The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

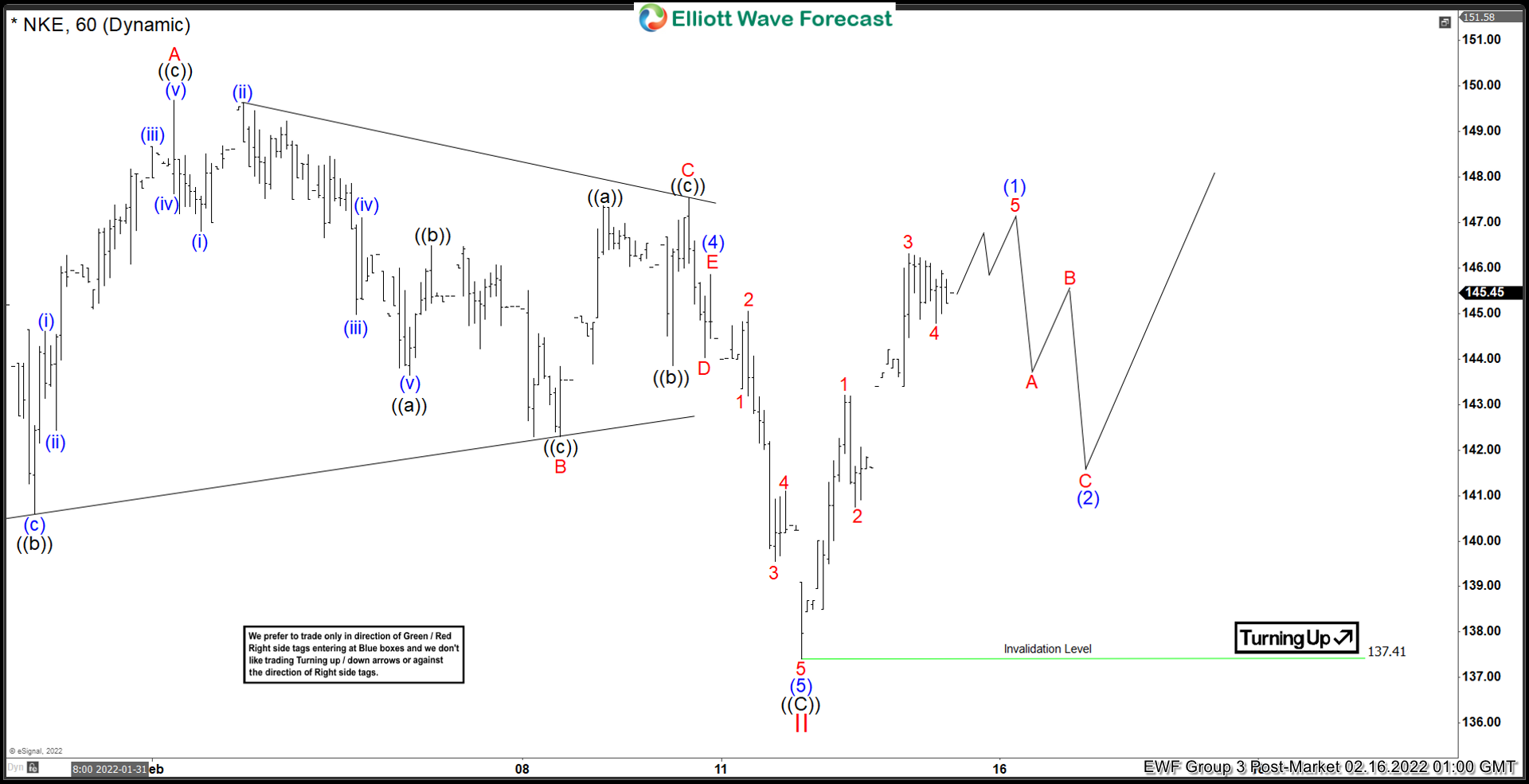

Elliott Wave View: Nike (NKE) At Potential Support Area

Read MoreNike (NKE) ended correction to the cycle from March 2020 low at 137.41. This article and video look at the Elliott Wave path.

-

Bit Digital ($BTBT) Is The Low Set?

Read MoreWith Bitcoin having rallied over 40K from the March 2020 low, Crypto and Blockchain markets continue to show potential. Bit Digital is a company that experienced a large vertical rally in late 2020. After that, it has been correcting the whole rally in a large wave II. Bit Digital touts itself as one of the […]

-

RTY_F Forecasting The Decline Into Blue Box And Reaction Higher

Read MoreRTY_F made a sharp decline during the month of January 2022. Clients of Elliottwave-Forecast were aware that decline was nothing more than another buying opportunity and our daily chart had the range defined where we expected 3 waves decline to end and buyers to appear to resume the rally or produce 3 waves reaction higher […]

-

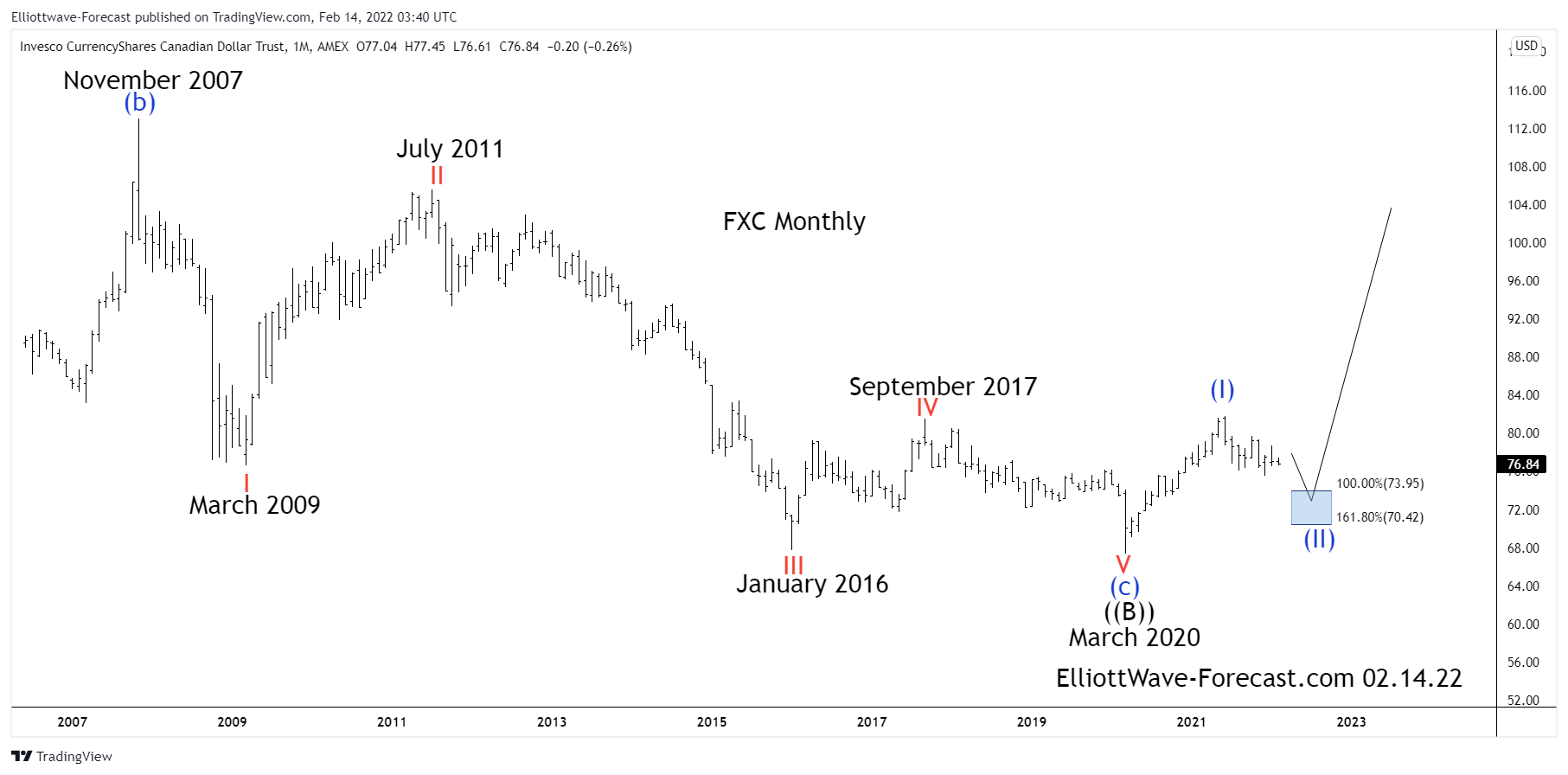

Canadian Dollar Trust Long Term Cycles & Elliott Wave $FXC

Read MoreCanadian Dollar Trust Long Term Cycles & Elliott Wave $FXC Firstly the FXC instrument inception date was 6/26/2006. The instrument tracks changes of the value of the Canadian dollar relative to the U.S. dollar. The FXC trades inversely to the USDCAD forex pair. In January 2002 the USDCAD forex pair made an all time high at […]

-

NIO Near the Support Area

Read MoreIn our previous May 31, 2021 article on Nio (NYSE: NIO), we argued that the stock is in the process of all-time low correction. Nio is a Chinese electric car manufacturer based in Shanghai. The stock sees a meteoric rise since it debuted on September 2018 at NYSE. We have suggested previously that due to […]

-

How We Saw CrowdStrike (CRWD) and What To Expect In Coming Months

Read MoreCrowdStrike Holdings, Inc. (CRWD) is an American cybersecurity technology company based in Austin, Texas. It provides cloud workload and endpoint security, threat intelligence, and cyberattack response services. CrowdStrike (CRWD) July 2021 Daily Chart On July 22nd, we analyzed CRWD showing an structure suggesting that a very important market cycle was near to end; that is, the whole cycle from its foundation in 2011. […]