The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

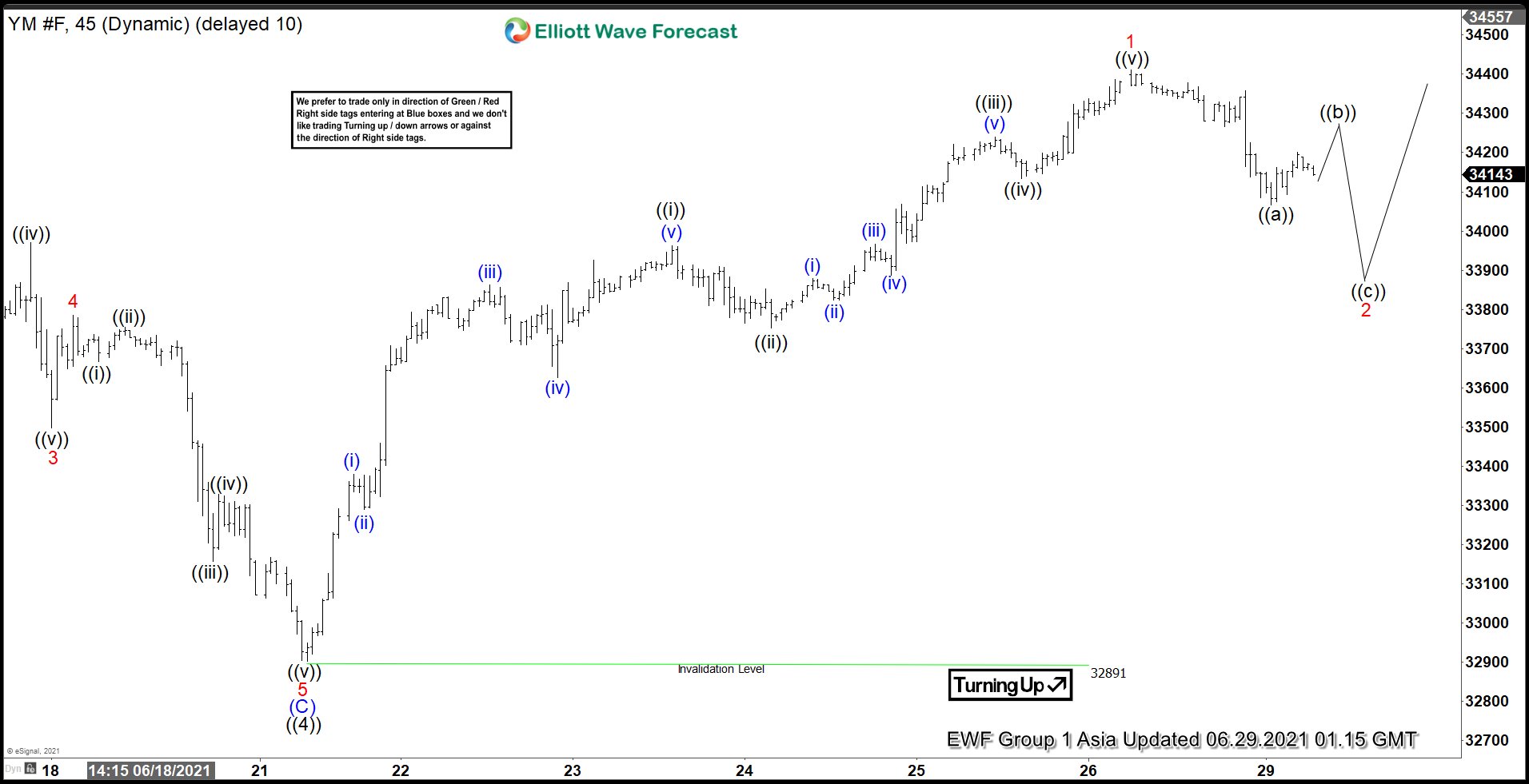

Elliott Wave View: Pullback in Dow Futures (YM) to Find Support

Read MoreDow Futures (YM) cycle from March 2020 low remains in progress and can see further upside. This article and video updates the Elliott Wave path.

-

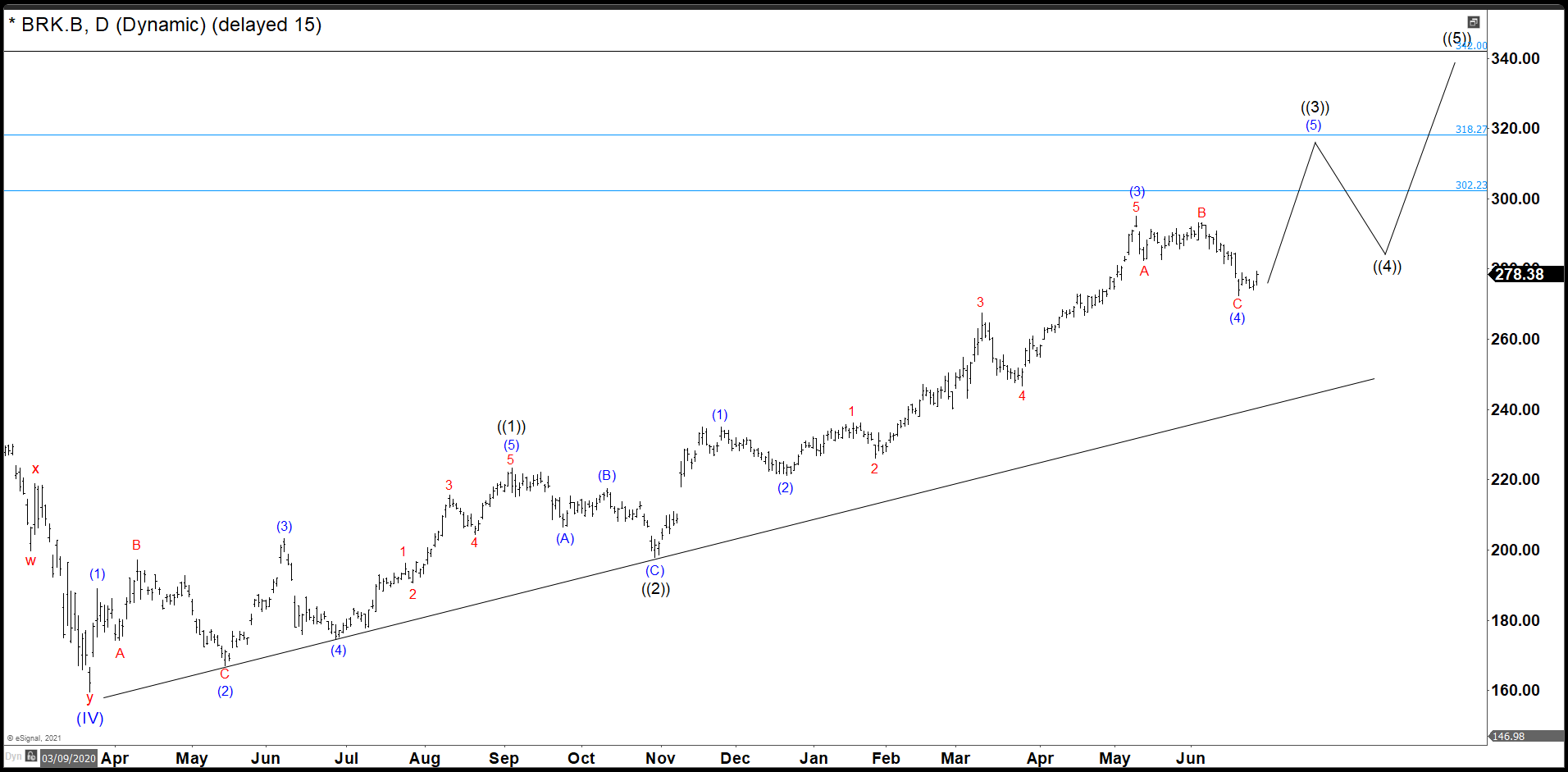

Berkshire Hathaway Needs To Break 295 To End Wave ((3))

Read MoreSince the crash of March 2020, all stocks have tried to recover what they lost, and Berkshire Hathaway was no exception. BRK.B did not only recover the lost, but It also reached historic highs. Now, it is building an impulse from March 2020 lows with a target to $318 – $342 area. Target measured from […]

-

BioNTech (BNTX) Continues To Benefit from Covid-19 Pandemic

Read MoreBioNTech SE (Nasdaq: BNTX) is a German biotechnology company that develops treatment based on messenger ribonucleic acid (mRNA). The company shot to fame and becomes a household name after becoming one of the first successful companies to develop vaccine for Covid-19. In 2020, partnering with Pfizer, BioNTech developed RNA vaccine BNT162b2 to prevent COVID-19 infection. […]

-

Shopify (NYSE: SHOP) – Wave (V) in Progress

Read MoreShopify (NYSE: SHOP) is a Canadian multinational e-commerce company headquartered in Ottawa, Ontario. It’s also an e-commerce platform for online stores. The stock is up above 28% over the past month, outperforming S&P 500 which has returned just about 2% over the past month. The stock has certainly benefited from the Covid-19 breakout, as the […]

-

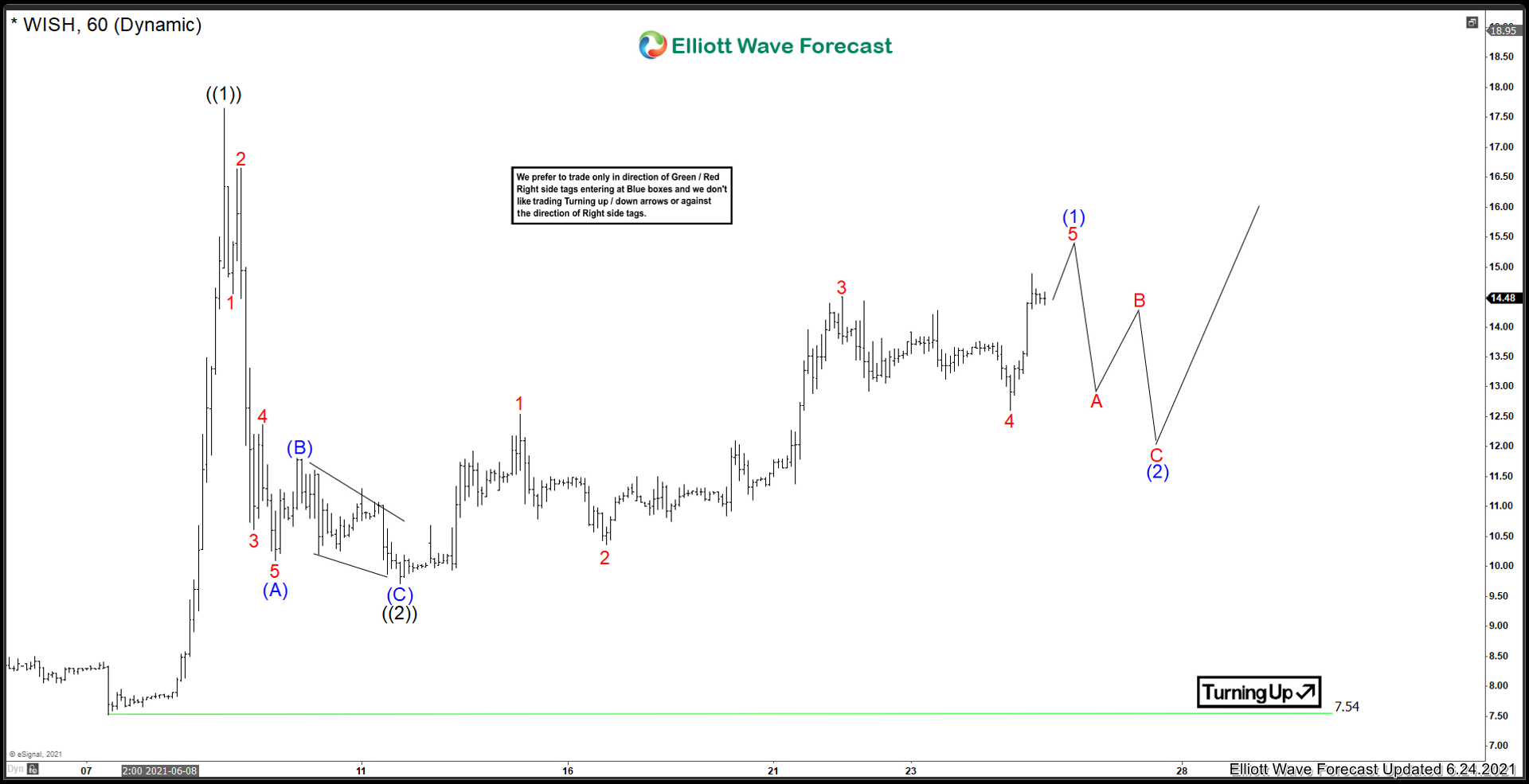

ContextLogic Inc ($WISH) Prepping For Next Leg Higher

Read MoreContextLogic Inc. is the latest meme stock to catch some attention. But is it a worthwhile trade? I must preface this blog with the fact that this stock does not have much data. However, elliottwave can still be useful in shorter cycles. Lets take a look at who and what this company is: “Wish was […]

-

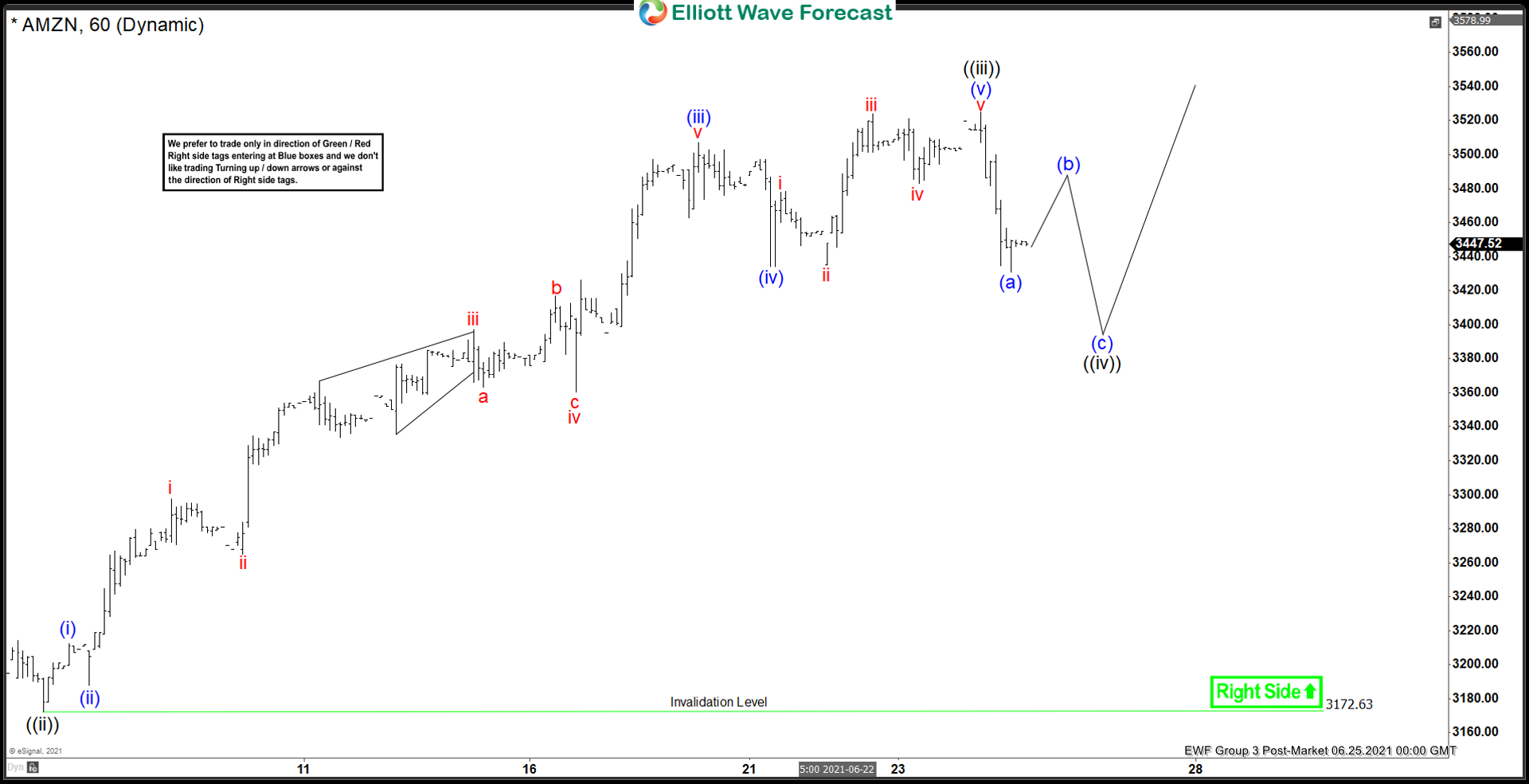

Elliott Wave View: Amazon (AMZN) Should Continue Impulsive Rally

Read MoreAmazon (AMZN) rally from May 11 low is in progress as an impulse. This article and video look at the Elliott Wave path for the stock.