The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

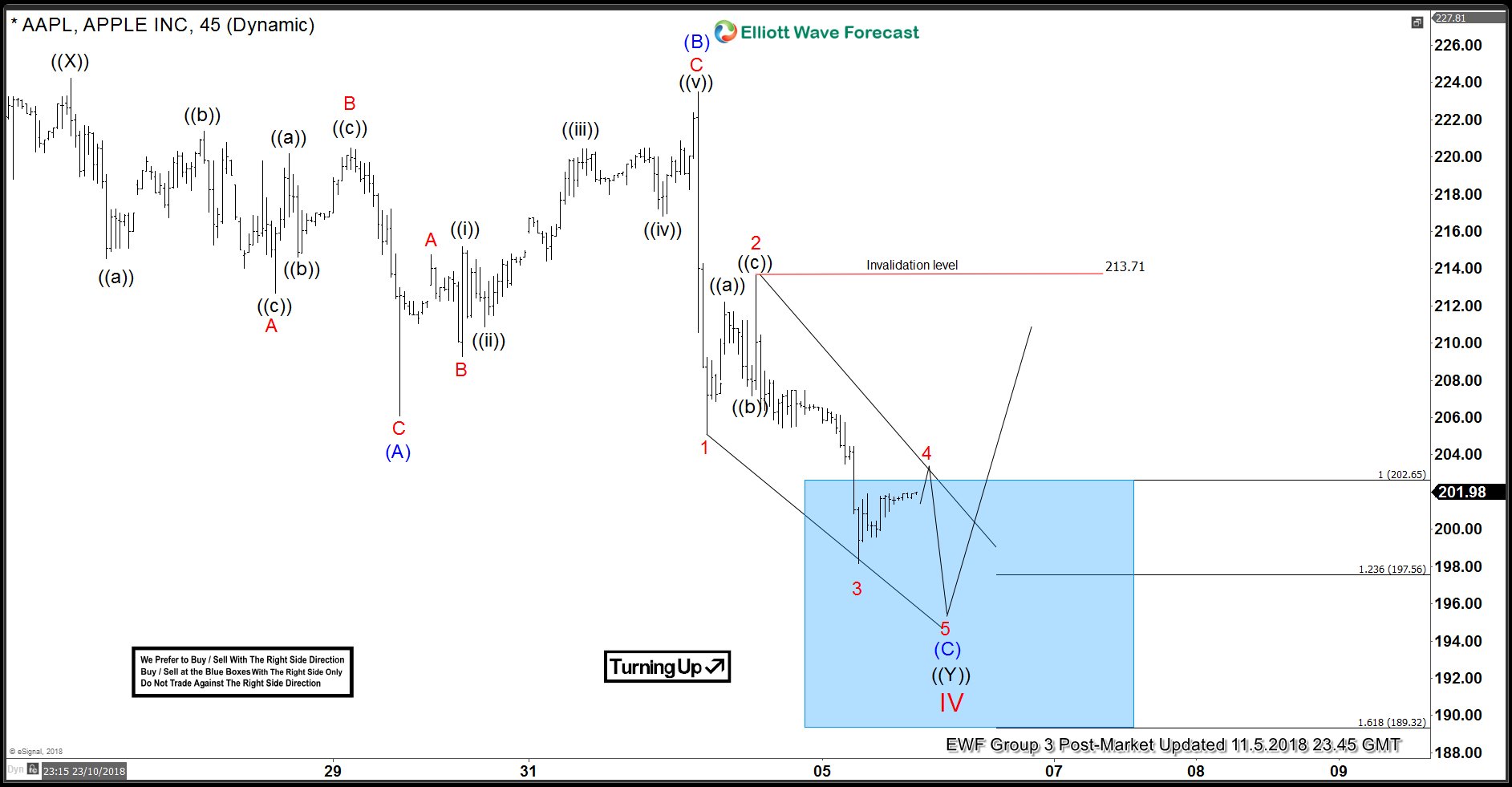

AAPL Elliott Wave Analysis Suggests Selloff Close to Ending

Read MoreApple (AAPL) short-term Elliott wave analysis suggests that the decline from $224.23 high, i.e. Primary wave ((X)), is unfolding as a Flat Elliot Wave structure. Down from $224.23, Intermediate wave (A) ended at $206.09 and bounce to $223.49 ended Intermediate wave (B). Intermediate wave (C) is currently in progress. Internal of Intermediate wave (C) is unfolding […]

-

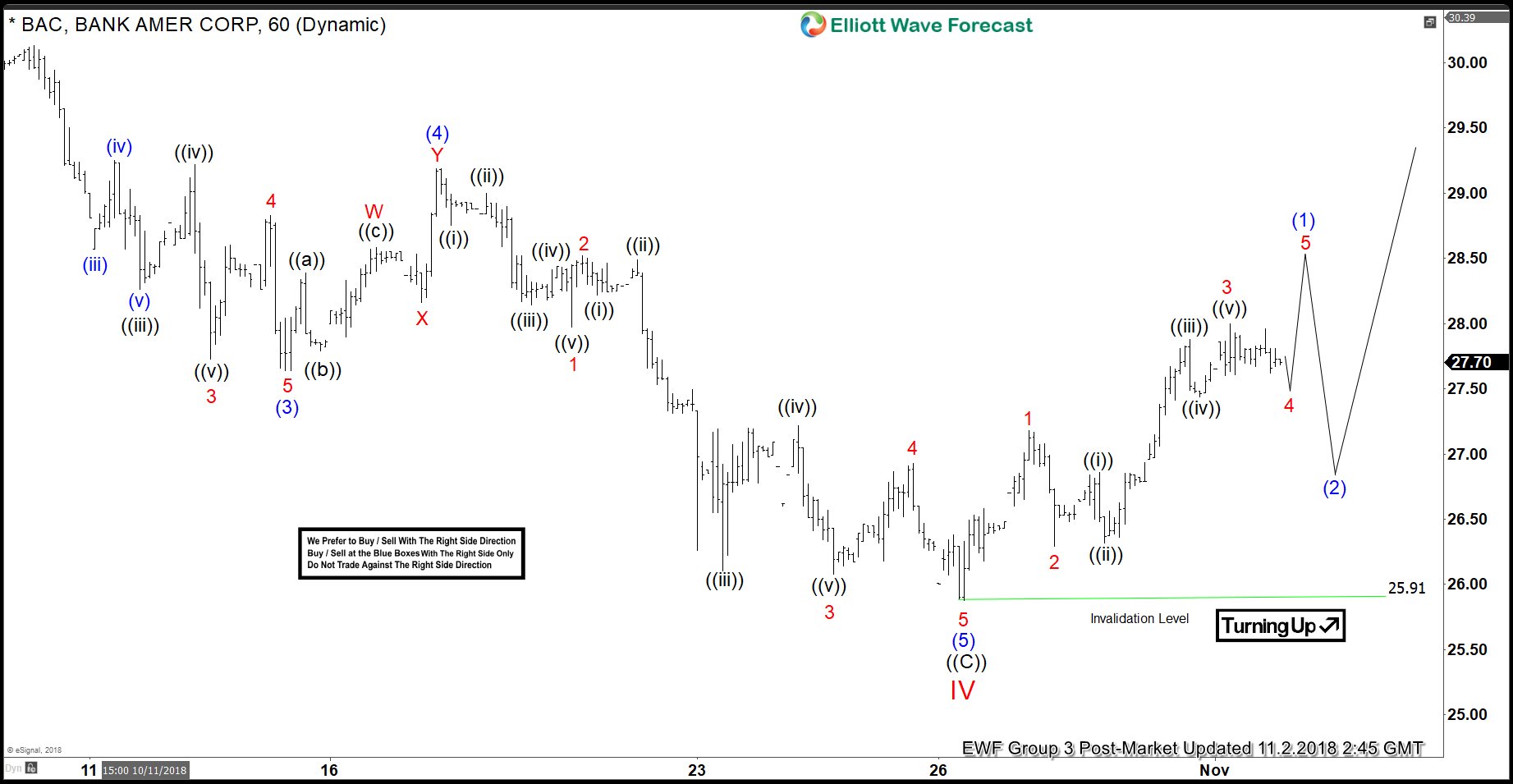

BAC Elliott Wave Analysis: Correction Ended

Read MoreBank of America corporation ticker symbol: BAC short-term Elliott wave analysis suggests that a decline to $27.26 low ended intermediate wave (3). The internals of that decline unfolded in 5 waves impulse structure in lesser degree cycles. Up from there a 3 wave bounce to $29.19 high ended intermediate wave (4) as double three structure. […]

-

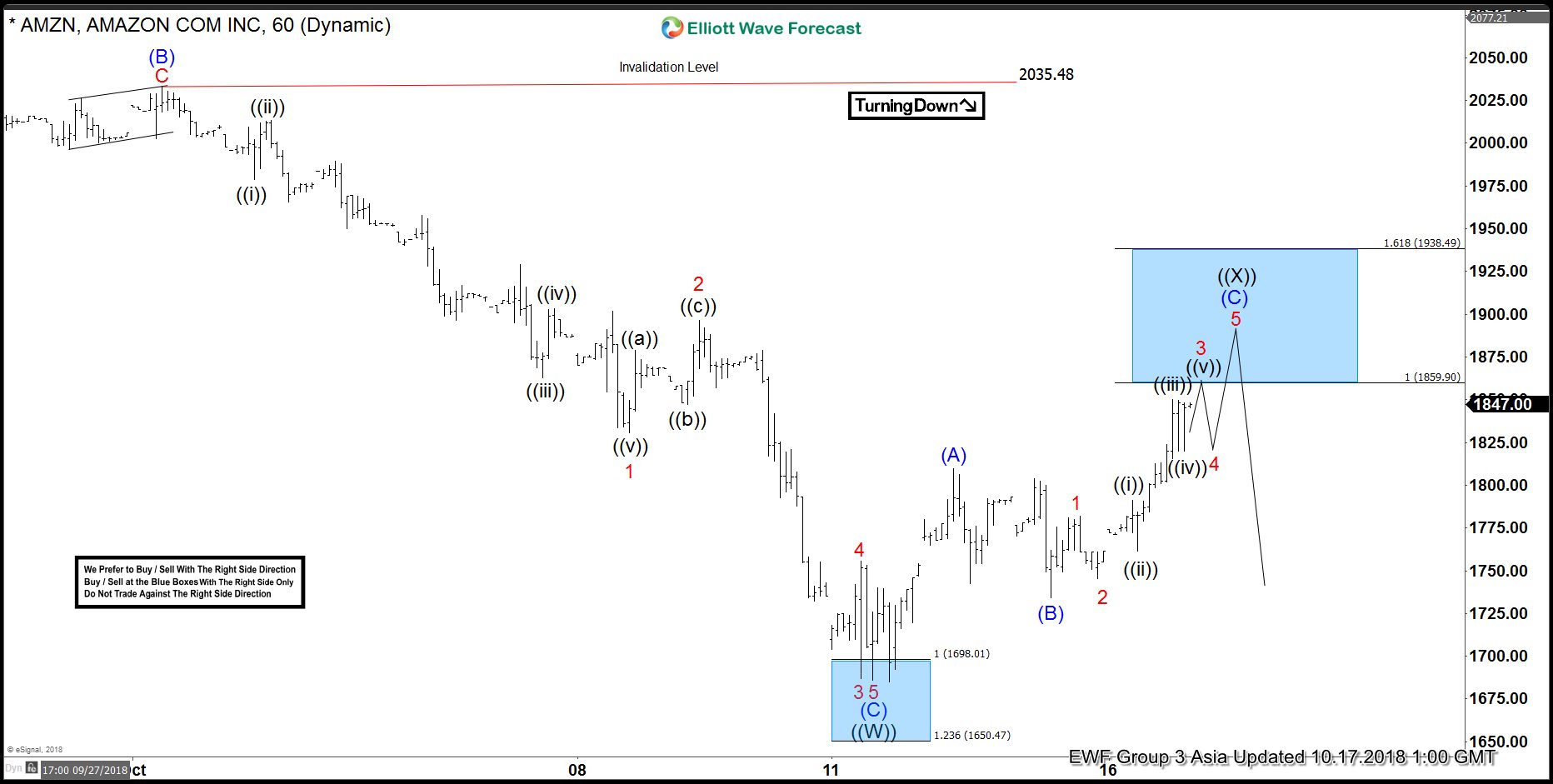

Being Down $45 Billion in AMZN Stock No Big Deal

Read More“What goes up must come down.” – Sir Isaac Newton It was widely reported this week that Amazon (AMZN) founder, Jeff Bezos, lost roughly $45 Billion dollars in net worth during the October stock market selloff as shares of AMZN cratered from all-time highs set on 9/4/2018 at $2,050.50/share to the most recent low of […]

-

Dow Jones Elliott Wave View: Correction Completed

Read MoreDow futures ticker symbol: YM short-term Elliott wave view suggests that a bounce to 25845 high ended cycle degree wave “b”. Down from there, cycle degree wave “c” unfolded as ending diagonal structure i.e lesser degree cycles within primary wave ((1)), ((3)) & ((5)) also unfolded in 3 swings structure. Where primary wave ((1)) ended […]

-

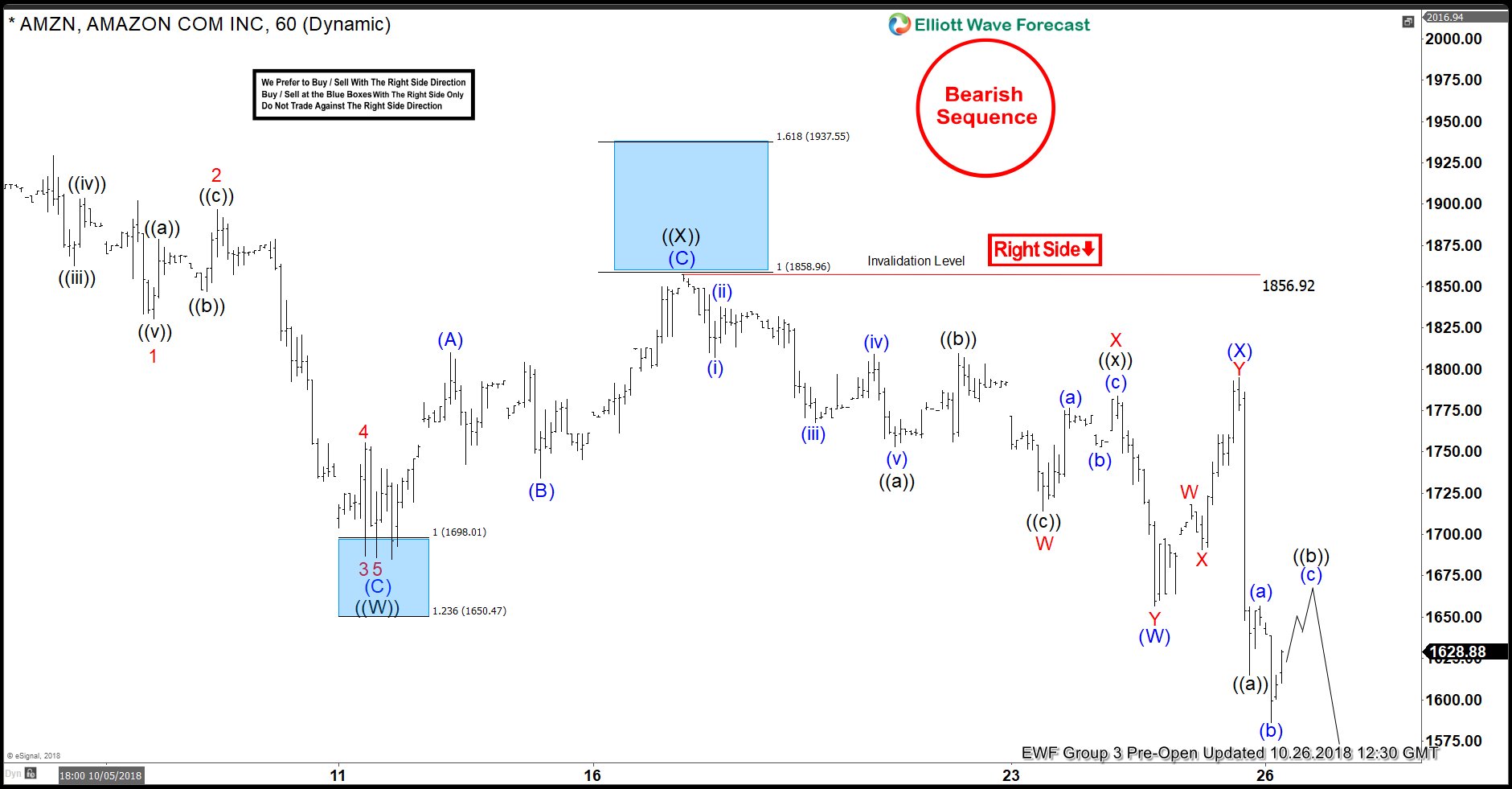

Amazon Elliott Wave View: Found Sellers in Blue Box

Read MoreIn this blog, I want to share some short-term Elliott Wave charts of Amazon which we presented to our members in the past. Below, you see the 1-hour updated chart presented to our clients on the 10/17/18 indicating that Amazon ended the cycle from 10/01/18 low in black wave ((W)). As Amazon ended the cycle from 10/01/18 peak, […]

-

Record Breaking Income Doesn’t Save Amazon from Tanking

Read MoreDuring the Earnings Report last Thursday, Amazon (ticker symbol: AMZN) beat Street estimates by reporting impressive revenue of $29 bn (10% higher yoy) and all-time-record of $2.8 billion quarterly net income. This compares to $256 million profit during the same period last year. The $3.7 billion in operating income also far exceeded Street estimates of […]