The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

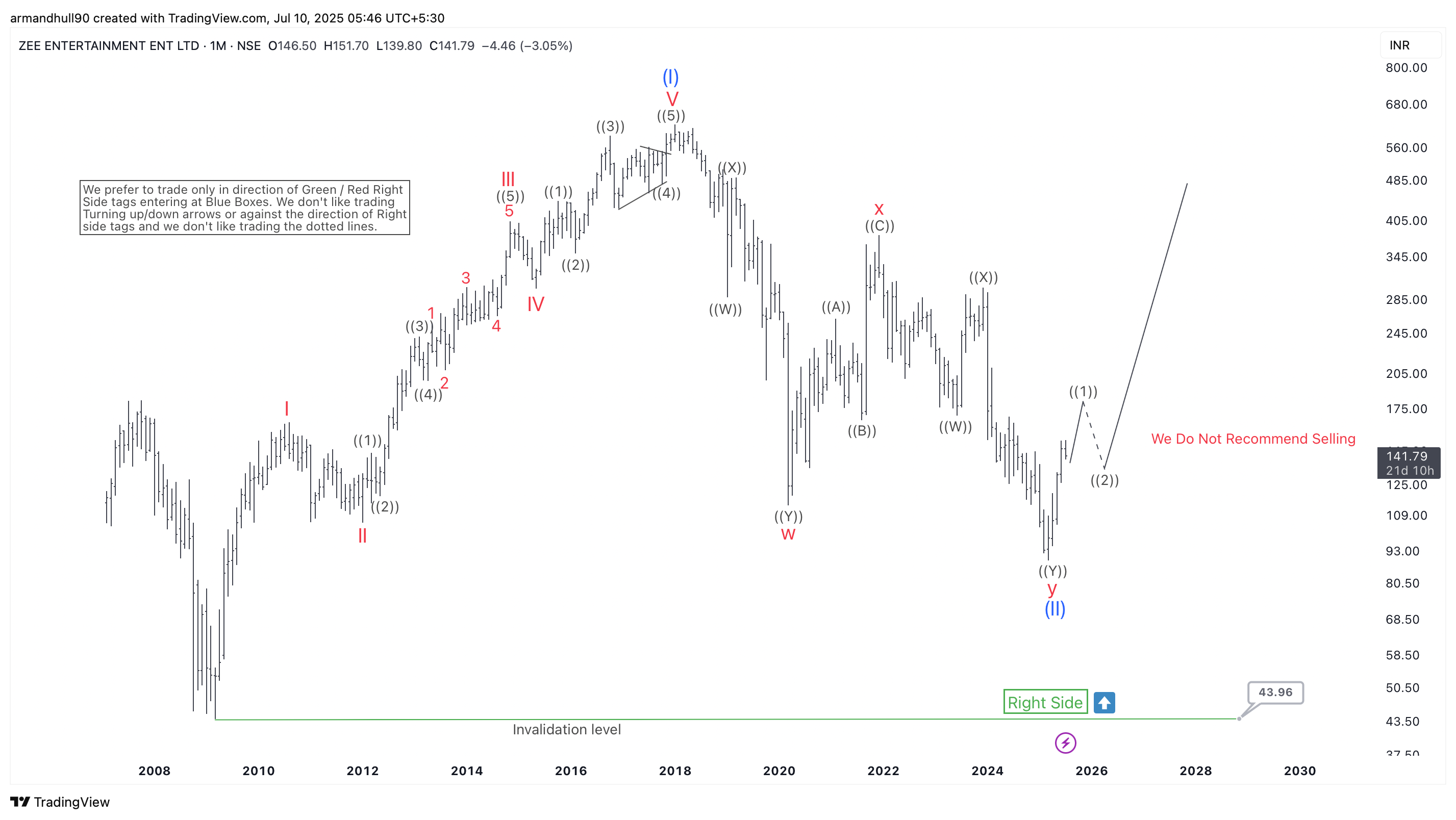

Zee Entertainment (ZEEL): New Elliott Wave Bullish Trend Emerges

Read MoreZEEL finishes a multi-year Elliott Wave correction and begins a fresh impulsive rally, signalling strong upside potential ahead. Zee Entertainment Enterprises Ltd (NSE: ZEEL) appears to be turning the corner after completing a long and complex Elliott Wave correction. According to the weekly chart, ZEEL has finished a multi-year double zigzag corrective structure in wave […]

-

Elliott Wave Outlook: S&P 500 ($SPX) Nests Upward in Strong Rally

Read MoreS&P 500 (SPX) rally from April 7, 2025 shows the strongest momentum, suggesting it’s still within wave 3. This article & video look at the Elliott Wave path

-

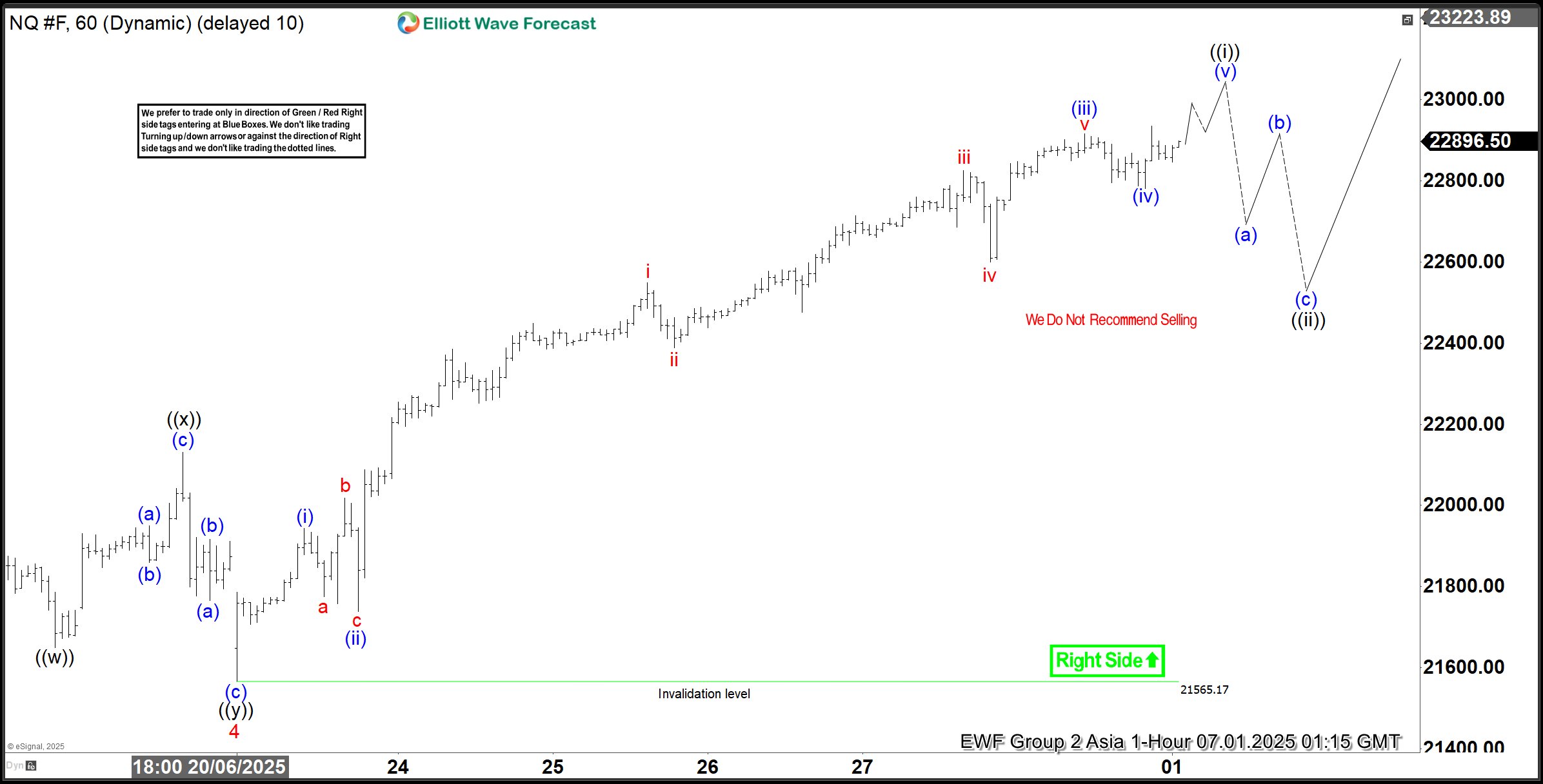

Elliott Wave Analysis: Nasdaq (NQ) Continues Bullish Cycle, Reaching New All-Time High

Read MoreNasdaq (NQ) extends to new all-time high, affirming the bullish trend. This article and video look at the Elliott Wave path of the Index

-

Royal Bank of Canada (RY) Hits New Highs – What’s Next?

Read MoreRoyal Bank of Canada., (RY) operates as diversified financial service company worldwide. It operates through personal finance, commercial banking, wealth management & Insurance segments. It comes under Financial services sector & trades as “RY” ticker at NYSE. RY is trading at all time high & pullback in 3, 7 or 11 swings should provide buying […]

-

IBEX Bounces Back: A Perfect Reaction from the Blue Box Zone

Read MoreIn this technical blog, we will look at the IBEX bouncing back. Producing a perfect reaction higher from the blue box zone.

-

MSTR Elliott Wave Signals Another +60% Move Toward Record Highs

Read MoreMicroStrategy (NASDAQ: MSTR) faced a 58% correction from its November 2024 peak. Meanwhile, Bitcoin resumed its rally this year and already reached new all-time highs. However, the stock continues to lag behind, failing to match Bitcoin’s bullish pace. In today’s article, we explore MSTR’s Elliott Wave structure and outline the bullish paths and key targets that may unfold […]