The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Best Bank Stocks to Buy Right Now in 2024

Read MoreBank stocks usually reflect the economic performance, making them cyclical stocks. Bank stocks have undergone a huge downfall in 2020 as consumer spending receded, auto loans dropped and businesses stopped amid the coronavirus crisis. Moreover, Berkshire Hathway, owned by Warren Buffet, also unloaded its stakes in Bank stocks, which further triggered the downfall journey of […]

-

Elliott Wave View: Nasdaq Futures (NQ) Short Term Support Area

Read MoreShort Term Elliott Wave in Nasdaq Futures (NQ) suggests the rally from March 5, 2021 low remains ongoing as a 5 waves impulse Elliott Wave structure. In the 45 minutes chart below, we can see wave 4 of this impulsive rally ended at 14445. The Index has resumed higher within wave 5 with internal subdivision […]

-

Best Small-Cap Stocks & Companies to Invest in 2024

Read MoreSmall-Cap indicates companies that are small in terms of market capitalization. Usually, a company falls under the small-cap label, if they have a market capitalization between $300 million and $2 billion. Being a small-cap company by no way indicates smaller profits. Some small-cap companies are excellent investments because of their low valuation and they have […]

-

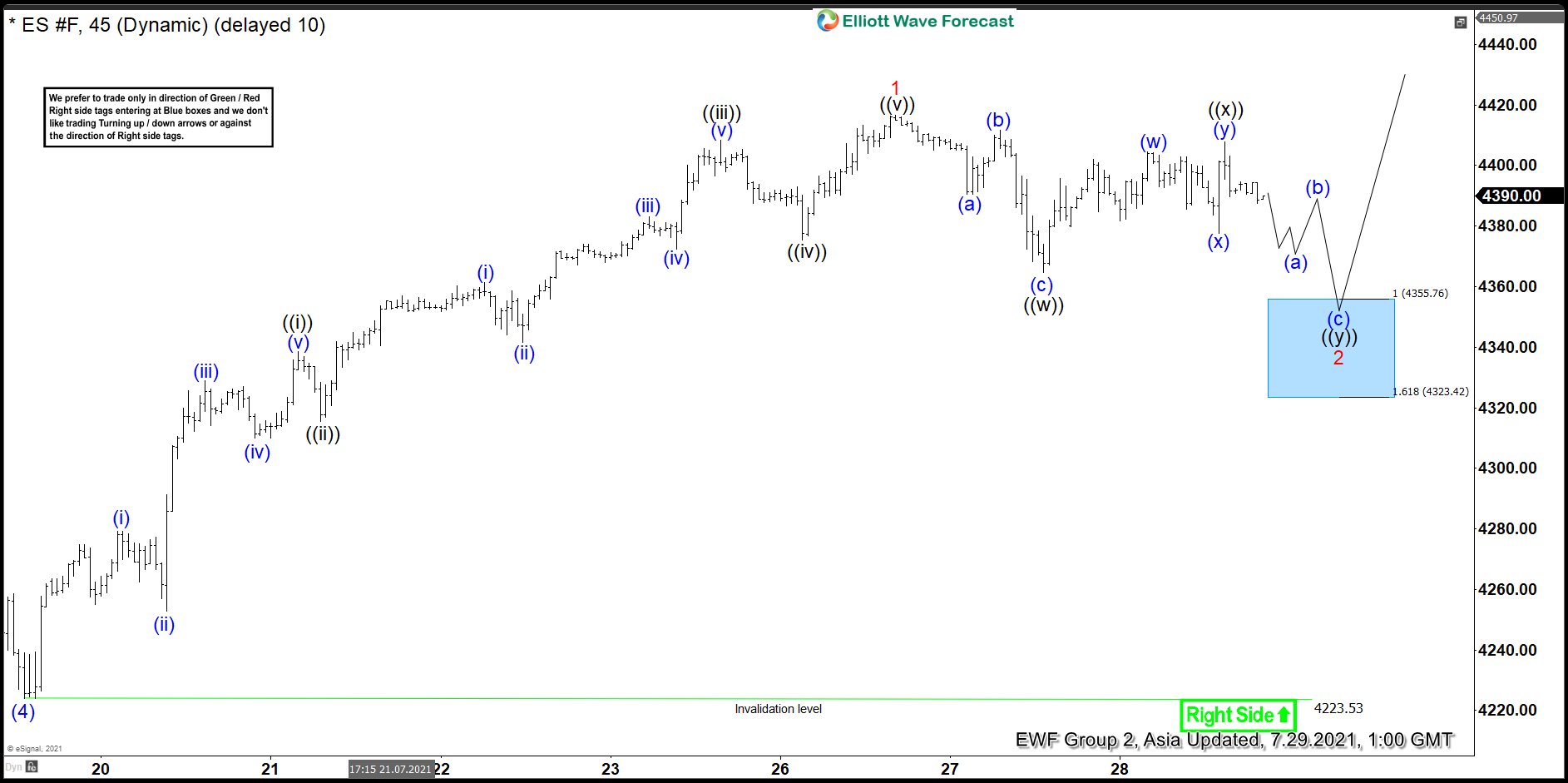

Elliott Wave View: S&P 500 E-Mini Futures (ES) Short Term Support Area

Read MoreS&P 500 E-Mini Futures (ES) is correcting cycle from July 20 low in 7 swing before it resumes higher. This article and video look at the Elliott Wave path.

-

Elliott Wave View: Nikkei 5 Swing Sequence Favors Further Downside

Read MoreNikkei Futures (NKD) shows a lower low bearish sequence from February 16, 2021 peak. The Index also shows a 5 swing bearish sequence from June 15, 2021 peak. Both of these sequence suggest Nikkei likely see further downside. Below is the chart showing a 5 swing sequence from June 15, 2021 peak. Nikkei (NKD) 5 […]

-

General Electric ($GE) Longs Are Risk Free

Read MoreIn this blog, we take a look at the past performance of General Electric charts. In which our members took advantage of the blue box areas.