The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

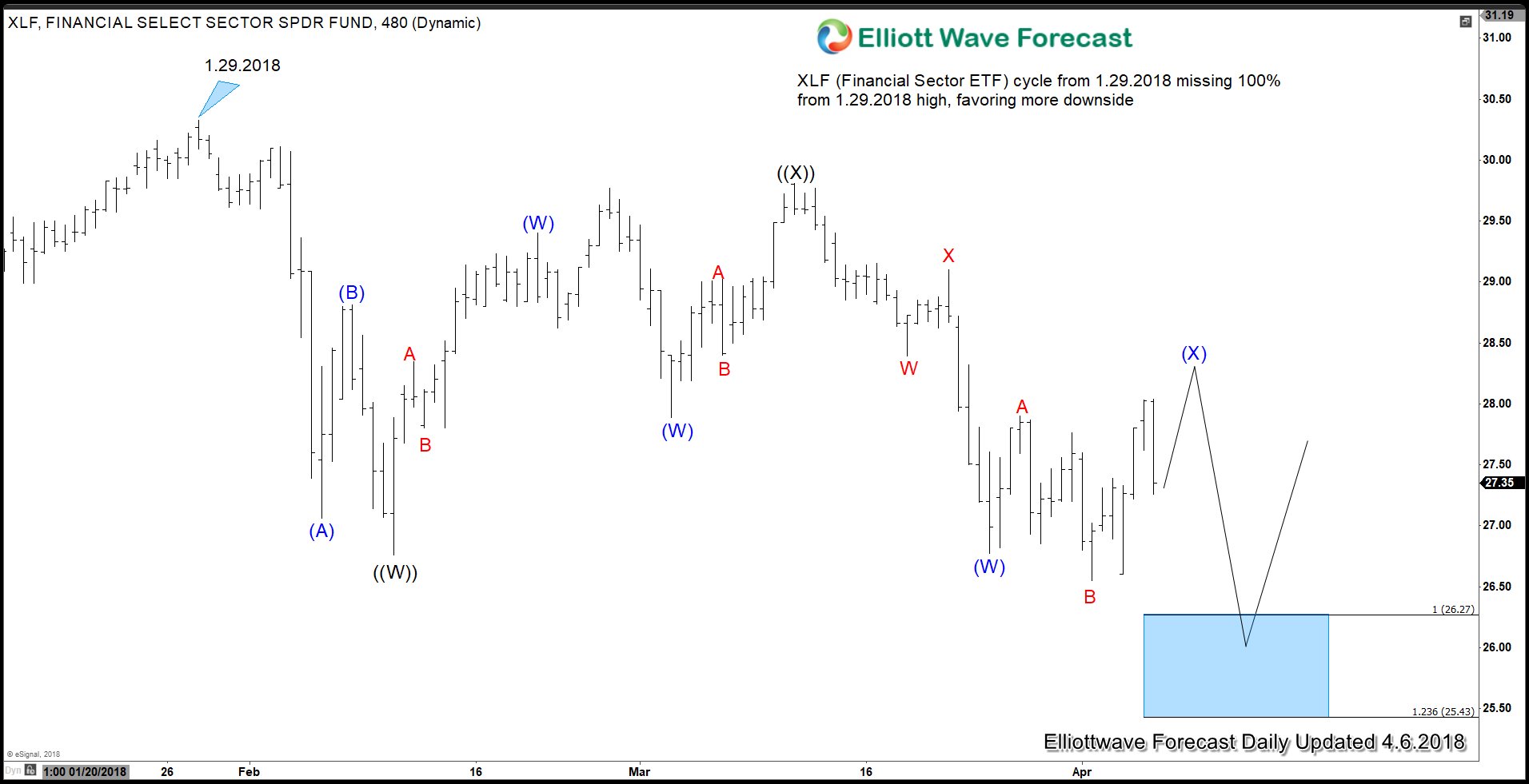

Trade War Uncertainty Limits Market Strength

Read MoreEscalation in U.S. and China Trade War On Tuesday, the White House published a list of 1300 Chinese products subject to tariffs with total value of $50 billion. It’s however still subject to a review process which will last through at least May before it takes effect. The U.S. list focuses on high-tech item such […]

-

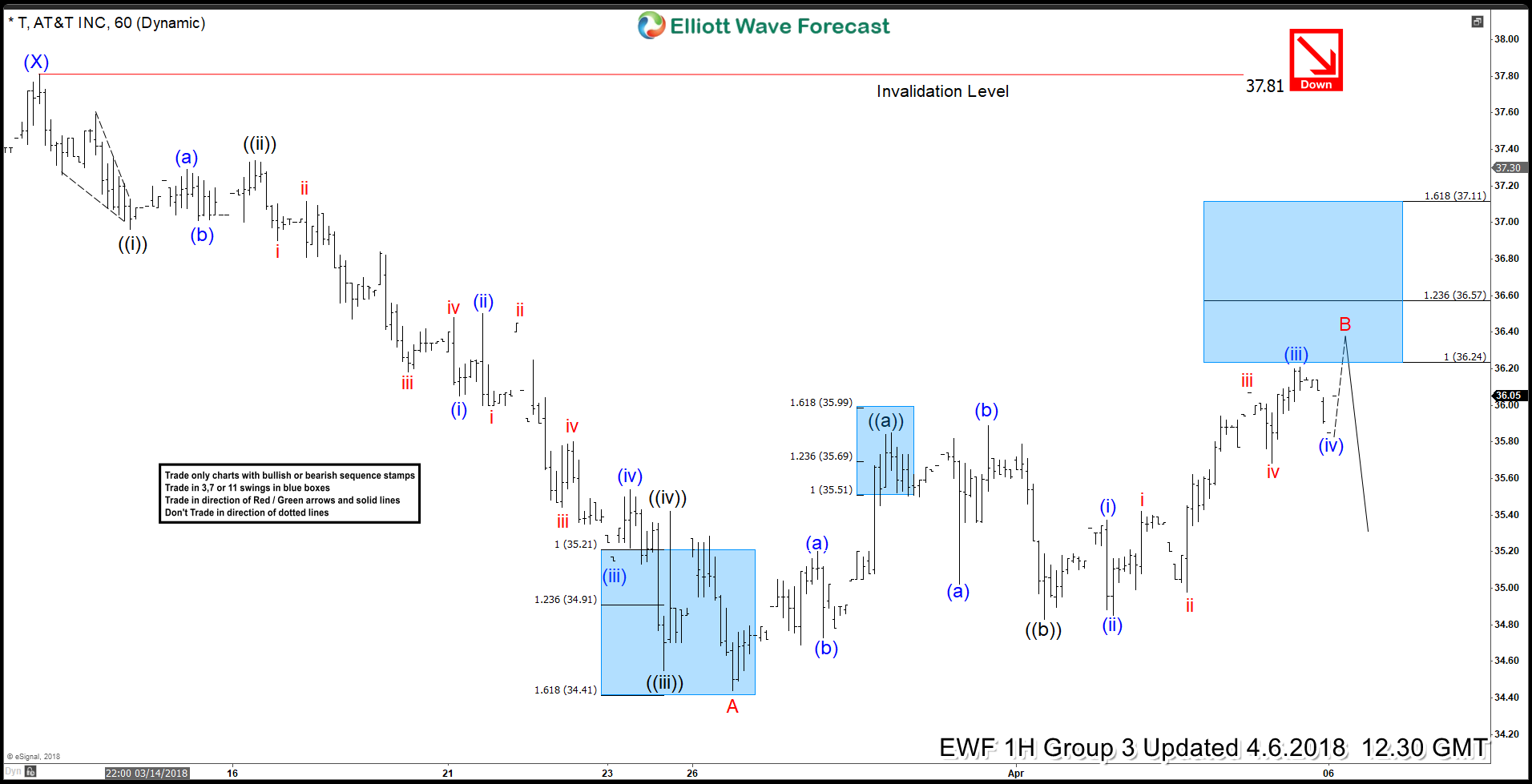

AT&T Elliott Wave View: Calling Bounces to Fail

Read MoreAT&T ticker symbol: ($T) short-term AT&T Elliott Wave view suggests that the bounce to 3/13 high (37.81) ended Intermediate wave (X) bounce. Below from there, intermediate Y leg lower remains in progress as a Zigzag correction. Where initial decline unfolded in 5 waves Elliott Wave Impulse Sequence with extension in Minor wave A. Which can be seen in […]

-

NASDAQ Elliott Wave : Bearish Sequence Called The Decline

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of NASDAQ published in members area of the website. As our members know, NQ #F have had incomplete sequences in the 4H cycle , according to Sequence Report. Consequently, we advised clients to keep on selling […]

-

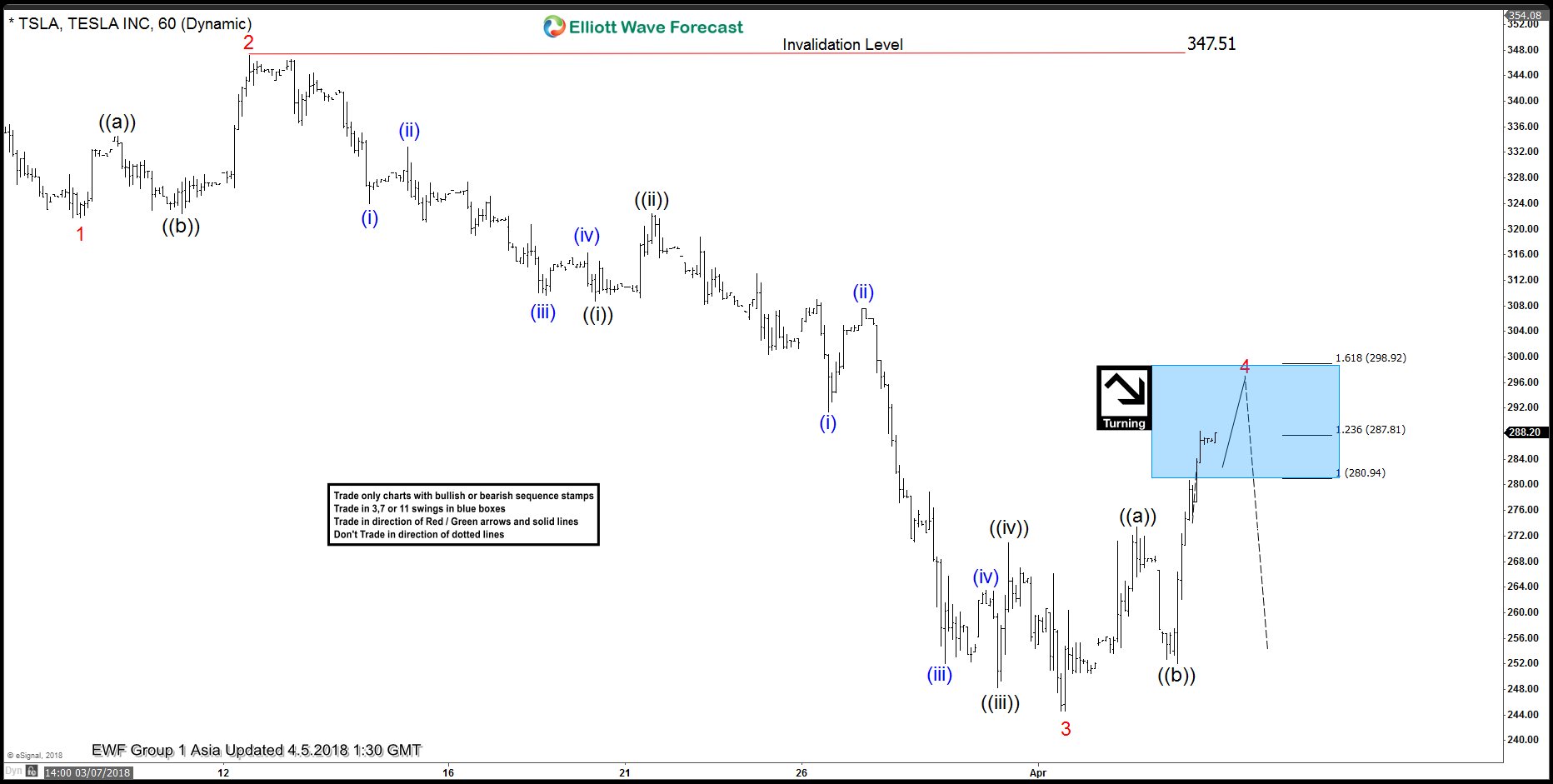

Elliott Wave Analysis: Tesla in a Turning Area

Read MoreLatest Elliott Wave view in Tesla (TSLA) suggests that the decline from 2.27.2018 ($359.99) is unfolding as an impulse Elliott Wave structure. Down from 2.27.2018 high, Minor wave 1 ended at $322.97, Minor wave 2 ended at 347.21, and Minor wave 3 ended at $244.59. Minor wave 3 has an extension and also have 5 waves […]

-

Tesla TSLA Providing the Floor in Stock market

Read MoreTESLA (NASDAQ:TSLA) shares spiked 7% higher today before closing the day at $268 same level as late March of last year. What’s hiding behind the move and can investors be relieved ? Shares of the electric-car maker are still down 16.5 percent since the beginning of the year, alongside other automakers like General Motors (NYSE:GM) Down […]

-

AMAZON Elliott Wave Analysis: Tracking Recent Price Action

Read MoreIn today’s blog, we will have a look at some past short-term Elliott Wave structures of the Amazon stock which we presented to our members. In the first chart below, you can see the 4-hour weekend update chart presented to our members on the 03/25/18. Calling for a bounce in 3 waves at least to the […]