The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Elliott Wave View: S&P 500 (SPX) Turning Lower

Read MoreS&P 500 (SPX) shows 5 swing sequence from March 30 peak favoring more downside. This article and video look at the Elliottwave path.

-

$EDF: French Electric Utility Stock EDF in Buying Area

Read MoreÉlectricité de France S.A. (literally, Electricity of France), commonly known as EDF, is a French multinational electric utility company. The operations include electricity generation and distribution, power plant design, construction and dismantling, energy trading and transport. Founded in 1946 and headquartered in Paris, France, the company is largely owned by the French state. EDF is a part […]

-

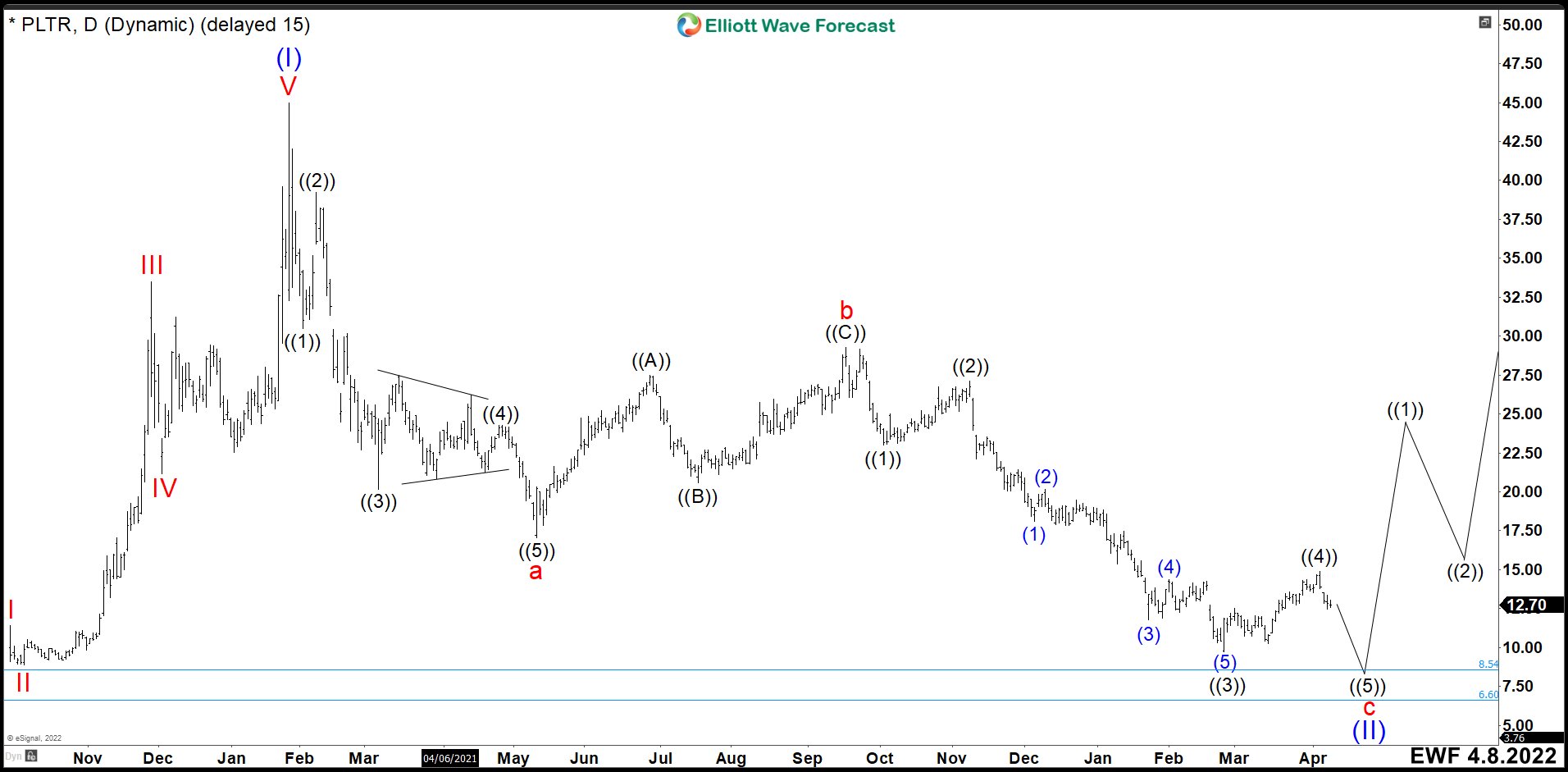

Palantir (PLTR) Is Near To End a Big Cycle From January 2021

Read MorePalantir Technologies (PLTR), Inc. is a holding company, which engages in the development of data integration and software solutions. It operates through the Commercial and Government segments. The Commercial segment offers services to clients in the private sector. The Government segment provides solutions to the United States (US) federal government and non-US governments. The firm […]

-

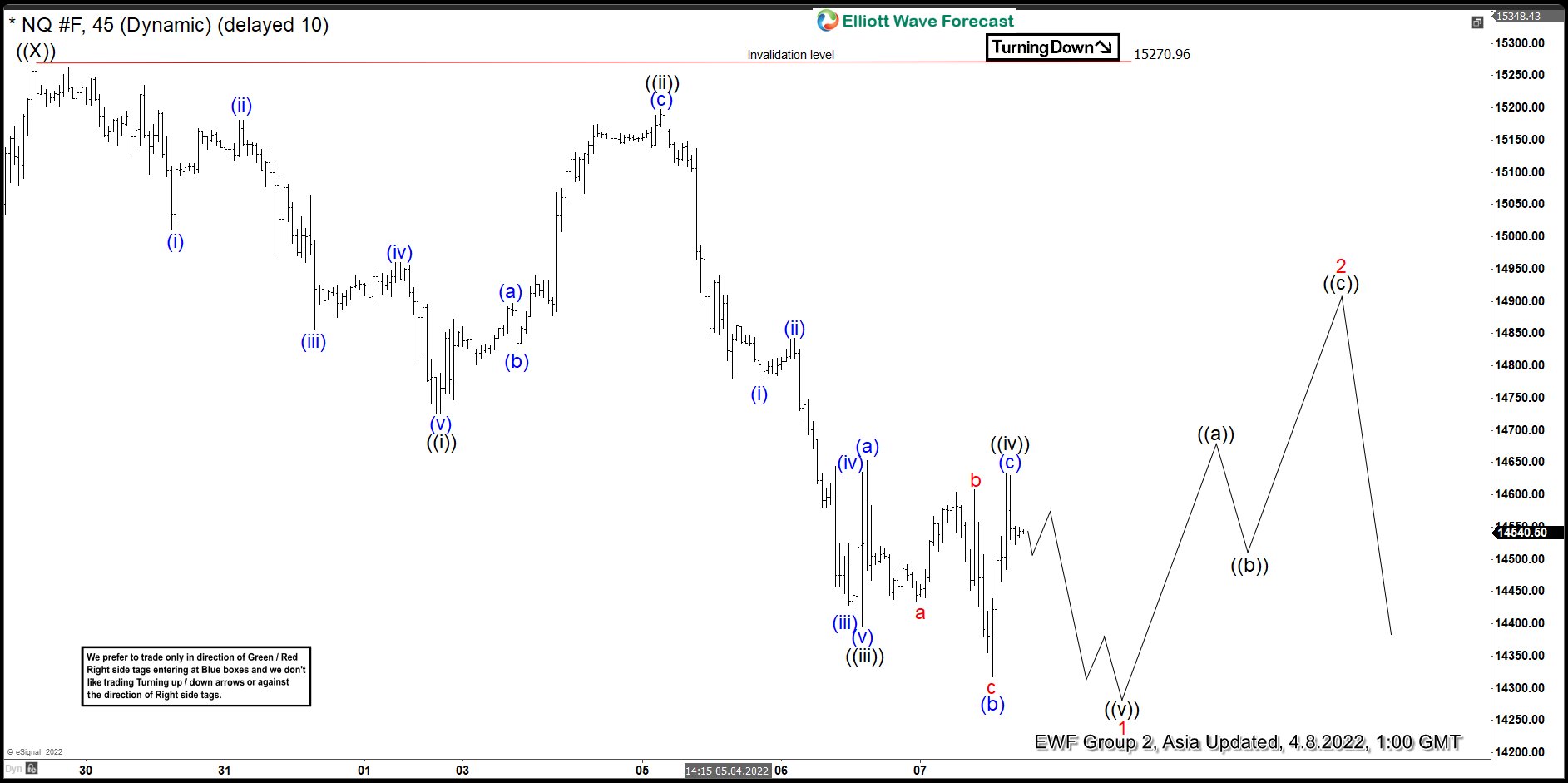

Elliott Wave View: Nasdaq Resumes Lower

Read MoreNasdaq decline from March 30 peak looks impulsive favoring more downside. This article and video look at the Elliott Wave path.

-

Canopy Growth Corporation ($CGC) A Lucrative Investment?

Read MoreToday I am looking at Canopy Growth Corporation. I am pretty sure everyone remembers the cannabis rally of 2018. When every trader, including their family members, were asking which cannabis company to buy to make money. Yes, cannabis had an incredible run from 2015 to 2018 peak, but like everything, it has pulled back and […]

-

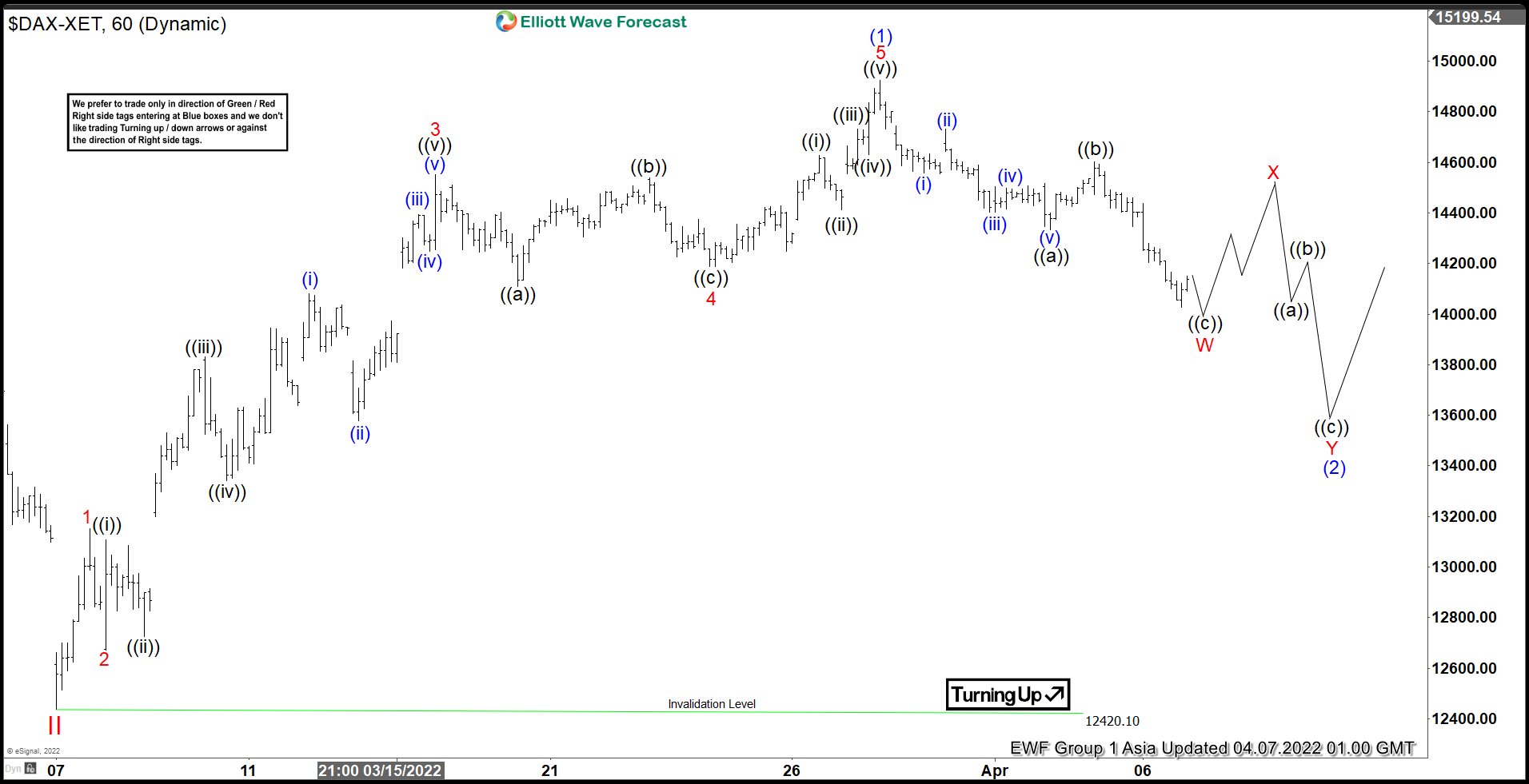

Elliott Wave View: DAX in 7 Swing Pullback

Read MoreDAX rally from March 7 low is impulsive and the Index can see further upside. This article and video look at the Elliott Wave path.