The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

DAX Elliott Wave Analysis: Ending The Wave 3 Soon

Read MoreDAX Elliott Wave view in shorter cycles suggests that the rally from March 26.2018 low (11704) is extending higher in Impulse sequence with extension in the 3rd wave. It’s important to note that an impulse structure should have internal subdivision of lesser degree 5 waves impulse. And in particular, DAX’s case, Minute wave ((i)), ((ii)) and […]

-

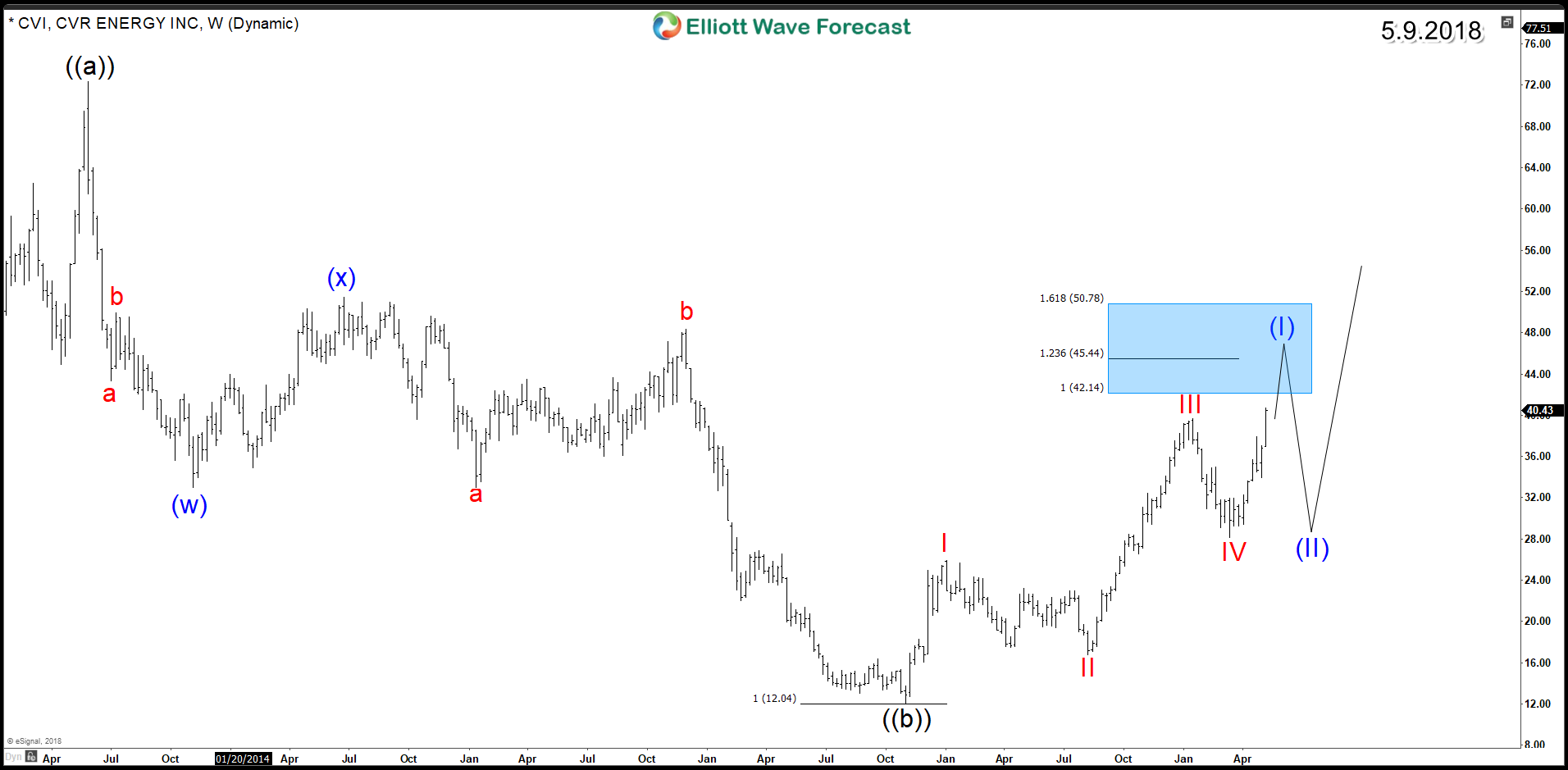

CVR Energy CVI Showing Bullish Structure

Read MoreCVR Energy (NYSE: CVI) is one of the best performing Energy stocks in the recent 2 years yielding +220% since November 2016 low. Despite the correction taking place in the stock market, CVI did manage to retrace the whole decline since January peak and it’s currently already up +7.9% year-to-date. To understand further the technical […]

-

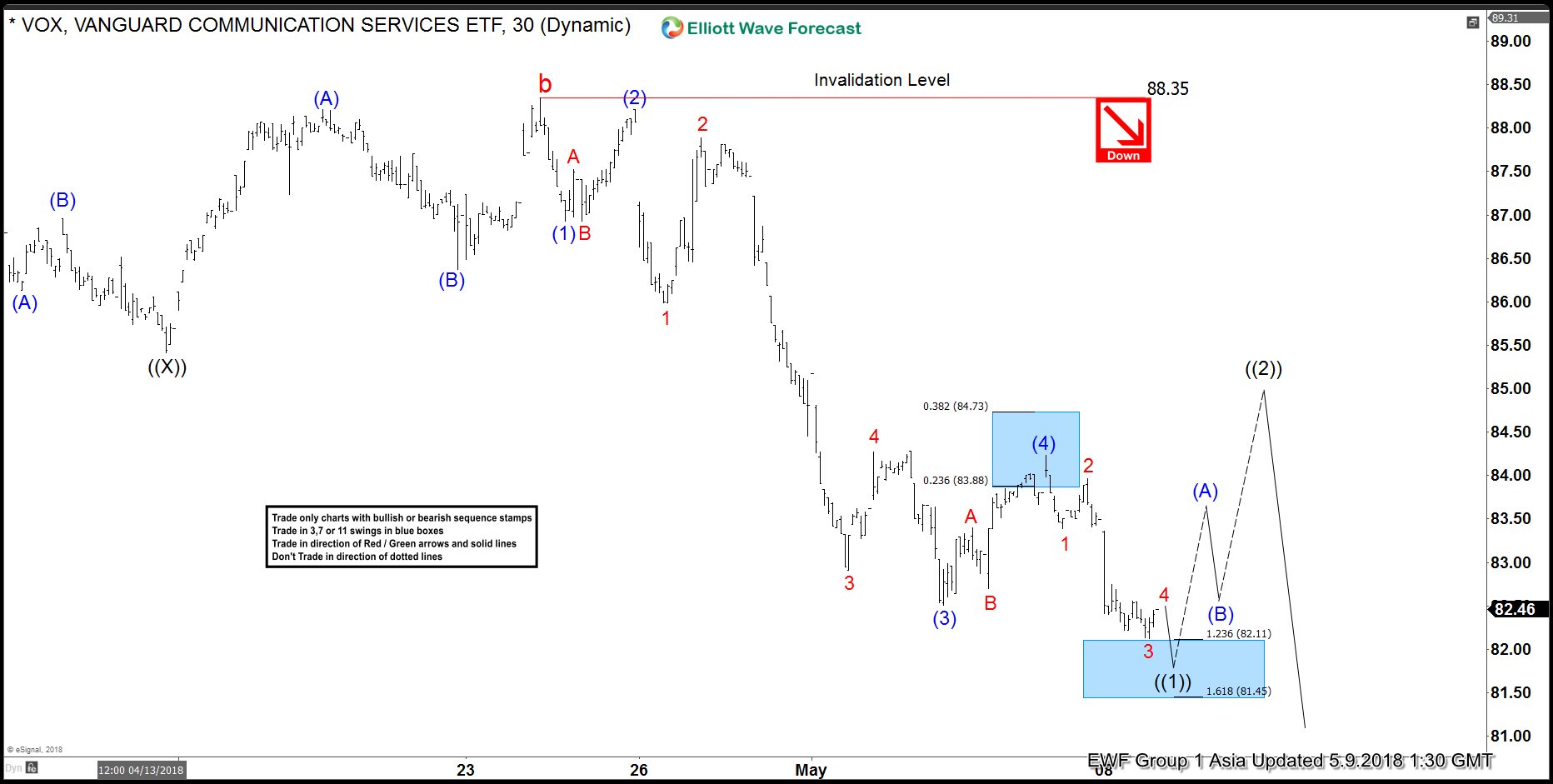

VOX Elliott Wave View: Calling For A Bounce Soon

Read MoreVanguard communication services ETF ticker symbol: VOX short-term Elliott Wave view suggests that the bounce to 88.35 on 4/24/2018 high ended cycle degree wave “b”. Below from there, the cycle degree wave “c” remain in progress as an Impulse Elliott Wave structure looking for more downside extensions. Down from 88.35 high, Primary wave ((1)) is in progress as […]

-

FTSE Showing Impulse Elliott Wave Structure

Read MoreFTSE short-term Elliott Wave view suggests that the decline to 3/26/2018 low 6866.94 ended the cycle degree wave “b”. Above from there, the index is rallying higher in a strong Impulse Elliott Wave structure with extension in the 3rd wave. It’s important to note that an impulse structure should have internal subdivision of lesser degree 5 […]

-

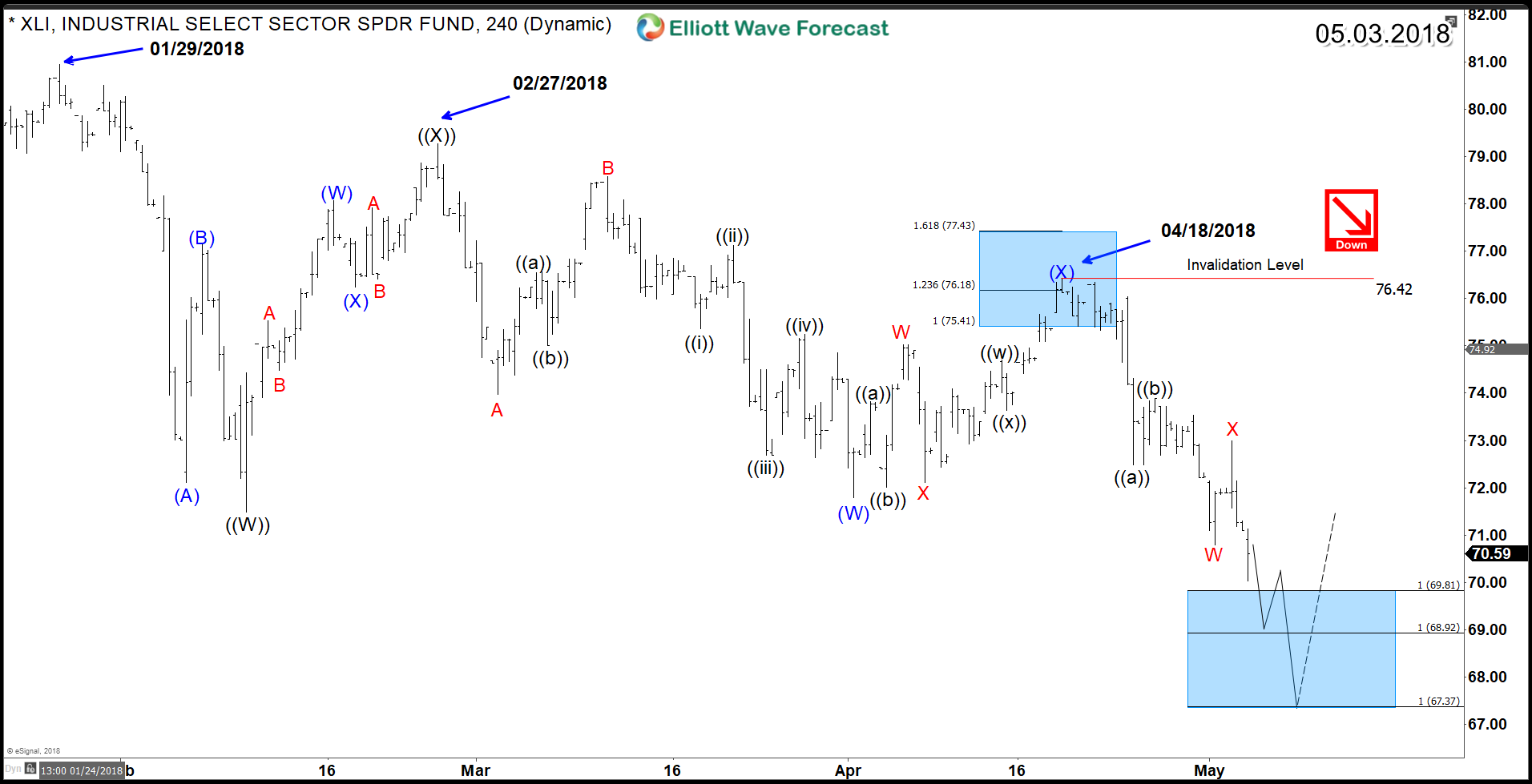

Industrial Select Sector XLI Corrective Structure Still calling Lower

Read MoreThe Industrial Select Sector SPDR Fund XLI tracks a market-cap-weighted index of industrial-sector stocks drawn from the S&P 500. Industries in the Index include aerospace and defense, building products, construction and engineering, electrical equipment, commercial services and supplies, airlines, marine, etc. It provides investors with broad US industrial exposure that’s cheap to hold and extremely […]

-

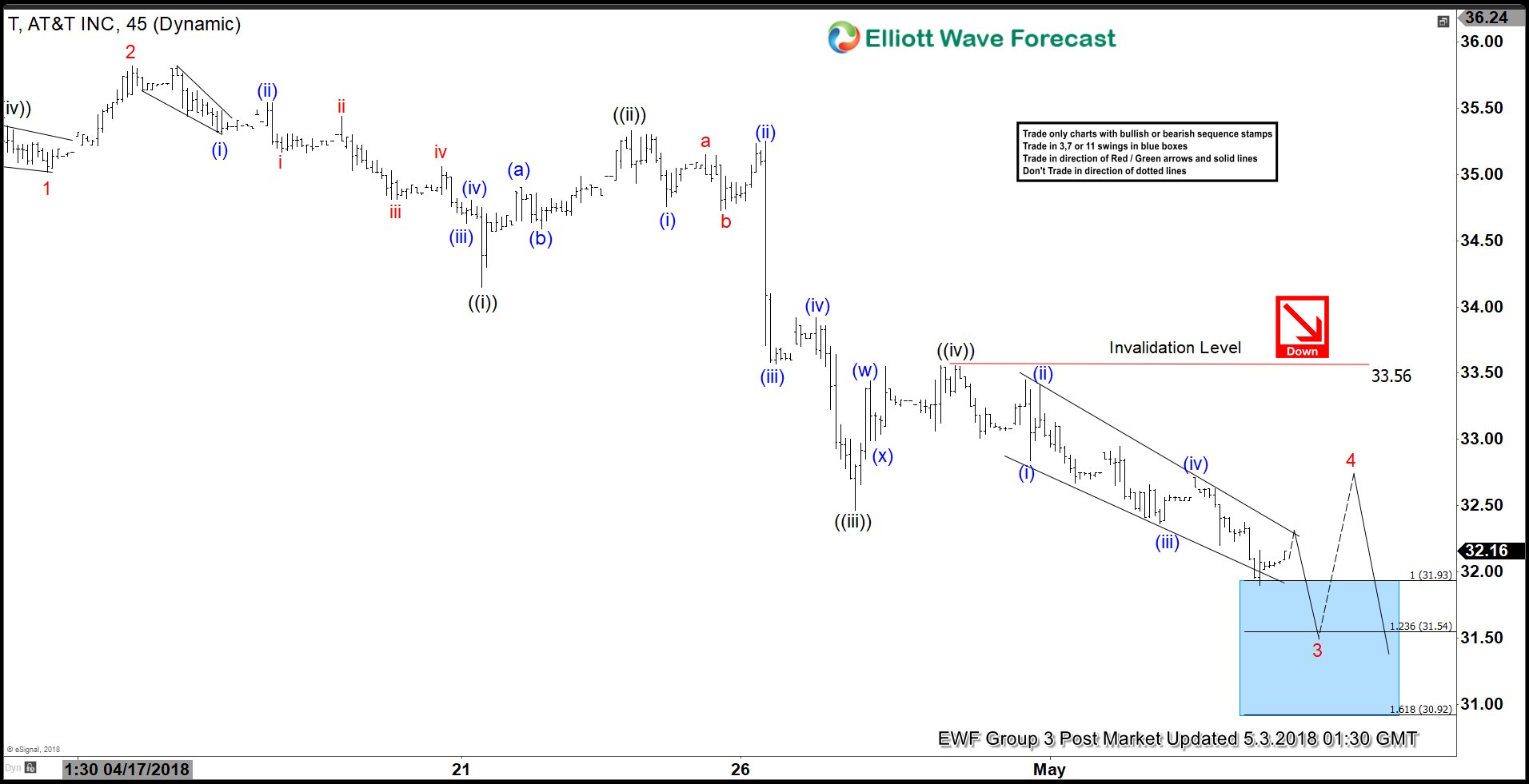

AT&T Elliott Wave View: Calling For 3 Wave Bounce

Read MoreAT&T ticker symbol $T short-term Elliott Wave view suggests that the decline from 4/10 peak is unfolding as an Impulse Elliott Wave structure. In the impulsive structure, wave 1, 3, and 5 should show 5 waves internal subdivision. Down from 4/10 peak ($36.39), Minor wave 1 ended in 5 waves structure at 35.02 low. Minor wave […]