The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Vertiv Holdings (VRT) Should Provide Swing Opportunity In Next Pullback

Read MoreVertiv Holdings Co., (VRT) is provider of critical infrastructure & services for data centers, communication networks & commercial & industrial environments. It comes under Industrials sector & trades as “VRT” ticket for NYSE. VRT favors impulse sequence in ((1)) of I of (III) after (II) pullback ended at $53.60 low in April-2025. It favors upside […]

-

Shopify (SHOP) Hits Target — 85% Profit Secured, Bulls in Control

Read MoreShopify Inc. (SHOP) continues to lead the e-commerce sector, with analysts maintaining a broadly optimistic outlook for 2025. The Ottawa-based company posted impressive financials, including a 31% year-over-year revenue increase and sustained double-digit free cash flow margins. After exiting the logistics business, Shopify refocused on its core software offerings—streamlining operations and boosting profitability. As a […]

-

LIC Share Price Extends Rally, Aligning with Elliott Wave Bullish Structure

Read MoreLife Insurance Corporation of India (LIC) advances in line with a bullish Elliott Wave sequence, supported by strong buying momentum. After completing a prolonged correction, Life Insurance Corporation of India (BSE: LICI) has resumed its bullish trend. The stock recently completed wave (4) near the 860 INR area, aligning with the blue box buying zone. […]

-

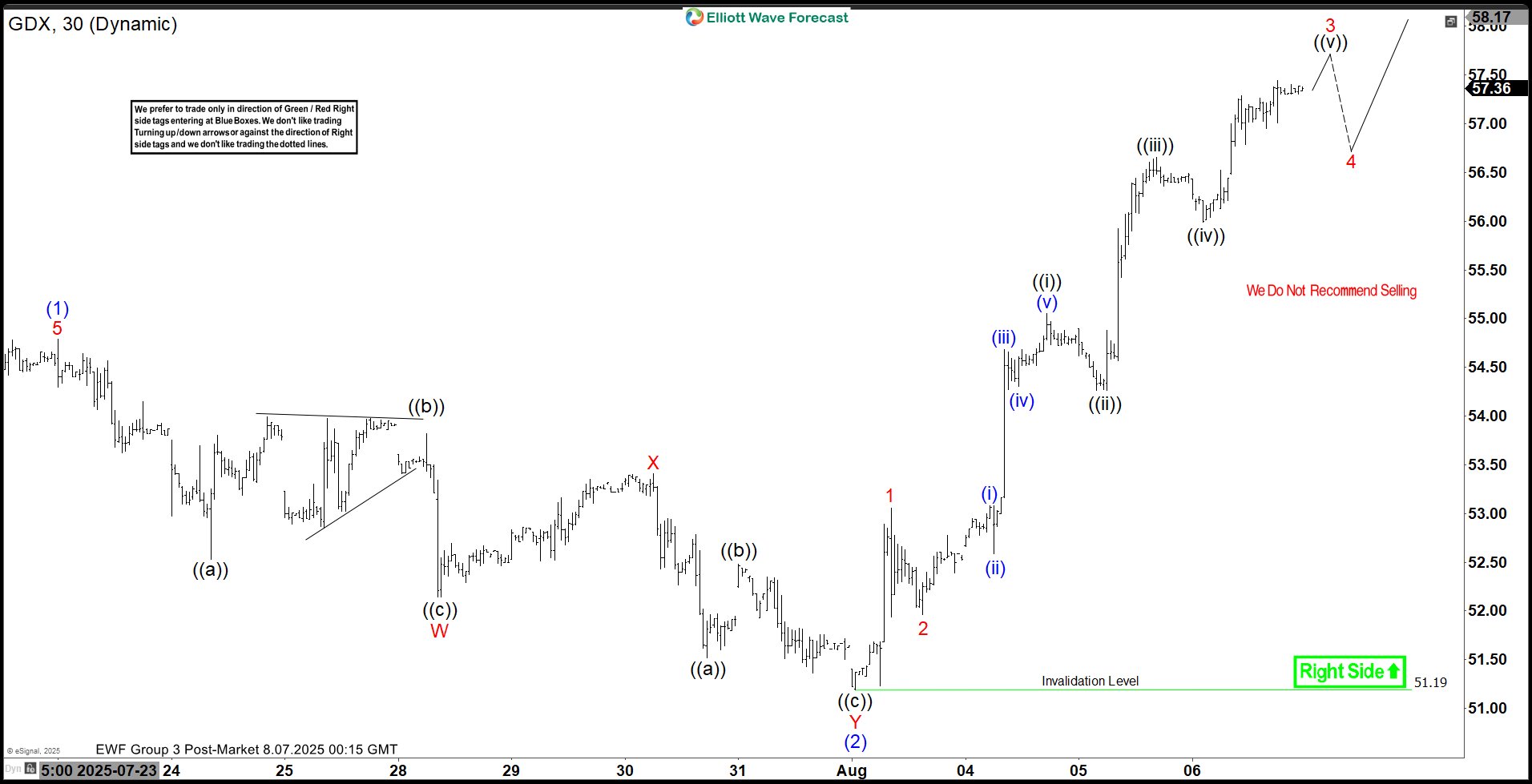

GDX Elliott Wave Outlook: Strong Wave 3 Surge with $58 Target

Read MoreGold Miners ETF (GDX) has extended higher and resume the bullish market. In this article, we look at the Elliott Wave path.

-

OKLO Poised to Surge Past $100 – Elliott Wave Prediction

Read MoreOklo Inc (NYSE: OKLO) is rewriting the rules of the energy sector. While traditional utilities struggle with aging infrastructure, this nuclear innovator has delivered 300%+ gains since April 2025 – turning skeptics into believers. The sector hasn’t seen this level of disruptive potential since the early days of solar. Today, we break down OKLO’s Elliott Wave structure, key targets, […]

-

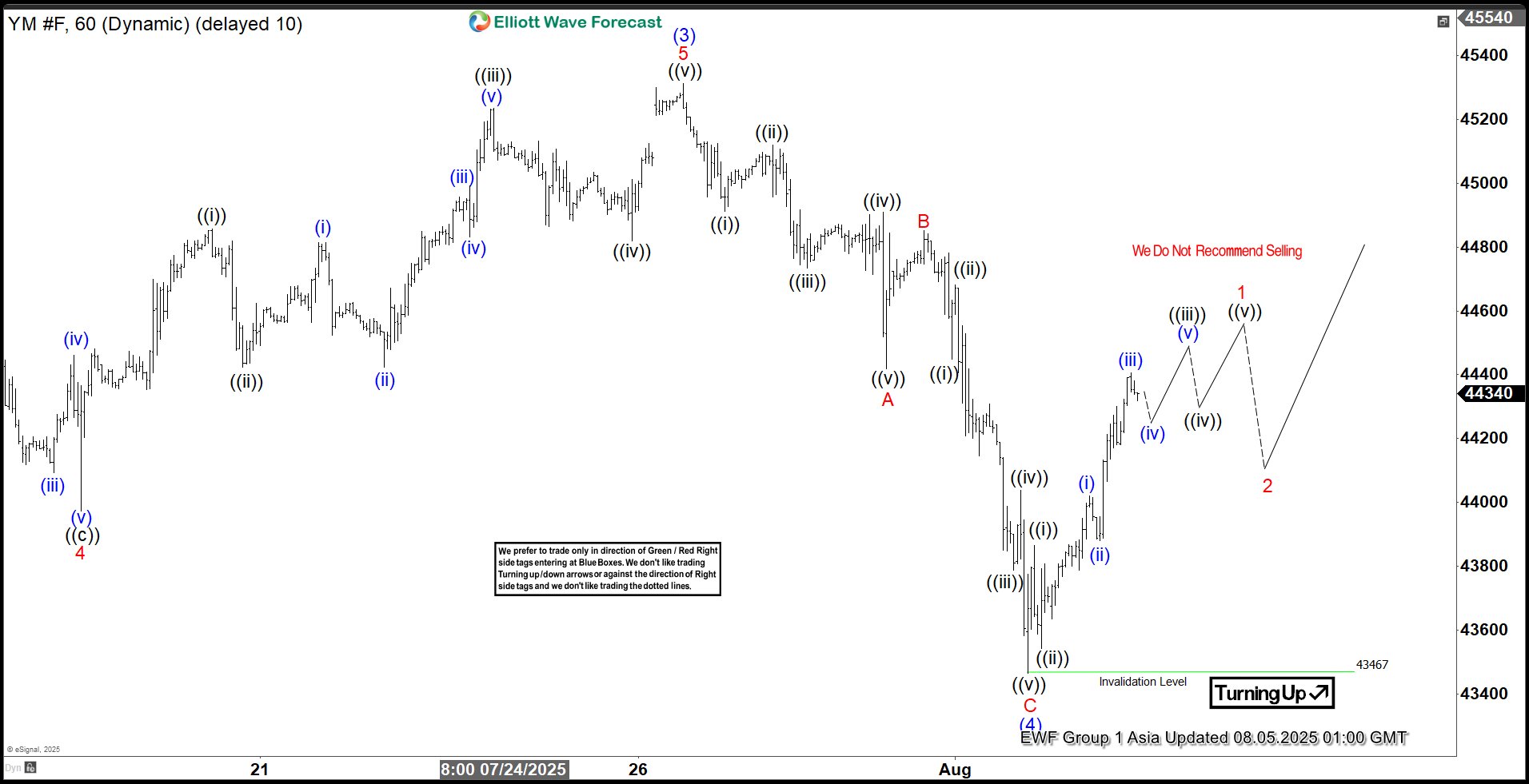

Elliott Wave Perspective: Dow Futures (YM) Nearing Final Push Before Significant Retreat

Read MoreDow Futures (YM) is looking to rally higher in wave 5 before ending cycle from April 2025 low. This article and video look at the Elliott Wave path.