The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Elliott Wave View Expects More Downside in Exxon Mobil (XOM)

Read MoreExxon Mobil (ticker: XOM) has broken below Nov 23 low ($74.7) and opens further downside in the stock with incomplete sequence from Sept 25 high ($87.36). Short Term Elliott Wave view suggests bounce to $81.97 on 12/5 high ended Minor wave X. Decline from there is unfolding as a double three Elliott Wave structure where […]

-

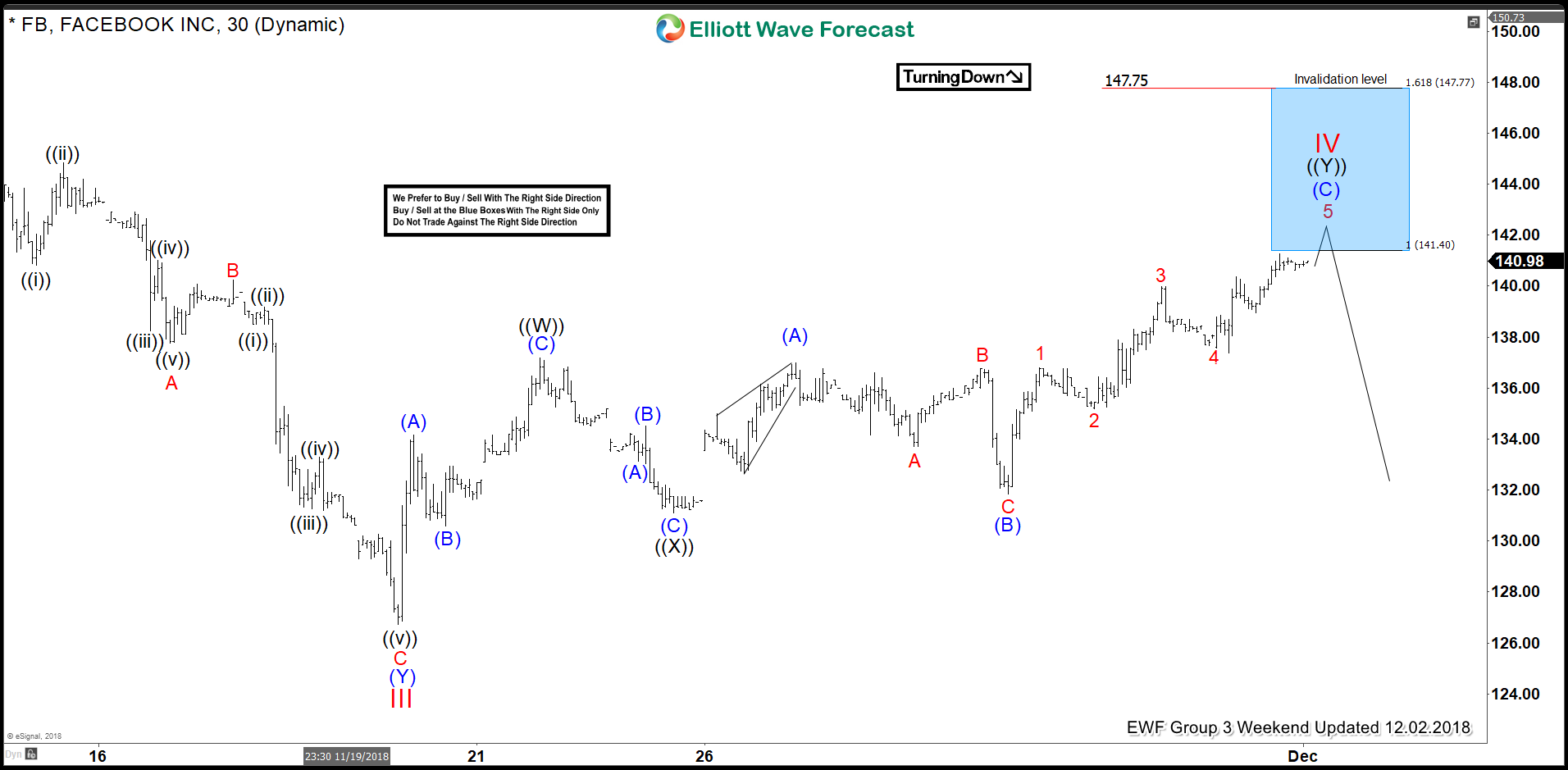

Facebook Elliott Wave Analysis: Forecasting the Decline

Read MoreIn this blog, I want to share some short-term Elliott Wave charts of Facebook which we presented to our members in the past. Below, you see the 1-hour updated chart presented to our clients on the 12/02/18. Showing that Facebook ended the cycle from 09/27/18 peak in red wave III at 11/20/18 low (128.45). As Facebook ended the cycle […]

-

Will the Arrest of Huawei Executive Derail Trade War Truce?

Read MoreThe market celebrated the trade war truce between U.S. and China after the successful meeting last week between President Trump and Xi. Unfortunately, it only lasted for about 24 hours as news came in with the arrest of Huawei top executive Meng Wanzhou in Canada. Meng faces an extradition to the U.S. on the allegation that […]

-

Goldman Sachs (NYSE: GS) – Bullish Trend is Still Intact

Read MoreSince the 2008 Financial Crisis, Goldman Sachs (NYSE: GS) established a new multi-year bullish trend which managed to break above 2007 peak after just 10 years joining the list of many other stocks which already achieved new all time highs in the previous years. GS has been moving within a bullish channel making higher highs […]

-

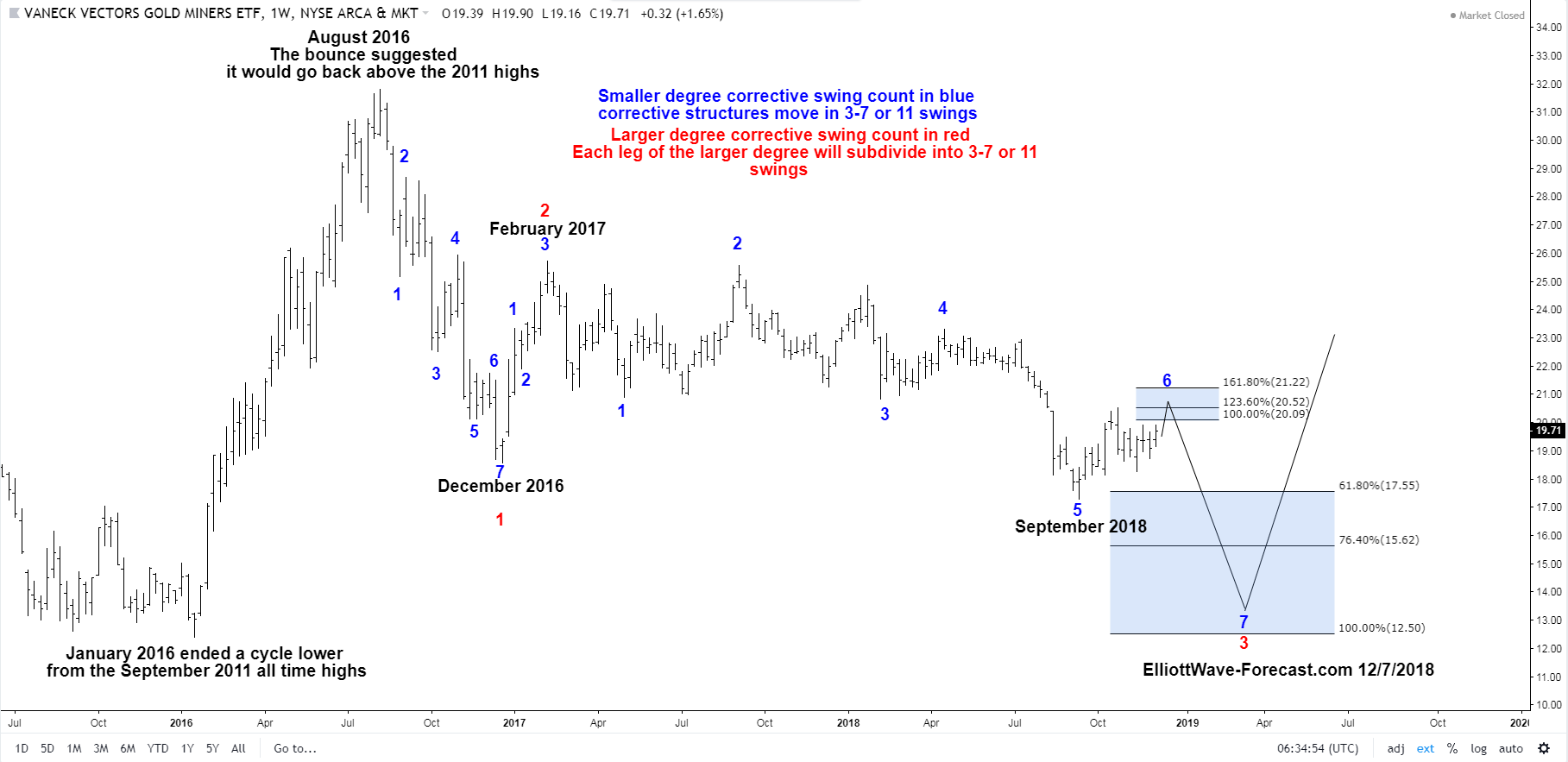

GDX Cycles from the January 2016 Lows

Read MoreGDX Cycles from the January 2016 Lows Firstly, the GDX ETF was created in 2006. From there it bounced higher into the September 2011 highs. This not shown on the chart however the price trend was obviously up. The pullback lower into the January 2016 lows corrected the cycle from the all time highs. The […]

-

An Industrial to Trade: Is BA a BUY Here?

Read MoreBA and the Trade Tensions Between China and Elliott wave As we all are well aware there are definitely heightened tensions on the global trading playing field these days. The markets have been whipping back in forth in exacerbated moves. Every hint or tweet about anything to do with trade, specifically, trade and China causes […]