The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

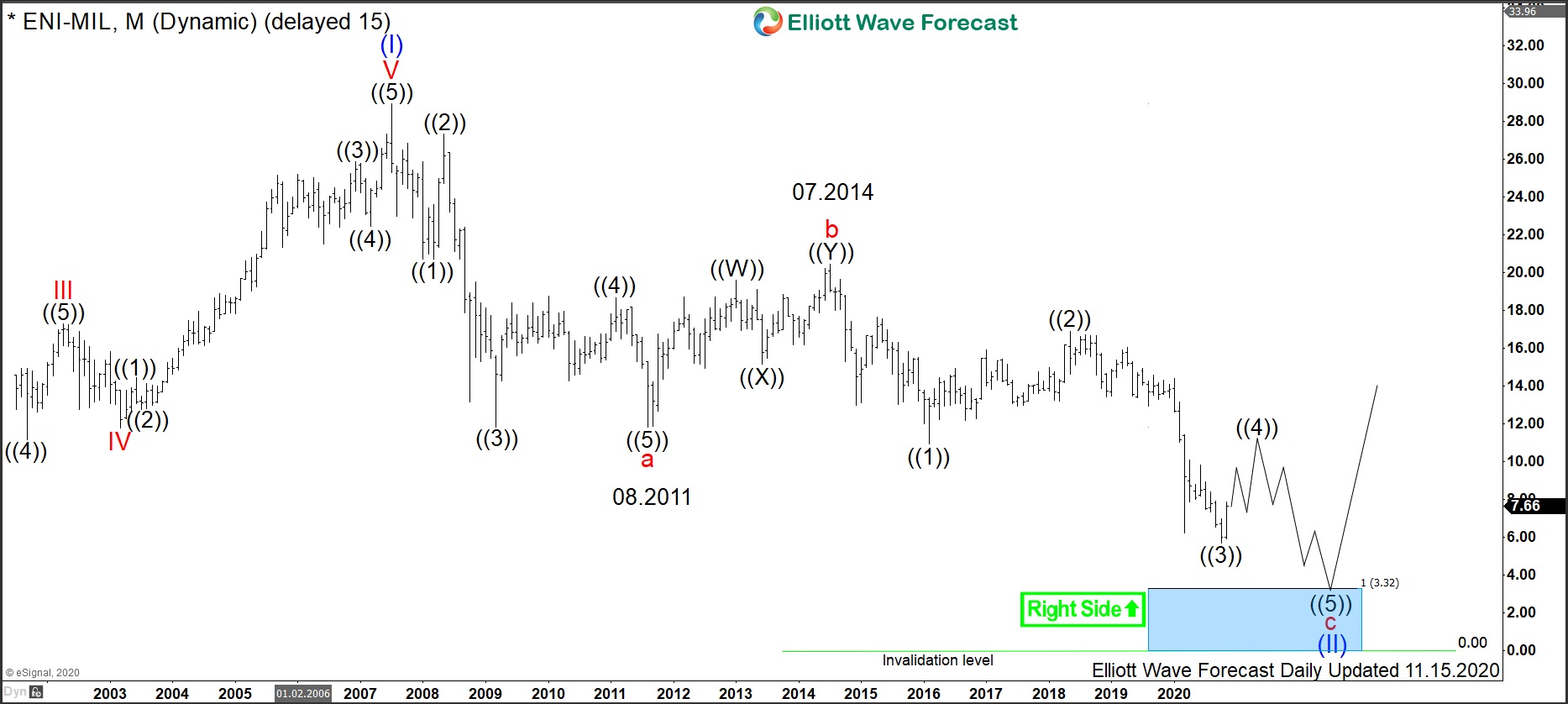

$ENI and $BP Stocks Help Locating Bottom in Energy Sector

Read MoreOil has found its bottom in April 2020. From the lows, it is extending higher and should become even more expensive in the coming years. Similarly, indices have found an important bottom in March 2020. From the lows, world indices like S&P500 and Nikkei have managed to break to new all-time highs. The mighty Energy […]

-

Bank Of America ($BAC) Cashes Higher After a Ranging Pause

Read MoreBank of America ended a movement in ranges that had been in place since June, after a slight recovery from the drawdown in March due to COVID-19. The global capital markets woke up stimulated with a strong risk appetite on November 9th, this made that stocks such as Bank of America could come out of […]

-

Elliott Wave View: Pullback in Dow Futures (YM) Should See Buyers

Read MoreDow Futures (YM) has broken to all-time high and should continue to find support in 3, 7, 11 swing. This article and video look at the Elliott Wave path.

-

Abraplata Resources ($ABBRF OTC, $ABRA.CA) Priming To Rally

Read MoreThe Metals sector has been slowly coming back since the lows in late 2015 and is ready for prime time attention after Gold has recently made new all time highs. Abraplata a Jr. silver, gold, and copper explorer. As such, has a very volatile chart but follows spot silver fairly closely in swings. Abraplata has […]

-

Jet Blue (JBLU) : Showing A Bullish Sequences Off The Lows

Read MoreJet Blue cycle from 3.23.2020 low is showing 5 swings bullish sequence favoring more upside in the sector. This article & video explains Elliott wave path.

-

Dow Futures (YM_F) Forecasting The Bounce From Blue Box Area

Read MoreIn this blog, we take a look at the past performance of 4hr Elliott Wave charts of Dow Futures, In which our members took advantage of the blue box areas.