The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

American Express (NYSE: AXP) – Right side of the Market Remains Bullish

Read MoreAmerican Express (NYSE: AXP) is an American multinational financial services corporation that was founded in 1850. Since it’s IPO back in the seventies, AXP rallied in an initial Elliott Wave 5 waves impulsive structure which ended in 2000 with the Dot Com Bubble as a wave ((I)). In the following years, the stock did a huge Flat as […]

-

Elliott Wave View: Apple (AAPL) Has Started Correction

Read MoreShort Term Elliott wave view in Apple (AAPL) is calling the decline to 170.44 on June 4 as wave I. Wave II bounce is currently in progress to correct cycle from June 4 low as a zigzag Elliott Wave structure. Up from 170.44, Wave ((A)) of II has ended at 196.79 as a 5 waves […]

-

Elliott Wave View: Dow Jones Futures Correction to Find Buyers

Read MoreDow Jones Futures (YM_F) shows 5 waves up from June 3 low favoring more upside. This article & video shows the short term Elliott Wave structure.

-

S&P 500 Futures (ES_F) Buying The Elliott Wave Dips

Read MoreIn this technical blog, we take a look at the past performance of 4 hour Elliott Wave charts of ES_F, in which our members took the advantage of blue boxes

-

Elliott Wave View Favors More Upside in Nike (NKE)

Read MoreNike (NKE) shows a 5 waves impulse from June 3 low ($76.9). While pullback stays above there, expect the stock to extend higher.

-

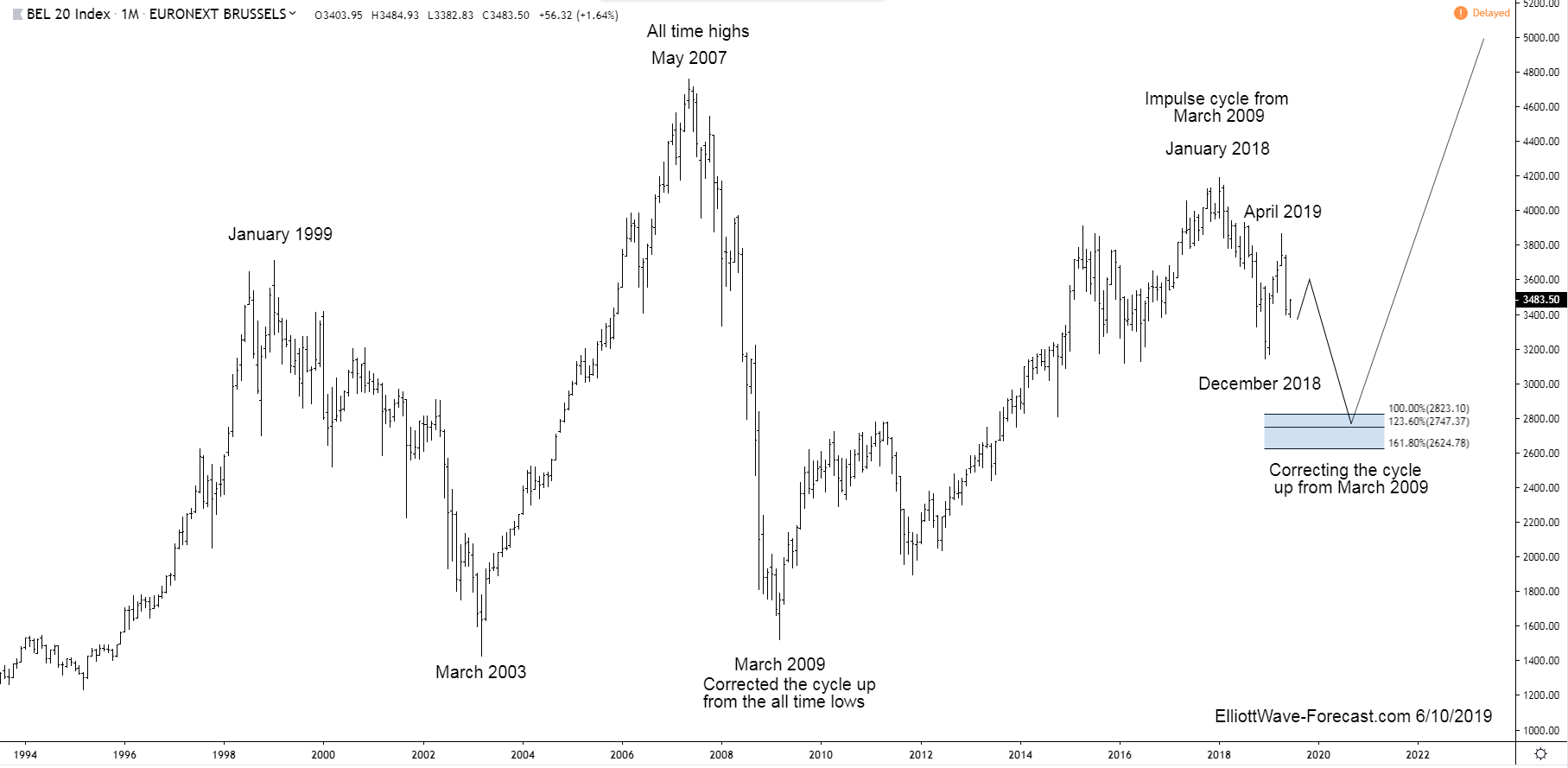

The BEL20 Index is Correcting the Cycle up from the 2009 Lows

Read MoreThe BEL20 Index is correcting the cycle up from the 2009 lows. Firstly the BEL20 Index has trended higher with other world indices since the benchmark was established. The index remained in a long term bullish trend cycle into the May 2007 highs. From there it made a sharp correction lower that lasted until March 2009 […]