The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Is Builders FirstSource (BLDR) Looking For Next Multi Year Rally?

Read MoreBuilders FirstSource, Inc., (BLDR) manufactures & supplies building materials, components & construction services to professional homebuilders, sub-contractors, remodelers & consumers in the United States. It comes under Industrials sector & trades as “BLDR” ticker at NYSE. BLDR was corrected more than 50 % since all time high of $214.70 in June-2025 low. It ended correction […]

-

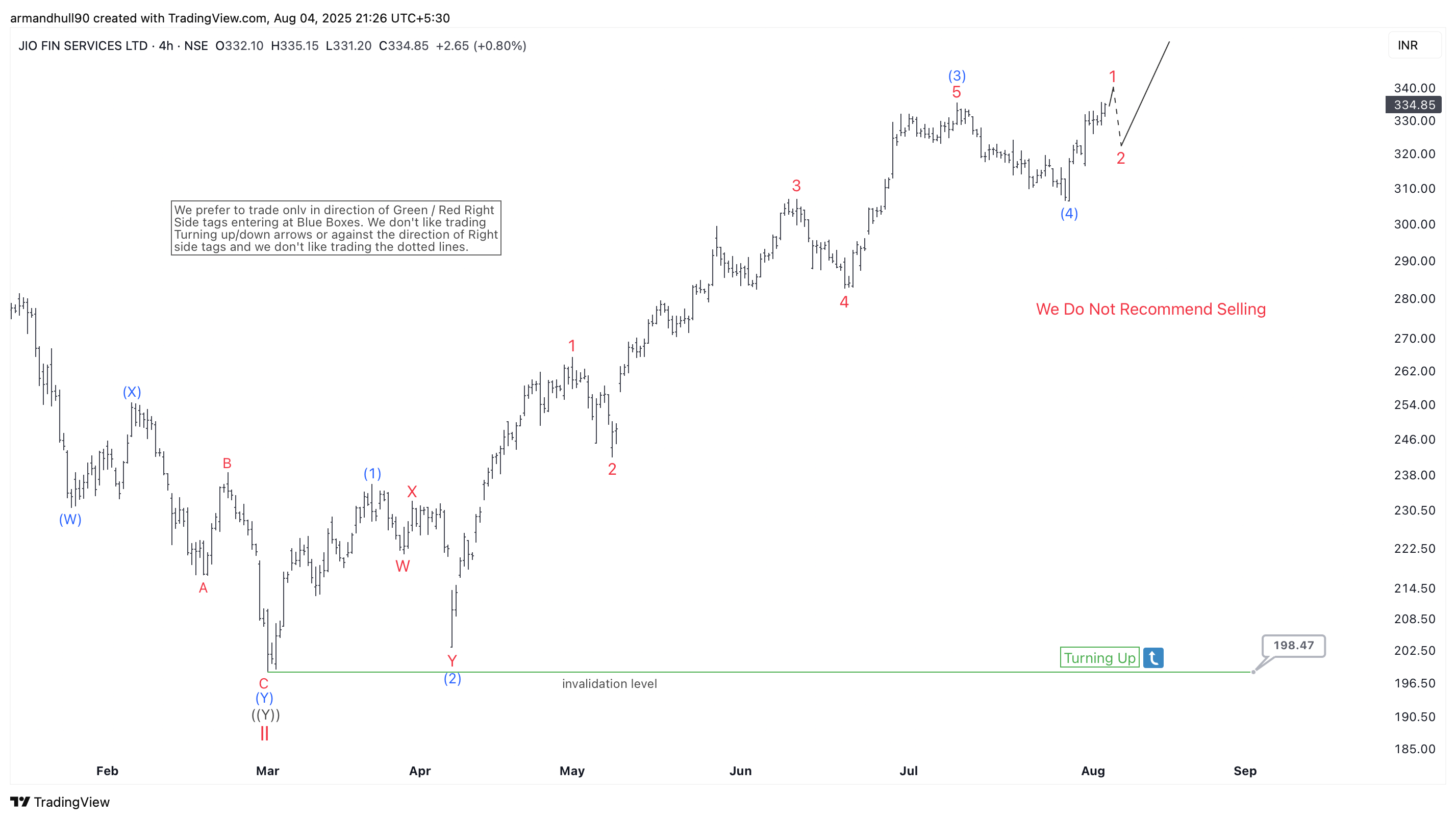

Jio Financial Services Elliott Wave Update: Wave (5) in Progress

Read MoreJIOFIN resumes its bullish trend after completing a correction near 198.47 INR. The stock is now advancing in wave (5) of a larger Elliott Wave sequence. After a prolonged correction, Jio Financial Services Ltd (NSE: JIOFIN) completed its larger wave II near the 198.47 INR level. This area also aligned with the ideal blue box […]

-

Microsoft Corp. $MSFT Blue Box Area Offers A Buying Opportunity

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of Microsoft Corp. ($MSFT) through the lens of Elliott Wave Theory. We’ll review how the rally from the July 23, 2025 low unfolded as a 5-wave impulse followed by a 3-swing correction (ABC) and discuss our forecast for the next move. Let’s dive into the structure and expectations for this […]

-

Dominion Energy (D) Elliott Wave Analysis: Major Bullish Cycle in Play

Read MoreWave ((2)) Correction Likely Complete – Long-Term Elliott Wave Rally May Be Underway Toward $100+ Dominion Energy (D) has shown a strong bullish structure on the monthly chart, suggesting a significant Elliott Wave progression. According to the latest analysis, the stock may have completed the corrective wave ((2)). If confirmed, this sets the stage for […]

-

Gold Miners Junior (GDXJ) Set to Resume Impulsive Move Higher

Read MoreThe VanEck Vectors Junior Gold Miners ETF (GDXJ) is an exchange-traded fund designed to track the performance of small-cap companies primarily engaged in gold and silver mining. Launched in 2009, GDXJ offers investors exposure to junior gold miners, which are often more volatile but can provide significant growth potential compared to larger mining firms. The […]

-

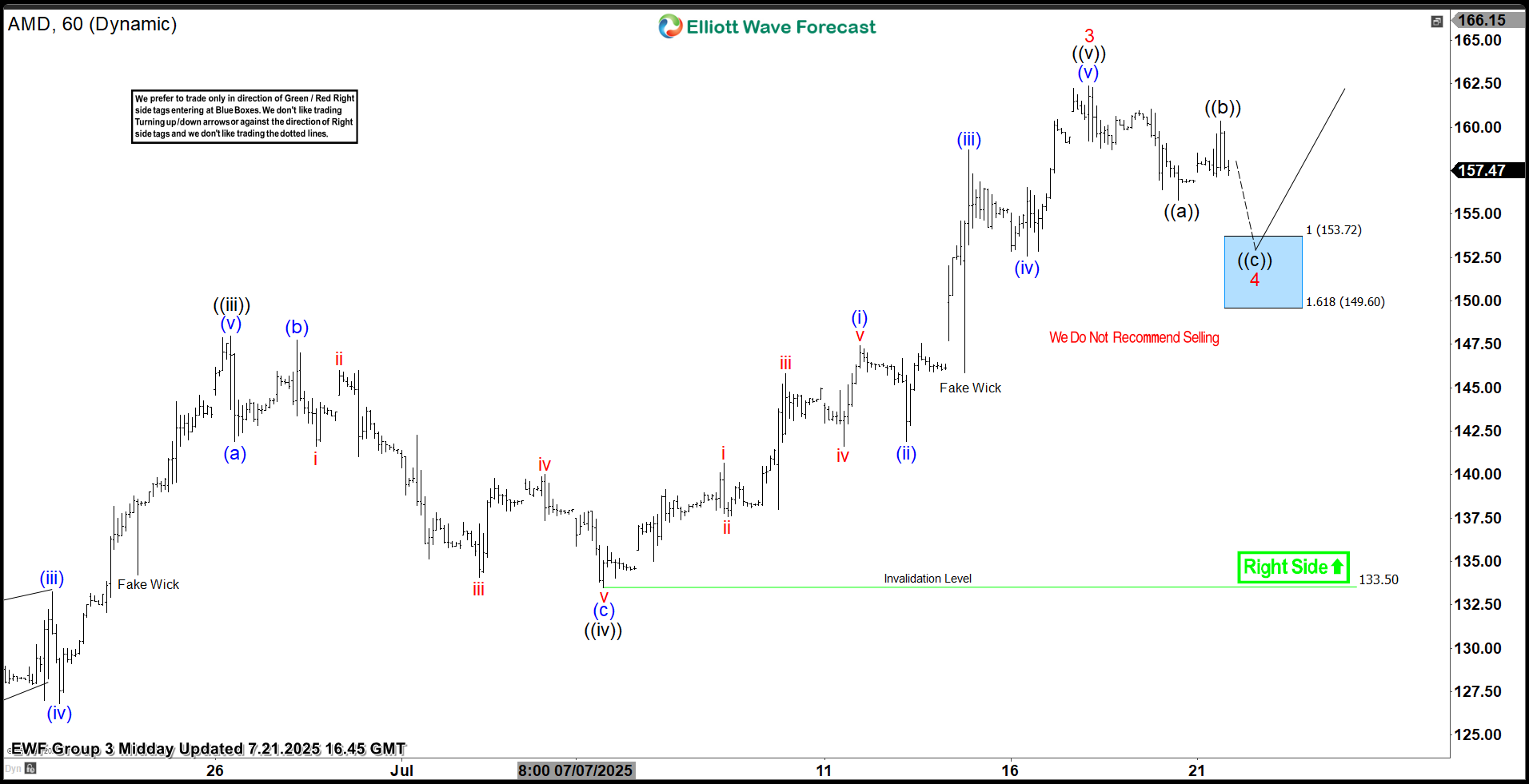

Advanced Micro Devices ( AMD) Stock Rallies from the Blue Box Area

Read MoreHello fellow traders. In this technical article, we are going to present Elliott Wave trading setup of AMD. The stock completed its corrective decline precisely at the Equal Legs area, also known as the Blue Box. In the following sections, we’ll break down the Elliott Wave structure in detail and explain the setup and trade management. […]