The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Sea Ltd ($SE) A Top Is In Sight

Read MoreGaming is one of the sectors that has really taken the spot light since COVID-19 hit the world by storm. Some companies in this sector have vastly outperformed the marketplace since the March 2020 low. Sea Ltd. is one of those stocks that have had explosive upside since the low that printed in March 2020. […]

-

Silver Miners ($SIL) Looking to Rally

Read MoreOne of the best performing assets this year is Silver. After bottoming on March 18 at $11.6 in the Covid-19 selloff, the metal has rallied to $30. Silver miners should benefit from the higher price of silver. As long as the price of Silver can stabilize at this upper twenty range or extend higher, we […]

-

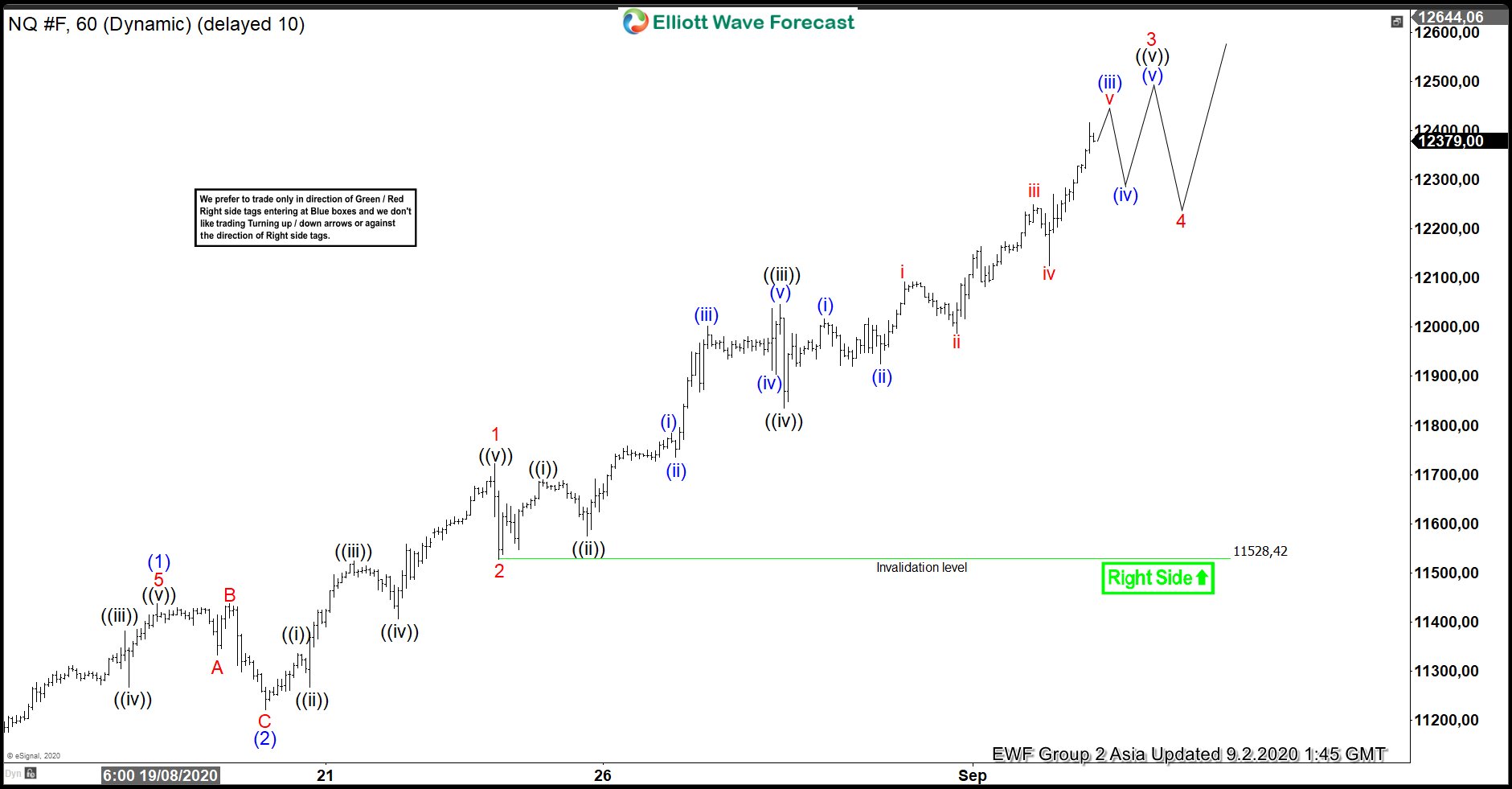

Elliott Wave View: Nasdaq (NQ) Looking to Extend Higher

Read MoreNASDAQ has continued to resume higher from 8/24 low and can see a few more highs. While above 8/24 low, expect dips to find support for more upside.

-

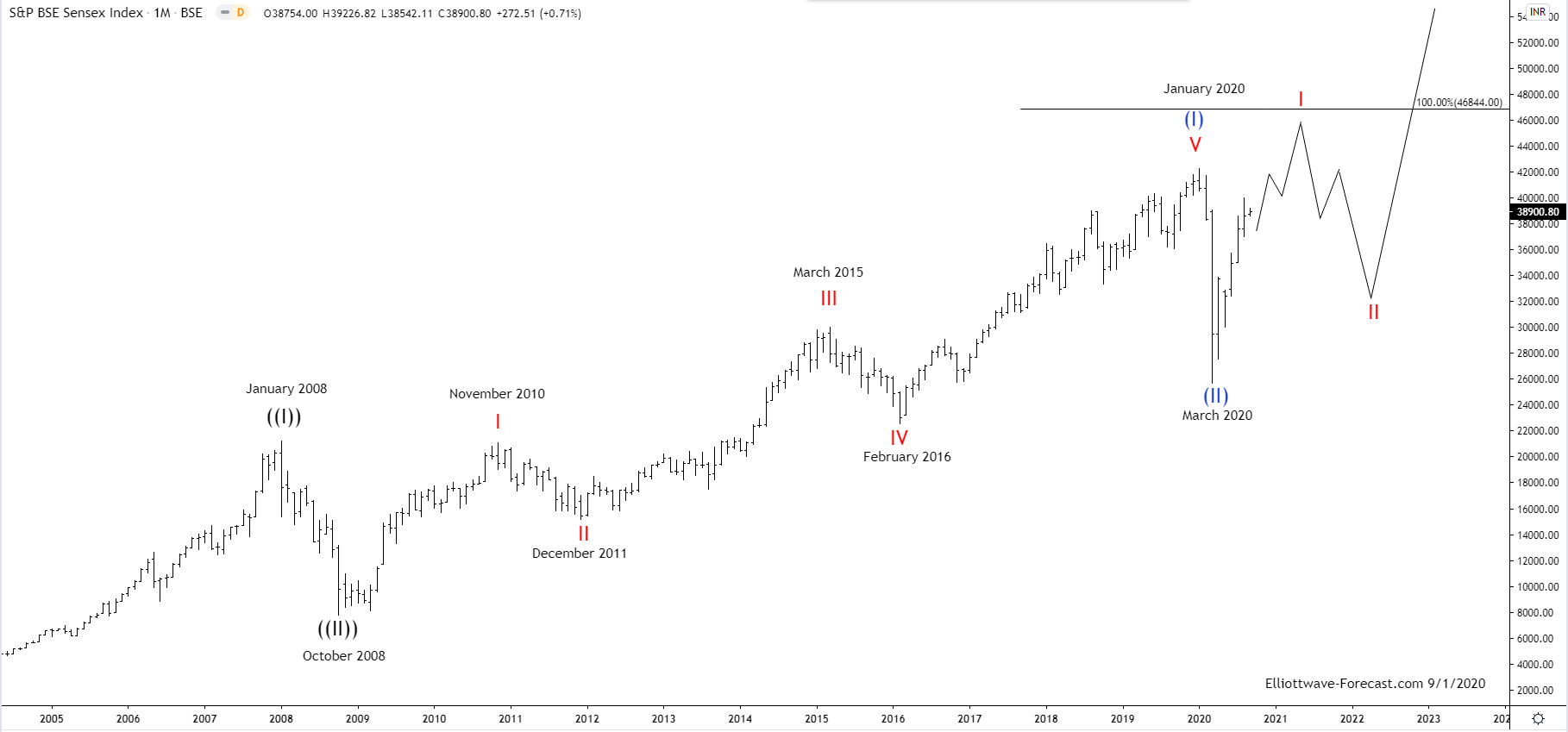

The Sensex Index Long Term Elliott Wave & Bullish Cycles

Read MoreThe Sensex Index Long Term Elliott Wave & Bullish Cycles The Sensex Index has been trending higher with other world indices. Firstly in it’s base year 1978 to 1979 the index’s point value was set at 100. From there it rallied with other world indices trending higher into the January 2008 highs. It then corrected the […]

-

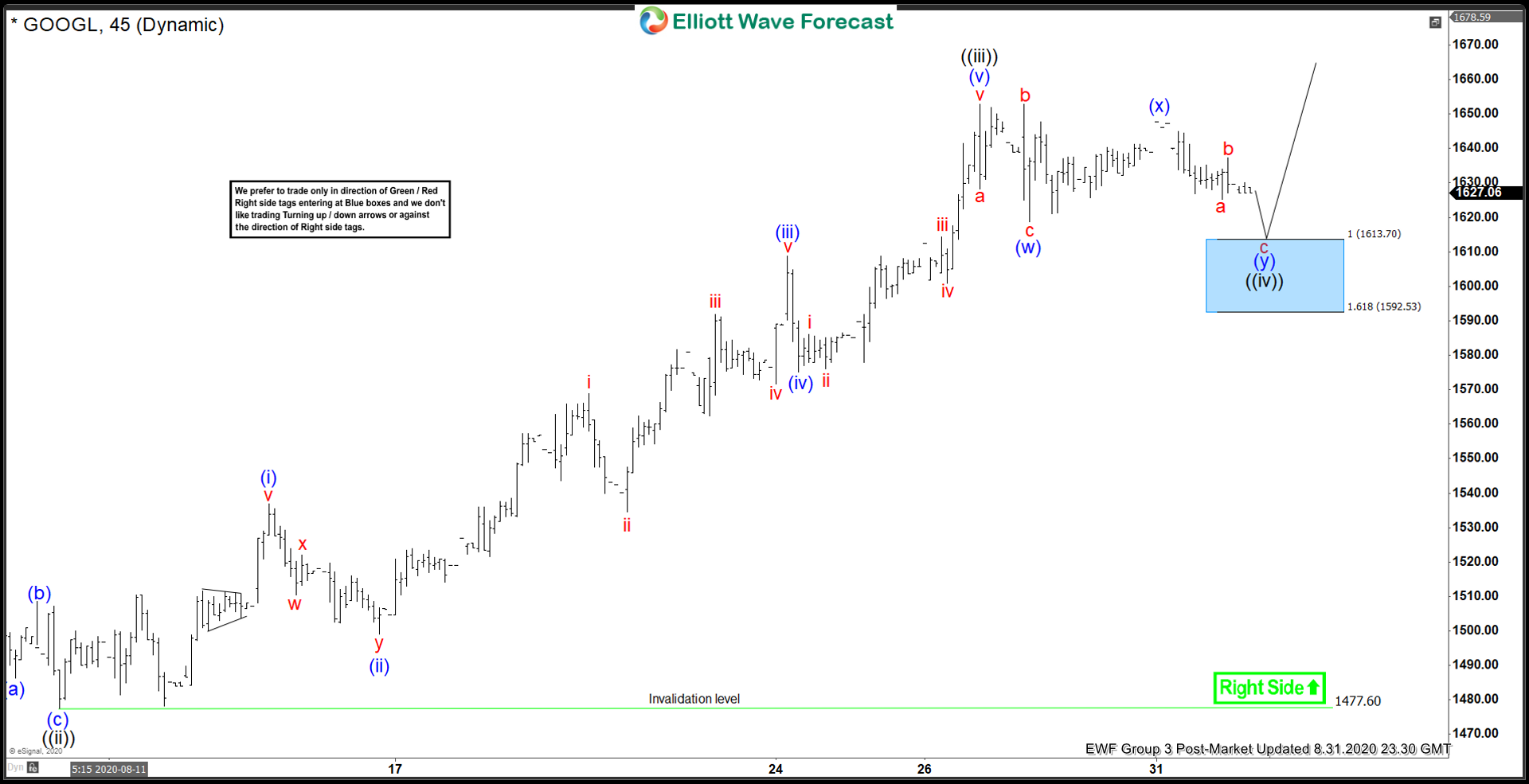

Elliott Wave View: Support Area for Alphabet (GOOGL)

Read MoreGOOGL resumed higher from 8/10 low. Currently, 3 waves pullback is unfolding and could reach blue box area, where it can see 3 waves bounce at least.

-

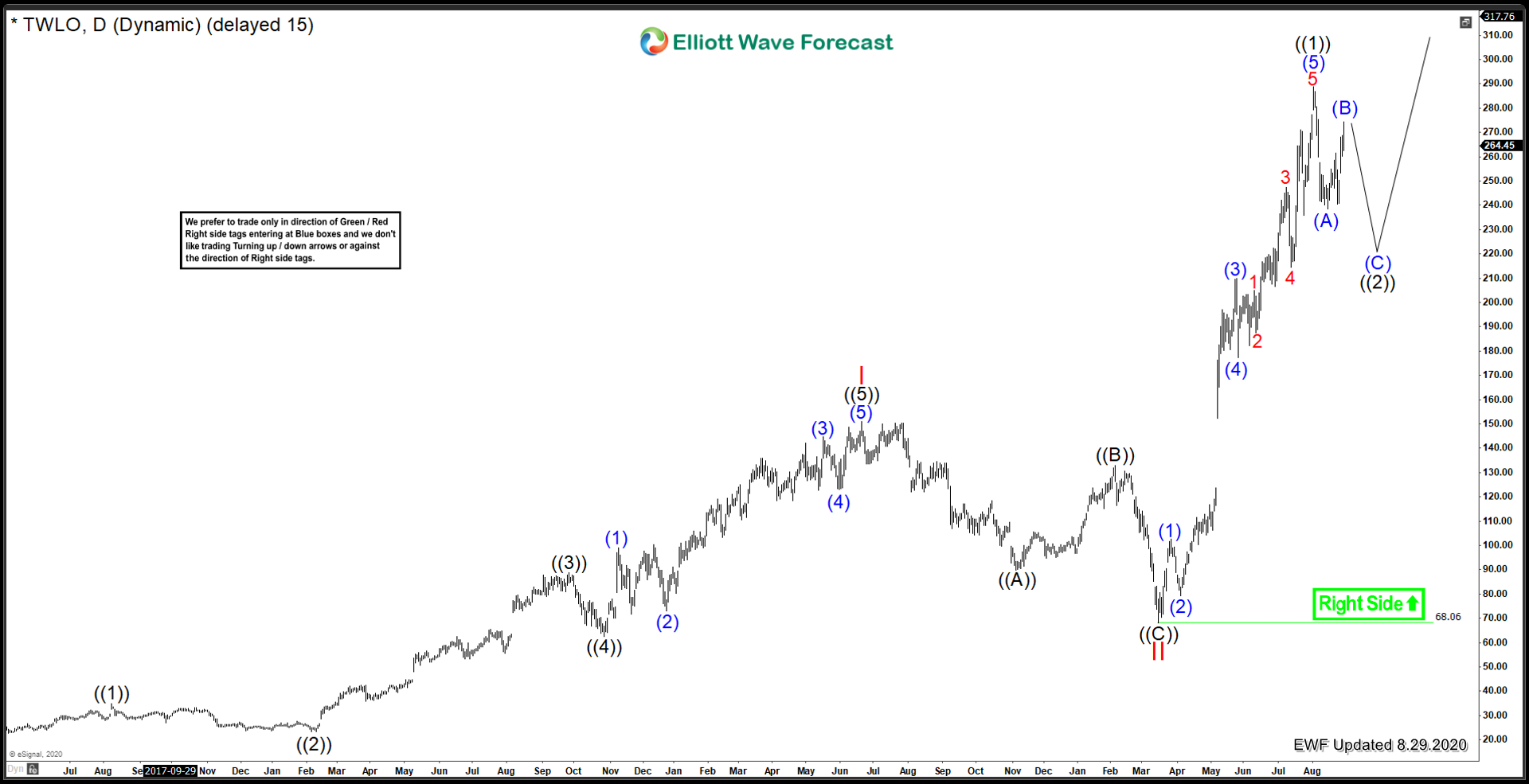

Twilio ($TWLO) Posturing For Major Rally

Read MoreCloud computing is one of the sectors that has really taken the spot light since COVID-19 hit the world by storm. This sector has vastly outperformed the marketplace since the March 2020 low. Twilio is in the cloud communications business and has had an extremely impressive rally since March 2020 low. It is a a […]