The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

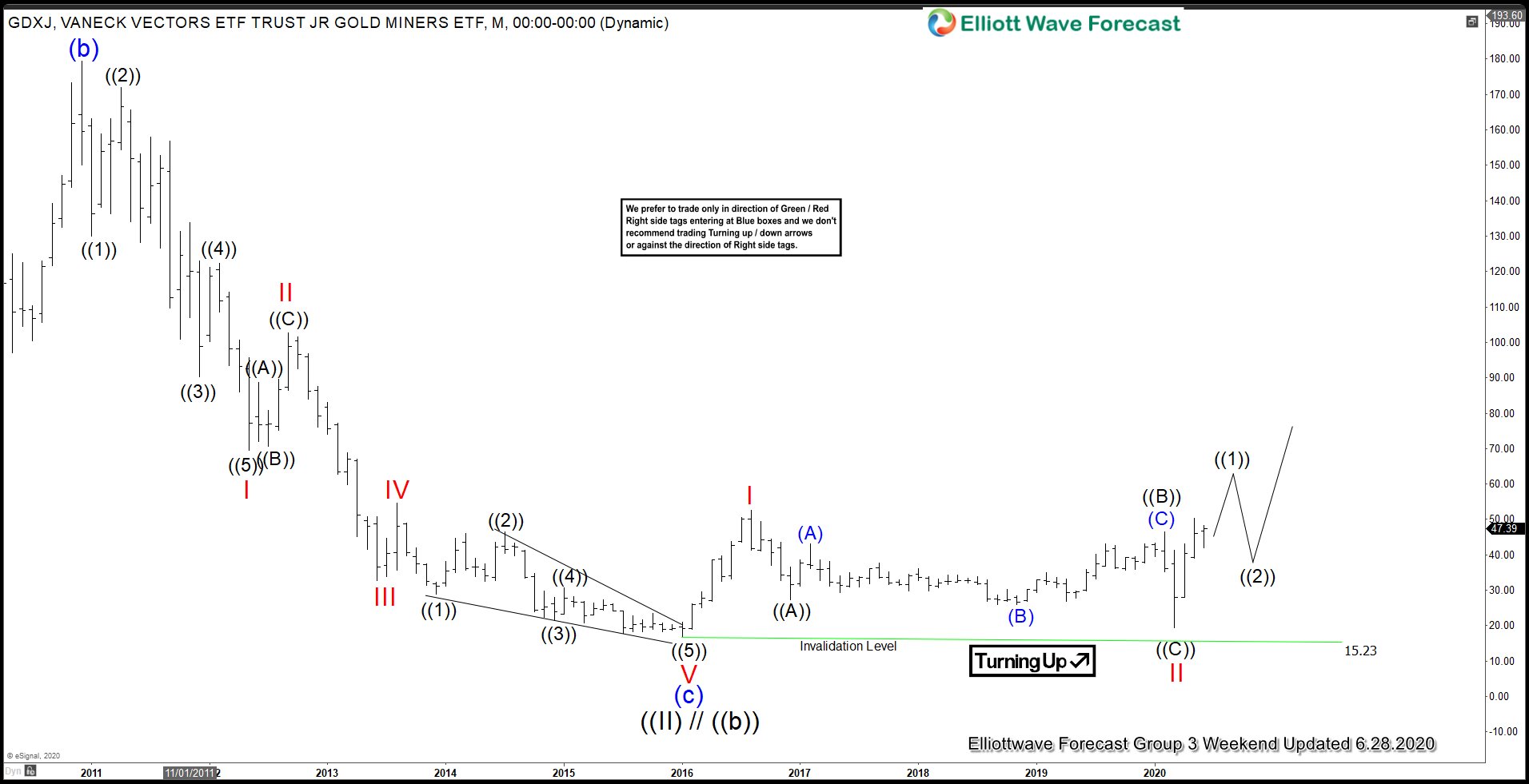

Bullish Breakout in GDXJ (Gold Miners Juniors) Imminent

Read MoreGold market continues to extend higher with uncertainties in pandemic and ultra-loose monetary policy by central banks. It has printed a 7 year high of $1779 and shows no sign of stopping. It has broken to new-all time high against many other major currencies, such as Euro, Pound Sterling, and Yen. Gold stocks should benefit […]

-

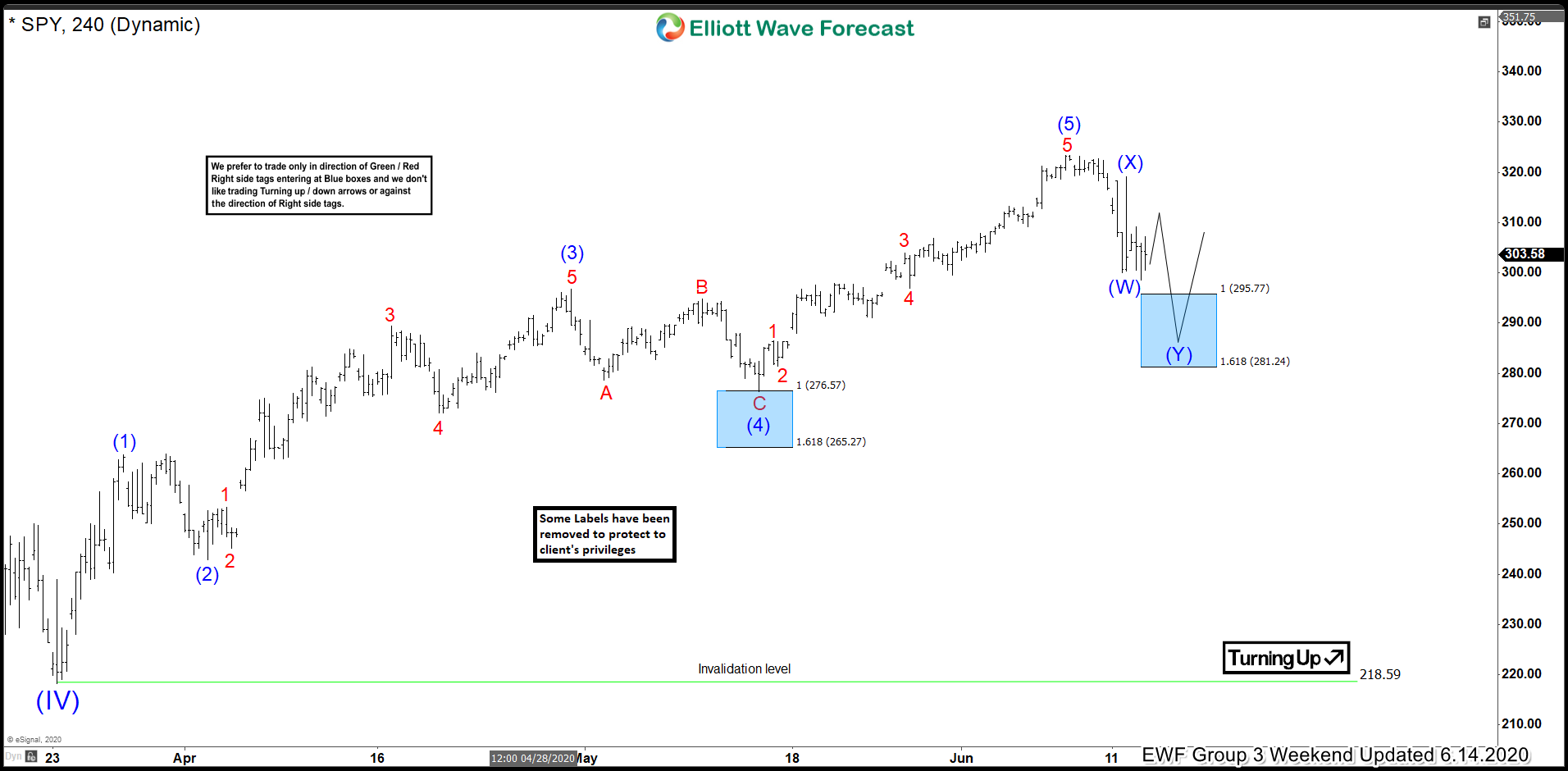

Elliott Wave View: SPX Resumes Correction Lower

Read MoreSPX ended the cycle from April 2 low and is currently correcting that cycle. While below June 9 high, index can do another leg lower before upside resume.

-

Drive Shack ($DS) Incomplete Bullish Sequence

Read MoreDrive Shack ($DS) has been making steady gains since the March 2020 low. Technically speaking, it has a nice Elliott Wave chart, and is following the pattern of the general indices fairly well. Let’s take a look at what they do as a company: “Drive Shack Inc. is a leading owner and operator of golf-related […]

-

Elliott Wave View: Exxon Mobil Pulling Back

Read MoreExxon (XOM) shows incomplete bearish sequence against June 8 high. While below June 16 high, expect bounce in 3,7,11 swing to fail for more downside.

-

SPY Elliott Wave View: Ready To Resume Higher?

Read MoreIn this blog, we take a look at the past performance of 4 hour Elliott Wave charts of SPY, In which our members took advantage of the blue box areas.

-

Elliott Wave View: Facebook Should See More Upside

Read MoreFacebook has broken above the previous wave 3 high. While above 6.17.2020 low, dips in 3,7,or 11 swing is expected to find support for more upside.