The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

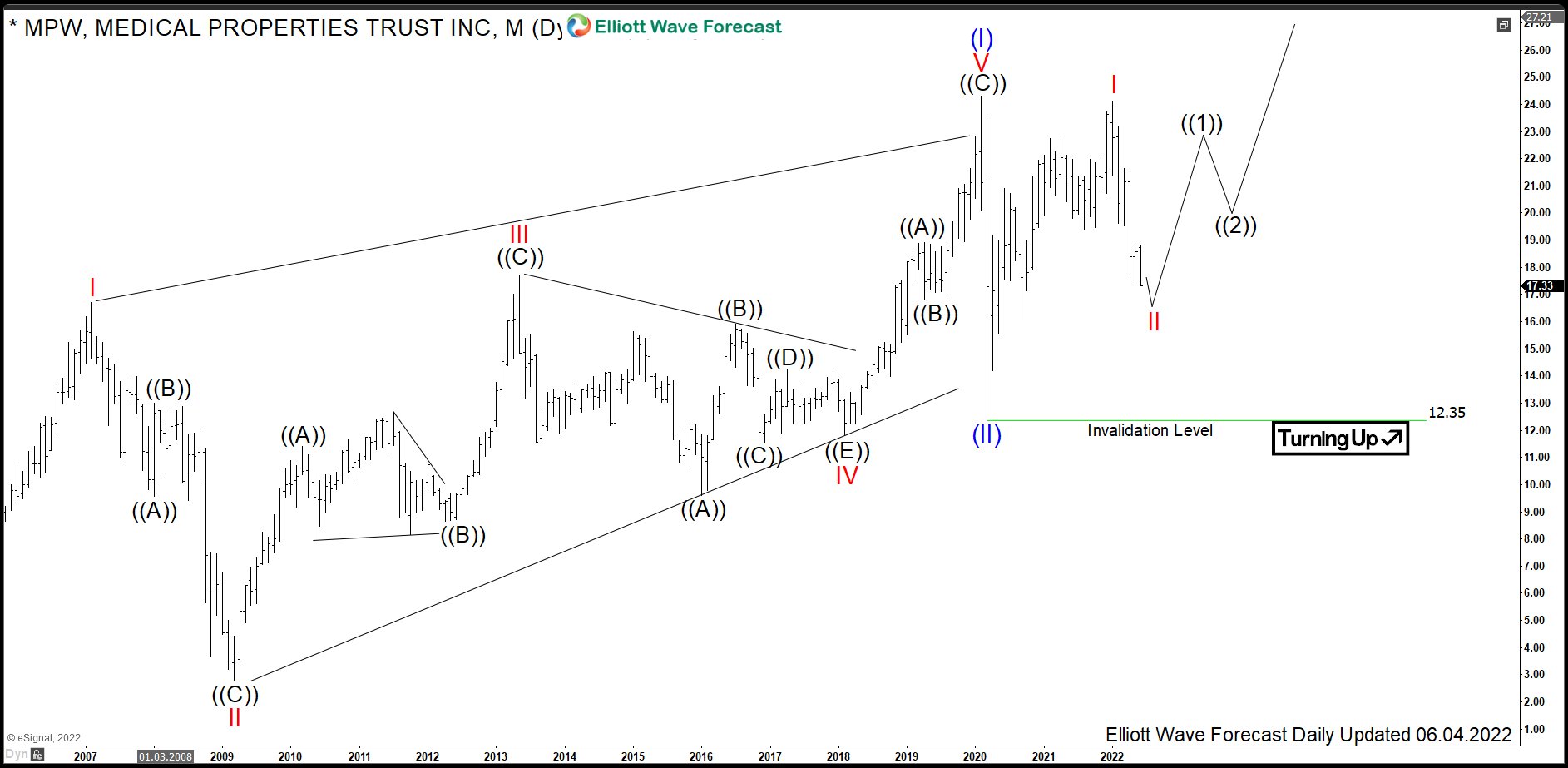

$MPW: Medical Properties Trust Provides a Buying Opportunity

Read MoreMedical Properties Trust is a real estate investment trust that invests in healthcare facilities subject to NNN leases. Founded in 2003 and headquartered in Birmingham, Alabama, USA, it is a part of S&P400 mid-cap index. Investors can trade it under the ticker $MPW at NYSE. The company owns 438 properties in the United States, Germany, […]

-

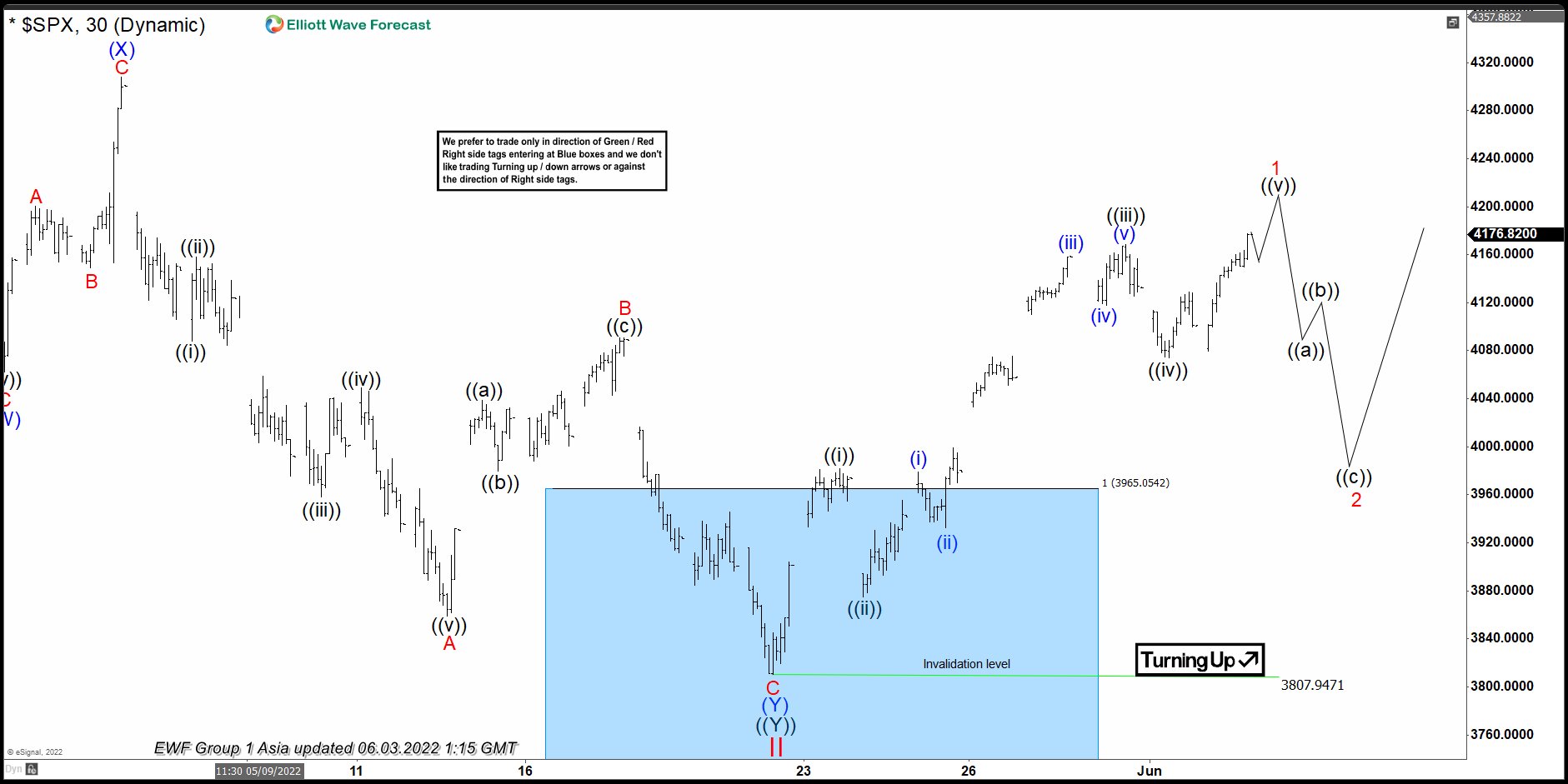

Elliott Wave View: SPX Is Close to Start A Pullback

Read MoreShort Term Elliott Wave View in SPX suggests the index has completed a corrective cycle from January 2022 peak. The market bounced from the blue box area at 3807.95 where wave II finished. The rally from 5/22/2022 low looks like it is unfolding as a 5 waves impulse Elliott Wave structure. Up from 5/22/2022 low, […]

-

Best Preferred Stocks for 2024

Read MoreSome companies issue preferred stocks to raise cash. Similar to bonds, preferred stocks are fixed-income securities. Preferred stocks get preferential treatment over common stocks when dividends stocks are distributed. referred stocks represent ownership in a company. But they are different from common stocks in many ways too. What are Preferred Stocks? Preferred stock is a […]

-

YM_F Buying The Dips in The Blue Box

Read MoreIn this technical blog we’re going to take a quick look at the Elliott Wave charts of Dow Futures (YM_F) published in members area of the website. As our members knew, we’ve been favoring the long side in YM_F due to it having an incomplete bullish sequence against 3.23.2022 low. Moreover, Indices like FTSE are also showing […]

-

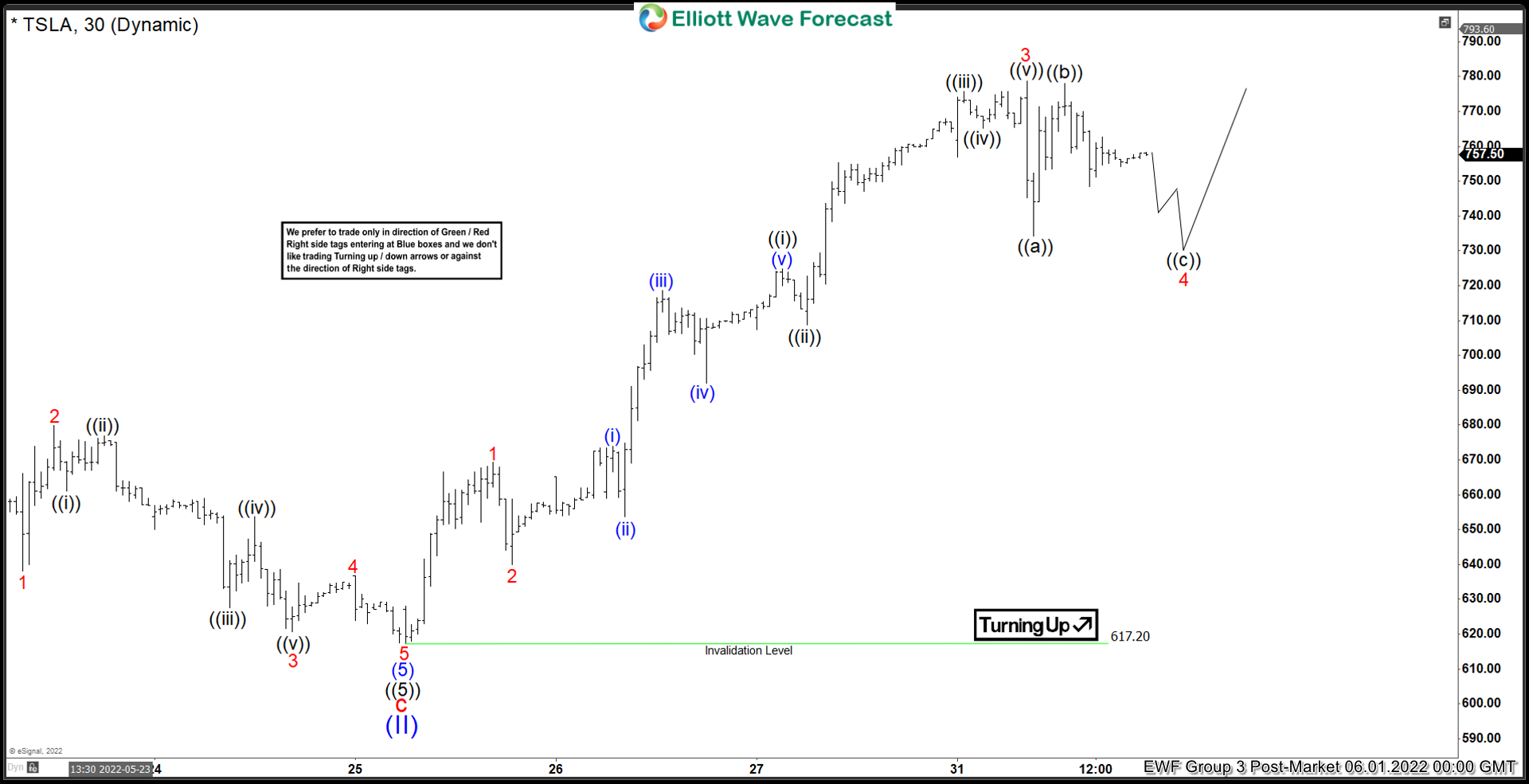

Elliott Wave View: Tesla (TSLA) Shows an Impulsive Rally

Read MoreTesla (TSLA) rally from 5/25/2022 low looks impulsive looking for further upside. This article and video look at the Elliott Wave of the stock.

-

DIS (Walt Disney Company): A Grand Super Cycle Opportunity

Read MoreDisney (DIS) has had a tremendous rally since the all-time lows which ended at the Peak early last year. The stock peaked at $202.73 and has dropped more than $100.00. The Elliott Wave Theory states that there is always a correction to happen in three, seven, and eleven after five waves advance. Disney advance since […]