The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Elliott Wave View: MRO Pullback Should Supported & Extend Higher

Read MoreMarathon Oil Corporation ( MRO ) is from Energy sector working as Independent Oil & Gas Exploration & Production. MRO is headquartered in Houston, Texas. It trades under MRO ticker at NYSE. MRO made all time low Since 1969 during Covid pandemic sell off at $3.02 low on 4/01/2020. Thereafter it started higher high sequence. […]

-

Elliott Wave View: Bank of America (BAC) Correction Should Find Buyers

Read MoreBAC (Bank of America) cycle from July 19, 2021 low looks incomplete looking for more upside. This article and video look at the Elliott Wave path.

-

Elliott Wave View: S&P 500 (SPX) Should Extend Lower

Read MoreS&P 500 (SPX) shows incomplete sequence from September 2, 2021 high favoring more downside. This article and video look at the Elliott Wave path.

-

Vinco Ventures ($BBIG) Ready For Next Leg Higher

Read MoreThe last time I covered this stock (article here) I was looking for a bit more upside to take place before pulling back. The market decided the larger pullback was happening sooner than anticipated. So lets take a look at the new view. It should be noted that there are some company events taking place […]

-

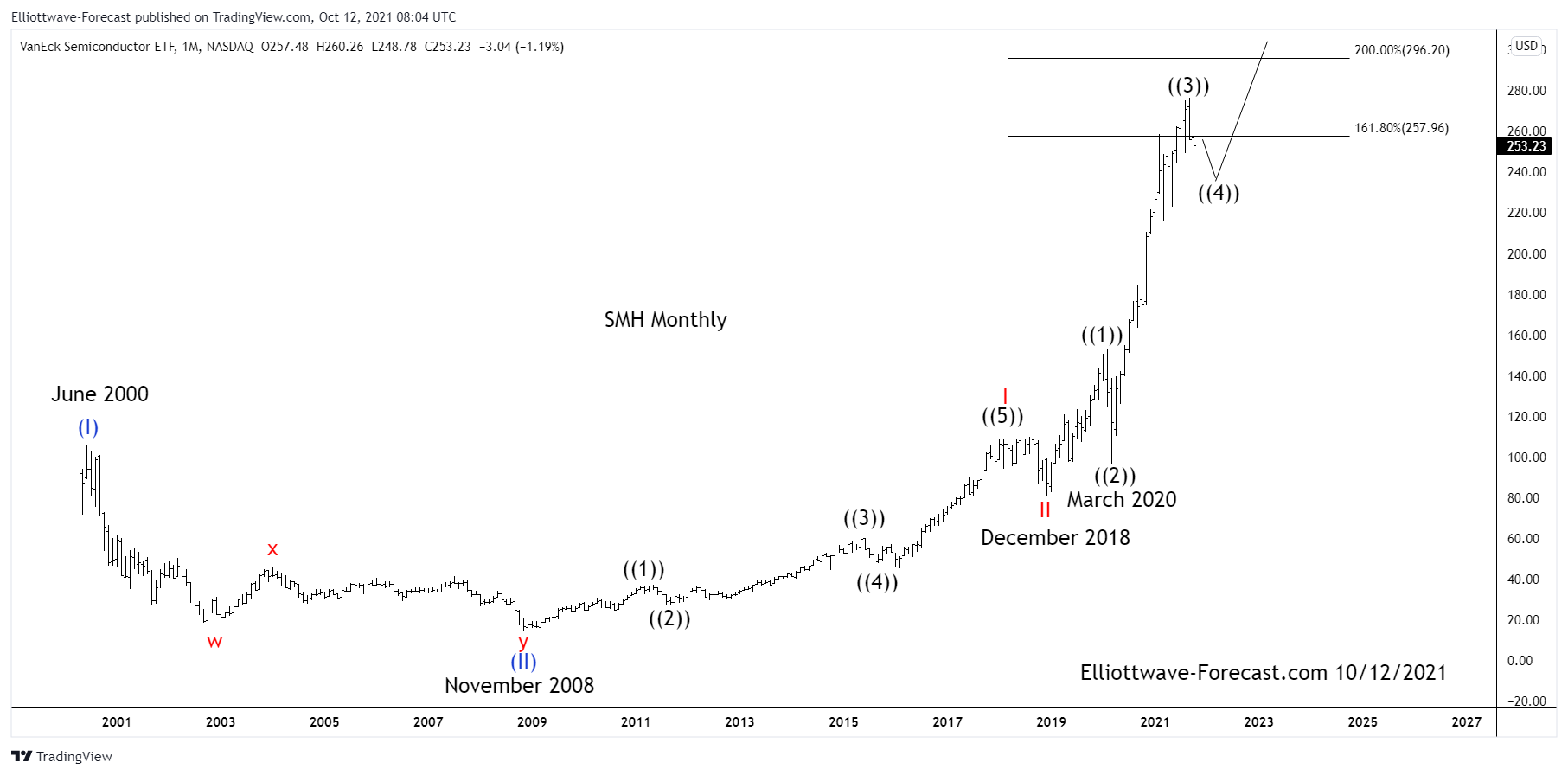

$SMH Semiconductors Long Term Cycles & Elliott Wave

Read More$SMH Semiconductors Long Term Cycles & Elliott Wave Firstly as seen on the monthly chart shown below. There is data back to May 2000 in the ETF fund. Data suggests the fund made a low in November 2008. This low has not been taken out in price. The cycles in this instrument tends to reflect the […]

-

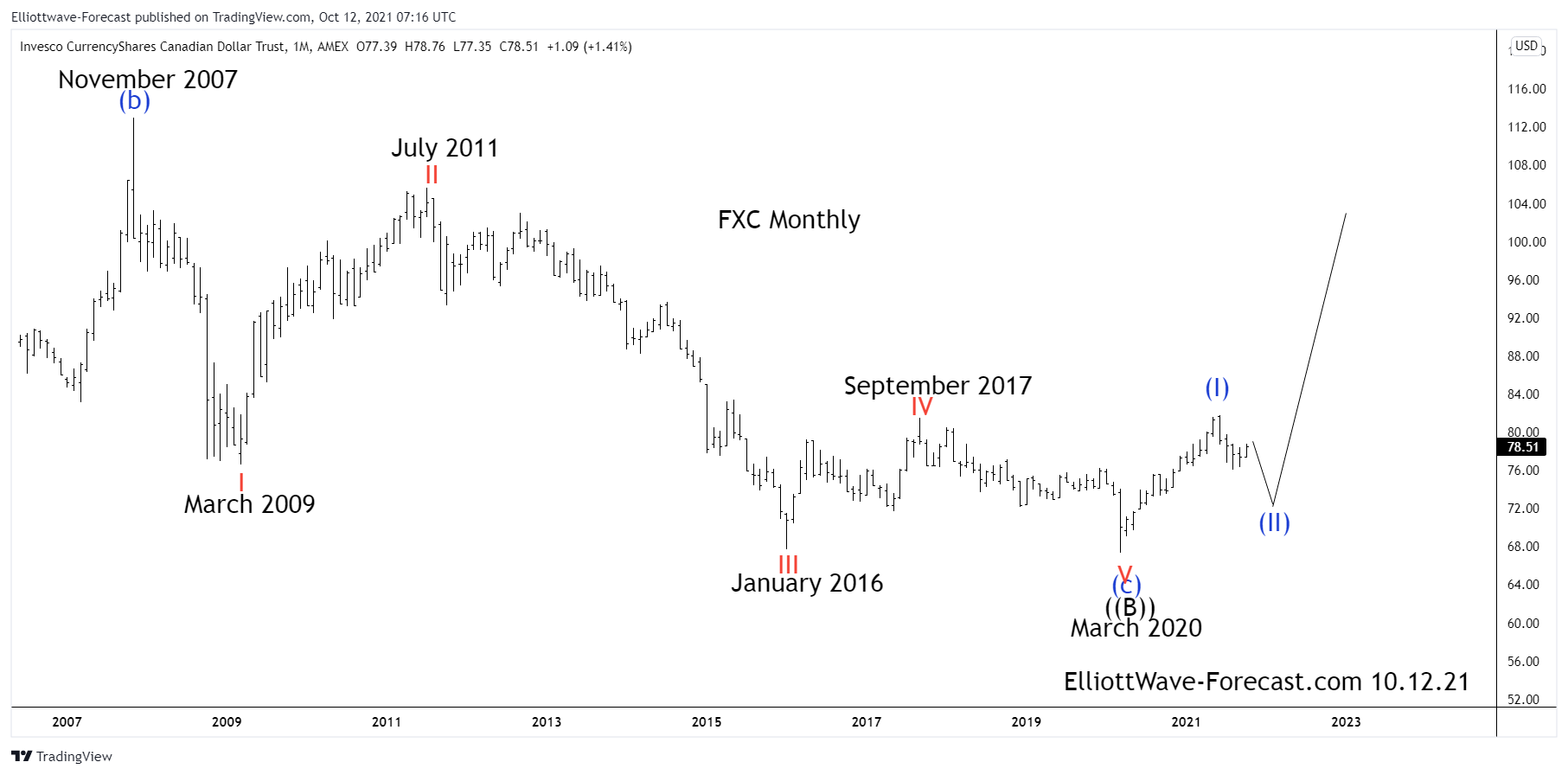

$FXC Canadian Dollar Trust Long Term Elliott Wave & Cycles

Read More$FXC Canadian Dollar Trust Long Term Elliott Wave & Cycles Firstly the FXC instrument inception date was 6/26/2006. The instrument tracks changes of the value of the Canadian dollar relative to the U.S. dollar. It increases in value when the Loonie strengthens and declines when the dollar appreciates. In January 2002 the USDCAD forex pair made […]