The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

DataDog ($DDOG) Pulling Back In A Nest

Read MoreI wanted to review DataDog again, and take a look at how the current chart is shaping out. I took a look at this stock about a month ago, you can see the article here. In that blog I was explaining the scenario for a minor pullback, then further upside. Lets take a look at […]

-

Top Cybersecurity Stocks to Invest In 2024

Read MoreCybersecurity attacks have increased in frequency in 2021. There have been some major cyberattacks in the current year which have caused serious damage to companies. The top cyber-attacks of 2021 are listed below: Colonial Pipeline attack – This cyberattacks disrupted gas supplies all along the East Coast of the United States which caused chaos and […]

-

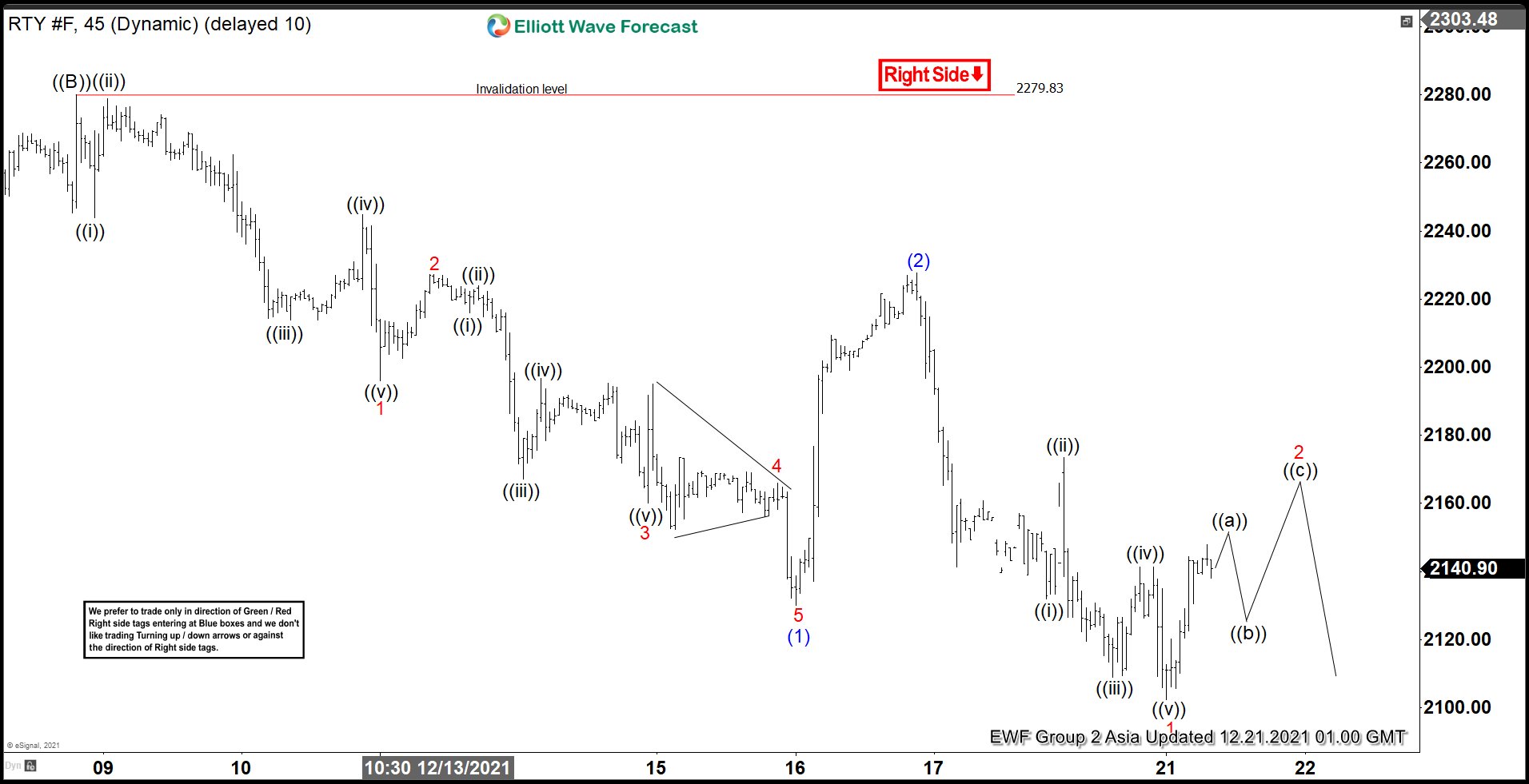

Elliott Wave View: Russell (RTY) Extends Lower

Read MoreRussell (RTY) shows bearish sequence from November 8, 2021 high favoring more downside. This article and video look at the Elliott Wave path.

-

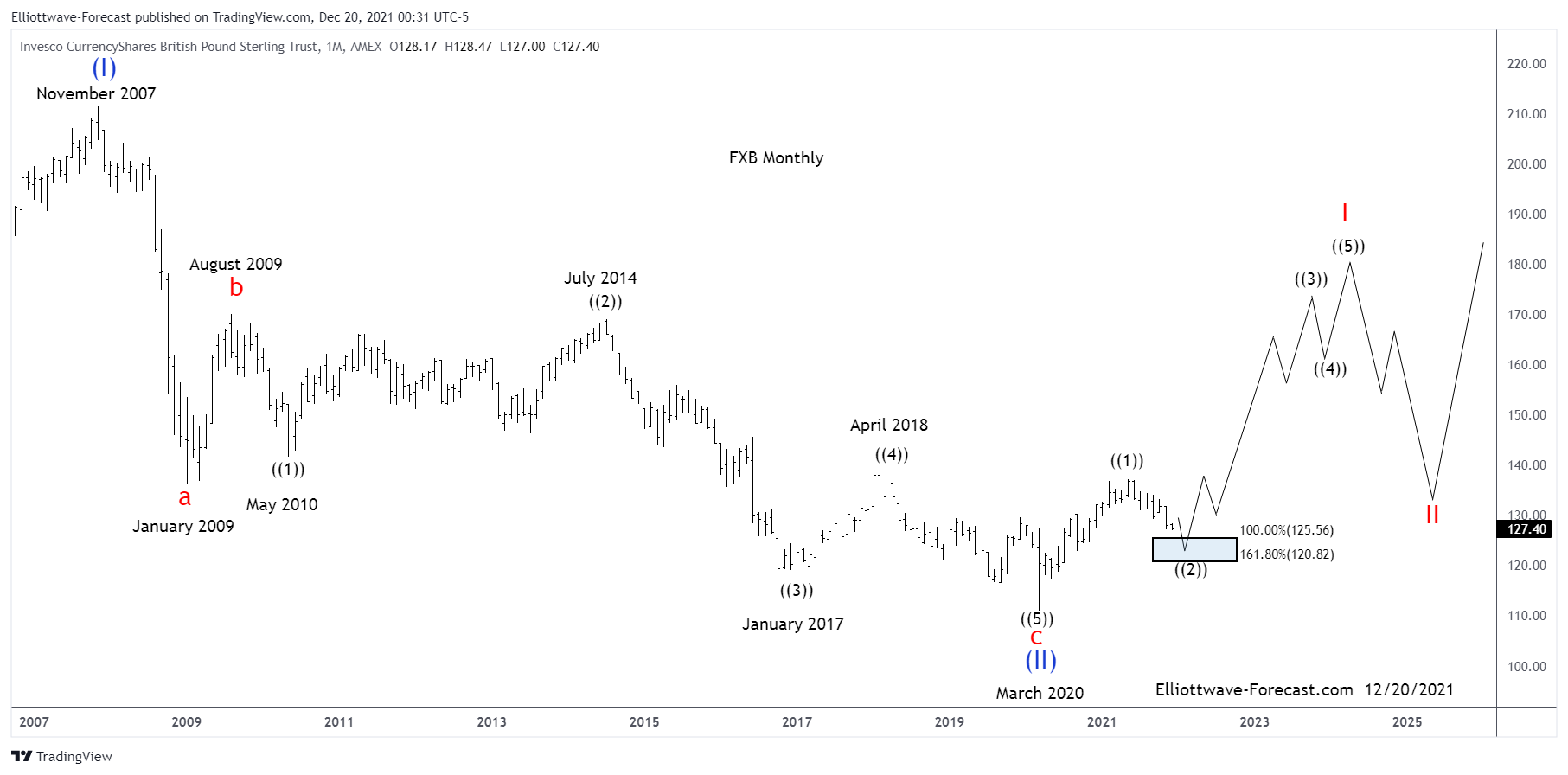

Can the British Pound ETF $FXB Turn Higher?

Read MoreCan the British Pound ETF $FXB Turn Higher? Firstly the British Pound Sterling tracking ETF fund FXB inception date was 6/21/2006. The bearish cycle lower from the November 2007 highs in FXB is favored ended in this analysis. The British Pound Sterling has been the currency of the Bank of England since 1694. Considering that date was back […]

-

Disney ($DIS) Connector Is On Its Way Before Continue With The Drop

Read MoreSince the crash of March 2020, all stocks have tried to recover what they lost, and Disney was no exception. Disney did not only recover the lost, but It also reached historic highs. Now, we are going to try to build an impulse from the March 2020 lows with a target around $230. Target measured […]

-

Berkshire Hathaway ($BRK.B) Needs To Break 274.79 To Confirm Pullback

Read MoreAll stocks tried to recover what they lost and Berkshire Hathaway was not exception since the crash of March 2020. BRK.B did not only recover the lost, but It also reached historic highs. Now, it is building an impulse from March 2020 lows and we are going to follow to determinate the best area to […]