The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

$USO United States Oil Fund Longer Term Cycles & Elliott Wave

Read More$USO United States Oil Fund Longer Term Cycles & Elliott Wave Firstly the USO instrument inception date was 4/10/2006. CL_F Crude Oil put in an all time high at 147.27 in July 2008. USO put in an all time high at 953.36 in July 2008 noted on the monthly chart. The decline from there into the […]

-

Elliott Wave View: Nike (NKE) Breaks to All Time High

Read MoreNike has made an all-time high and pullback can continue to find support in 3, 7, or 11 swing for more upside. This article looks at the Elliott Wave path.

-

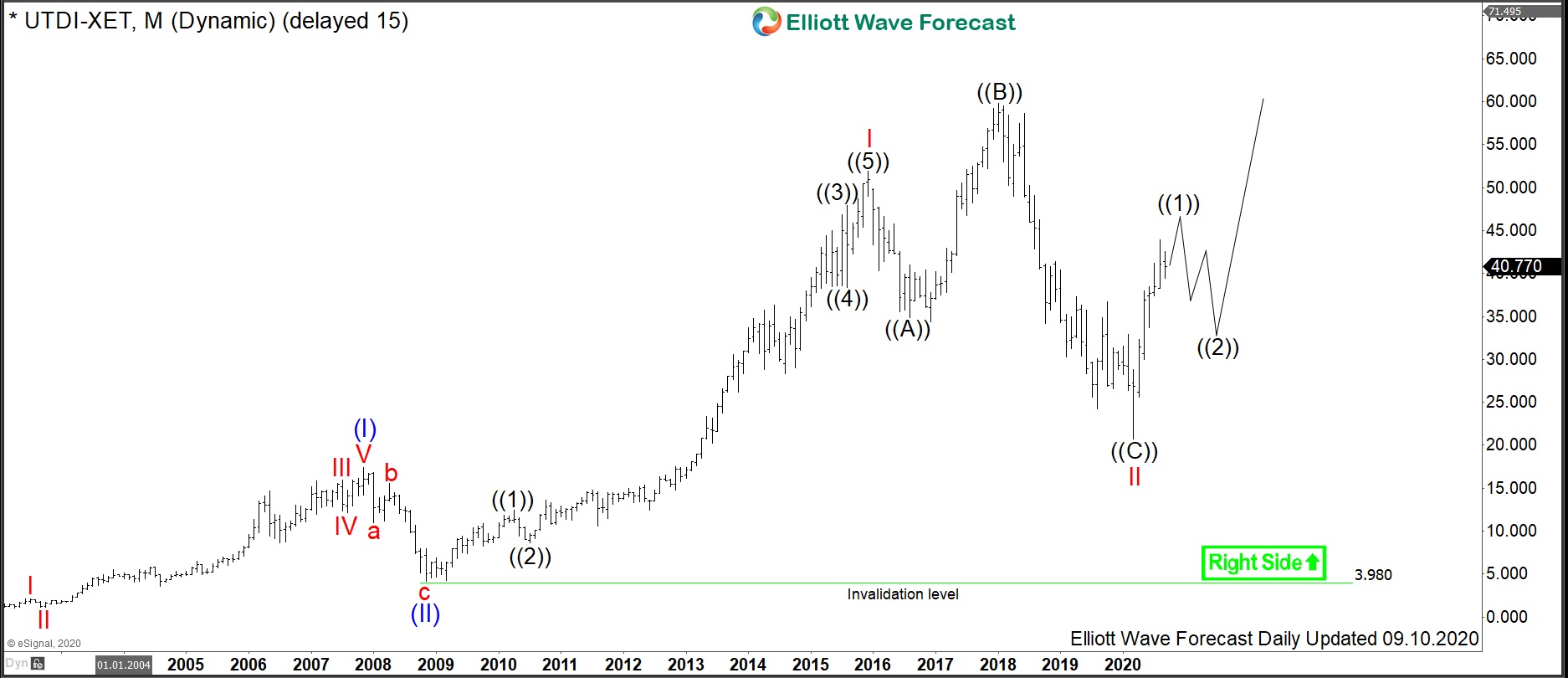

$UTDI : Technology Stock United Internet to Shoot Higher

Read MoreUnited Internet AG is a global internet services company. Founded 1988, headquartered in Montabaur, Germany, and traded under the ticker $UTDI at FSE, it is a component of the TecDax index. First of all, United Internet comprises two units, Access and Applications. In particular, it owns the leading internet service providers in Germany as well […]

-

Elliott Wave View: Dow Futures (YM) Correction Maybe Complete

Read MoreDow Futures correction against 6/15 low is proposed complete at 9/9 low. While above that low, dips in 3,7,11 swings can find support for more upside.

-

Elliott Wave View: Pullback in Nikkei Should Continue

Read MoreNikkei is correcting the cycle from April 2 low as a double three correction. While below September 3 high, Index can extend lower before upside resume.

-

What Nasdaq (NQ) is saying about the Right Side of Market

Read MoreTechnology is the strongest sector in the current bullish trend in World Indices. Nasdaq (NQ) which has a lot of technology stocks naturally is one of the best performing Indices. We had some pullback in the Indices last week. As always, with every pullback, many traders and analysts start to speculate if major top is […]