The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Elliott Wave View: Amazon (AMZN) Continues to Benefit from the Pandemic

Read MoreAMZN rallied higher from August 12 low as impulse structure. While above that low, expect dips in 3,7 or 11 swings to find support for more upside.

-

DataDog Inc. ($DDOG) Looking For Higher Prices

Read MoreThe Corona Virus has provided some amazing opportunities for certain sectors. Cloud computing is one of those sectors that have vastly outperformed the marketplace since the March 2020 low. DataDog Inc is in the cloud computing business and has been on a tear since the all time lows that were printed in March 2020. Lets […]

-

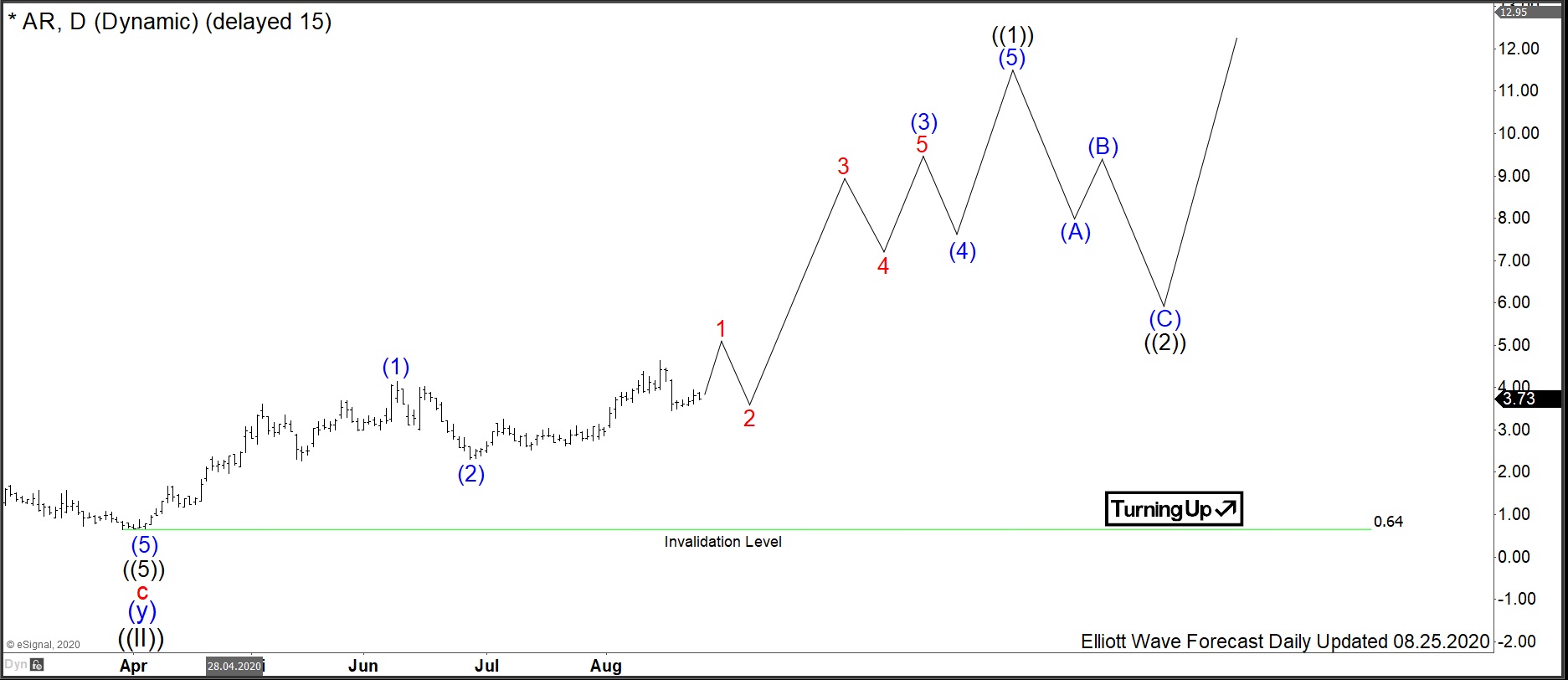

$AR : Gas Producer Antero Resources May Accelerate

Read MoreAntero Resources is an U.S. american corporation which has its headquarters in Denver, USA. Founded in 2008 and traded under tickers $AR at NYSE, it is a component of the Russel1000 index. Antero Resources is the 3rd largest U.S. producer of natural gas and possesses the reserves entirely within the Appalachian Basin. Using hydraulic fracturing, […]

-

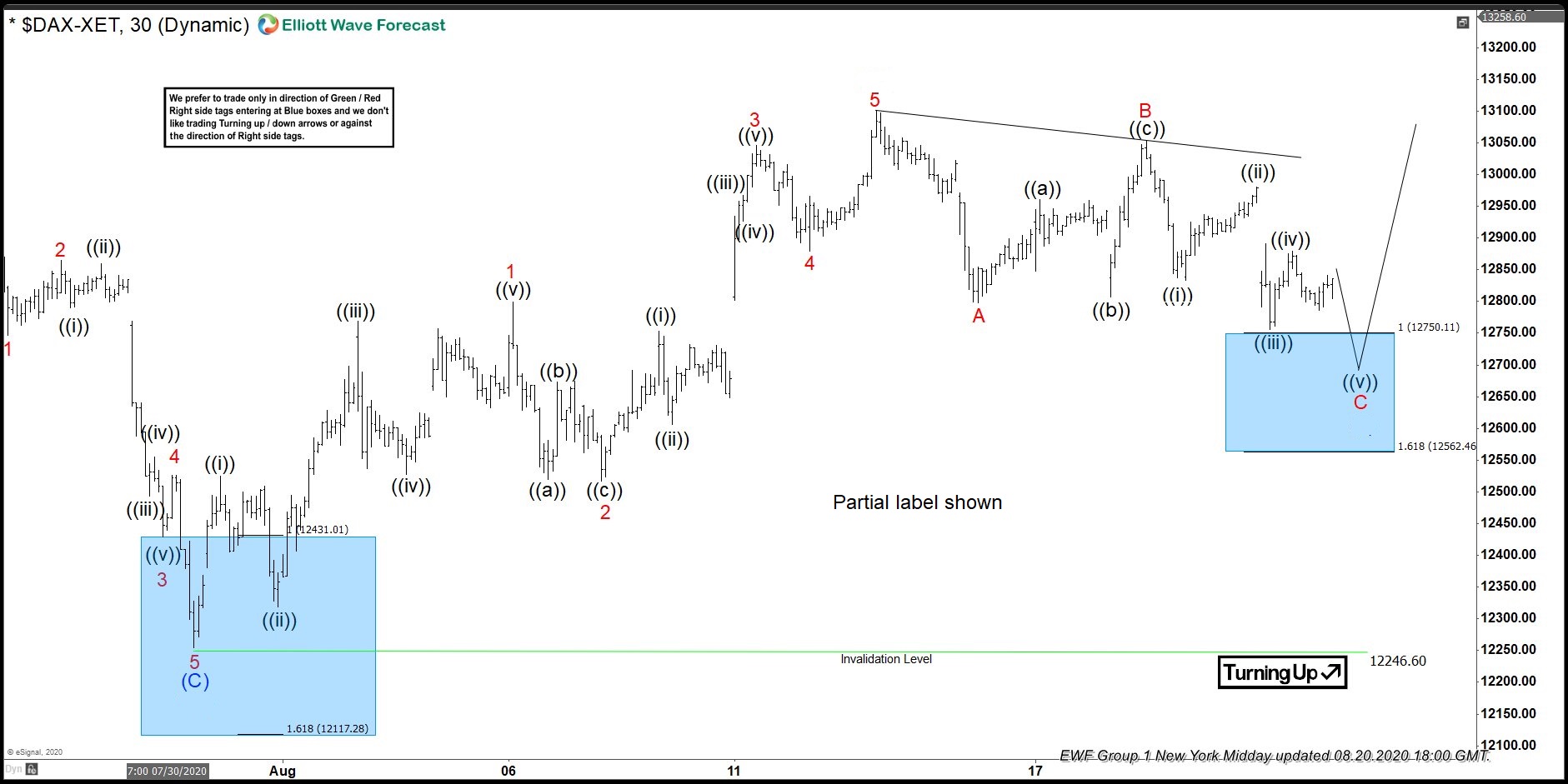

DAX Reacting Higher Once Again From Blue Box Area

Read MoreIn this blog, we take a look at the past performance of 1 hour Elliott Wave charts of DAX In which our members took advantage of the blue box areas.

-

Nikkei (NKD_F) Reacted Higher From Blue Box Area

Read MoreIn this blog, we are going to take a look at the Elliott Wave chart of Nikkei (NKD_F). The NY Midday chart update from August 20 shows that Index has ended the cycle from August 7 low as wave 3 at 23355 high. The sub-waves of the rally unfolded as 5 waves impulsive structure. Elliott […]

-

Elliott Wave View: Support Expected in SPY Pullback

Read MoreSPY extended higher from August 20 low. ETF could be ending that cycle soon. Dips in 3,7,11 swings is expected to find support while above August 20 low.