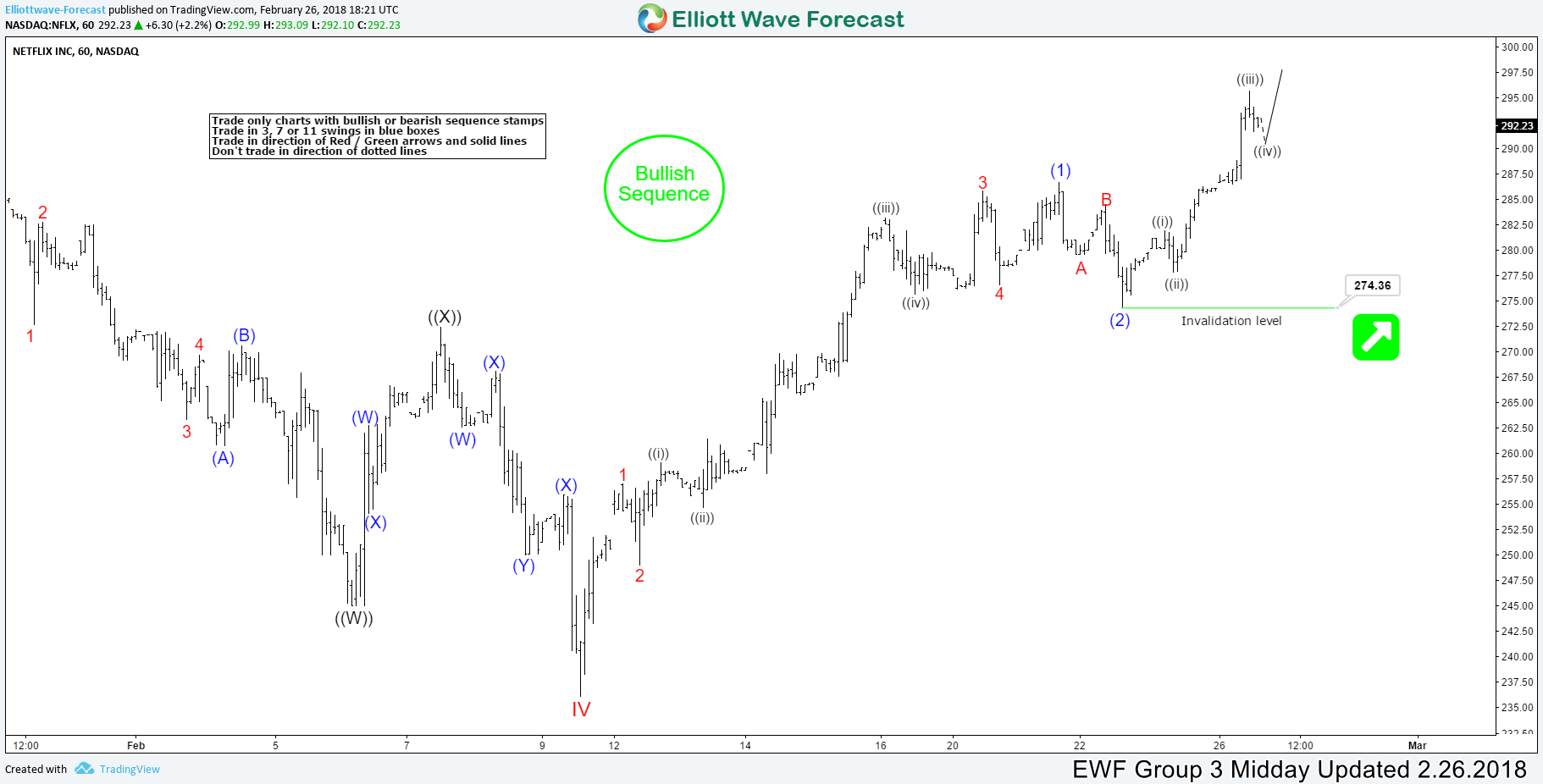

NFLX (Netflix) Elliott Wave: Showing incomplete Impulse sequence

Read MoreNetflix stock symbol: (NFLX ) Short Term Elliott Wave view suggests that the decline from January 29.2018 peak 286.70 to decline to 236.16 low on February 09.2018 low ended Cycle degree wave IV. Above from there, the rally has resumed higher by a break above 286.70 high in Cycle degree wave V looking for more upside extension. Also, it’s […]

-

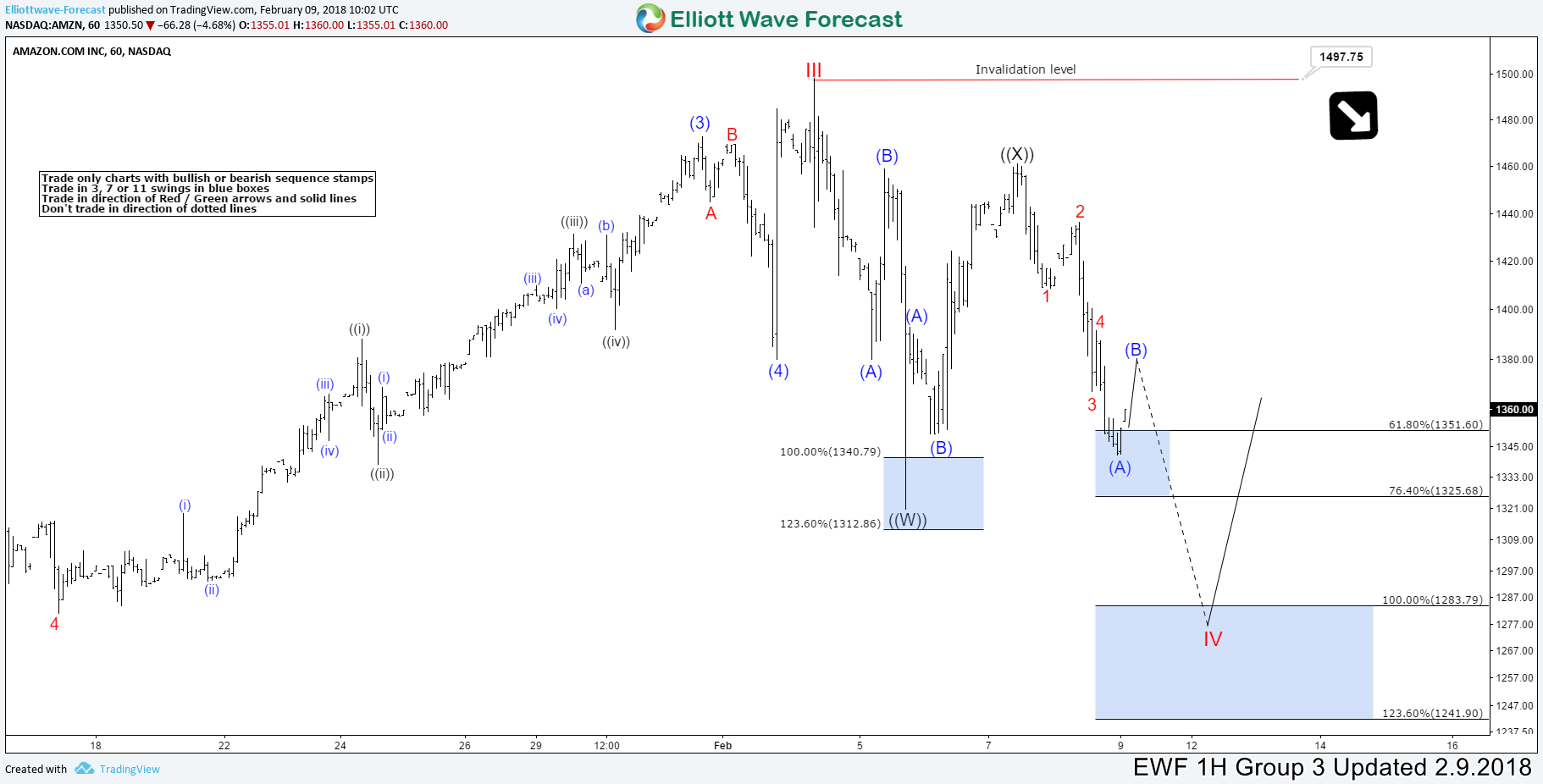

Trading The Amazon Stock The Right Way

Read MoreHello fellow traders, In this blog I want to share with you a trade in Amazon stock which we took in our Live Trading Room from Group 3. In Group 3 we cover stocks and ETFs. Now, let us have a look at some past charts of the stock Amazon and the respectable entry in […]