The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Elliott Wave Outlook: FTSE to Signal Market Direction Soon

Read MoreFTSE is looking to extend higher as an impulse and soon may break above its previous peak on March 4 reinforcing the bullish view.

-

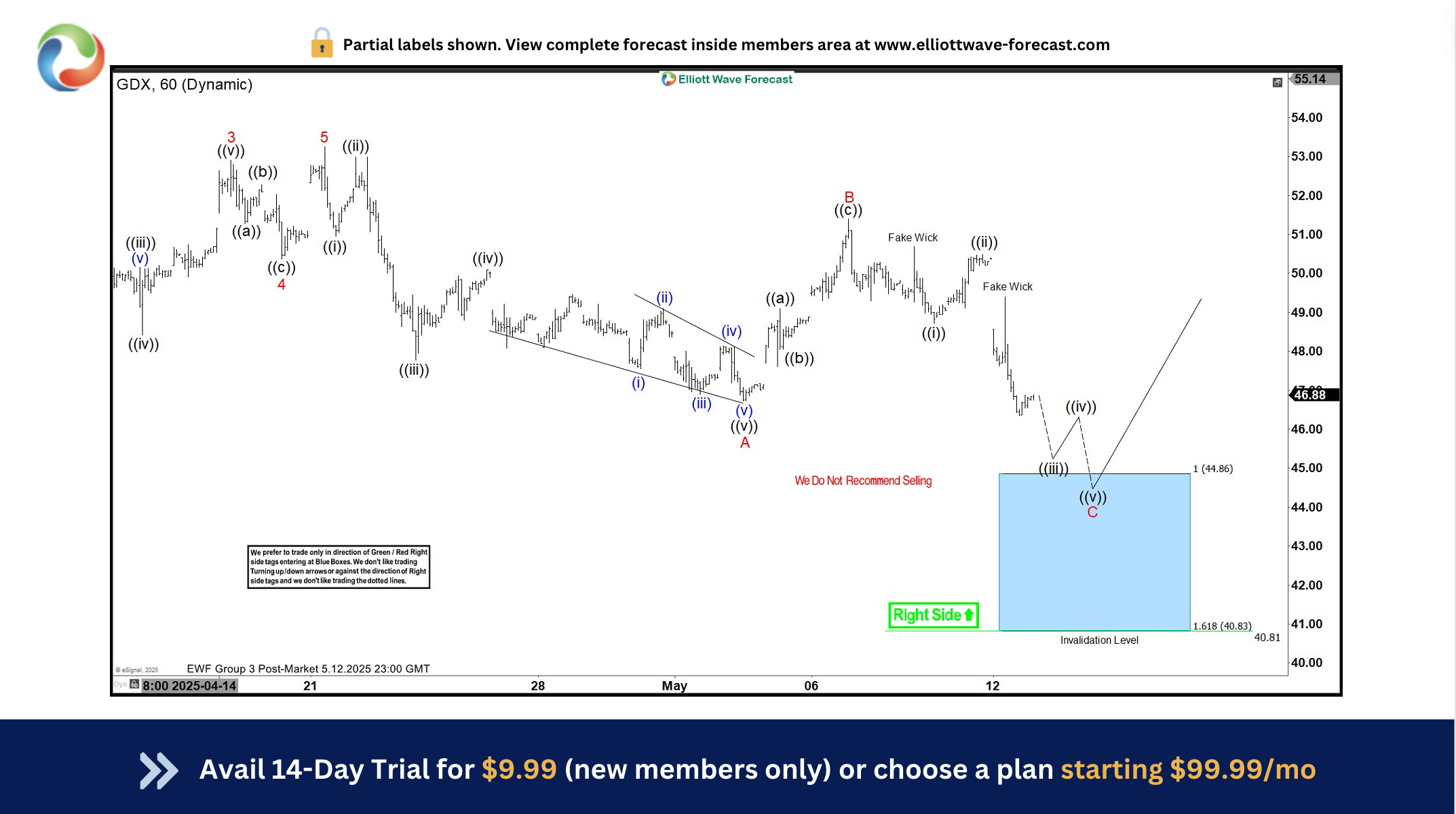

Gold Miners (GDX) Buying the Dips at the Blue Box Area

Read MoreAs our members know we have had many profitable trading setups recently. In this technical article, we are going to present another Elliott Wave trading setup we got in Gold Miners ETF GDX . The ETF completed its correction precisely at the Equal Legs zone, referred to as the Blue Box Area. In the following sections, […]

-

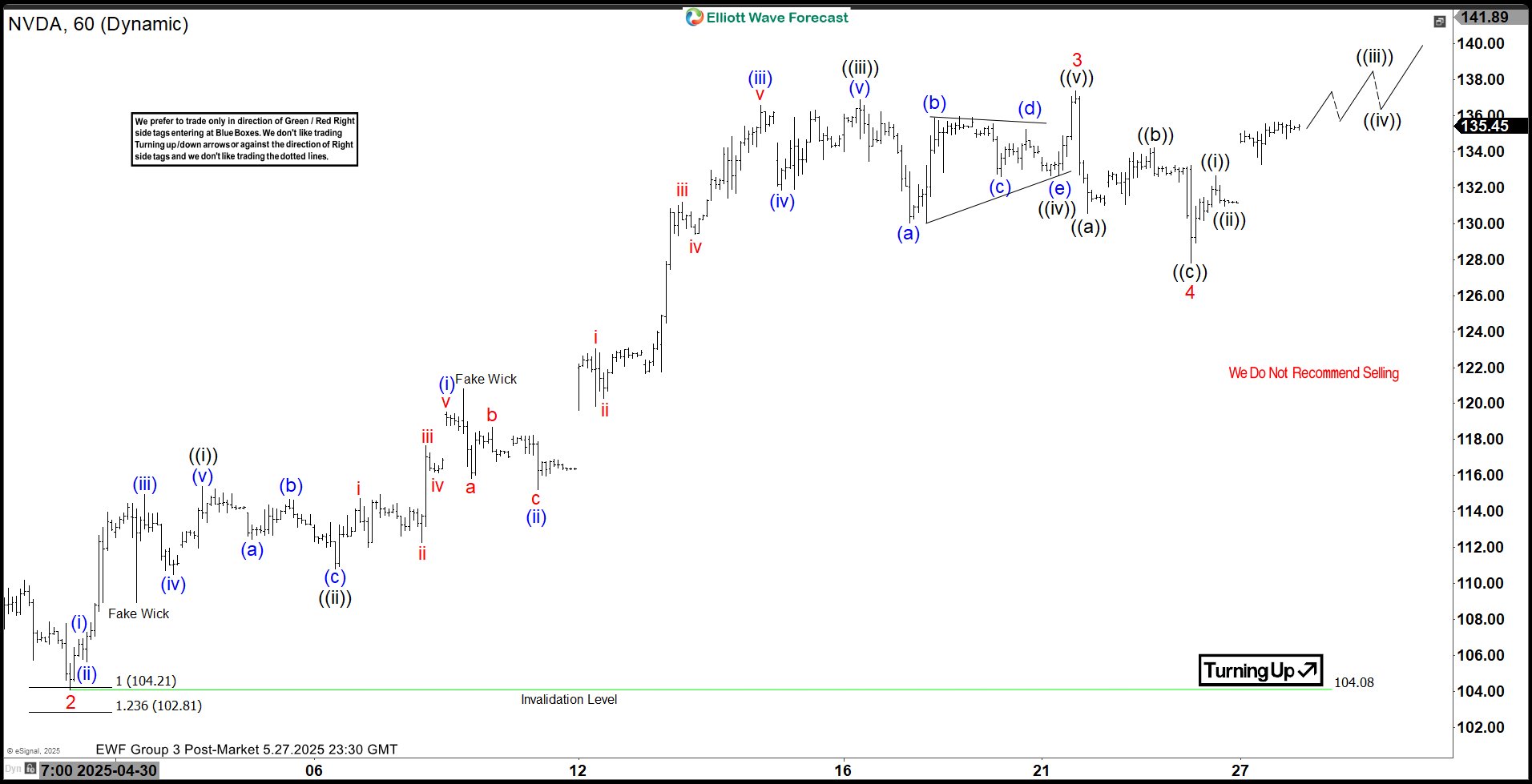

Nvidia (NVDA) Elliott Wave Analysis: Wave 5 Nearing Its End

Read MoreNVIDIA (NVDA) is poised for a rally to complete Wave 5 before a broader pullback. This article and video analyze the stock’s Elliott Wave trajectory.

-

Ford (F) Stock: A Temporary Rebound Before Further Declines?

Read MoreFord’s stock finally rebounded after months of decline. Earlier, we predicted a failed rally that would push prices lower. Instead, the stock kept falling. Now, it’s bouncing back—but will it last? According to Elliott Wave analysis, this rally seems weak. Ford’s stock will likely drop again, sinking below $8 soon. Several issues weigh on Ford. […]

-

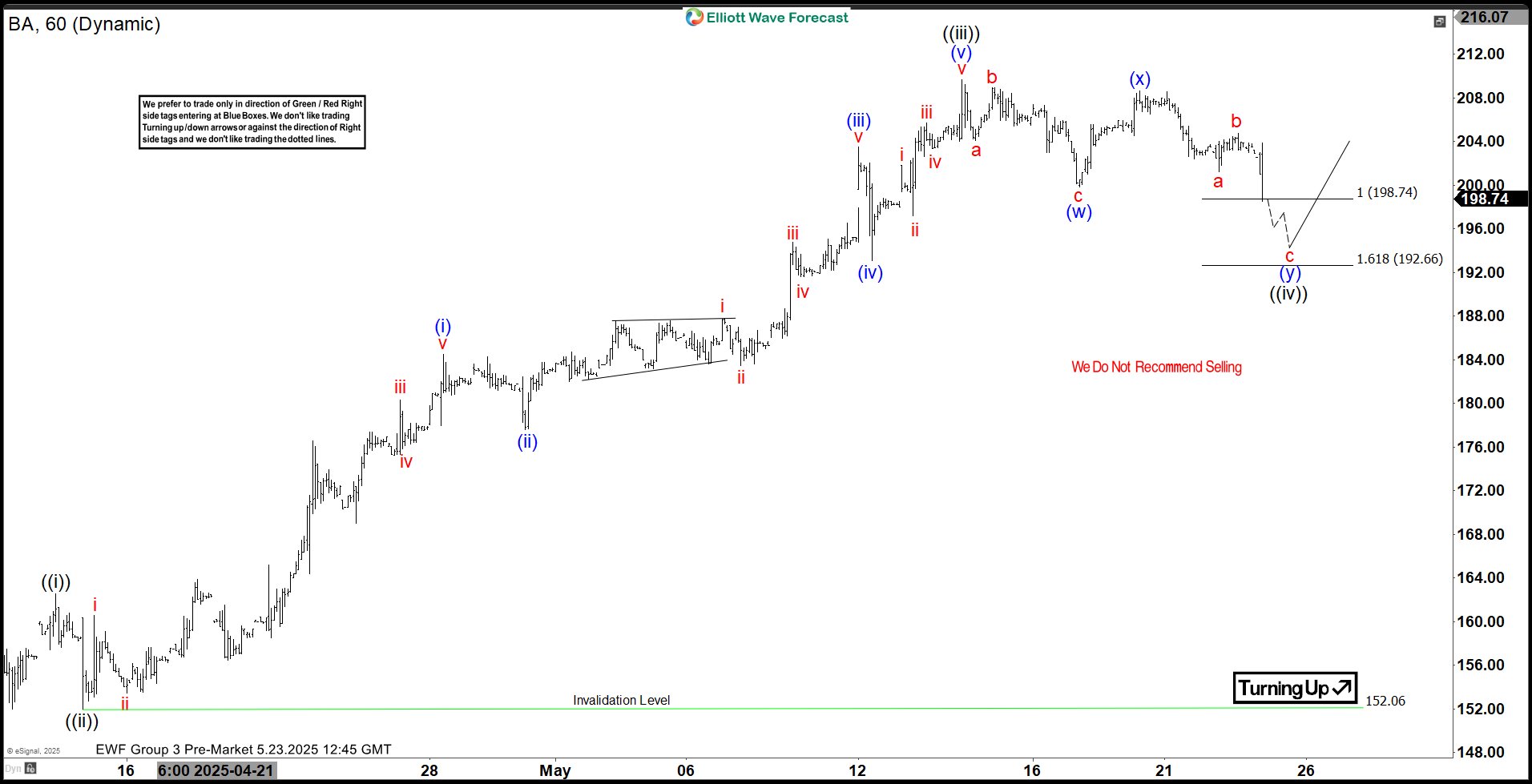

Boeing Co. $BA Extreme Areas Offering Buying Opportunities

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of Boeing Co. ($BA) through the lens of Elliott Wave Theory. We’ll review how the rally from the April 15, 2025 low unfolded as a 5-wave impulse followed by a 7-swing correction (WXY) and discuss our forecast for the next move. Let’s dive into the structure and expectations for this stock. 5 […]

-

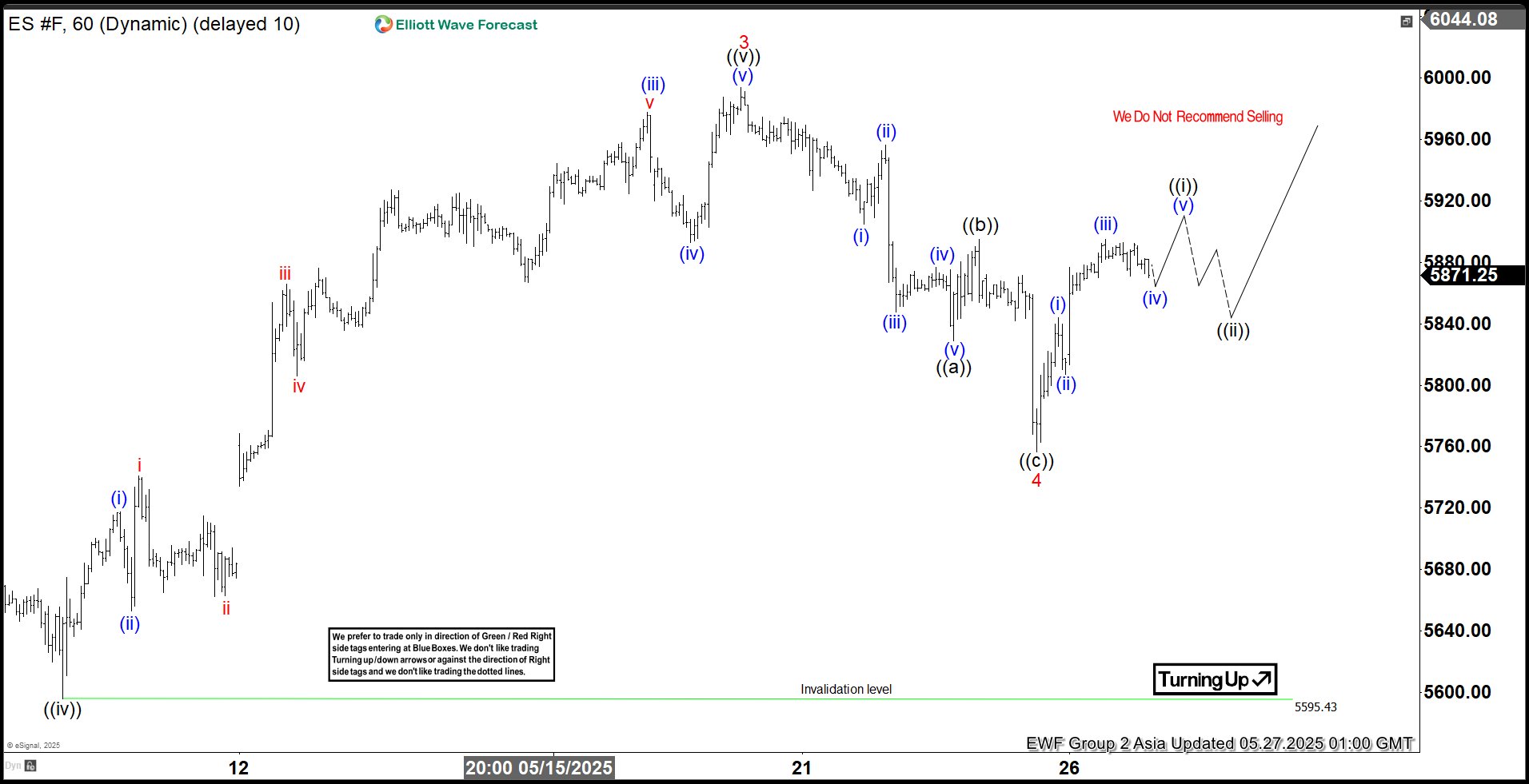

Elliott Wave Analysis: Will S&P 500 Futures (ES) Form Five Waves to Provide Market Clarity?

Read MoreS&P 500 Futures (ES) is looking to extend in wave 5 which will confirm the next leg higher. This article and video look at the Elliott Wave path.