The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

DOCU: Docusign Growth Accelerated due to Covid Pandemic

Read MoreDOCU History: From contracts to offer letters to purchase orders, agreements are the foundation of doing business. Innovation and agreements are intrinsically connected. Both fuel each other and create that opportunity where ideas collide and intellectual capital starts to flow. Had it not been for the innovative thinking of certain businesses, industries and luminaries, opportunities […]

-

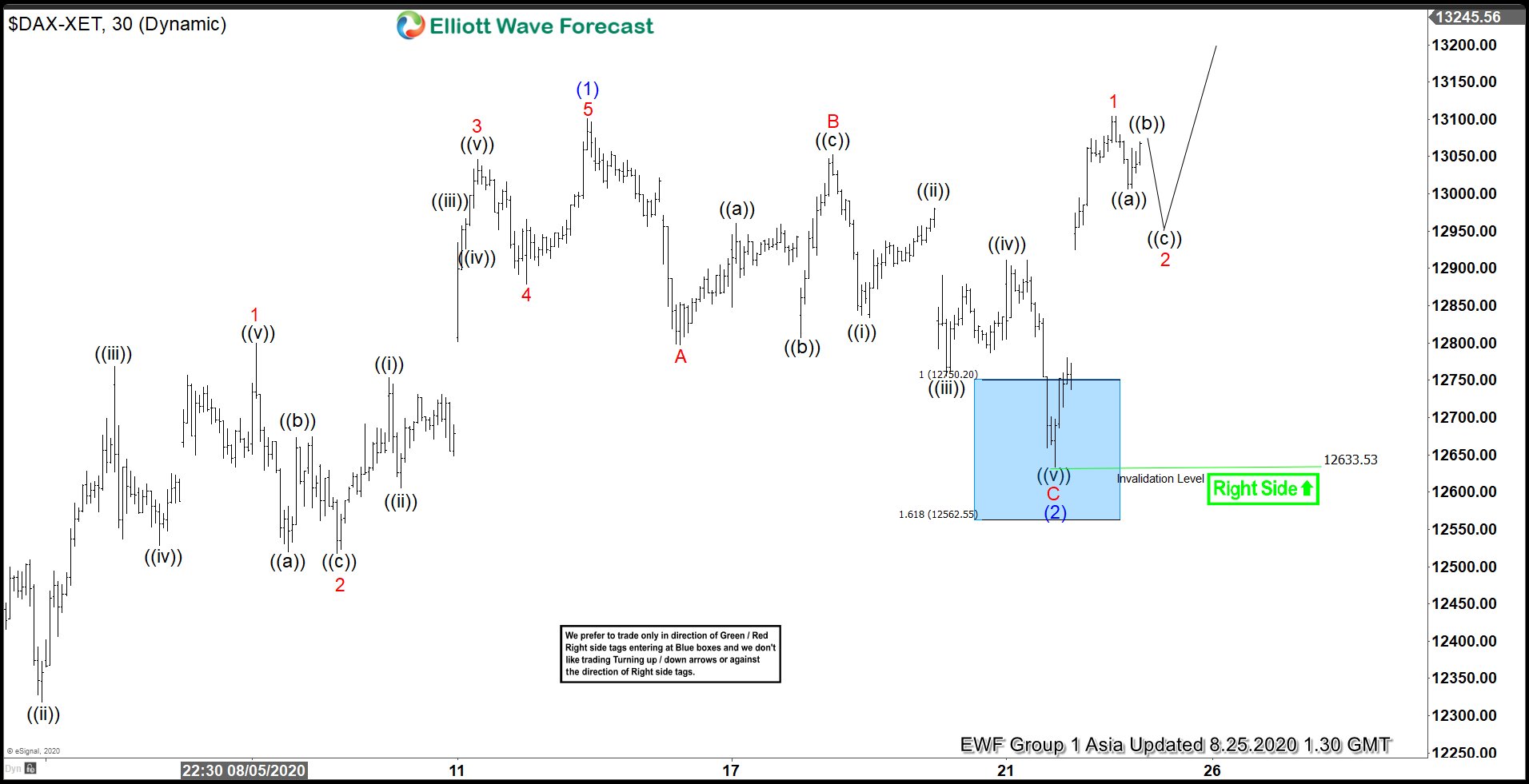

Elliott Wave View: DAX Resumes Rally Higher

Read MoreDAX ended correction from 8/12 high at the blue box area. From there, Index has resumed rally. While above 8/21 low, expect Index to resume higher.

-

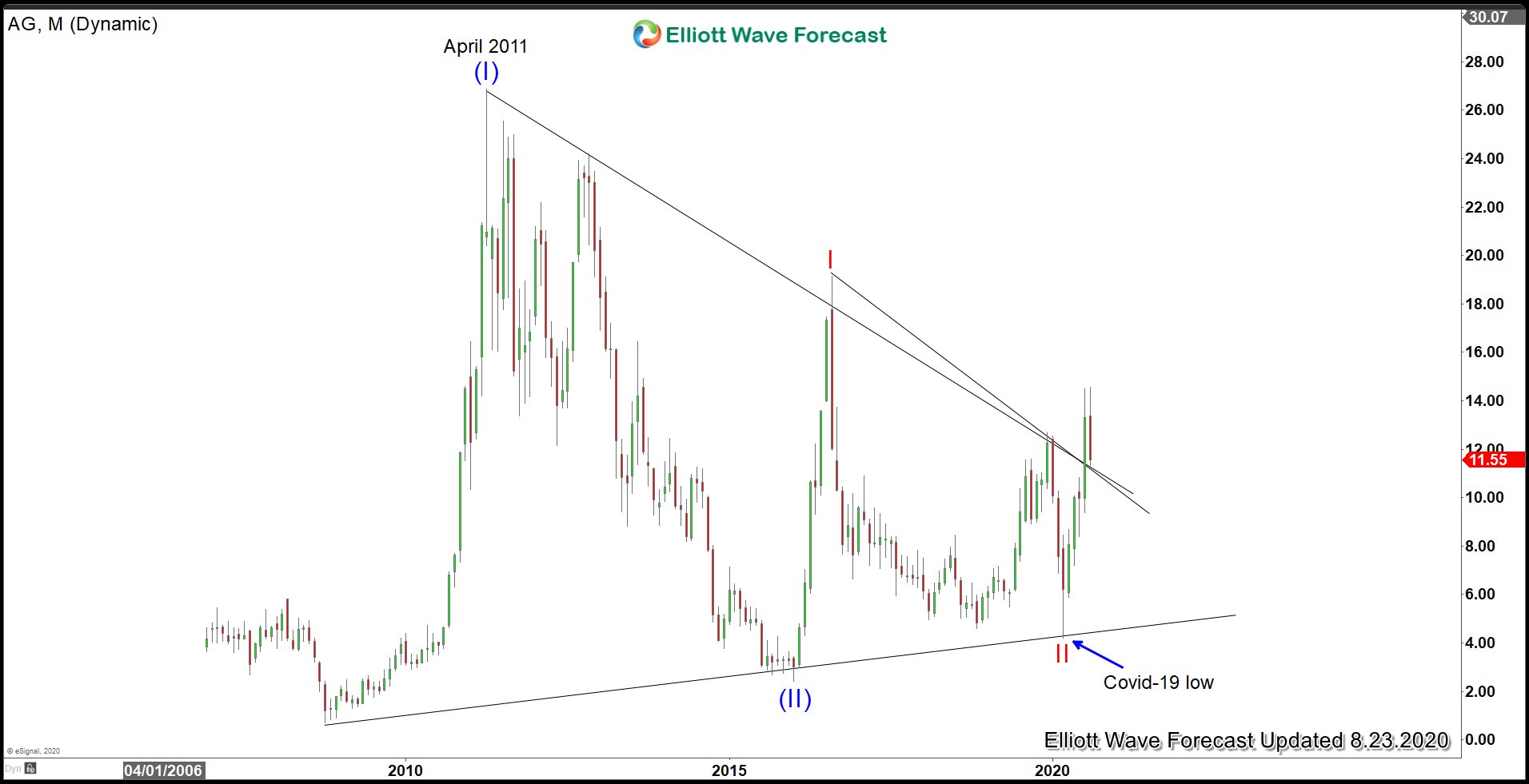

First Majestic Silver ($AG) Broke Higher from 10 Year Consolidation

Read MoreFirst Majestic Silver (symbol: $AG) is a Canadian silver-mining company which operates in Mexico. It has 7 mines, although only 3 most cost-efficient mines are currently operating in San Dimas, Santa Elena, and La Encantada. It’s considered to be one of the purest silver mining companies with 60% of the revenue derived from Silver. If […]

-

$KGH : Major Metals Producer KGHM Ramping Up

Read MoreKGHM Polska Miedź S.A. is a multinational corporation which has its headquarters in Lubin, Poland. Traded under tickers $KGH at WSE and $KGHPF in US in form of ADRs, it is a component of the WIG30 index. KGHM has been a major copper and silver producer for more than 50 years. As a matter of fact, it […]

-

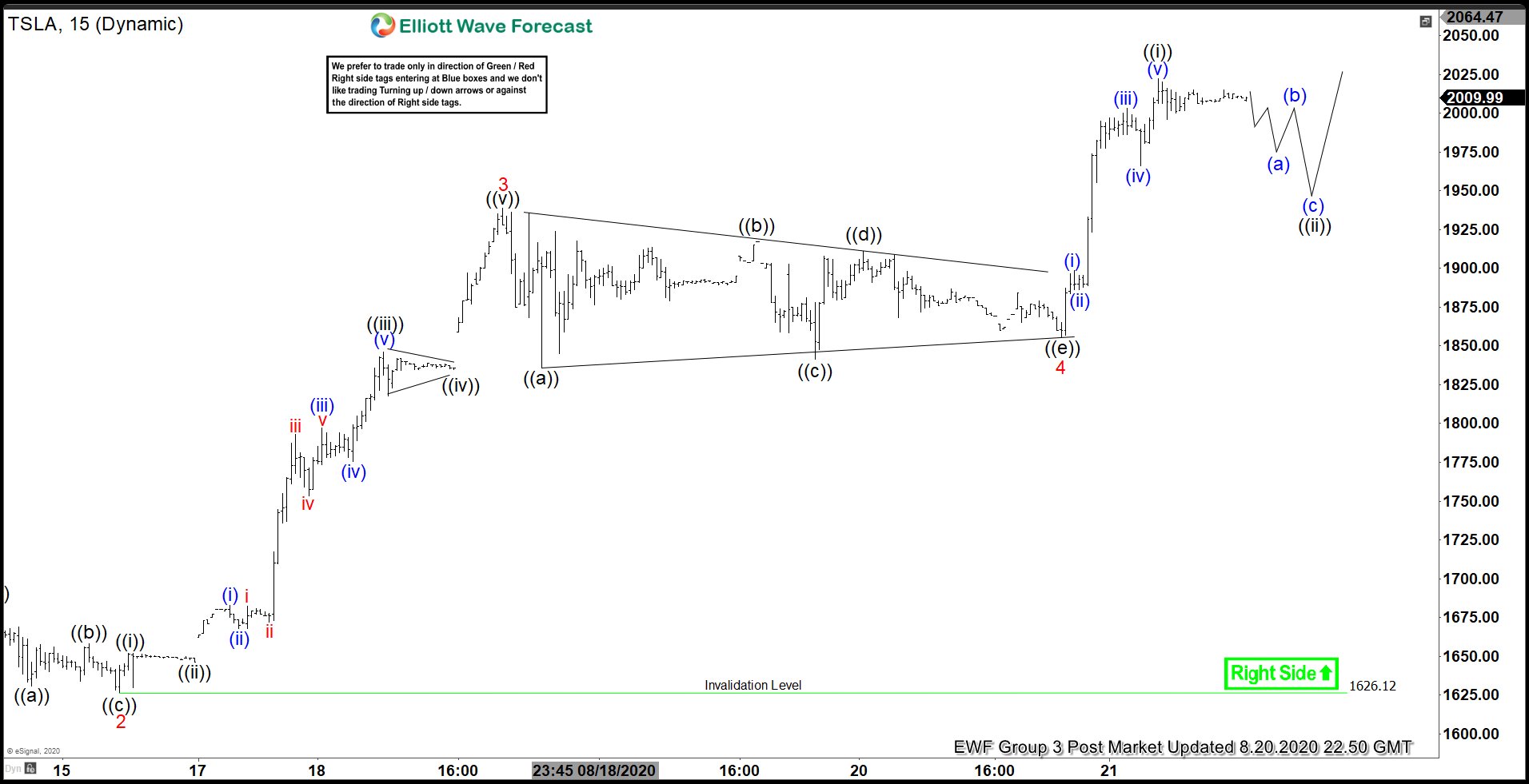

Elliott Wave View: Tesla (TSLA) Ending Wave 5

Read MoreTSLA continue to extend higher and now is close to ending wave 5. While above August 15 low, expect dips in 3,7,11 swing to find support for more upside.

-

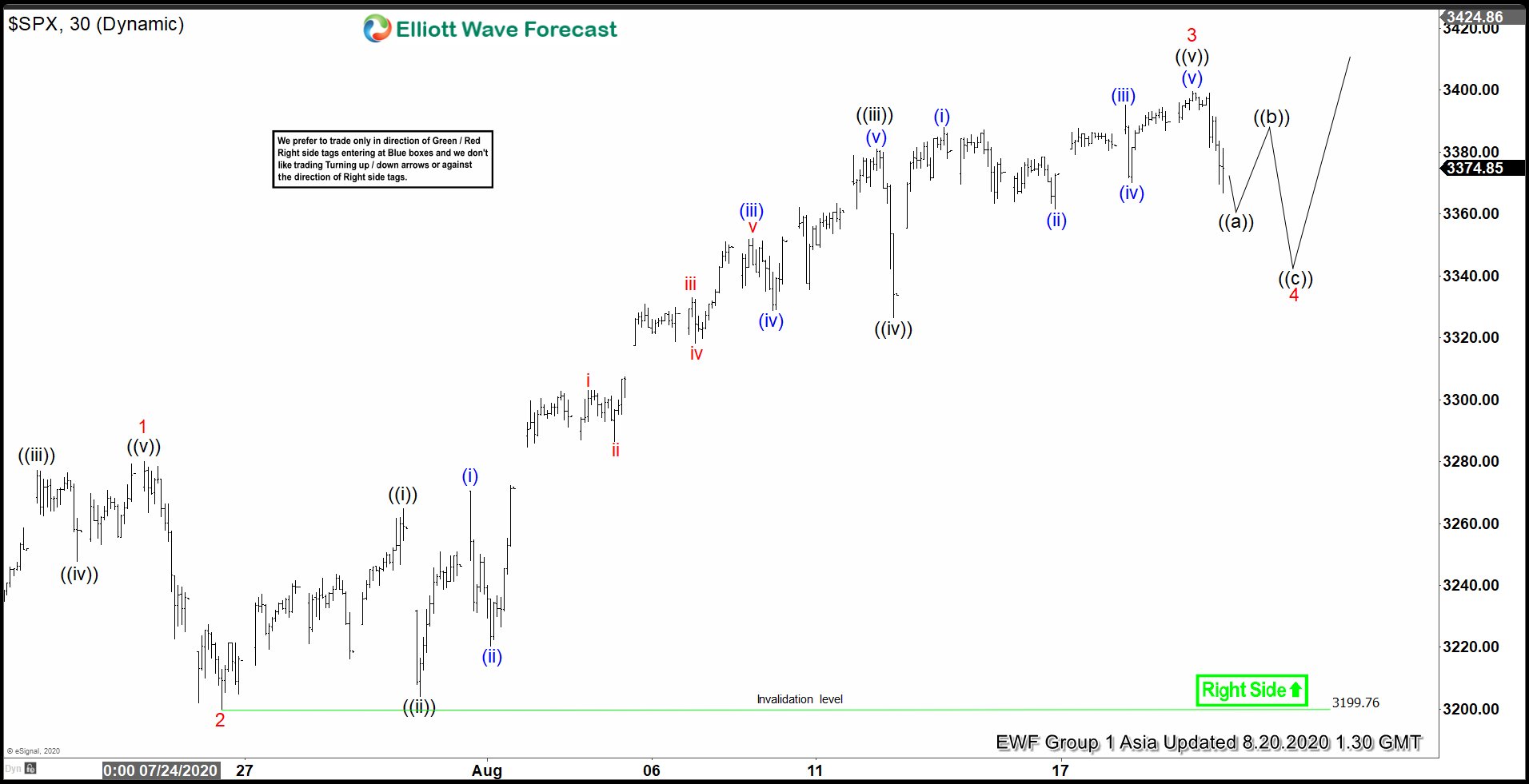

Elliottt Wave View: S&P 500 (SPX) Pulling Back After Making All-Time High

Read MoreSPX ended cycle from July 25 low. The index is currently correcting that cycle. While above July 25 low, expect dips to continue to be supported.