The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Liquidia (LQDA): Buy The Breakout Or Wait For Pullback?

Read MoreLiquidia Corporation, (LQDA) is a biopharmaceutical company. It develops, manufactures & commercializes various products for unmet patient needs in the United States. It comes under Healthcare sector in Biotechnology Industry & trades as “LQDA” ticker at Nasdaq. As discussed in last article, it extends rally in impulse I from June-2025 low. It should extend into […]

-

Newmont Mining (NEM) Elliott Wave Outlook: Impulsive Rally Building Momentum

Read MoreNewmont (NEM) resumes the powerful nesting impulse and should continue to stay supported. This article looks at the Elliott Wave path.

-

SPDR Financial Sector $XLF Blue Box Area Offering a Buying Opportunity

Read MoreHello everyone! In today’s article, we’ll review the recent performance of SPDR Financial Sector ($XLF) through the lens of Elliott Wave Theory. We’ll look at how the pullback from all-time highs unfolded as a textbook 3-swing correction and discuss what could come next. Let’s explore the structure and the expectations for this ETF. 5 Wave […]

-

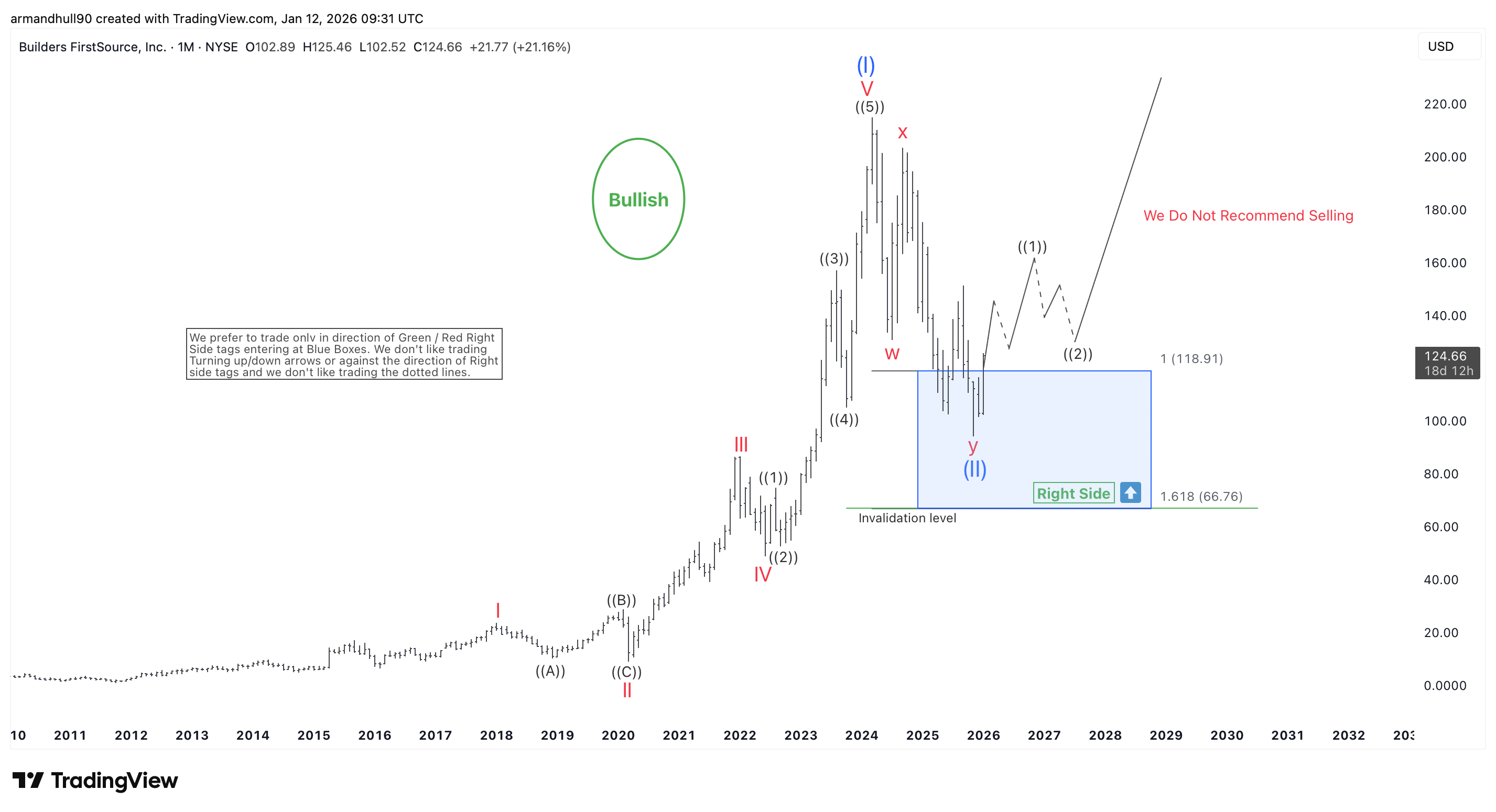

BLDR Elliott Wave Bullish Structure Points Toward New All-Time Highs

Read MoreWave (II) Looks Complete, Right-Side Remains Bullish, and Wave (III) Targets Higher Prices Ahead Builders FirstSource (NYSE: BLDR) continues to show a strong bullish outlook based on Elliott Wave Theory. The monthly chart highlights an impressive impulsive advance into the peak of wave (I). After that strong rally, the stock entered a larger corrective phase. […]

-

SanDisk (NASDAQ: SNDK) Bullish Path Beyond $440

Read MoreSanDisk (NASDAQ: SNDK) surged over 1000% since its IPO last year and it shows no signs of slowing. Today, we decode the Elliott Wave structure behind its powerful breakout. Consequently, our analysis charts a precise path to higher targets. This technical blueprint reveals a compelling setup fueled by pure momentum. Elliott Wave Analysis SNDK rallied from […]

-

DAX Resumes Bullish Structure After Finding Support at the Equal Legs Zone

Read MoreHello fellow traders. In this article we’re going to take a quick look at the Elliott Wave charts of DAX index , published in the members area of the website. As our members know, DAX is showing impulsive bullish sequences in the cycle from the November’s 2025 low. Recently it pulled back and found buyers […]