The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

JPMorgan (JPM) Could Lose More Than 10% Before Rally

Read MoreJPMorgan Chase & Co. (JPM) is an American multinational investment bank and financial services holding company headquartered in New York City and incorporated in Delaware. As of December 31, 2021, JPMorgan Chase is the largest bank in the United States, the world’s largest bank by market capitalization, and the fifth-largest bank in the world in […]

-

$NVAX: Biotechnology Stock Novavax Enters the Buying Area

Read MoreNovavax, Inc. is an US American biotechnology company. Founded in 1987 and headquartered in Gaithersburg, Maryland, USA, it is a part of Russel1000 index. Investors can trade it under the ticker $NVAX at NASDAQ as well as $NVV1 at XETRA. Before 2020, the company has developed vaccines to counter such diseases like Ebola, influenza, respiratory […]

-

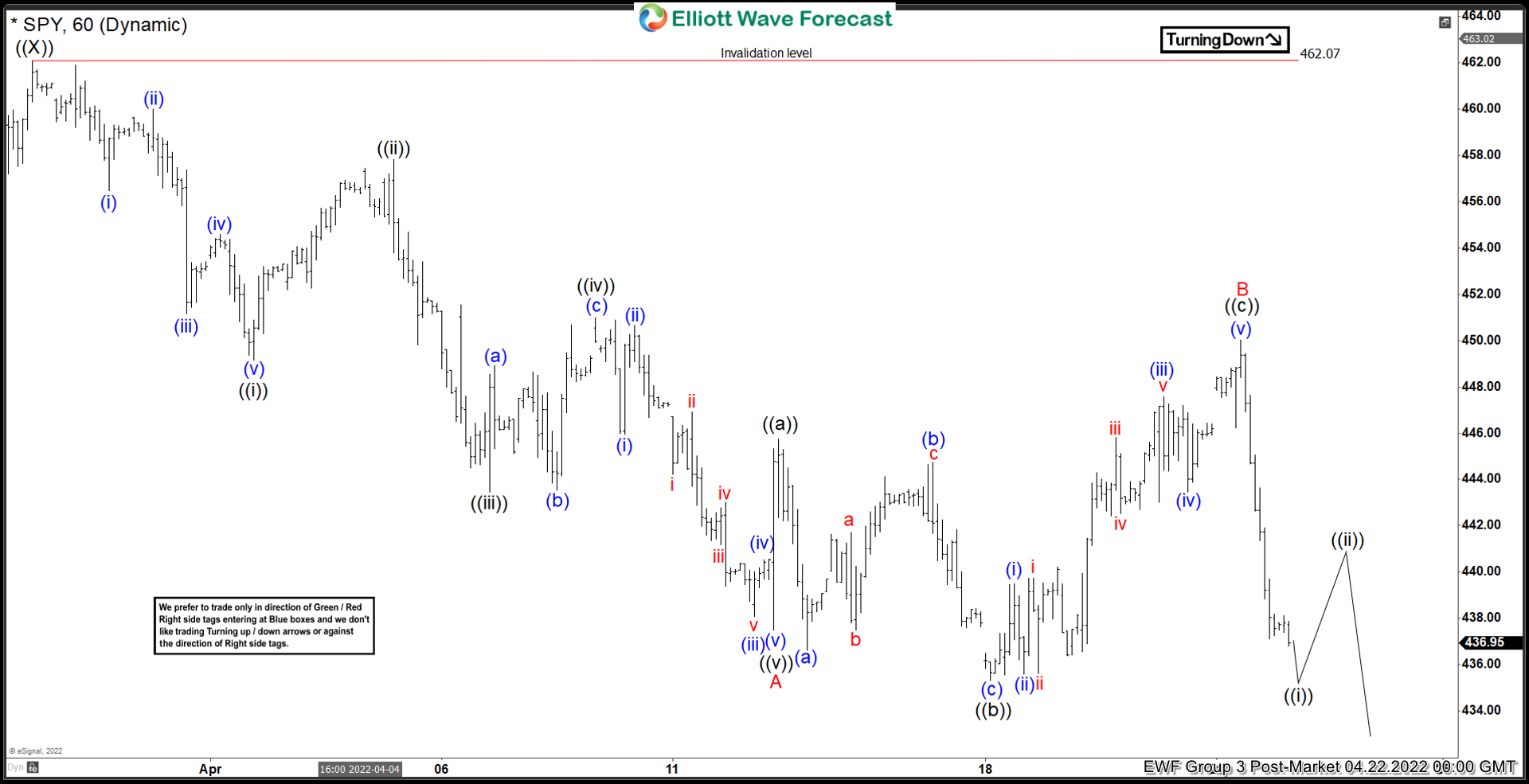

Elliott Wave View: SPY Starts Next Leg Lower

Read MoreSPY has resumed the move lower. This article and video look at the short term path as well as target using Elliott Wave technical analysis.

-

Elliott Wave View: GDX Pullback In Progress

Read MoreGDX ended cycle from October 2021 low & now correcting that cycle in larger degree 3, 7, or 11 swing. This article and video look at the Elliott Wave path.

-

Best Healthcare Stocks to Buy in 2024

Read MoreThe global healthcare sector continues to face the new challenges of the ongoing pandemic. The pandemic continues to dominate healthcare systems’ attention and resources. The healthcare sector continues to improve the human experience of its employees and redesign what to work, how, and where. As a result of this, there have emerged virtual health services […]

-

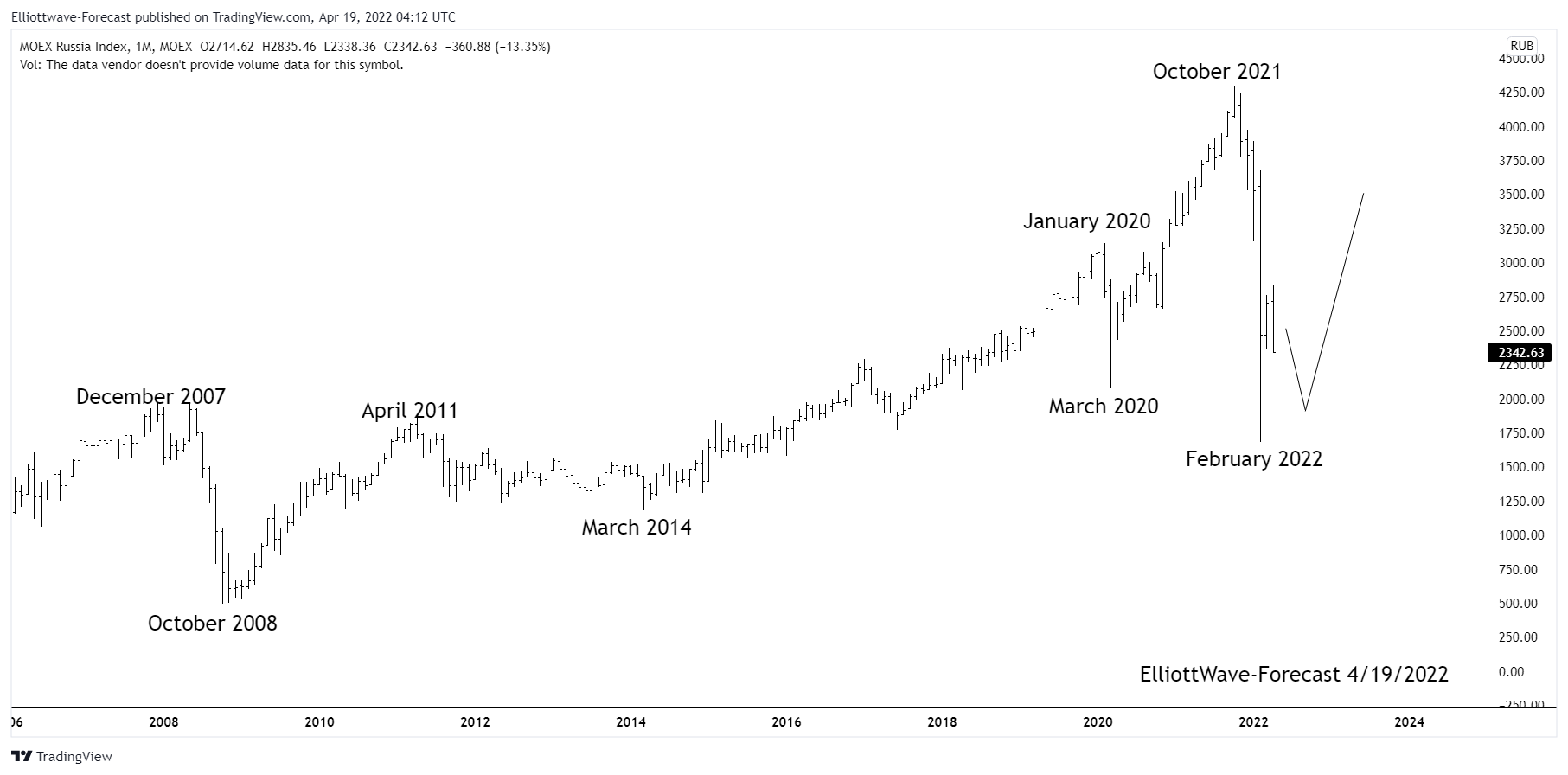

$MICEX Russia Index Longer Term Trend and Bullish Cycles

Read More$MICEX Russia Index Longer Term Trend and Bullish Cycles The Russian index has trended higher with other world indices since inception. The index remained in a long term bullish trend cycle into the December 2007 highs. It made a sharp correction lower in 2008 that lasted until October 2008 similar to other world indices. That is […]