The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Elliott Wave View: Nikkei (NKD_F) Extending Higher

Read MoreNikkei extended higher from July 31 low. While above August 7 low, expect dips in 3,7 or 11 swings to find support for more upside.

-

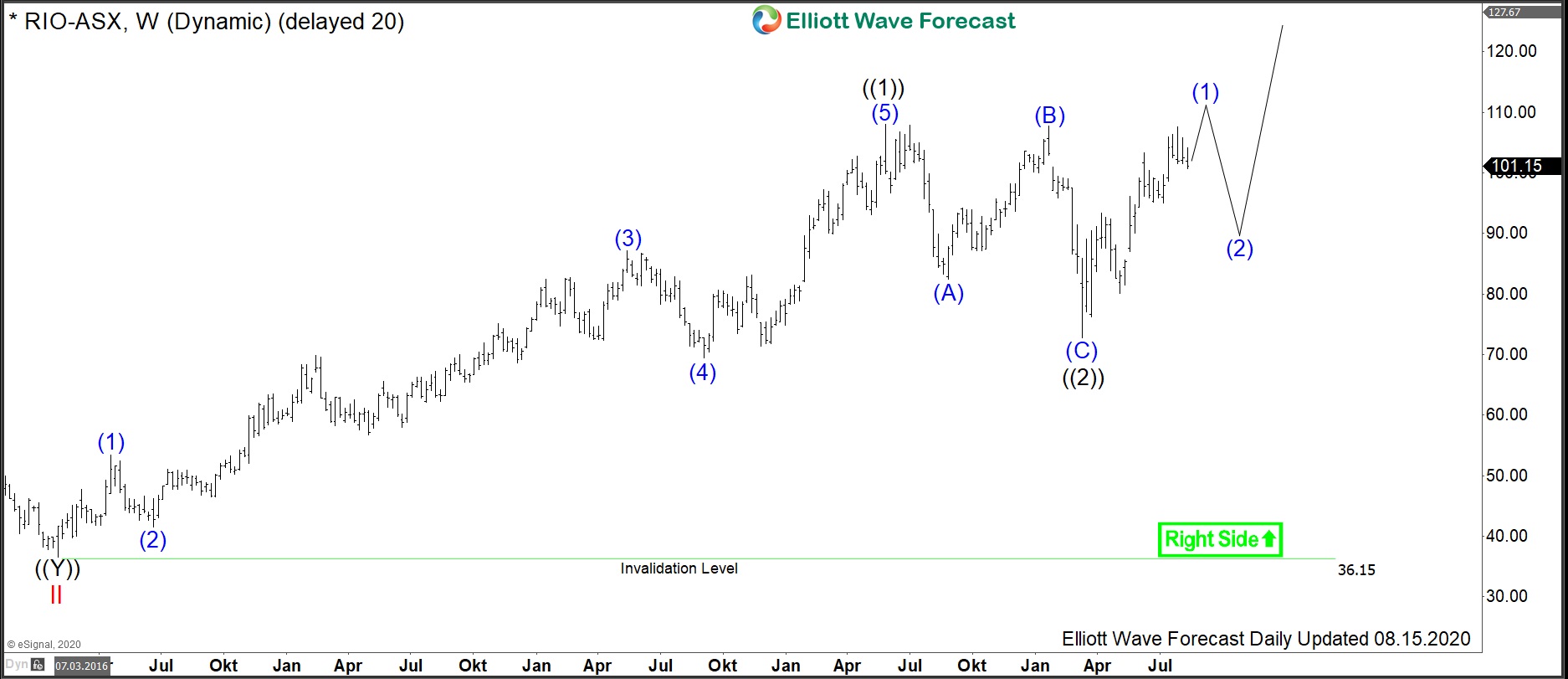

$RIO : Rio Tinto Shares are Ready to Accelerate Higher

Read MoreRio Tinto Group is the world’s second largest metals and mining corporation which has its headquarters in London and Melbourne. Founded in 1873 and traded under tickers $RIO at LSE, ASE and also in US in form of ADRs, it is a component of both the FTSE100 and ASX200 indices. In terms of operations, Rio Tinto […]

-

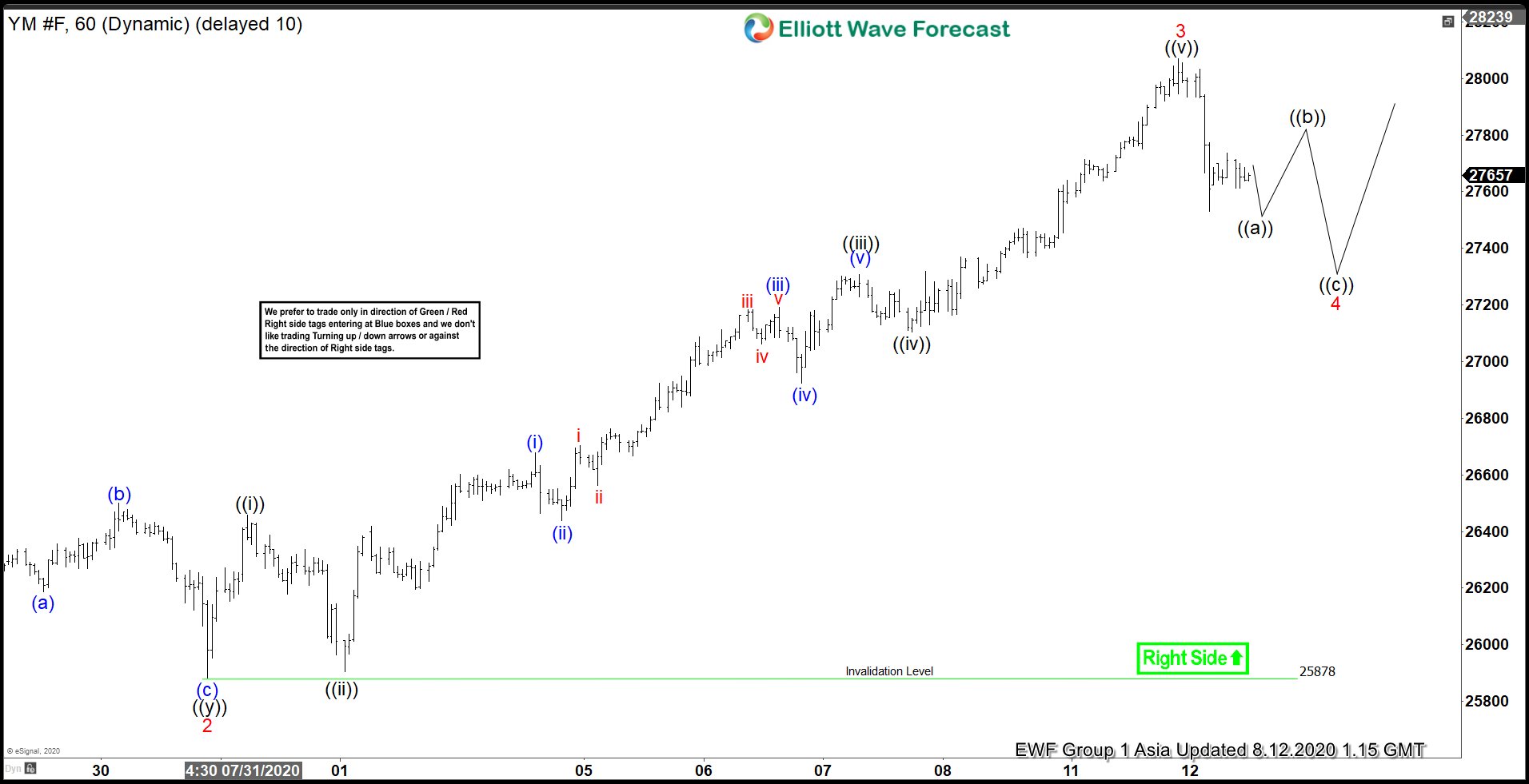

Elliott Wave View: Dow Futures (YM_F) Zigzag Correction In Progress

Read MoreYM_F ended cycle from July 30 low. Currently, 3 waves pullback is in progress. While above July 30 low, expect dips in 3,7 or 11 swings to find support.

-

Workhorse Group Inc ($WKHS) Incomplete Bullish Sequence

Read MoreWorkhorse has had a great 2020 off the March low. With the stock price running from 1.31 to a high of 22.90, the momentum has been strong. They are a zero emissions Electric Vehicle manufacturer. Lets take a look at the company profile below: “Workhorse Group Incorporated is an American manufacturing company based in Cincinnati, Ohio, currently […]

-

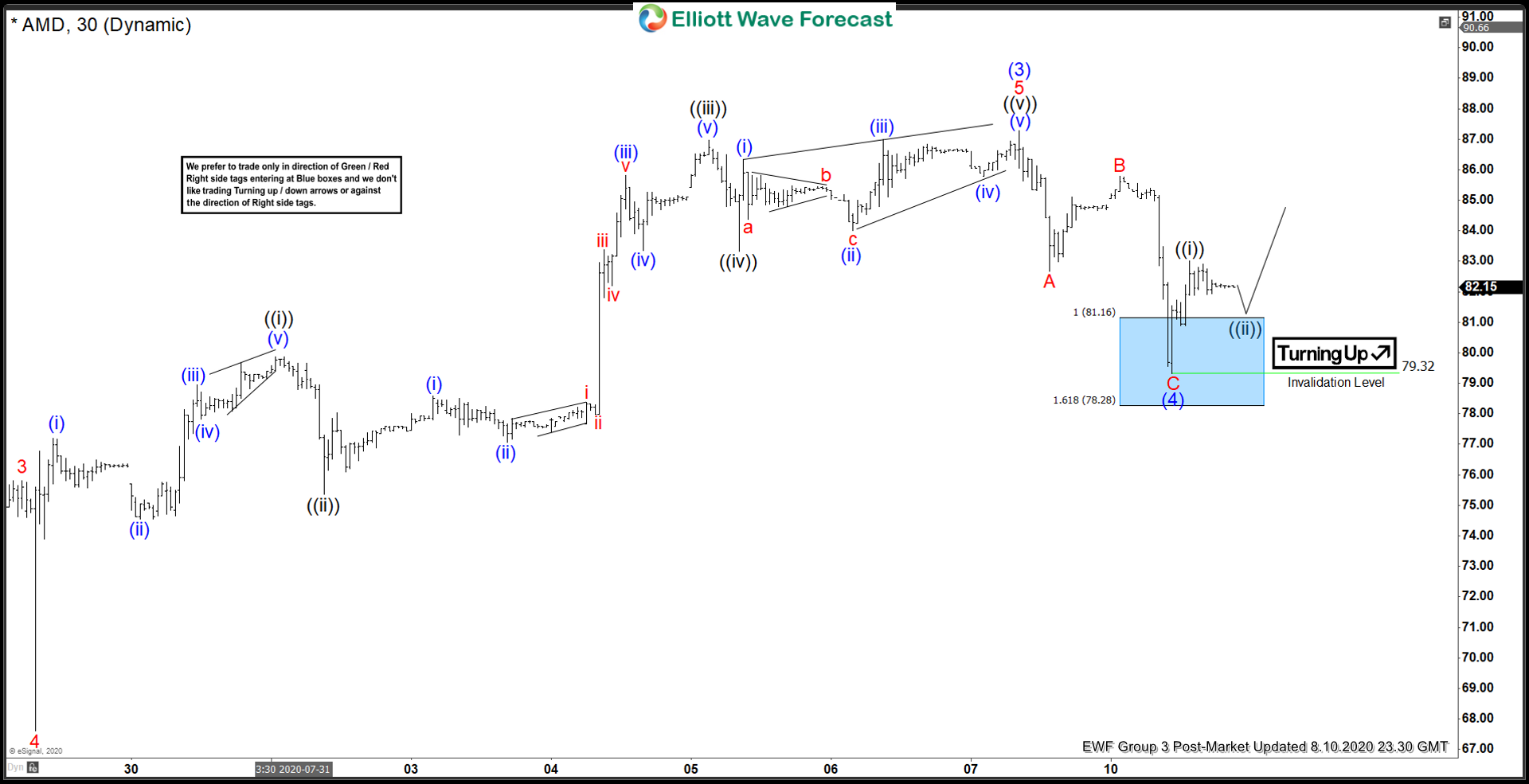

Elliott Wave View: More upside in Advance Micro Devices (AMD)

Read MoreAMD ended the pullback from August 7 high at the blue box area. It has bounce higher from there. While above August 10 low, stock can see more upside.

-

Buying The Dips In Facebook (FB) At the Blue Box

Read MoreIn this blog, we are going to take a look at the Elliott Wave chart of Facebook (FB). The 30 minutes pre-market chart from August 4, 2020 shows that the stock has rallied higher from wave (2) low at 226.92. That pullback in wave (2) reached the blue box area, which is an area where […]