The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

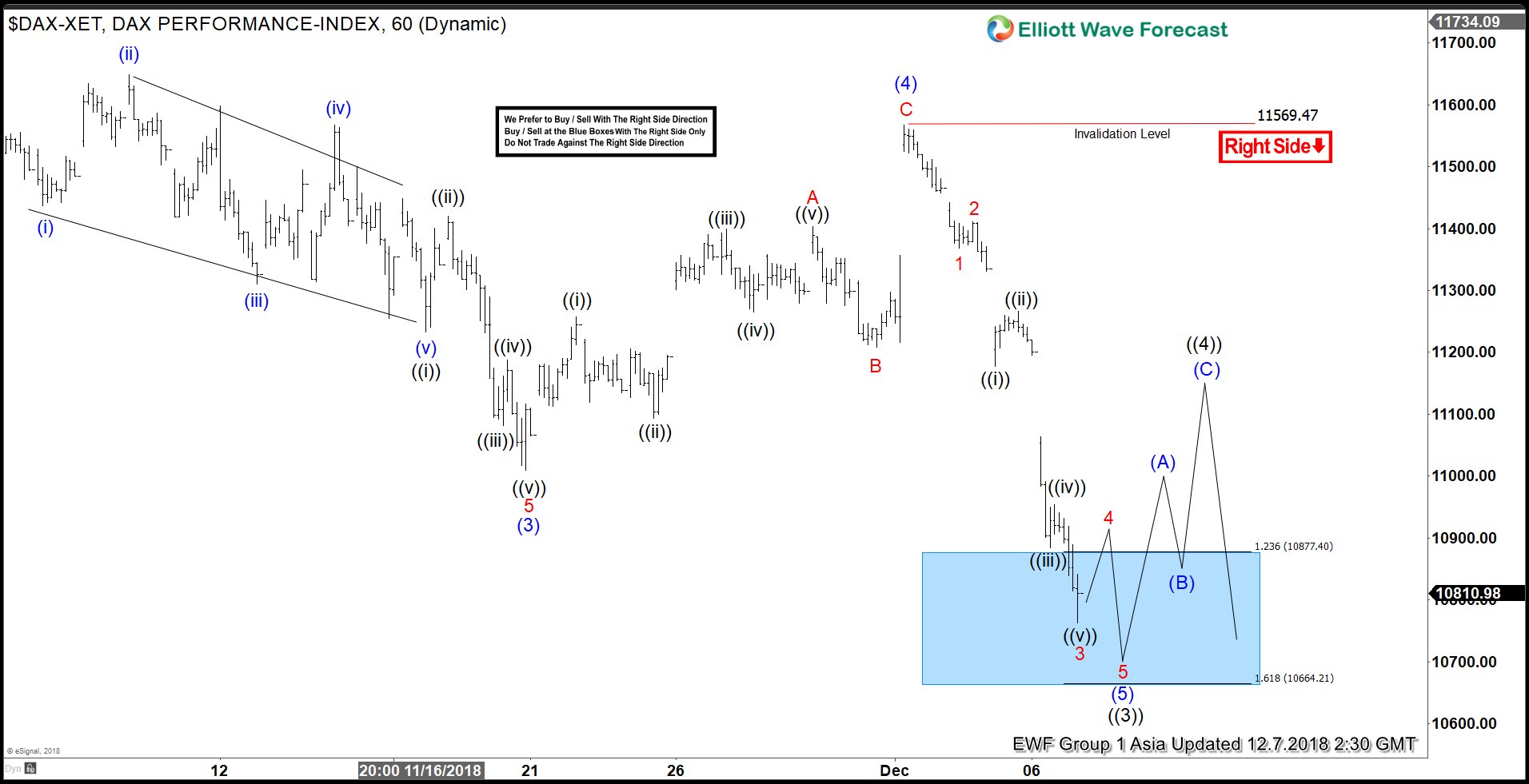

Elliott Wave View: DAX Looking for Further Downside

Read MoreDAX continues to make a new low and this week broke below 11/20 low (11009) suggesting that the move lower remains in progress. Near term Elliott Wave outlook calls for the decline to 11009.25 on 11/20 as Intermediate wave (3). From there, rally to 11566.97 ended Intermediate wave (4) as a zigzag Elliott Wave structure. […]

-

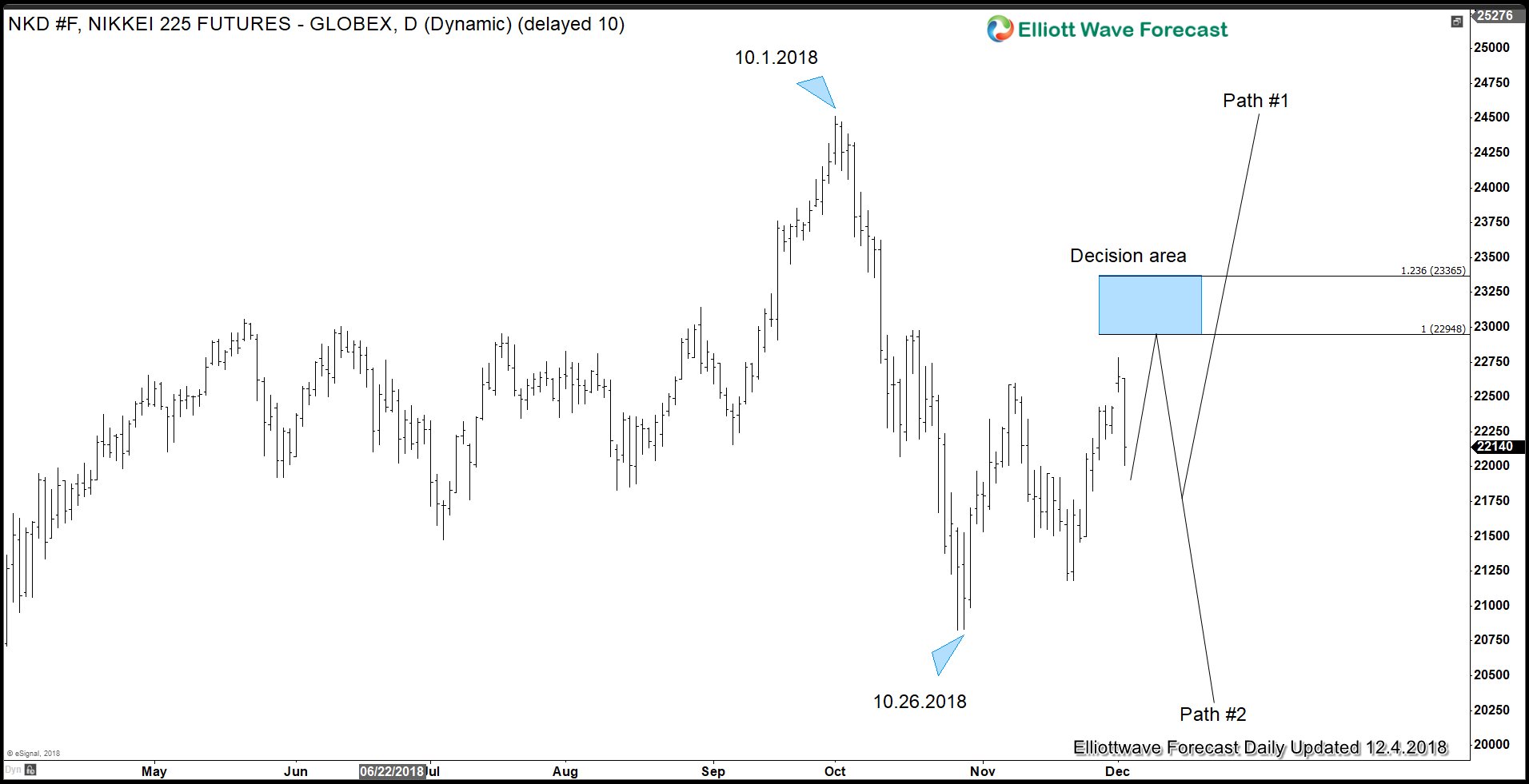

G20 Meeting Produces Trade War Truce between US and China – Will it last?

Read MoreDuring the dinner meeting at G20 summit in Buenos Aires last weekend, the U.S. and China agreed to suspend new tariffs for 90 days. The market reacts positively with stock market rallying around the world, creating a risk on environment for potential Santa Claus rally in December. However, has a real significant breakthrough made during […]

-

BABA Forecasting The Rally & Buying The Dips

Read MoreHello fellow traders. Another instrument that we have been trading lately is BABA Stock from Group 3. In this technical blog we’re going to take a quick look at the Elliott Wave charts of BABA, published in members area of the website. As our members know, BABA has been correcting larger cycle from the 59.5 […]

-

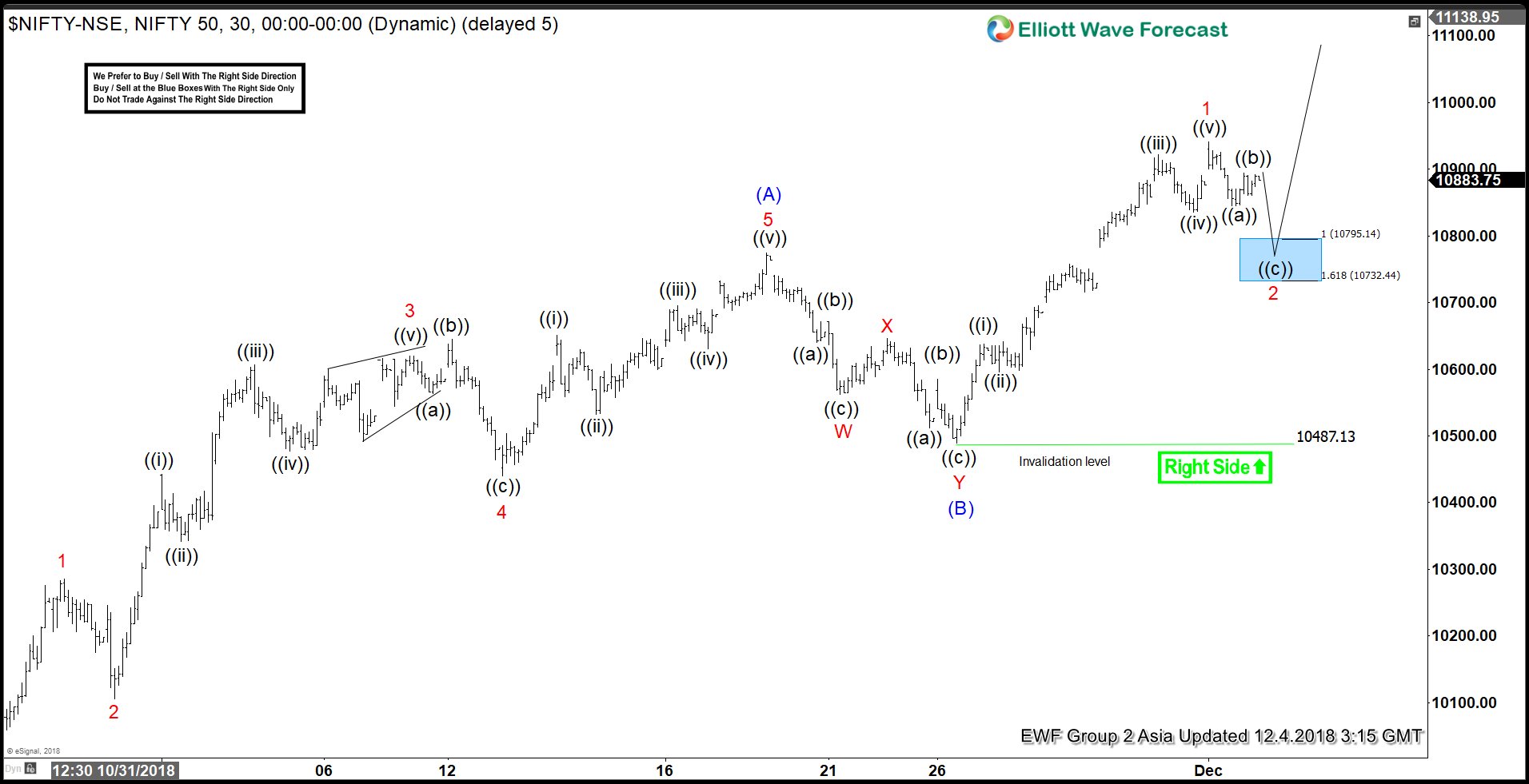

Elliott Wave View favoring more upside in NIFTY

Read MoreNIFTY is showing an incomplete sequence to the upside in the short term, favoring more upside while above 11/26 low (10487.1). Near term, cycle from 10/26 low (10004) remains in progress as a zigzag Elliott Wave structure. Intermediate Wave (A) ended at 10774.7 as 5 waves impulse Elliott Wave structure and Intermediate wave (B) ended […]

-

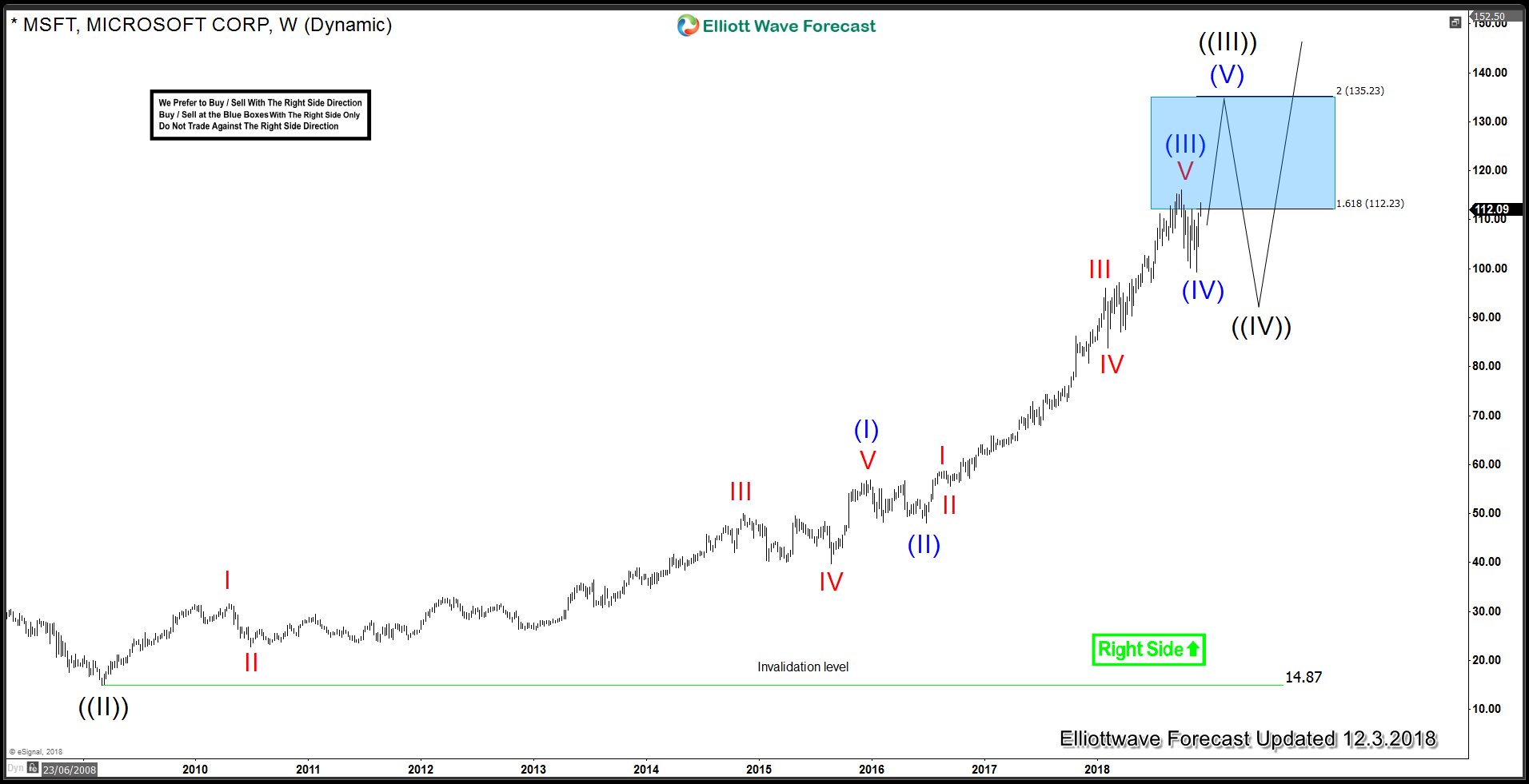

MSFT: In the Race for World’s Most Valuable Firm

Read More(RTTNews) – Microsoft Corp. (MSFT) has unseated Apple Inc. (AAPL) to rank as the world’s most valuable listed company. The software giant ended Friday with a market value of more than $851 billion compared with Apple’s $847 billion. Both companies remain well below the $1 trillion milestone that Apple and Amazon hit earlier this year. […]

-

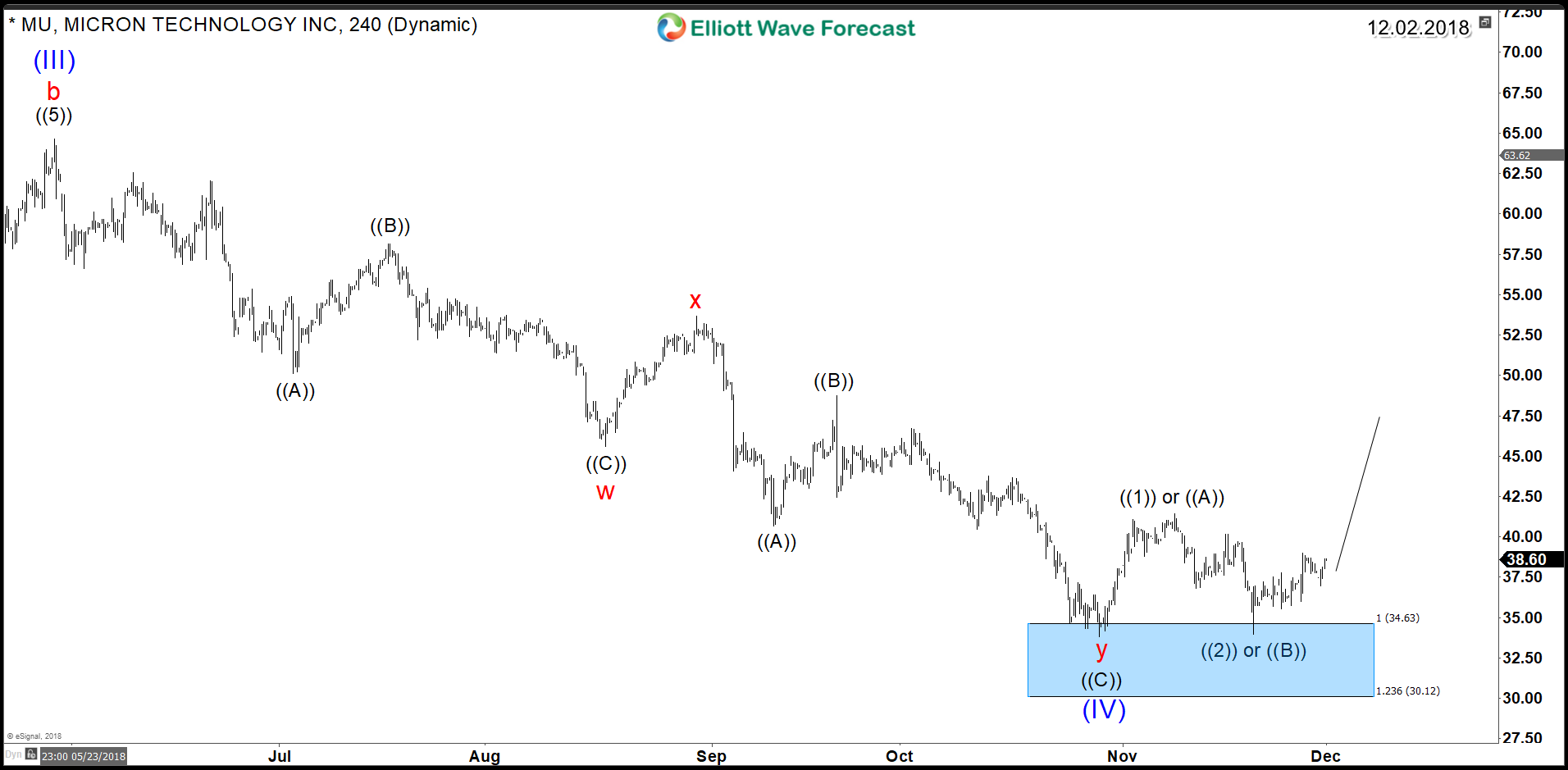

Micron Technology (MU) – Reversal Around the Corner

Read MoreIn the recent 2 years, Micron Technology (NASDAQ: MU) Investors were in the sky as the stock gained +500% in value since 2016 lows. The global corporation is one of largest semiconductor producer in USA behind giants like Intel & NVDIA. In the recent 6 months, the prices of dynamic random-access memory DRAM and NAND flash memory […]