The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

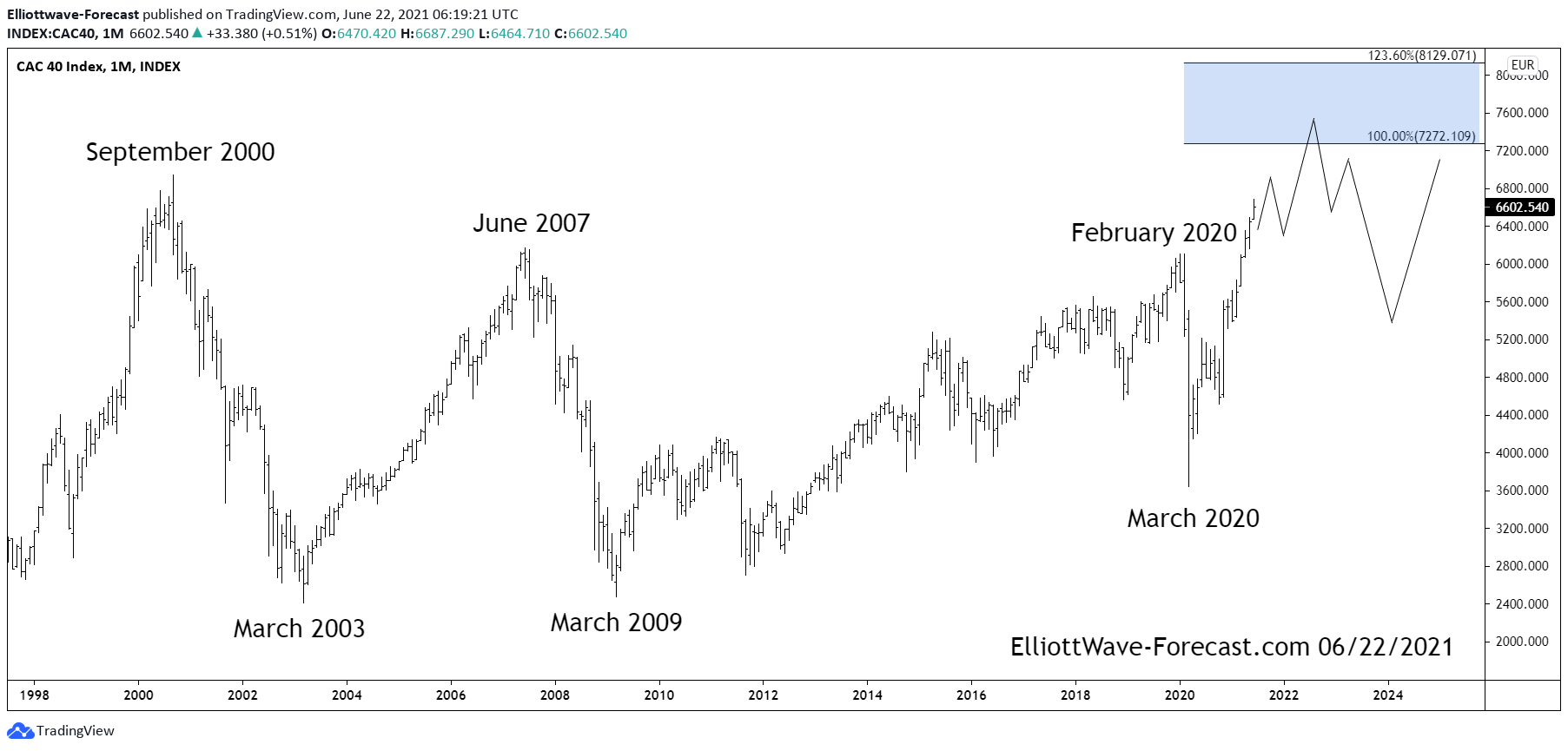

The $CAC40 Longer Term Bullish Cycles & Swings

Read MoreThe $CAC40 Longer Term Bullish Cycles & Swings Firstly the CAC 40 index has been trending higher with other world indices where in September 2000 it put in an all time high. From there it followed the rest of the world indices lower into the March 2003 lows which was a larger degree pullback. From […]

-

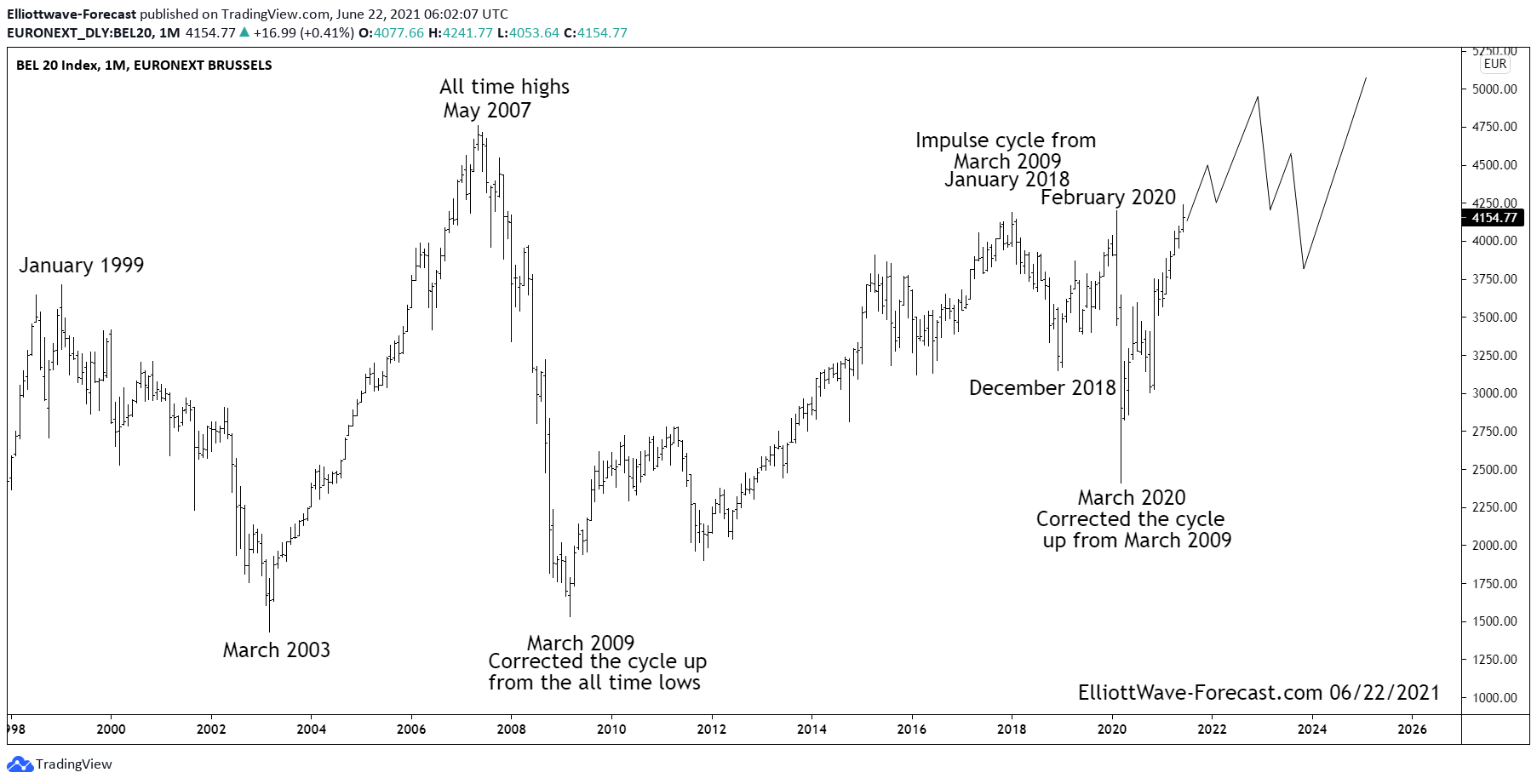

$BEL20 Index Longer Term Swings & Bullish Cycles

Read More$BEL20 Index Longer Term Swings & Bullish Cycles Firstly the BEL20 Index has trended higher with other world indices since the benchmark was established. The index remained in a long term bullish trend cycle into the May 2007 highs. From there it made a sharp correction lower that lasted until March 2009 similar to other world […]

-

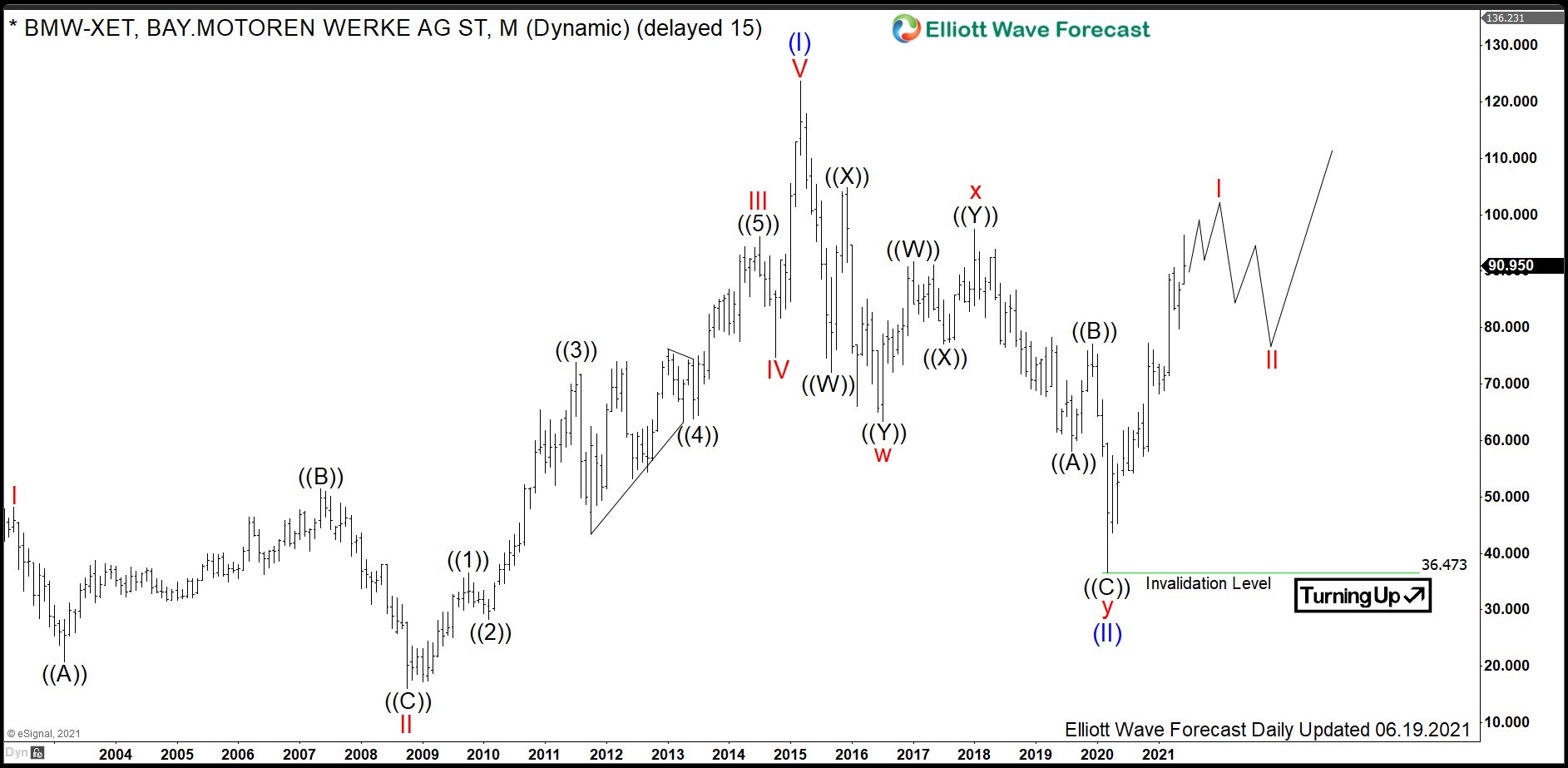

$BMW: What Expect from BMW after Strong Rally?

Read MoreBMW is one of the biggest german car manufacturers excelling in quality and technical characteristics. In April 2020, we were calling for a begin of a new cycle higher. We were right, the price has more than doubled. Now, medium-term cycle might be ending and many investors are asking themselves if there will be straight […]

-

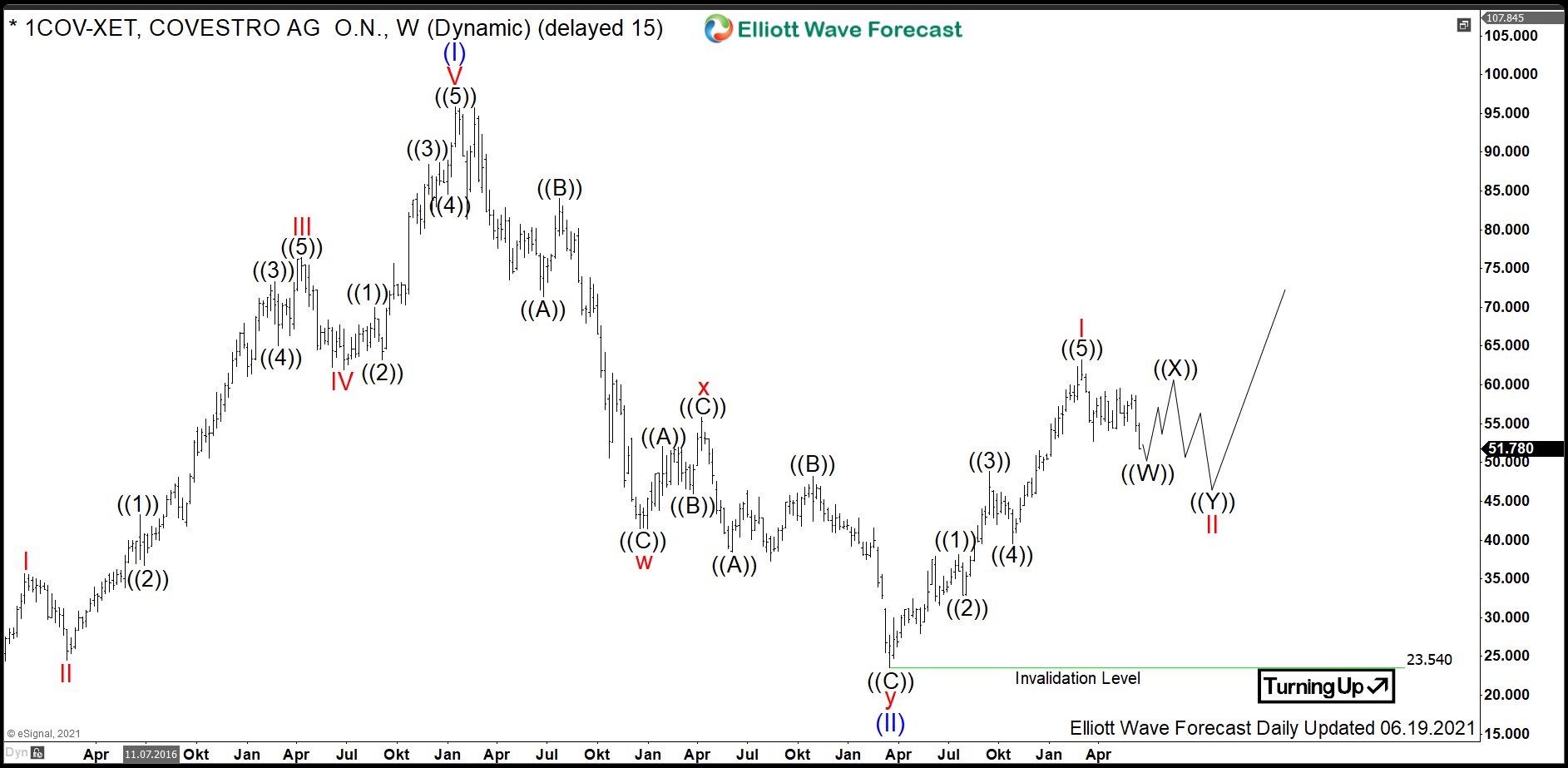

$1COV : Material Science Stock Covestro Offers a Great Opportunity

Read MoreCovestro AG (formerly, Bayer MaterialScience) is a German company which produces a variety of polycarbonate and polyurethane based raw materials. The products include coatings and adhesives, polyurethanes for thermal insulation and electrical housings, polycarbonate based highly impact-resistant plastics (Makrolon) and more. Formed in 2015 as a spin off from Bayer, Covestro is headquartered in Leverkusen, […]

-

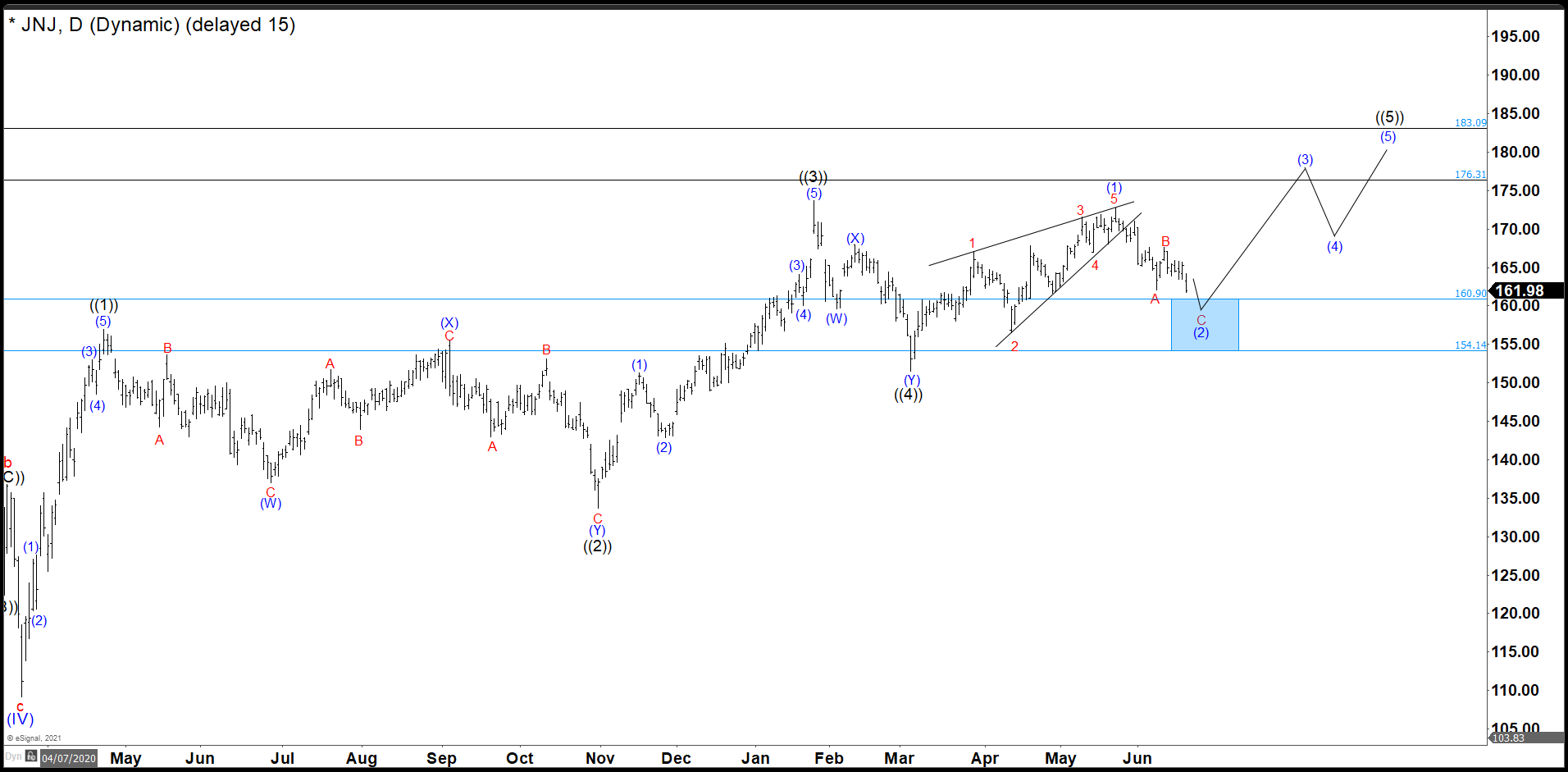

JNJ Is Ending An ABC Correction As Wave (2)

Read MoreSince the crash of March 2020, all stocks have tried to recover what they lost and JNJ was no exception. Johnson & Johnson did not only recover the lost, but It also reached historic highs. Now, we are going to try to build a wedge from the March 2020 lows with a target above $176. […]

-

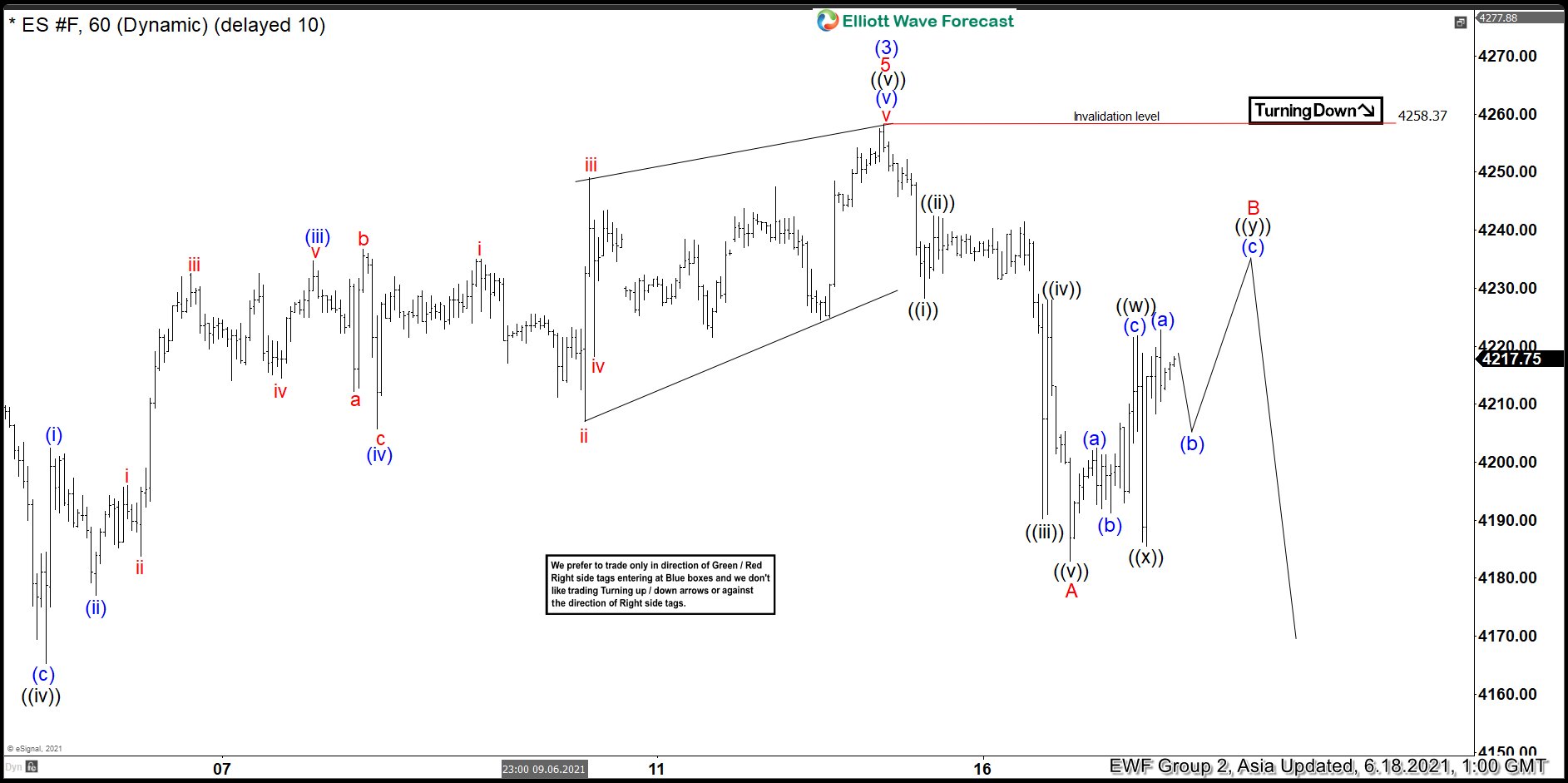

Elliott Wave View: S&P 500 E-Mini Futures (ES) Looking to Pullback

Read MoreS&P 500 E-Mini Futures (ES) is correcting cycle from February low. This article and video look at the Elliott Wave path of the Index.