The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

$POWW : Ammo Incorporated Shows High Upside Potential

Read MoreAmmo Incorporated is an U.S. American defense company producing high-quality ammunition. The company owns STREAK (R), HyperClean and military ammunition technologies. Headquartered in Scottsdale, Arizona, USA, Ammo can be traded under the ticker $POWW at Nasdaq. Ammo Monthly Elliott Wave Analysis 10.04.2021 The monthly chart below shows the Ammo stock $POWW traded at Nasdaq. From the all-time […]

-

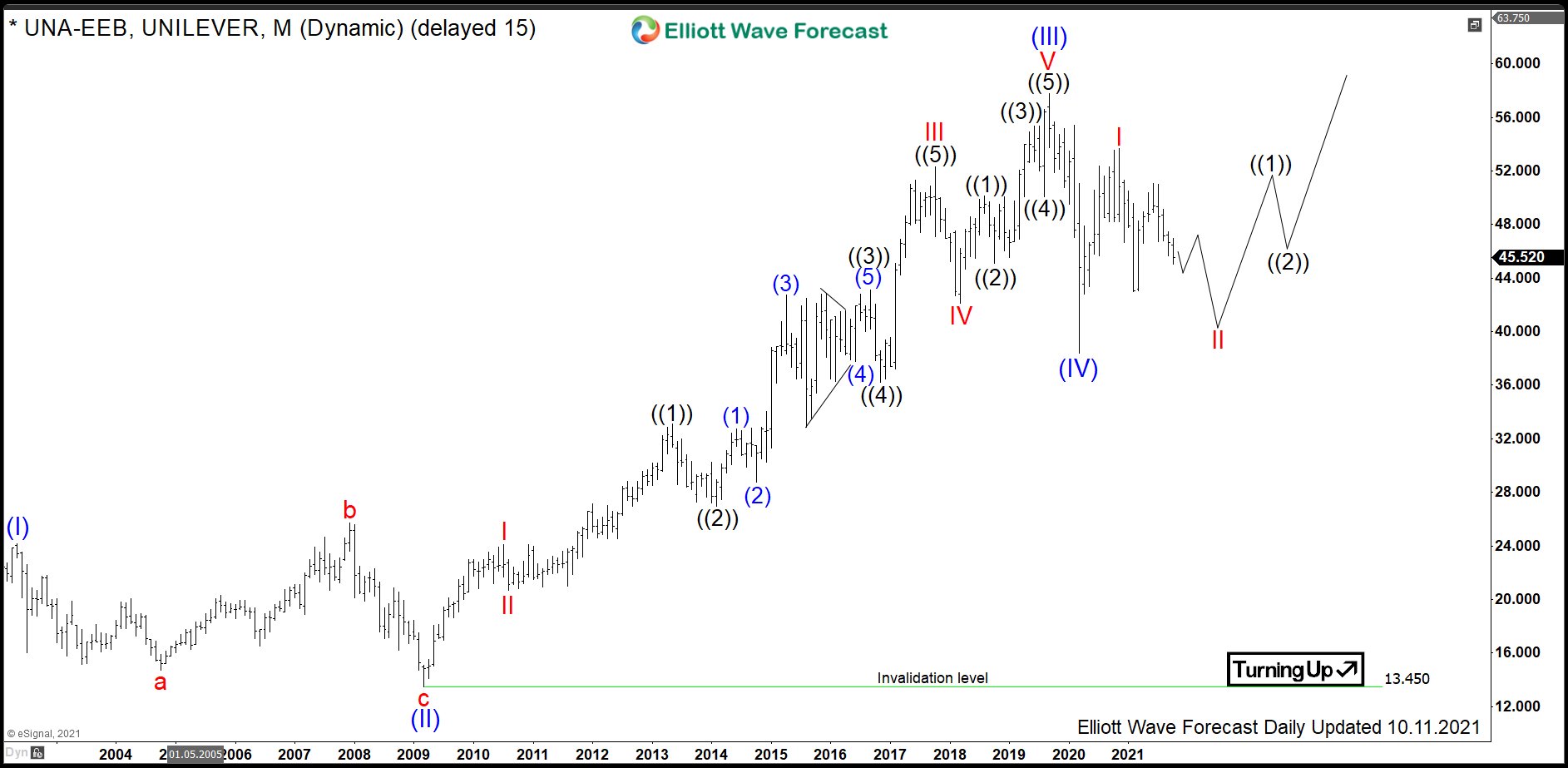

$UNA : Success Story of Unilever Stock in another Extension Higher

Read MoreUnilever is a multinational consumer goods corporation. Unilever products include food, condiments, ice cream, coffee, cleaning agents, pet food, beauty products, personal care and more. Founded 1919 by the merger of the Dutch margarine producer Margarine Unie and the British soapmaker Lever Brothers, it is headquartered in London, UK. Unilever is a part of FTSE 100, AEX and Eurostoxx […]

-

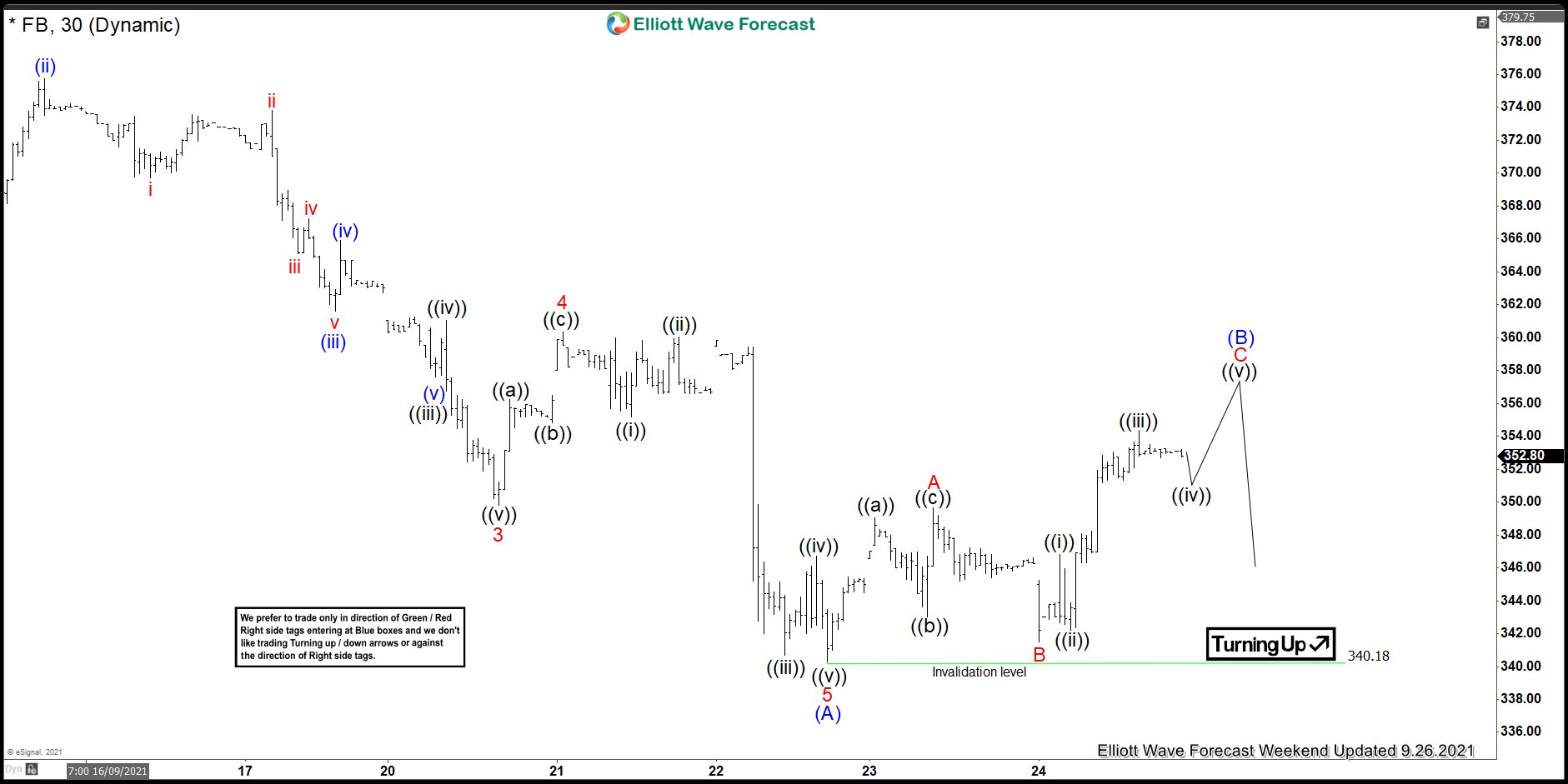

Facebook Reacted Lower After Ending Flat Correction

Read MoreIn this blog, we take a look at the past performance of Facebook’s 1hr charts. In which, the stock started reacting lower after ending flat correction.

-

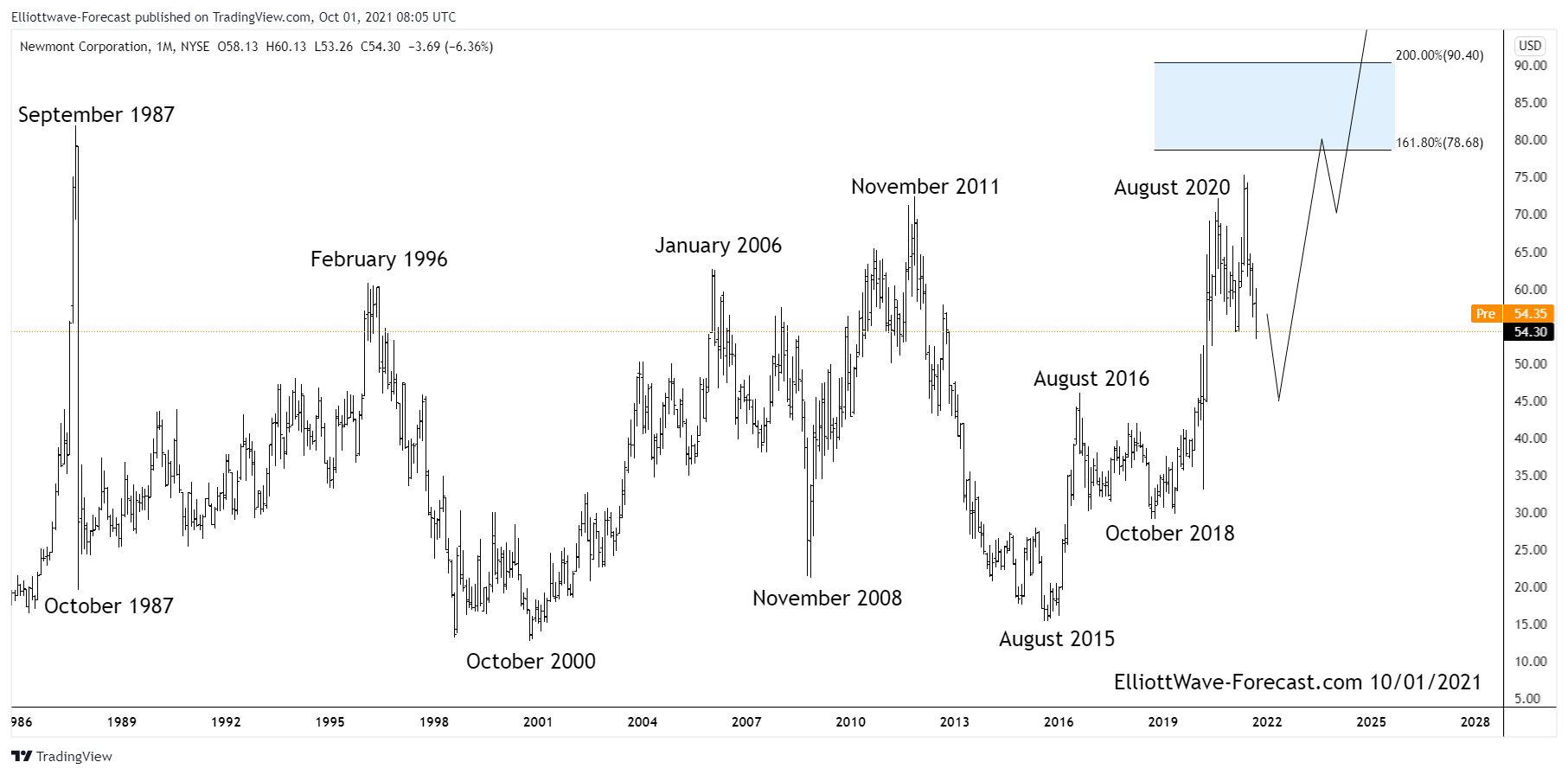

$NEM Longer Term Bullish Cycles of The Newmont Corporation

Read More$NEM Longer Term Bullish Cycles of The Newmont Corporation Firstly from the beginning of price data from back in the 1970’s not shown on the chart, the price trend was obviously up. It ended that bullish cycle in September 1987 and pulled back really hard during the October 1987 crash. Price stabilized from there several […]

-

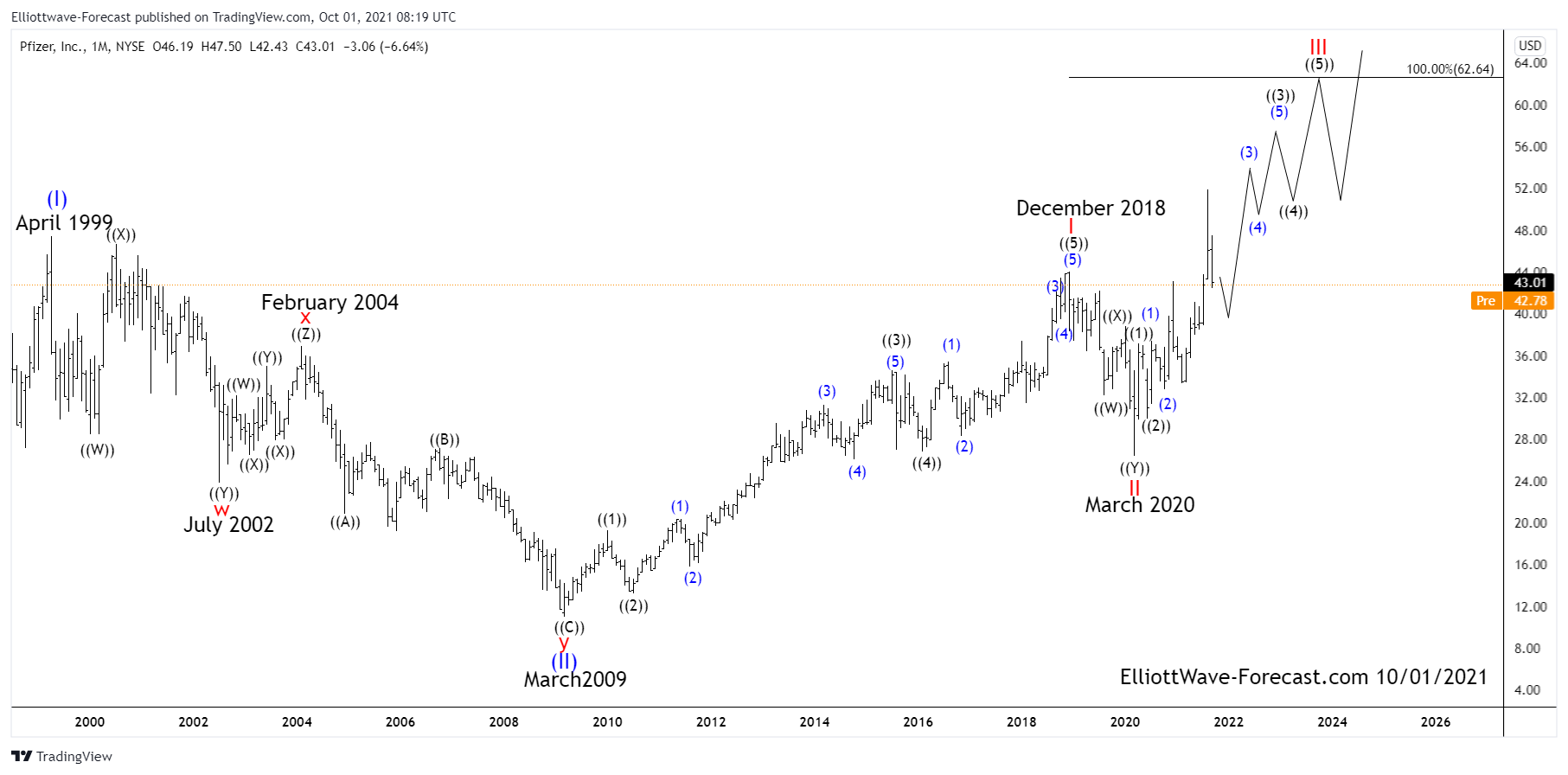

$PFE Elliott Wave Cycles & Long Term Bullish Trend

Read More$PFE Elliott Wave Cycles & Long Term Bullish Trend The Pfizer Long Term Bullish Trend and Elliott Wave Cycles suggest the stock price will be trending higher. The cycles project it should continue toward the April 1999 highs while it is above the March 2020 lows. From the beginning of the stock trading it had […]

-

Dow Futures (YM): A Double Three Correction Is Taking Place

Read MoreDow Futures (YM) the decline from August peak is taking a form of a double three structure. This article and video look at the Elliott Wave path.