The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

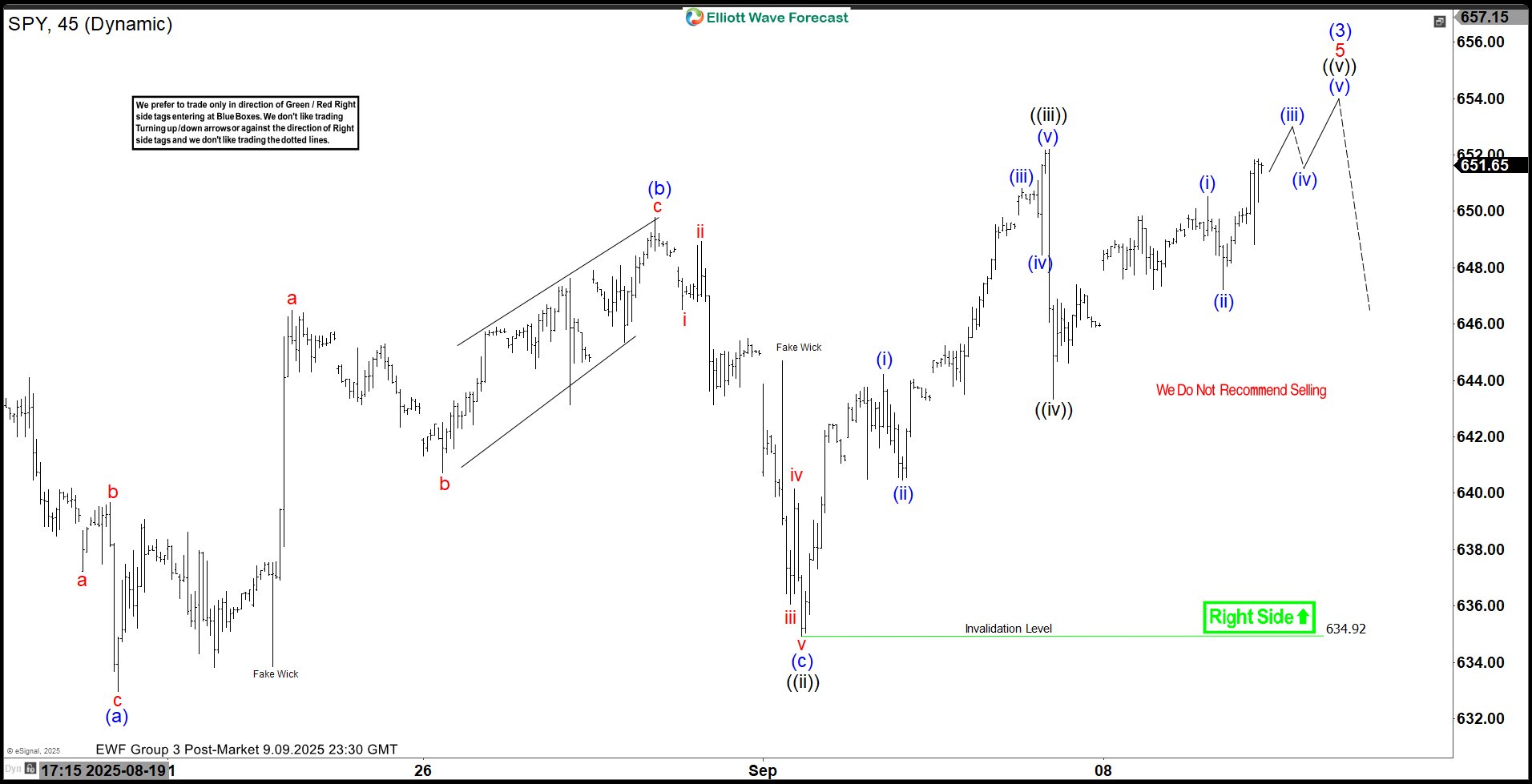

SPY Elliott Wave Outlook: Wave (3) Nearing Termination

Read MoreS&P 500 ETF (SPY) is looking to rally higher to end wave (3). This article and video look at the technical Elliott Wave path and target.

-

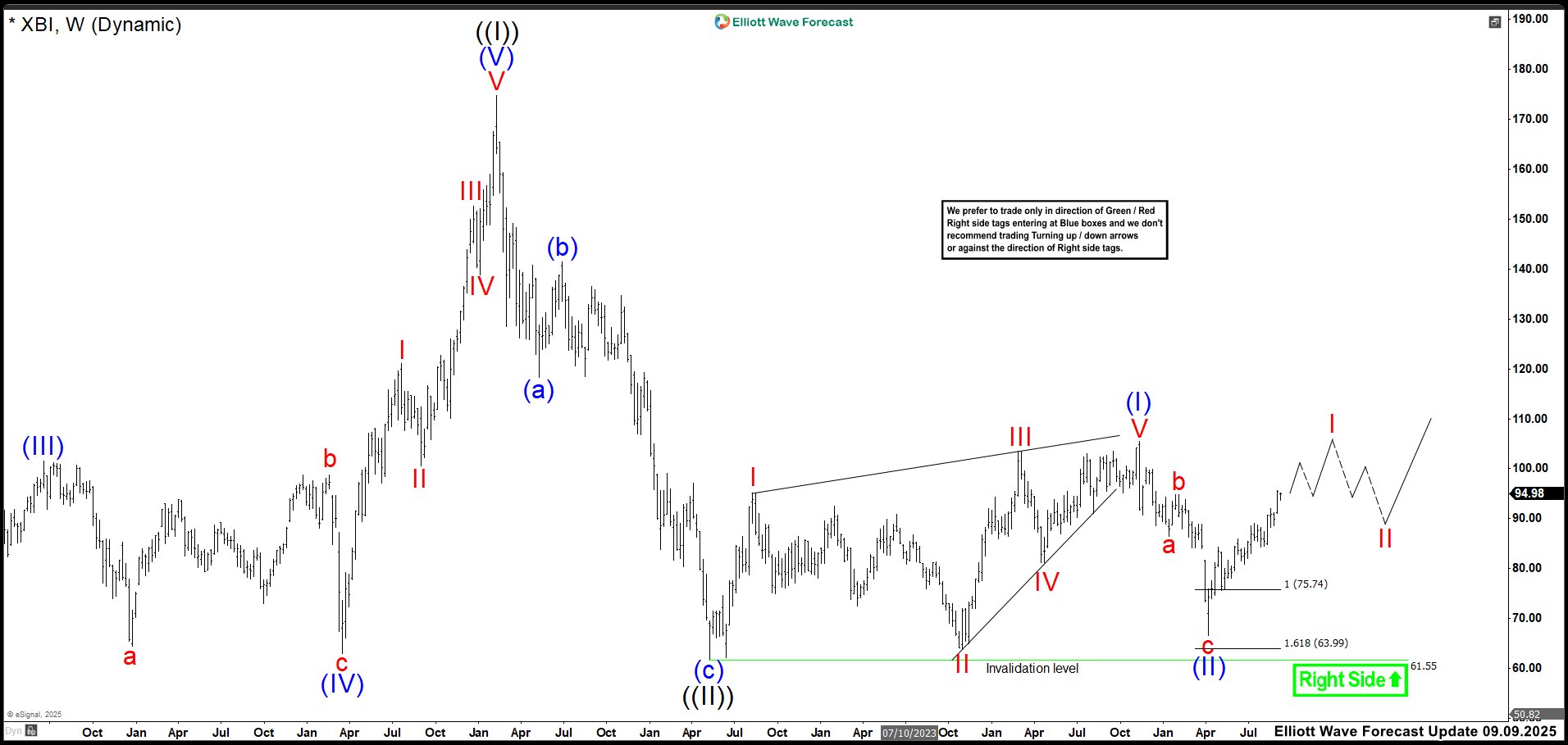

Biotech Surge: XBI Ends Correction and Rallies as Expected

Read MoreThe SPDR S&P Biotech ETF (XBI) draws investors who seek high-risk, high-reward exposure to the biotech sector. In late 2025, investor sentiment remains cautiously optimistic. This reflects both strong opportunities and ongoing uncertainty. Analysts set a 12-month price target near $141.31. That suggests a 48% upside from current levels around $95. Technical indicators support this […]

-

Elliott Wave Insights for QQQ Nearing wave (3) Termination at 589

Read MoreNasdaq 100 Index ETF (QQQ) is looking to complete wave (3). This article and video look at the Elliott Wave path of the ETF and target higher

-

Alnylam (ALNY) Should Rally Into $479-$494 Before Correction Start

Read MoreAlnylam Pharmaceuticals Inc., (ALNY) discovers, develops & commercializes therapeutics based on ribonucleic acid interference. It comes under Healthcare – Biotech sector & trades as “ALNY” ticker at Nasdaq. ALNY is showing strong rally from April-2025 low in previous article & expect further rally once (4) pullback ends. It rallied more than 40% since last update […]

-

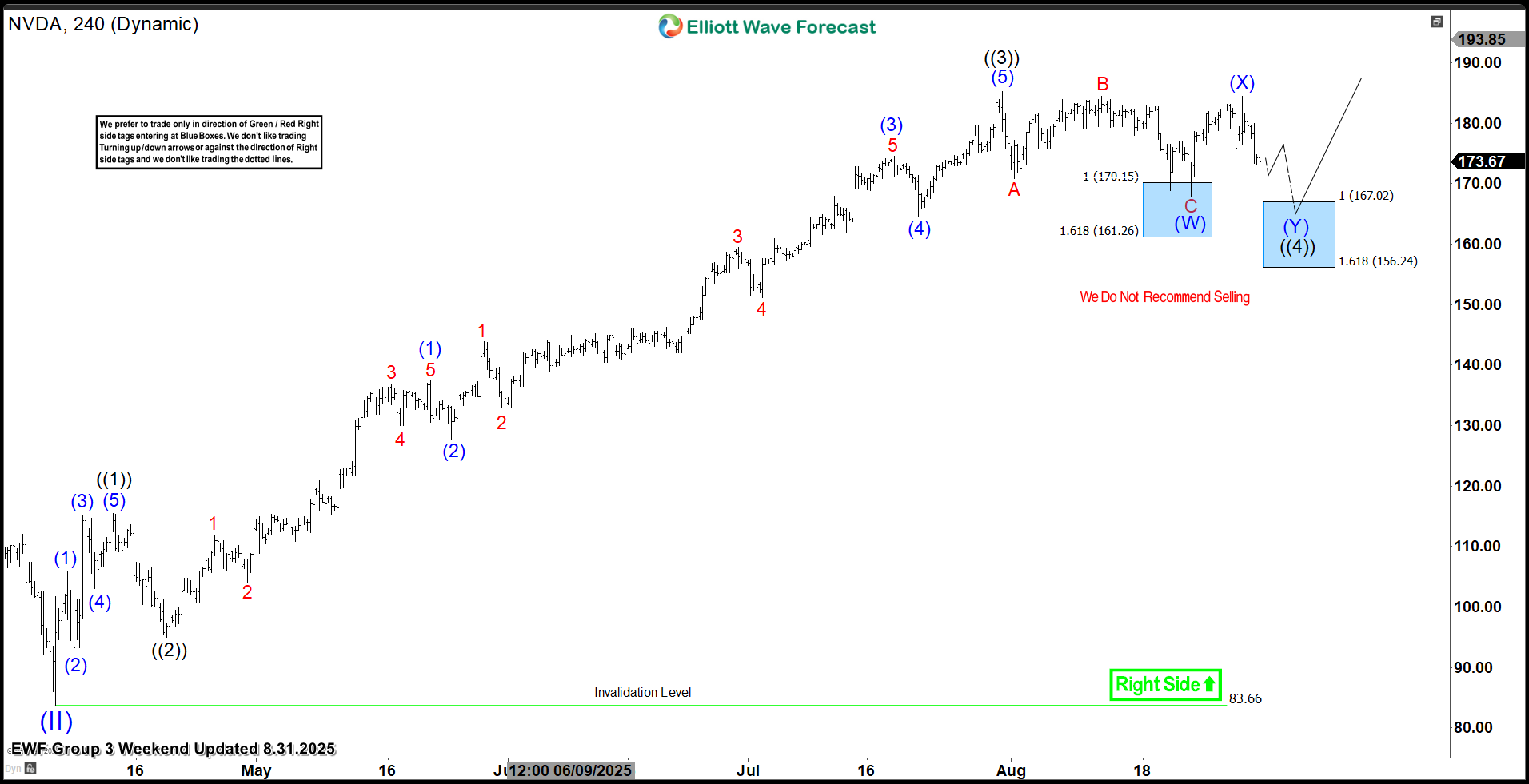

NVIDIA Corp. $NVDA Blue Box Area Offers A Buying Opportunity

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of NVIDIA Corp. ($NVDA) through the lens of Elliott Wave Theory. We’ll review how the rally from the April 2025 low unfolded as a 5-wave impulse followed by a 7-swing correction (WXY) and discuss our forecast for the next move. Let’s dive into the structure and expectations for this stock. 5 Wave […]

-

Magnificent Seven ETF (MAGS) Set to End Cycle from April 2025 Low

Read MoreMagnificent Seven (MAGS) ETF long term outlook suggests it may soon end cycle from April 2025 low and pullback. This article looks at the Elliott Wave path