The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

XLY Reacting Higher After Ending Double Correction

Read MoreIn this technical blog, we will look at the past performance of 4 hour Elliott Wave Charts of XLY. In which, the rally from 18 March 2020 low unfolded as a nest and showed a higher high sequence. Therefore, we knew that the structure in XLY is incomplete to the upside & should see more upside. […]

-

JNJ More Downside Is Expected Before Resume The Rally

Read MoreSince the crash of March 2020, all stocks have tried to recover what they lost and JNJ was no exception. Johnson & Johnson did not only recover the lost, but it also reached historic highs. In those days, we were looking for an entry in 155.33 – 156.93 area to reach a target above $176.00 […]

-

Best Semiconductor Stocks to Buy in 2024

Read MoreSemiconductors are the major building blocks of modern electronics. They are not only used in electronic devices but also enable advances in communications, computing, healthcare, military systems, transportation, clean energy amongst others. The Semiconductor Industry Landscape was valued at USD 439.8 billion in 2020, and it is projected to be worth USD 679.6 billion by […]

-

10 Best Lithium Stocks to Buy in 2024

Read MoreThe dynamics of the car industry are changing with the shift towards electric cars. The EV market size is expected to grow to 245 million vehicles by 2030. With this increase in demand for electric vehicles, there will be a huge increase in demand for lithium because EV cars use lithium-ion battery cells. XPENG is […]

-

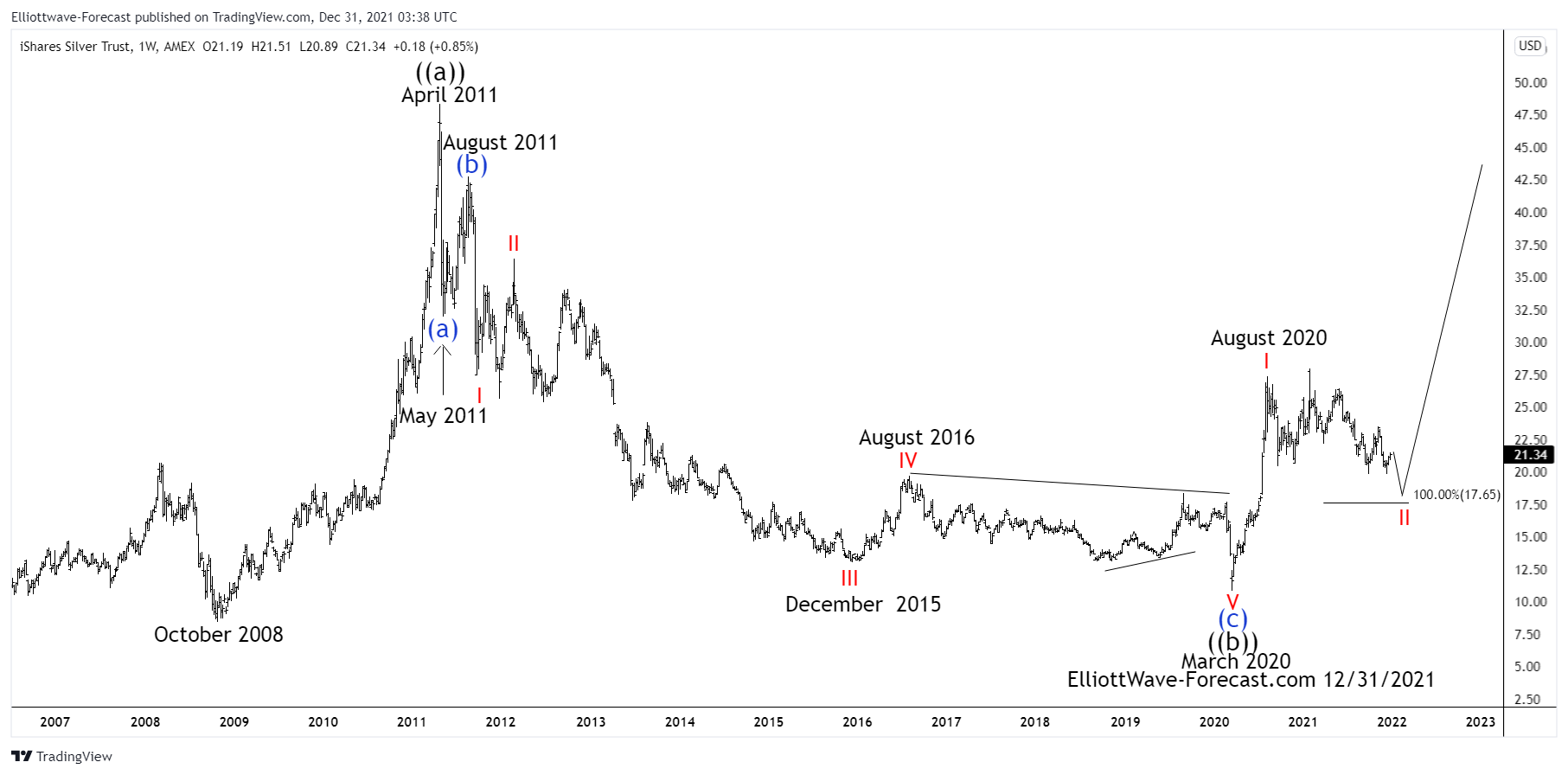

Is $SLV Ready to Turn Higher In The Larger Cycles?

Read MoreIs $SLV Ready to Turn Higher In The Larger Cycles? Firstly there is data back to when the ETF fund began in 2006 as seen on the weekly chart shown below. The fund made a low in 2008 at 8.45 that has not since been taken out in price. This analysis assumes from the October 2008 […]

-

10 Best Robinhood Stocks to Buy in 2024

Read MoreRobinhood Trading Platform is an online brokerage that upscaled the brokerage industry with its zero-commission investing. The key feature of this trading platform that is the reason behind its success is it is a simple and easy-to-use interface. Its founders, Vladimir Tenev and Baiju Bhatt are graduates of Stanford University creates this platform to attract […]