The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Nikola Corporation ($NKLA) Looking For The Next Leg Up

Read MoreNikola has had quite a stellar 2020. With the stock price running from 10.31 to a high of 97.41 within the span of a few months, there is a lot of eyes on Nikola. They are a zero emissions vehicle manufacturer, using hydrogen cell technology. Lets take a look at the company profile below: “Nikola […]

-

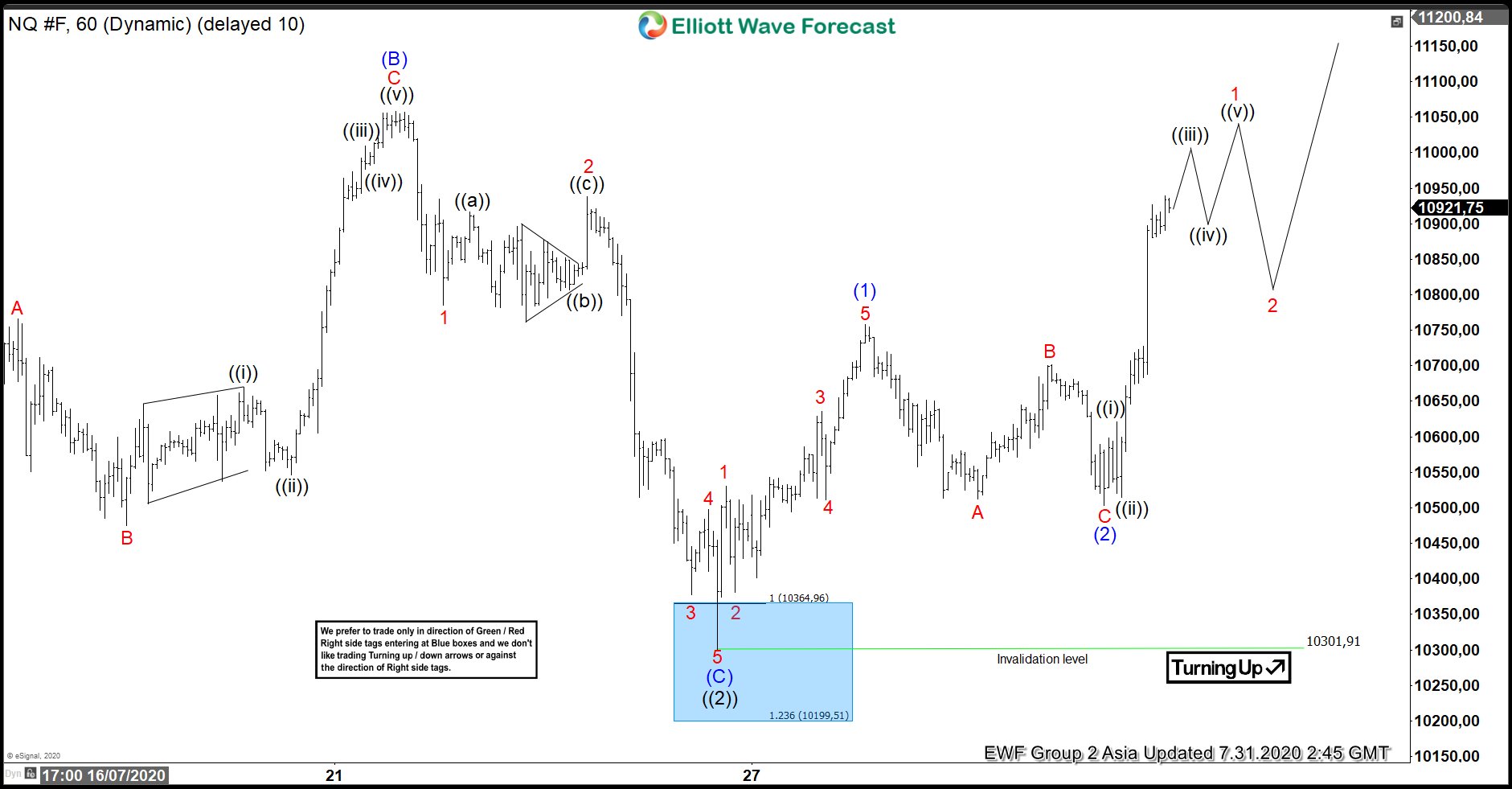

Elliott Wave View: Nasdaq Attempting for New Record

Read MoreNASDAQ ended pullback from July 13 peak as a flat correction at blue box. While above July 24 low, expect dips in 3,7 or 11 swing to be supported.

-

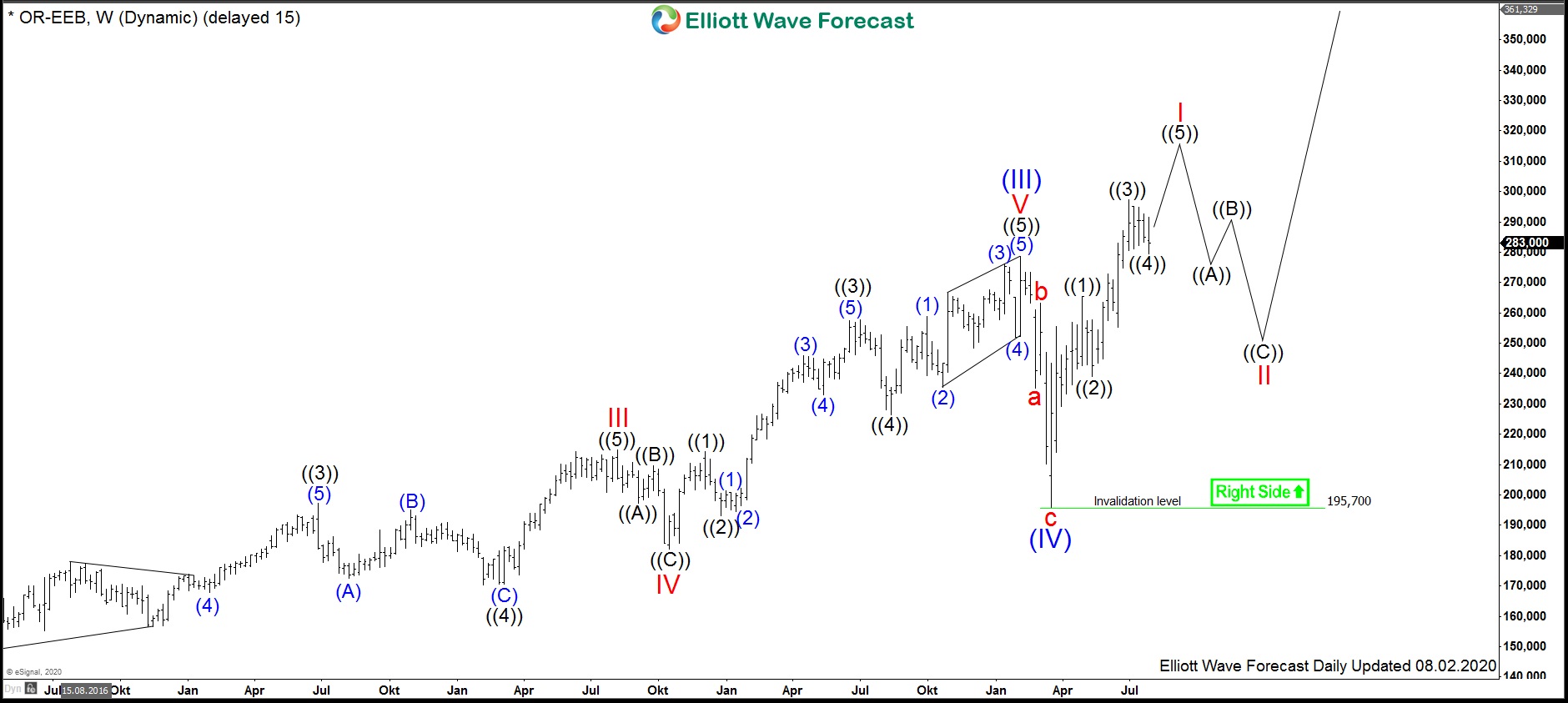

$OR: Giant of Cosmetics l’Oréal Remains Strong During Lockdown

Read MoreL’Oréal S.A. is the world largest cosmetics and beauty company. Headquartered in Clichy, France, the field of activities concentrates on skin care, hair color, perfume, make-up, hair care, sun protection etc. L’Oréal is a part of Euro Stoxx 50 (SX5E) and CAC40 indices. Investors can trade it under the ticker $OR at Euronext Paris. As […]

-

Elliott Wave View: Tesla (TSLA) Ended Correction

Read MoreTesla (TSLA) ended cycle from July 13 high at the blue box. While above July 24 low, expect dips in 3,7 or 11 swings to find support for further upside.

-

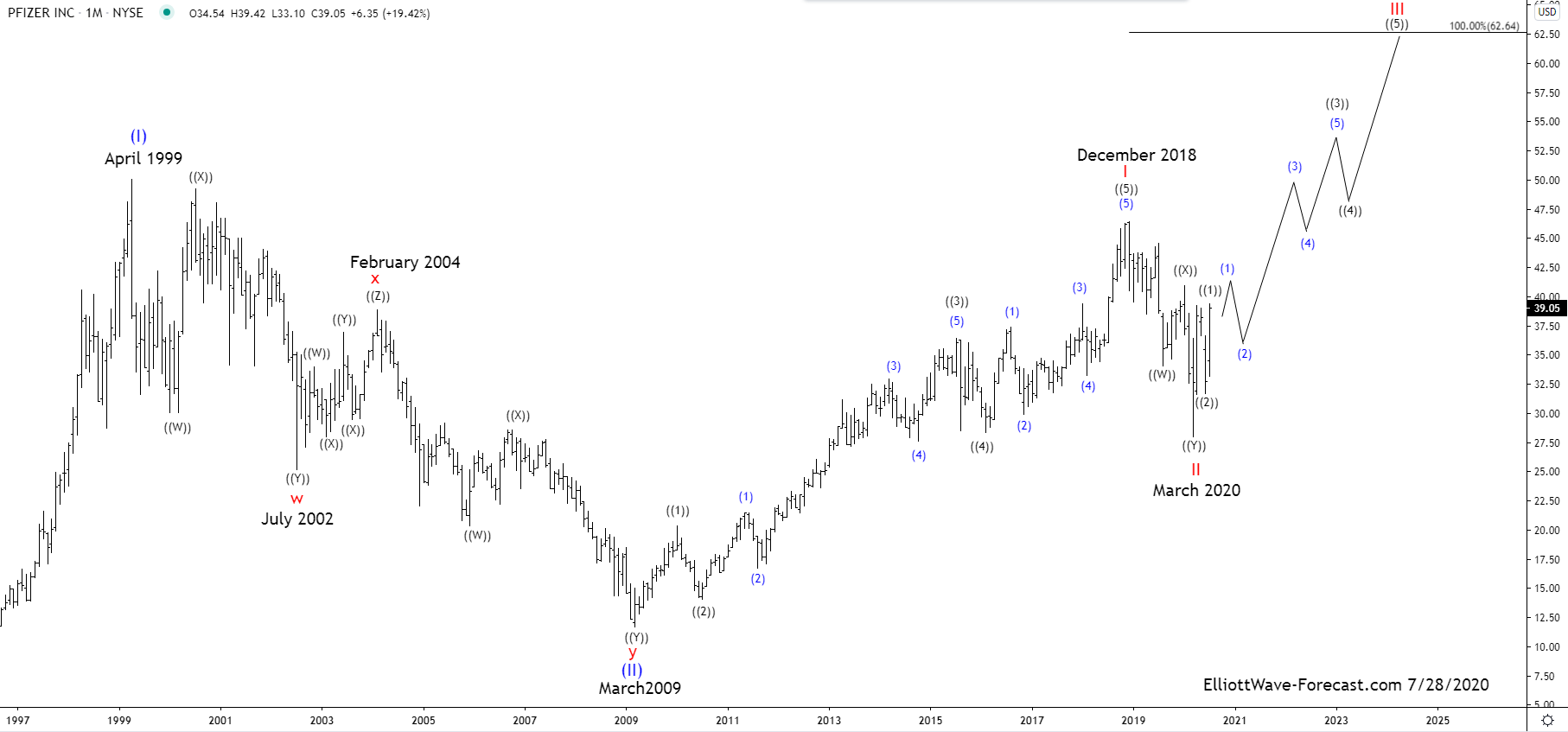

$PFE Elliott Wave Cycles and Long Term Bullish Trend

Read More$PFE Elliott Wave Cycles and Long Term Bullish Trend The PFIZER Elliott Wave Cycles and Long Term Bullish Trend suggest the stock price will be trending higher. The cycles project it should continue toward the April 1999 highs 50.04 while it is above the February 2018 lows. From the beginning of the stock trading it had […]

-

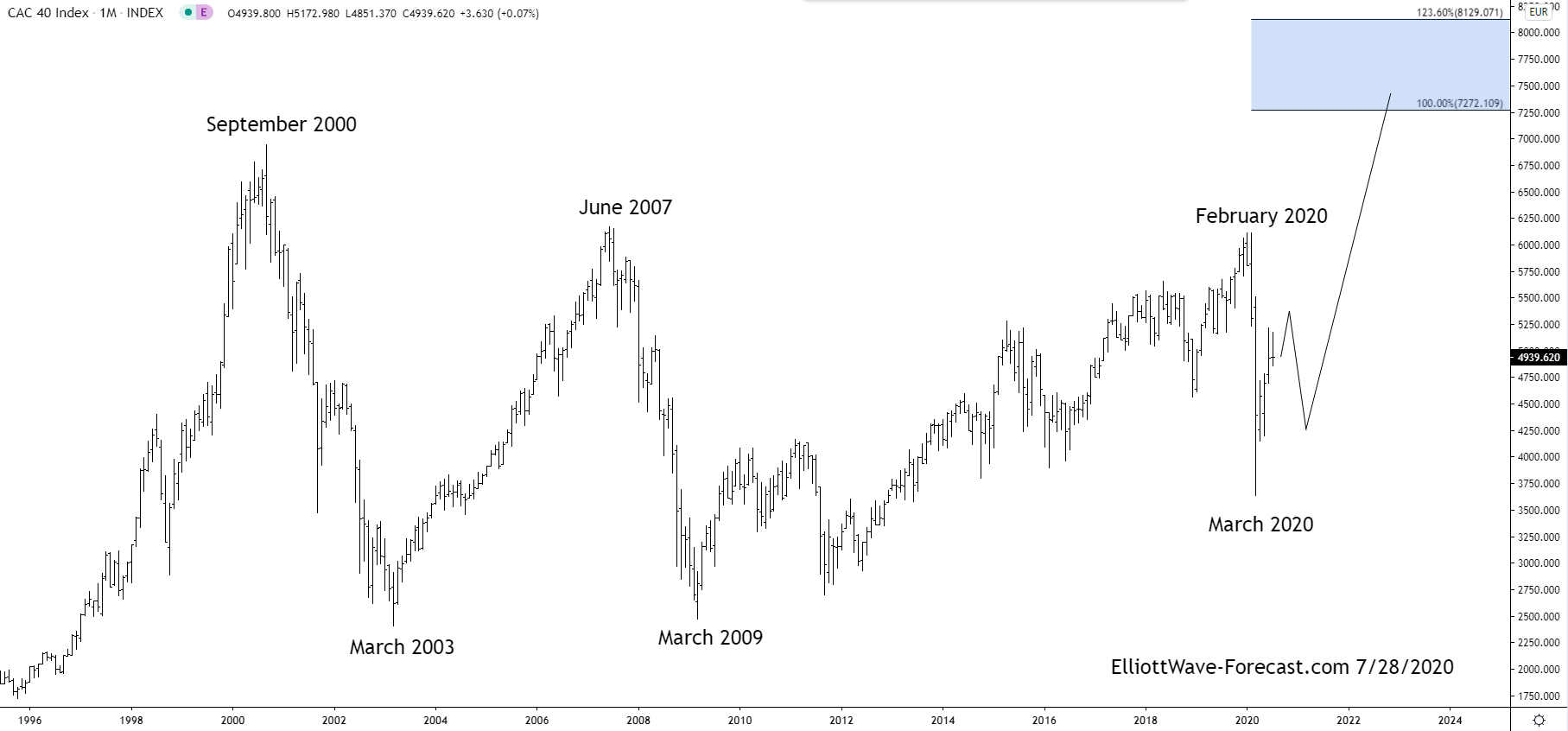

The Longer Term Bullish Cycles of the $CAC40

Read MoreThe Longer Term Bullish Cycles of the $CAC40 Firstly the CAC 40 index has been trending higher with other world indices where in September 2000 it put in an all time high. From there it followed the rest of the world indices lower into the March 2003 lows which was a larger degree pullback. From […]