The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Elliott Wave View: S&P 500 (SPX) Rally Expected To Fail

Read MoreSPX shows bearish sequence from January 4 high favoring more downside. This article and video look at the Elliott Wave path of the Index.

-

$NOKIA : Acceleration in Nokia after Short-Term Pullback

Read MoreNokia is a Finnish multinational telecommunications, consumer electronics and information technology company. Founded 1865, it is headquartered in Espoo, Finland. Investors can trade it under the ticker $NOKIA at Nasdaq Nordic OMX and at Euronext Paris. The company is a part of Euro Stoxx 50 (SX5E) index. Also, one can trade Nokia under the ticker $NOK […]

-

19 Best Stocks for Covered Calls in 2024

Read MoreWhat Is A Covered Call? A covered call is a position that consists of shares of a stock and a call option on that underlying stock. When you execute a covered call, you sell the call option while owning the underlying stock. Covered calls give the right to purchase the underlying stock at a set […]

-

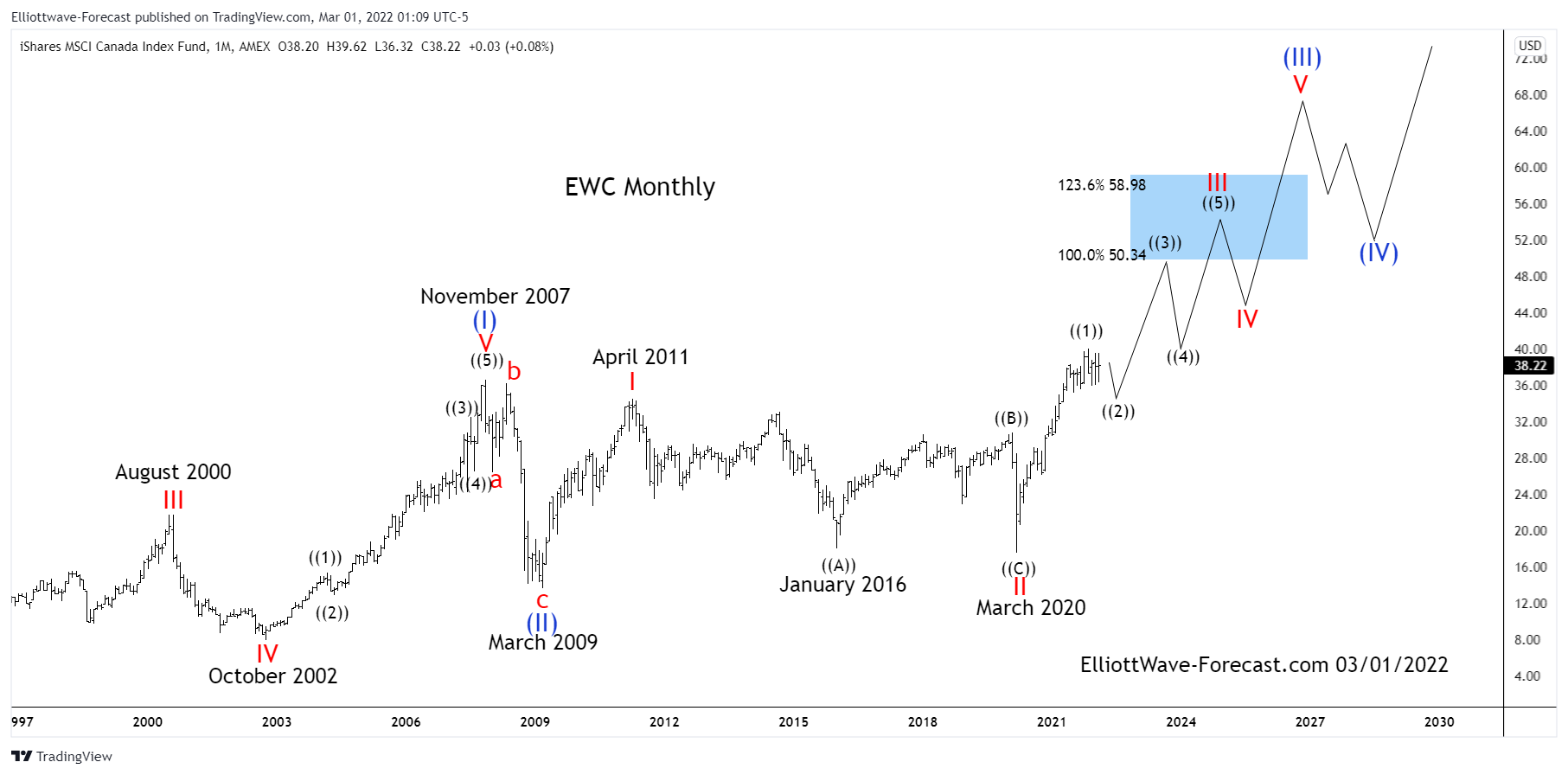

Long Term Cycles and Elliott Wave Uptrend $EWC

Read MoreLong Term Cycles and Elliott Wave Uptrend $EWC Firstly the EWC instrument inception date was 3/12/1996. The Canada ETF seeks to track the investment results of an index composed of large and mid-sized companies in Canada. This is of course reflected in the price. The best Elliott Wave reading of the long term cycles presume some […]

-

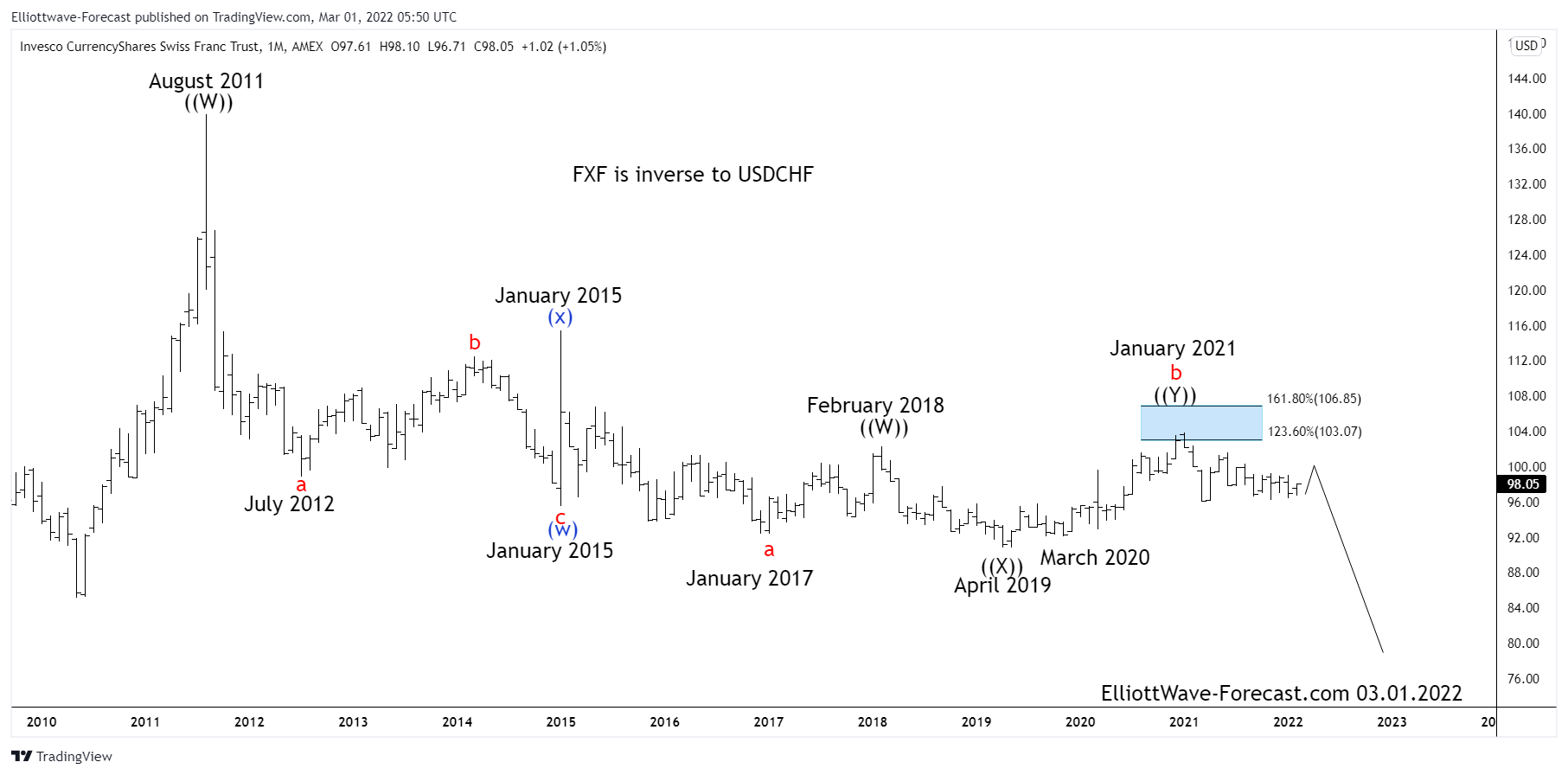

Long Term Cycles & Elliott Wave Analysis $FXF

Read MoreLong Term Cycles & Elliott Wave Analysis $FXF Firstly there is data back to when the ETF fund began in 2006 as low as 78.43. Data correlated in the USDCHF foreign exchange pair suggests the FXF high in August 2011 is also the lows of a cycle lower from the all time in the USDCHF. In this instrument […]

-

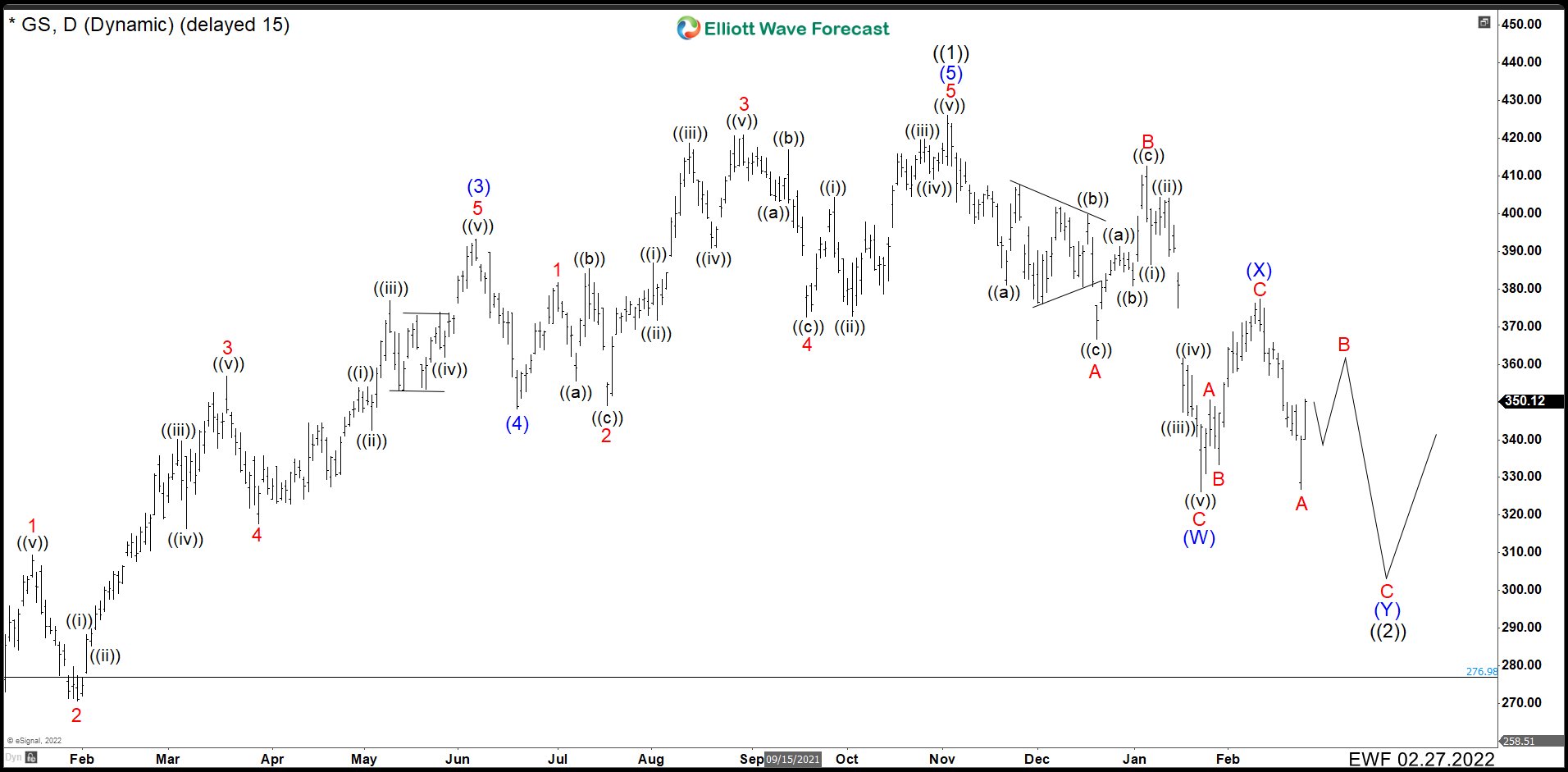

Is It Possible Goldman Sachs (GS) Keeps Falling?

Read MoreThe Goldman Sachs Group, Inc. (GS) is an American multinational investment bank and financial services company headquartered in New York City. It offers services in investment management, securities, asset management, prime brokerage, and securities underwriting. GS OCTOBER 2021 DAILY CHART Last October, we were looking to complete an impulse from March 2020 low. The first wave of impulse that we called wave (1) ended at 225.24 dollars. […]