The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

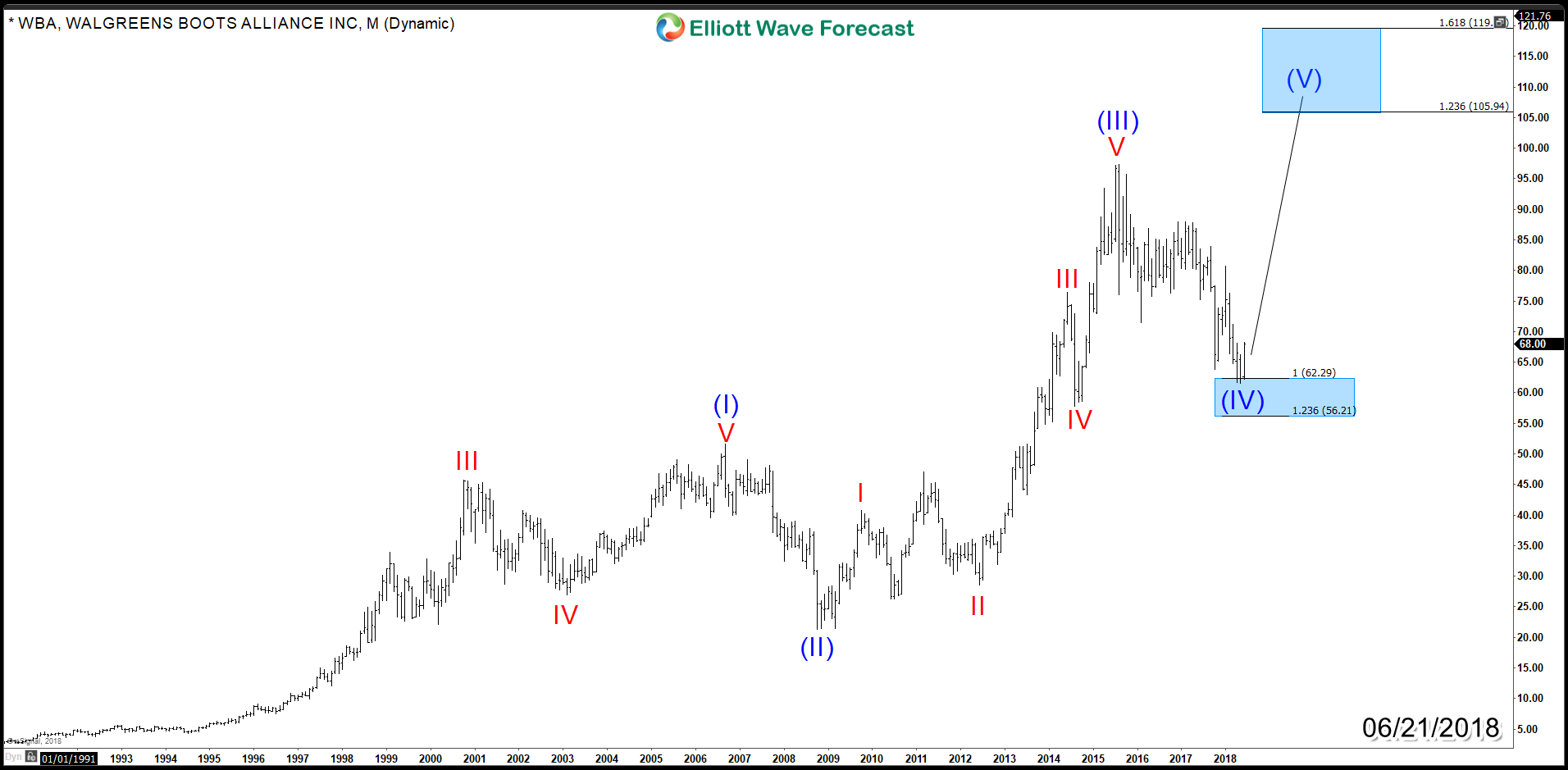

Walgreens WBA Ready to Rally to New All Time Highs

Read MoreWalgreens Boots Alliance (NASDAQ: WBA) is the second-largest pharmacy store chain in the United States. The drugstore chain will be listed in the Dow Jones Index replacing General Electric and a lot of expectation for the stock price to rise in future has come up recently following that news. We believe the market is ruled by […]

-

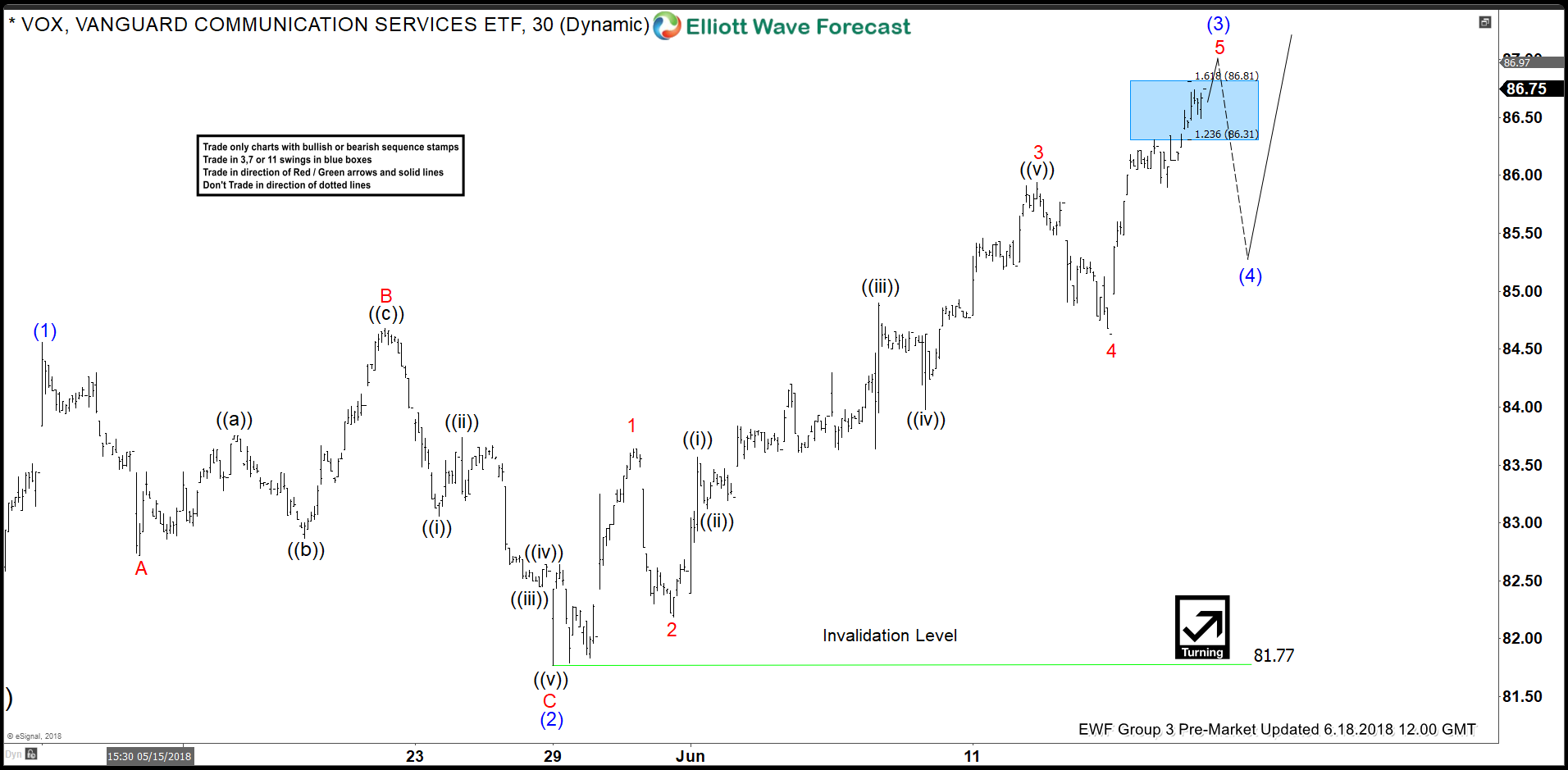

VOX Elliott Wave View: Extending Higher As Impulse

Read MoreVanguard communication services ticker symbol: VOX short-term Elliott Wave view suggests that the rally to 84.50 on 5/11 peak ended intermediate wave (1) as an impulse. Down from there, the pullback to 81.78 on 5/29 low ended intermediate wave (2) pullback as expanded Flat. The internals of a Flat correction ended Minor wave A at […]

-

RUSSELL Forecasting The Rally & Buying The Dips

Read MoreHello fellow traders. Another trading opportunity we have had lately is RUSSELL Futures. In this technical blog we’re going to take a quick look at the Elliott Wave charts of RUSSELL published in members area of the website. In further text we’re going to explain the forecast and trading setup. As our members know, RUSSELL […]

-

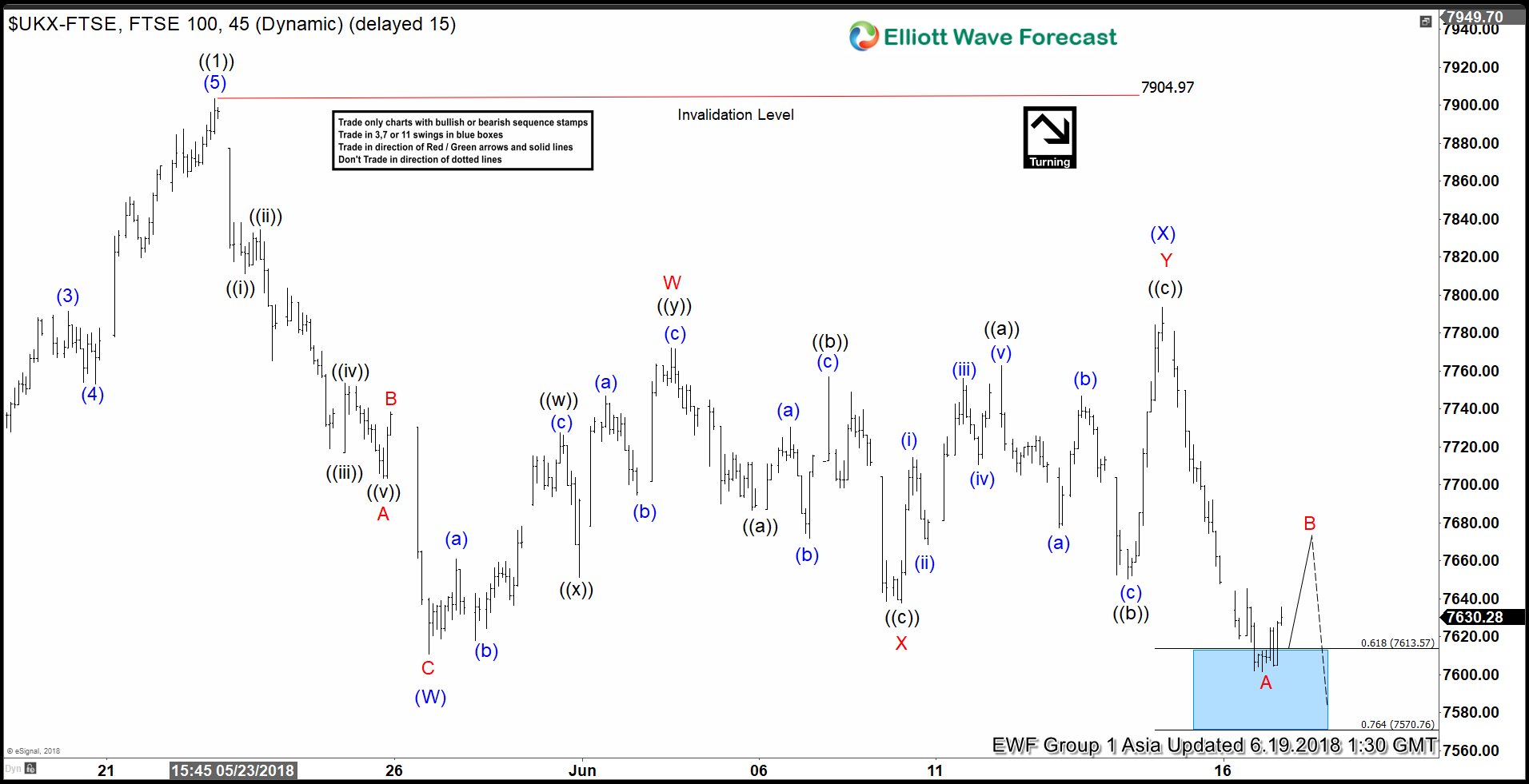

FTSE Elliott Wave View: Calling For Another Leg Lower

Read MoreFTSE short-term Elliott Wave view suggests that the bounce to 7904.97 high on 5/22/2018 peak ended primary wave ((1)). Below from there, the index is doing a pullback in Primary wave ((2)) in 3, 7 or 11 swings to correct cycle from 3/23/2018 low. Down from 7904.97 high, the decline to 7610.66 low ended the first leg […]

-

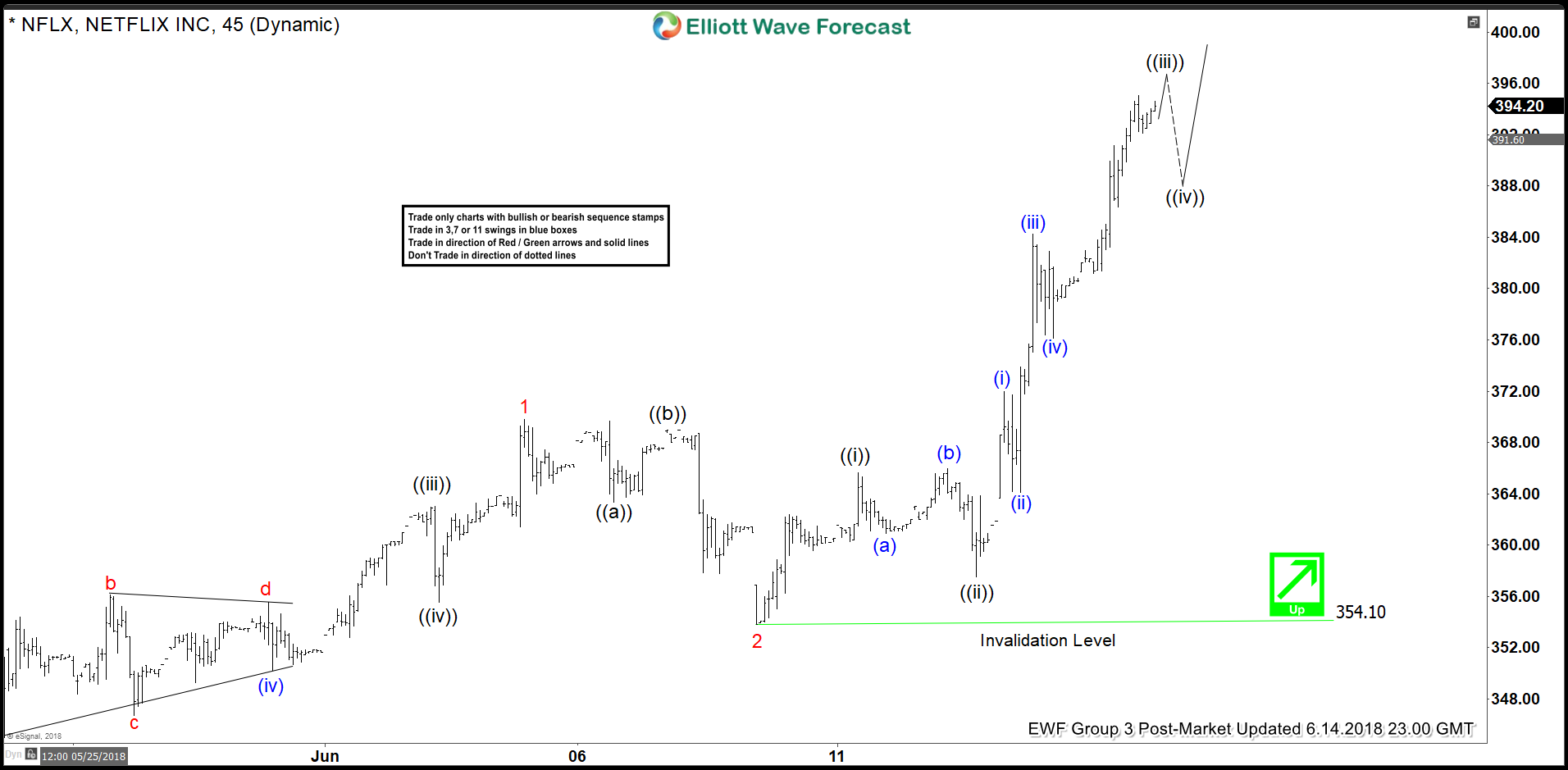

Netflix Elliott Wave View: More Strength is Expected

Read MoreNetflix ticker symbol: $NFLX short-term Elliott wave view suggests that the rally to $369.83 high on 6/05/2018 ended Minor wave 1. The internals of that rally unfolded as Elliott wave impulse structure with lesser degree 5 waves structure in Minute wave ((i)), ((iii)), and ((v)). Below from $369.83, the decline to $354.10 low on 6/08/2018 […]

-

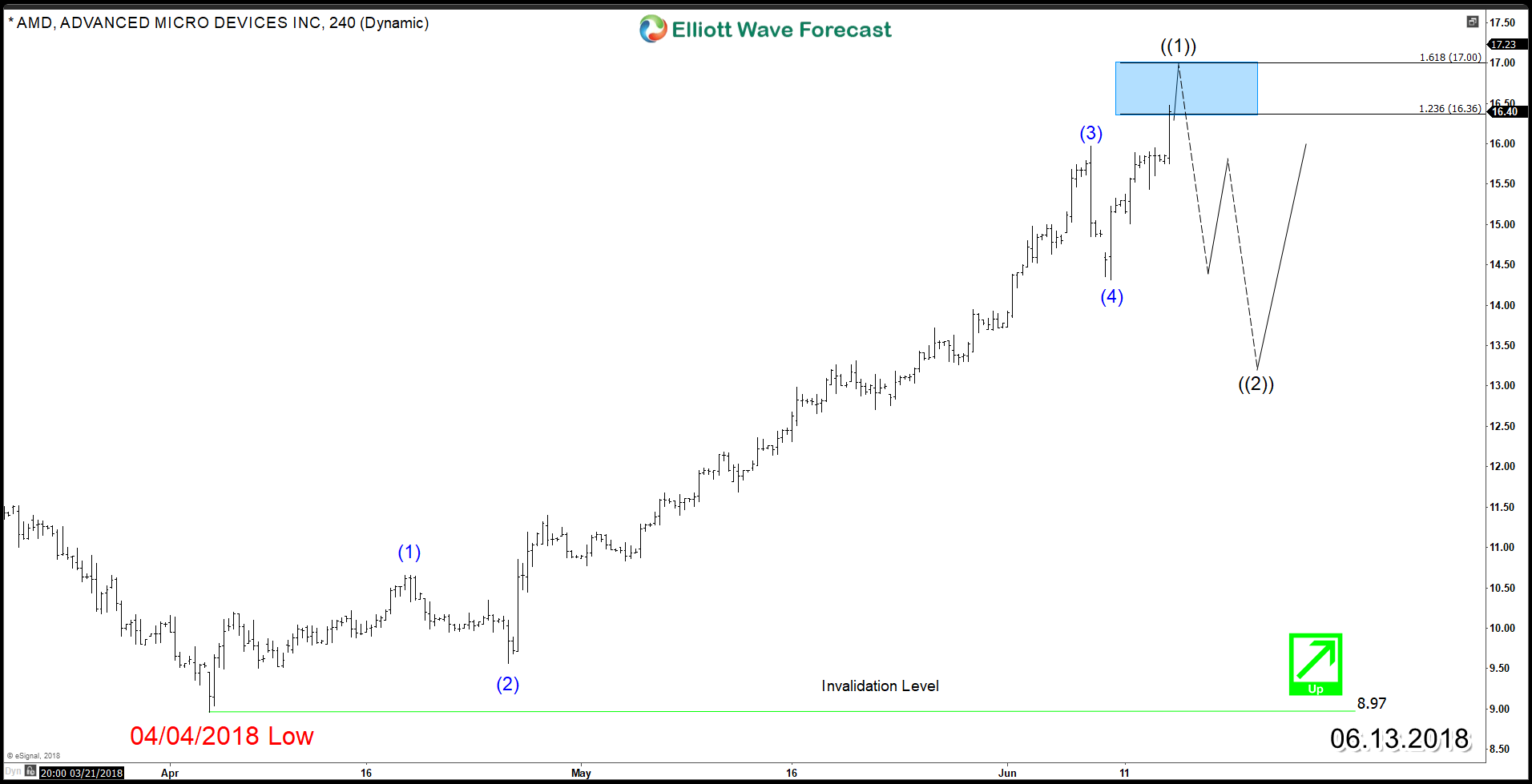

AMD Elliott Wave Bullish structure suggesting more upside

Read MoreSince 2017 peak, Advanced Micro Devices (AMD: NASDAQ) has been lagging the move higher compared to its competitors. Despite a weak start of 2018 around the stock market, AMD managed to recover strongly since the 4th of April. The semiconductor stock, starred a strong rally showing an impulsive 5 waves structure to the upside as […]