The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

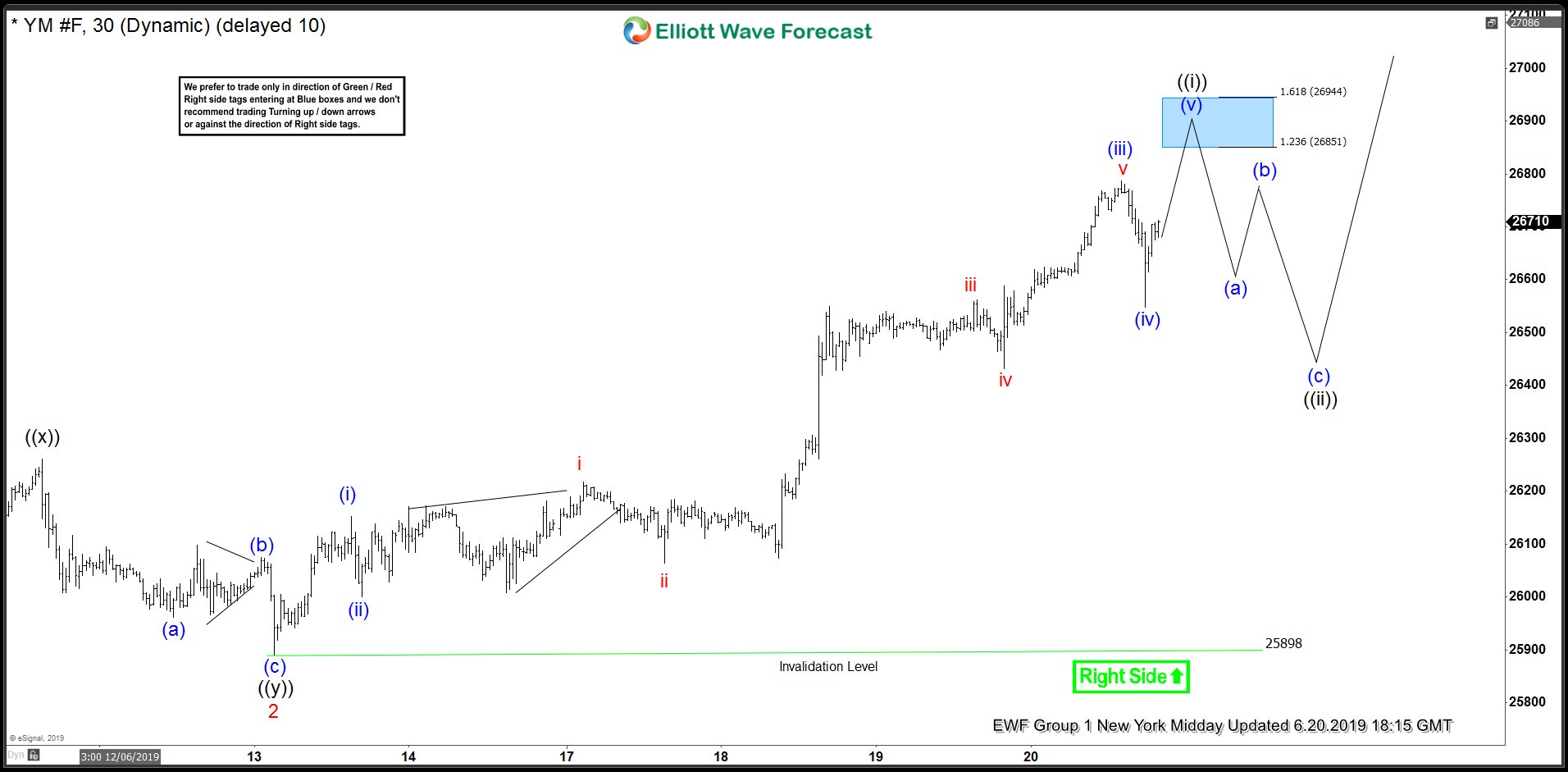

$YM_F (Dow Futures) Forecasting The Rally with Elliott Wave

Read MoreIn this article, we will take a look at how we forecast the rally which took place last week in $YM_F. We presented YM_F as Chart Of The Day on 6.19.2019 and explained that break above 6.18.2019 (26289) peak created an incomplete bullish sequence from June 3 low and suggested $YM_F rally has resumed. We […]

-

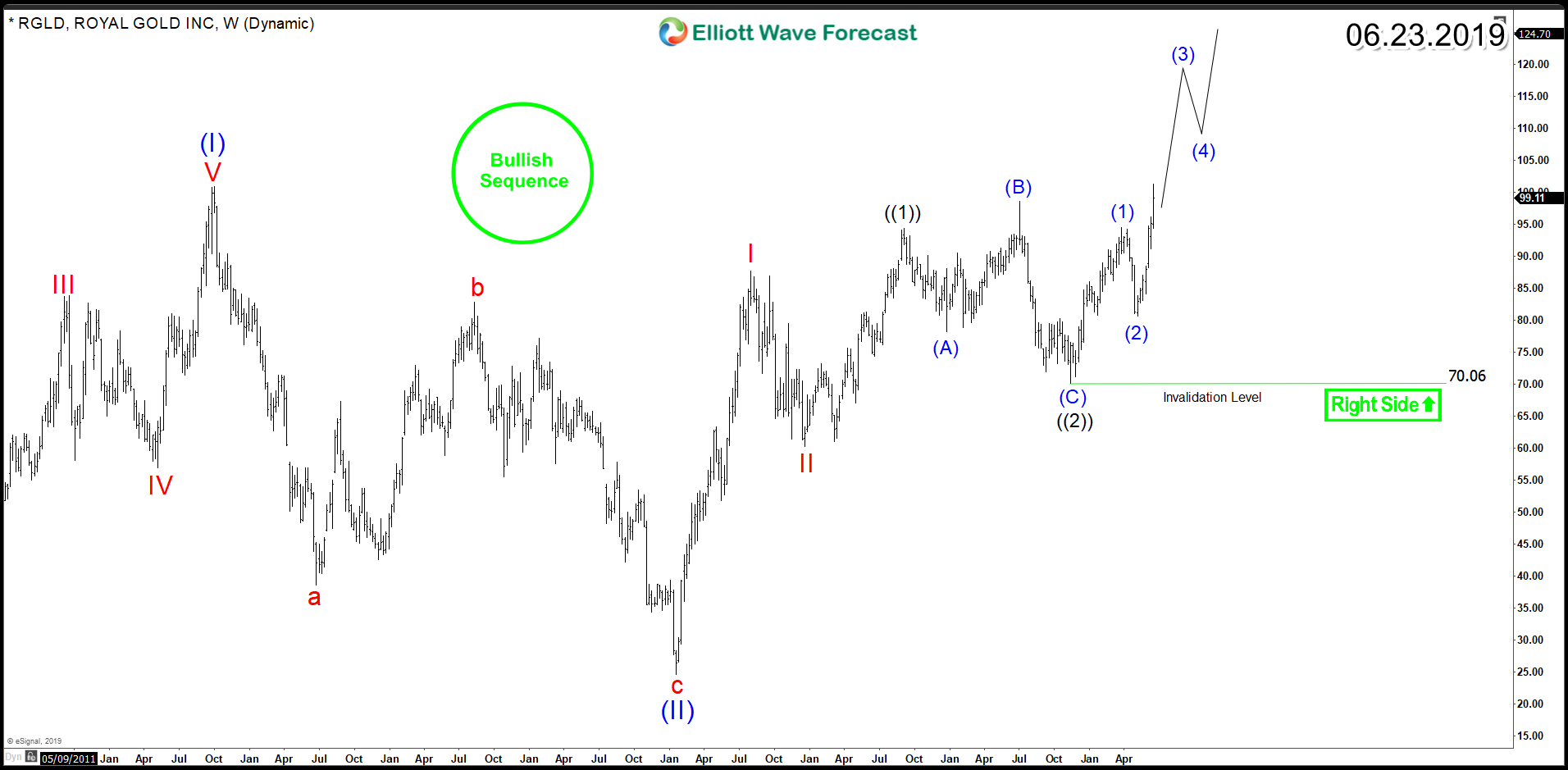

Royal Gold (RGLD) – Leading The Path Higher for Mining Stocks

Read MoreRoyal Gold (NASDAQ: RGLD) is one of the world’s leading precious metals royalty & stream companies, it’s engaged in the acquisition and management of gold, silver, copper, lead and zinc. The Company was founded in 1991 and currently owns interests on 194 properties in over 20 countries. Since August 2018, Gold price started rising significantly and […]

-

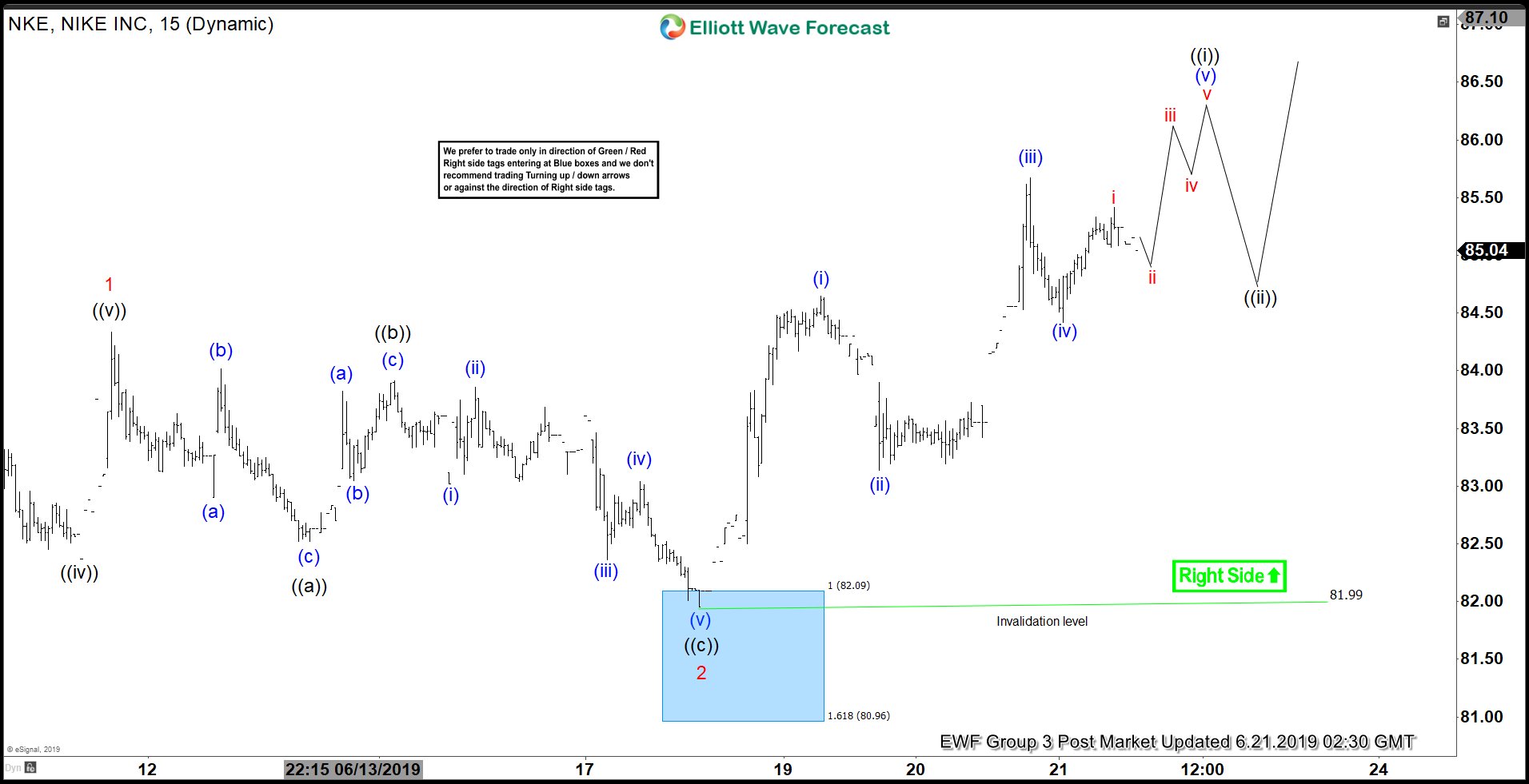

Elliott Wave View: Nike Resumes Rally Higher

Read MoreNike has resumed the rally higher. As far as dips stay above June 18, it can extend higher. This article & video looks at the short term Elliott Wave path.

-

Elliott Wave View Calling for More Upside in Nasdaq

Read MoreNasdaq Futures (NQ_F) shows a higher high sequence from June 4 low, favoring further upside. Short term, rally to 7600.75 ended wave (1) and pullback to 7421.48 ended wave (2). Wave (3) rally is in progress as an impulse Elliott Wave structure. Up from 7421.48, wave ((i)) ended at 7536 and wave ((ii)) pullback ended […]

-

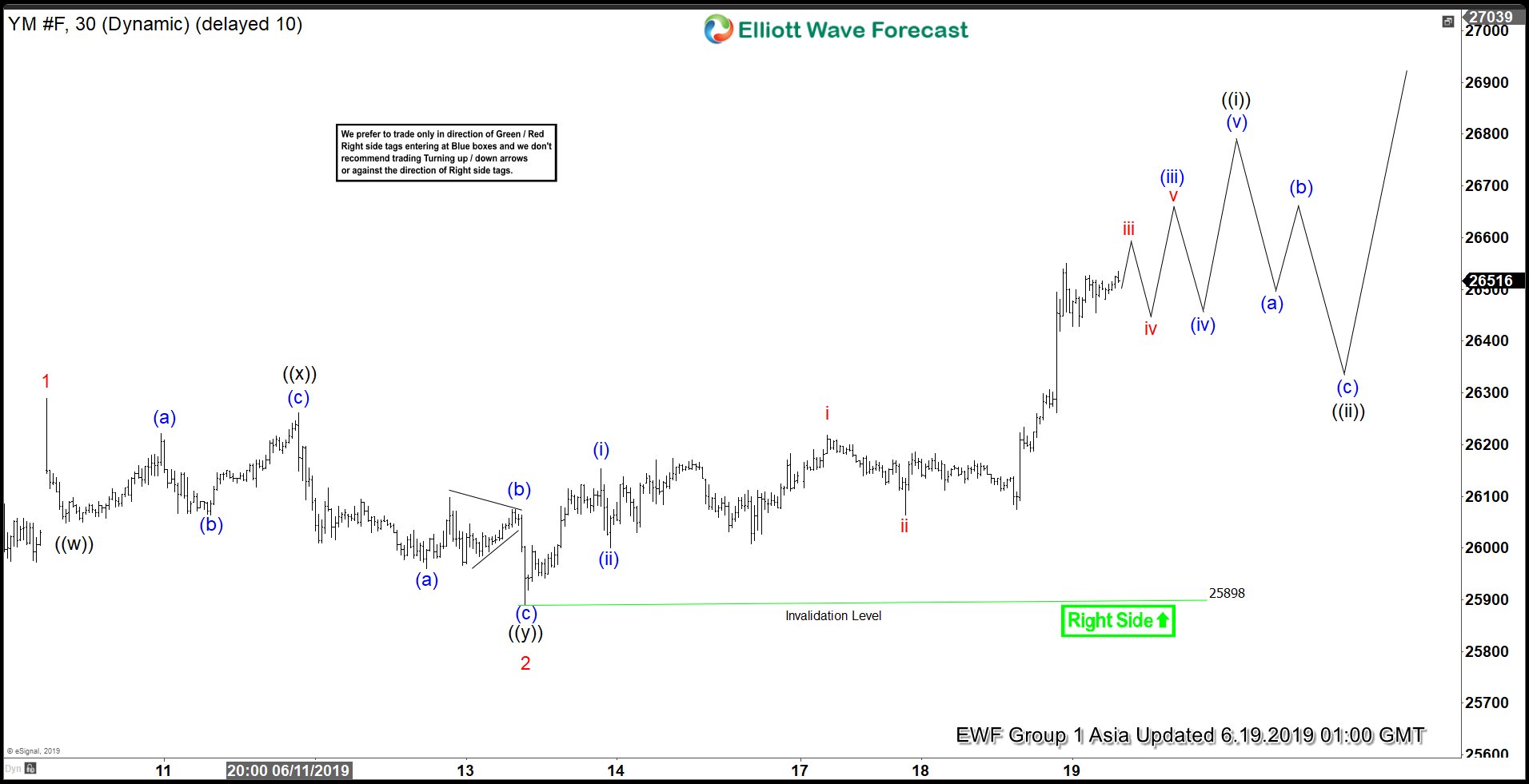

Elliott Wave View: Dow Jones Futures (YM_F) Has Resumed Higher

Read MoreDow Jones Futures (YM_F) shows incomplete sequence from June 3 low favoring more upside. This article and video shows the Elliott Wave path.

-

Facebook Cryptocurrency Project Can Propel The Stock to New All-Time High

Read MoreVarious sources believe that Facebook will unveil a new cryptocurrency payment plan sometimes this month. The company will allow employees working on the project to take their salary in the form of the new currency. One year ago, Facebook has appointed former Paypal executive David Marcus to explore the blockchain technology. Since then, Facebook has […]